- Share.Market

- 3 min read

- Published at : 30 Sep 2025 12:29 PM

- Modified at : 15 Nov 2025 11:42 AM

Bharat Electronics Ltd. announced a boost to its strong order pipeline, having secured additional contracts worth ₹1,092 crore. This continuous inflow of high-value, specialized orders reaffirms BEL’s central role in India’s strategic electronics and ‘Aatmanirbhar Bharat’ defence initiatives.

The newly secured contracts are diverse, encompassing critical technological requirements for the Armed Forces. The major orders pertain to the modernization and supply of systems, including Electronic Warfare (EW) system upgrades, defence network upgrades, tank sub-systems, TR modules, and communication equipment. The new orders also cover the supply of Electronic Voting Machines (EVMs), along with associated spares and services, demonstrating the company’s dual-use capabilities in both defence and non-defence sectors.

This latest success adds to BEL’s already substantial contract wins for the year. The company’s total order inflows since the beginning of the new financial now amount to over ₹11,000 crores, representing approximately 42% of its full-year guidance, which stands at ₹27,000 crore.

About the Company

Bharat Electronics is a Navratna PSU under the Ministry of Defence, Government of India, and is India’s leading defence electronics company. The company specializes in manufacturing advanced electronic products and systems for the Army, Navy, and Air Force.

For the first quarter of the fiscal year 2025-26, BEL reported a PAT of ₹969 crore, marking a 25% year-on-year growth, which was achieved through operational efficiency that saw its EBITDA margin surge to 28.1% from 22.3% in the previous year.

Over the last three and five years, this stock has delivered multibagger returns of more than 305% and 1,165%, respectively.

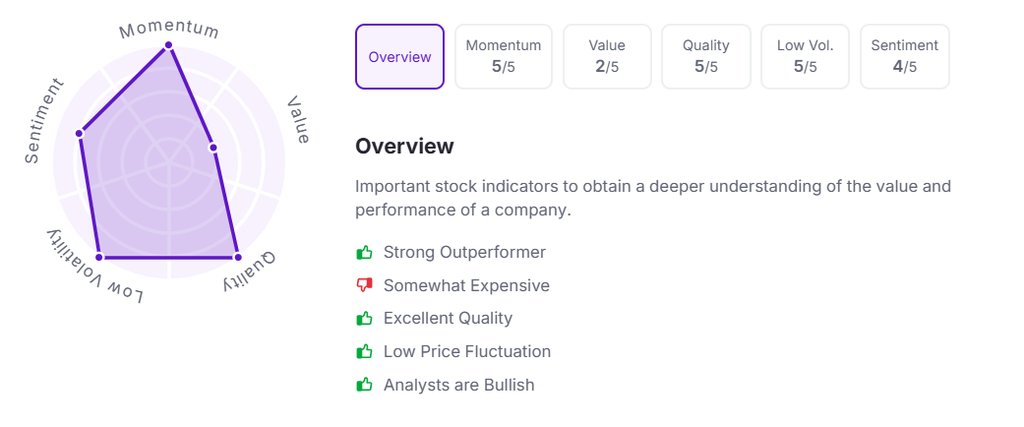

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 12:30 pm

Disclaimer and Disclosure

Investments in the securities market are subject to market risks, read all the related documents carefully before investing. Registration granted by SEBI, enlistment as Research Analyst with Exchange and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Kindly refer to https://share.market/ for more details.Investments in WealthBaskets are subject to the Terms of Service. All investors are advised to conduct their own independent research into investment strategies before making an investment decision. PPWB acts as a distributor of mutual funds and it is not an exchange traded product. PPWB acts as a distributor of mutual funds and WealthBaskets and it is not an exchange traded product. Disputes with respect to the distribution activity of Mutual Funds and WealthBaskets will not have access to Exchange investor redressal or Arbitration mechanism. The securities are quoted as an example and not as a recommendation. This is for informational purposes and should not be considered as recommendations.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887 and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226. Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA. CIN: U65990KA2021PTC146954