- Share.Market

- 6 min read

- Published at : 06 Aug 2025 11:42 AM

- Modified at : 06 Aug 2025 11:42 AM

The shares of Bayer Cropscience, NAVA, CCL Products India, Sharda Cropchem, and Avanti Feeds are set for their record date on Thursday, August 07, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Bayer Cropscience Ltd. has announced a final dividend of ₹35 per equity share. Its current dividend yield is 1.40%.

Bayer is a global life science company with over 160 years of expertise in healthcare and agriculture, committed to improving lives through innovation in health and nutrition. With a focus on science-driven solutions to some of the world’s biggest challenges, Bayer operates across Pharmaceuticals, Consumer Health, and Crop Science. In Q1 2025, the Group reported flat sales at €13.74 billion . Pharmaceuticals and Consumer Health delivered growth, while Crop Science declined due to regulatory and volume pressures.

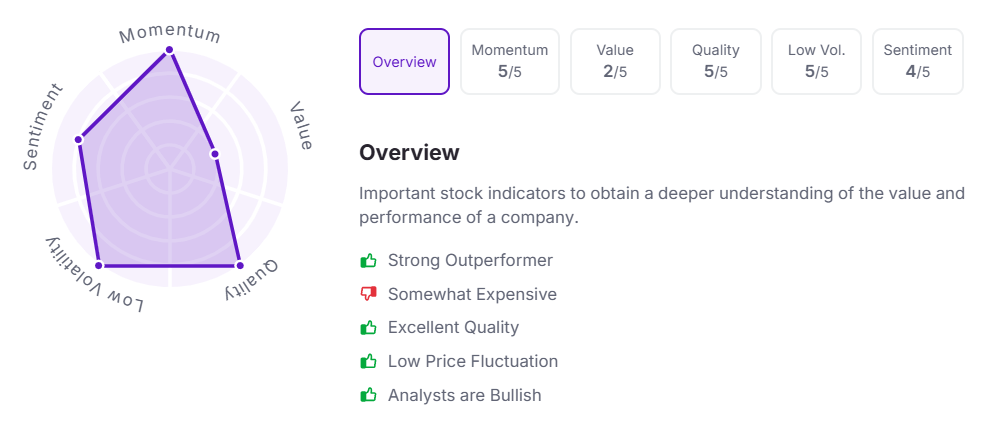

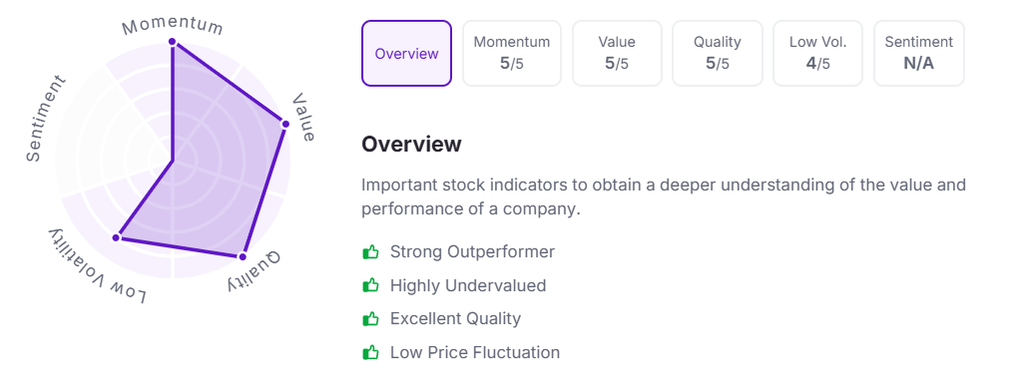

Let’s take a look at its Factor Analysis scores:

NAVA Ltd. has announced a final dividend of ₹6 per equity share. Its current dividend yield is 0.30%.

NAVA Limited is a diversified Indian multinational with a 50+ year legacy in metals, mining, energy, commercial agriculture, and healthcare. In FY25, the company reported its highest-ever consolidated revenue at ₹4,135.2 crore, up 4.6% YoY, and record net profit of ₹1,434 crore, up 14.2%. Q4 revenue rose 10.9% YoY to ₹1,055.8 crore, while PAT grew 18.8% to ₹302.8 crore. The Energy segment saw strong performance in both India and Zambia, with MEL sustaining high PLFs and clearing dues.

Over the last three and five years, this stock has given multibagger returns of more than 535% and 2,420%, respectively.

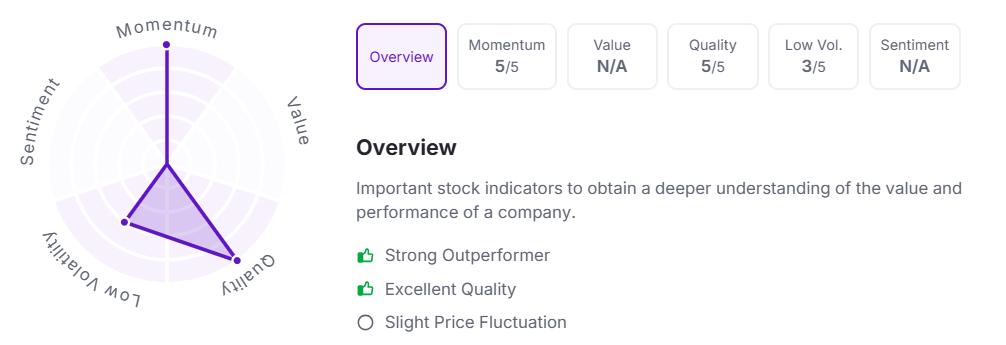

Let’s take a look at its Factor Analysis scores:

CCL Products India Ltd. has announced a final dividend of ₹5 per equity share. It has a dividend yield of 0.20%.

CCL Products (India) Ltd, established in 1994, is a global leader in instant coffee manufacturing and private label exports, serving over 100 countries with a strong focus on quality, innovation, and customer trust. In FY25, the company reported its highest-ever consolidated revenue of ₹835.8 crore, marking a 15% year-on-year growth. Net profit surged 56.2% to ₹101.9 crore, driven by strong operational performance and sustained demand across key markets.

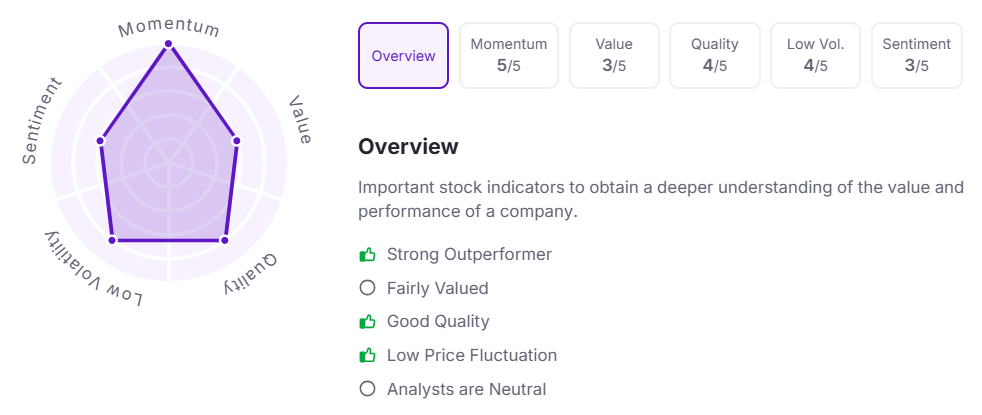

Let’s take a look at its Factor Analysis scores:

Sharda Cropchem Ltd. has announced a final dividend of ₹6 per equity share. Its current dividend yield is 0.30%.

Sharda Cropchem is a fast-growing, IP-driven agrochemical company with a strong foothold in generic crop protection across 80+ countries, including key markets in Europe, North America, and Latin America. In Q1 FY26, the company reported a 25% revenue growth to ₹985 crore, driven by 13% volume growth across segments. EBITDA rose 67% to ₹142 crore, while PAT surged over 4x to ₹143 crore, supported by improved gross margins of 35.5%.

Over the last three and five years, this stock has given multibagger returns of more than 100% and 240%, respectively.

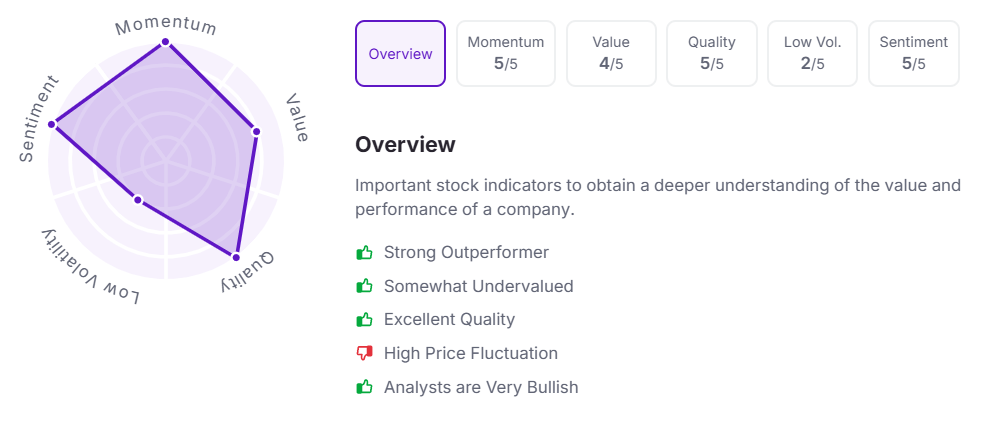

Let’s take a look at its Factor Analysis scores:

Avanti Feeds Ltd. has announced a final dividend of ₹9 per equity share.

Avanti Feeds is a leading Indian aquaculture company with an integrated farm-to-fork model, delivering high-quality shrimp feed and processed seafood products to global markets. In Q4FY25, consolidated revenue rose 8% YoY to ₹1,385 crore, driven by robust volume growth in both feed and processed shrimp businesses. FY25 highlights include 4% growth in shrimp feed sales and 23% higher processing volumes, along with the launch of Avanti Pet Care’s cat food under the “Avant Frust” brand.

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 11:40 am.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.