- Share.Market

- 3 min read

- Published at : 02 Jun 2025 02:56 PM

- Modified at : 16 Jul 2025 07:53 PM

Shares of AstraZeneca Pharma India Ltd. over 11% to ₹8,866.00 (as of 12:13 PM on June 2), following the release of its Q4 and FY25 results after market hours on Friday. The company crossed the ₹1,700 crores annual revenue mark for the first time.

Q4 Momentum Boosts Full-Year Growth

In Q4FY25, AstraZeneca’s total revenue rose to ₹480 crores. Profit Before Tax rose to ₹84 crores from ₹54 crores. Profit After Tax rose to ₹58 crores from ₹40 crores.

For the full year, revenue grew 33% to ₹1,716 crores. Profit Before Tax rose to ₹253 crores from ₹203 crores. Profit After Tax fell to ₹116 crores from ₹162 crores.

Management credited the strong results to sustained growth across key therapy areas, especially oncology, biopharmaceuticals, and rare diseases. Oncology revenue rose to ₹316 crores for Q4, while the biopharma vertical contributed over ₹123 crores.

Therapy Portfolio Expansion and Key Launches

FY25 was marked by a significant expansion of AstraZeneca’s therapeutic portfolio, with 14 new approvals across oncology, respiratory, and rare diseases since 2023. Notable launches included Palivizumab for RSV prevention in high-risk infants, Tremelimumab for liver cancer in combination with Durvalumab, and Budesonide/Glycopyrronium/Formoterol for COPD.

Durvalumab, already a key product, gained several new indications during the year, including expanded use in non-small cell lung cancer (NSCLC), small cell lung cancer (SCLC), and endometrial cancer, often in combination therapies with agents like Olaparib and Tremelimumab. Another key approval was for Sodium Zirconium Cyclosilicate, offering a novel approach to managing hyperkalemia in adults with cardiovascular and metabolic conditions.

Recognition and Health System Partnerships

During the year, AstraZeneca was honored with multiple awards, including ‘ET Now Progressive Company of the Year,’ a ‘Great Place To Work’ recognition for the seventh consecutive year, and accolades for diversity and inclusion.

AstraZeneca also contributed to national healthcare dialogue through its Partnership for Health System Sustainability and Resilience (PHSSR). A commissioned report was presented at the Embassy of Sweden in Delhi, focusing on public-private collaboration to future-proof India’s healthcare system.

Over the last three years, this stock has given multibagger returns of more than 208%.

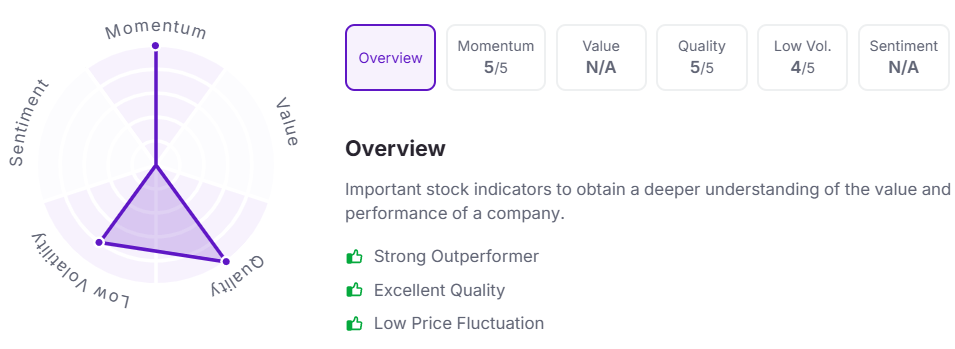

Let’s take a look at its Factor Analysis scores:

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.