- Share.Market

- 5 min read

- Published at : 26 Aug 2025 12:03 PM

- Modified at : 26 Aug 2025 12:03 PM

The shares of Aster DM Healthcare, Vedant Fashions, Procter & Gamble Hygiene and Health, and Route Mobile are set for their record date on Thursday, August 28, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Aster DM Healthcare Ltd. has announced a final dividend of ₹1 per equity share. It has a dividend yield of 0.70% TTM.

Aster DM Healthcare is one of India’s leading integrated healthcare providers, with a strong presence across hospitals, clinics, labs, and pharmacies. The company delivered a healthy start to FY26, with Q1 revenues rising 8% year-on-year to ₹1,078 crore and operating EBITDA up 21% to ₹215 crore, while normalised PAT grew 22% to ₹90 crore.

Performance was supported by improved efficiency, higher ARPOB, and growth across clusters, alongside expansion plans including a new 500-bed hospital in Bengaluru and a stake increase in Aster Ramesh Hospitals.

Over the last three and five years, this stock has given multibagger returns of more than 180% and 330%, respectively.

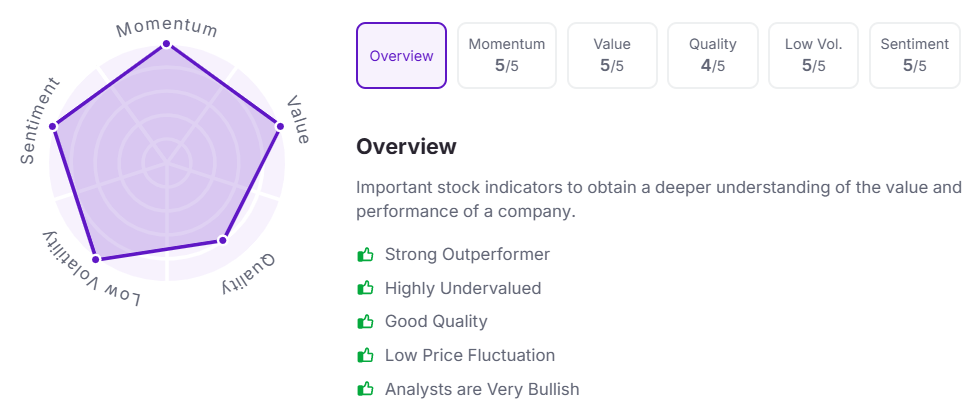

Let’s take a look at its Factor Analysis scores:

Vedant Fashions Ltd. has announced a final dividend of ₹8 per equity share.

Vedant Fashions, headquartered in Kolkata and best known for its flagship brand Manyavar, is India’s largest player in the men’s wedding and celebration wear market with a growing portfolio across men’s, women’s, and kids’ ethnic wear.

In Q1 FY26, the company delivered strong performance with retail sales rising 23.2% year-on-year, same-store sales growth of 17.6%, and revenue from operations up 17.2%. Gross margins remained industry-leading at 66.9%, while profit after tax increased 12.4%, underscoring its consistent financial strength alongside an expanding pan-India and international footprint.

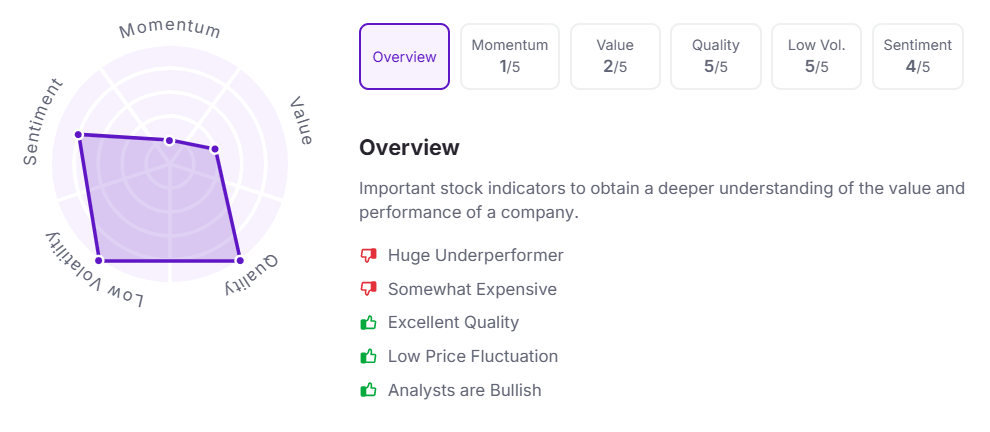

Let’s take a look at its Factor Analysis scores:

Procter & Gamble Hygiene & Healthcare Ltd. has announced a final dividend of ₹65 per equity share. It has a high dividend yield of 1.60% TTM.

Procter & Gamble Hygiene and Health Care Ltd., one of India’s leading FMCG companies with brands like Whisper, Vicks, and Old Spice, reported sales of ₹937 crore in Q1 FY26, up 1% year-on-year. Profit after tax surged to ₹192 crore from ₹81 crore a year ago, aided by a lower advertising base, reflecting strong profitability despite a challenging operating environment.

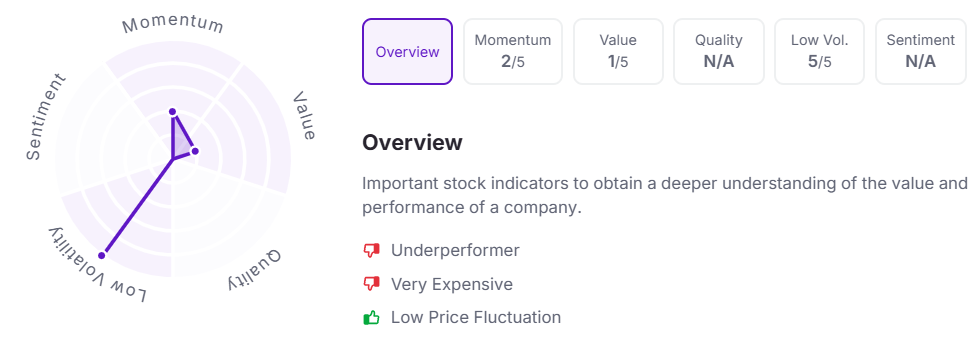

Let’s take a look at its Factor Analysis scores:

Route Mobile Ltd. has announced a final dividend of ₹2 per equity share. It has a dividend yield of 1.40% TTM.

Route Mobile Limited, a Mumbai-headquartered cloud communications platform service provider and part of the Proximus Group, caters to enterprises, OTT players, and mobile network operators across global markets.

In Q1 FY26, the company reported revenue from operations of ₹1,050.83 crore, down from ₹1,103.42 crore in Q1 FY25, while profit after tax stood at ₹58.78 crore versus ₹81.16 crore a year ago. Despite revenue softness in the A2P SMS segment, improved gross margins supported stronger EBITDA performance, with management highlighting growing traction in non-SMS product lines and continued execution of its diversification strategy.

Over the last five years, this stock has given multibagger returns of more than 145%.

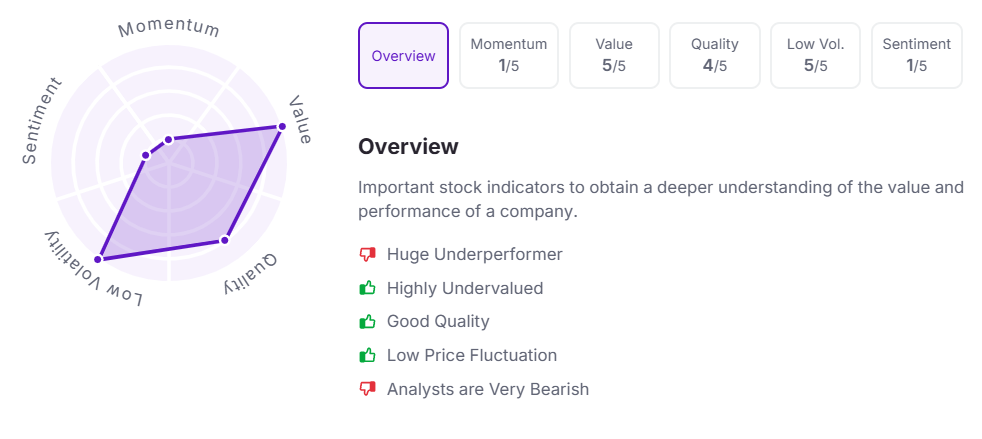

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 12:00 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.