- Share.Market

- 3 min read

- Published at : 17 Nov 2025 12:32 PM

- Modified at : 17 Nov 2025 02:02 PM

The shares of Asian Paints and Ashok Leyland are set for their record date on Tuesday, November 18, 2025. To be eligible for the upcoming buyback and dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

The paint company has announced an interim dividend of ₹4.50 per equity share. It has a dividend yield of 0.90% TTM.

For the second quarter of Fiscal Year 2026, Asian Paints Ltd. reported Revenue from Operations of ₹8,514 crore, reflecting an increase of over 6.4% compared to Q2 FY25. The Profit After Tax (PAT) for the quarter was ₹993.6 crore , an increase of over 43% compared to Q2 FY25. The domestic decorative business achieved a double-digit volume growth of 10.9%, which, combined with steady growth in industrial and international segments, drove the overall success. However, the Home Décor business, including Bath Fittings and Kitchen segments, continued to face challenges and registered losses

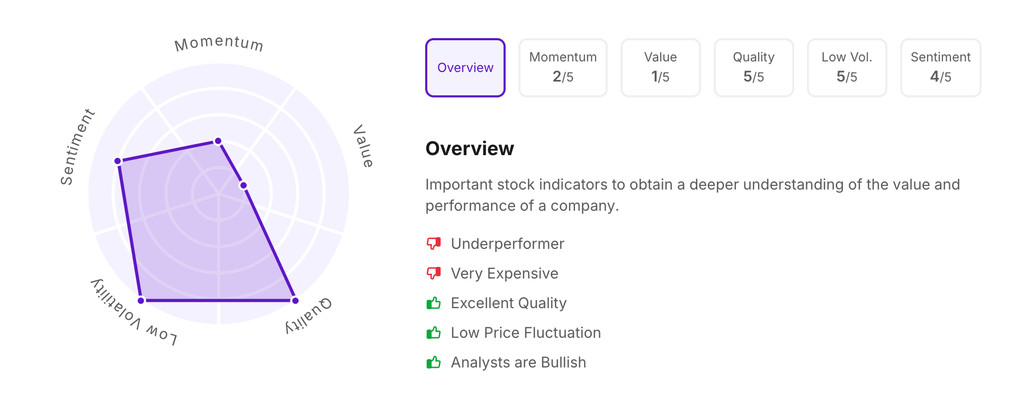

Let’s take a look at its Factor Analysis scores:

The automotive manufacturer has announced an interim dividend of ₹1.00 per equity share. It has a dividend yield of 0.10% TTM.

For Q2FY26, Ashok Leyland Ltd. reported Revenue from Operations of ₹12,576.86 crore, reflecting an increase of over 12.9% compared to Q2 FY25. The Profit After Tax (PAT) for the quarter was ₹819.70 crore , an increase of over 6.93% compared to Q2 FY25. Volume growth was positive across key segments: MHCV sales rose 3% and LCV sales rose 6% year-on-year. Export volumes saw an impressive surge of 45%.

Over the last five years, this stock has given multibagger returns of more than 220%.

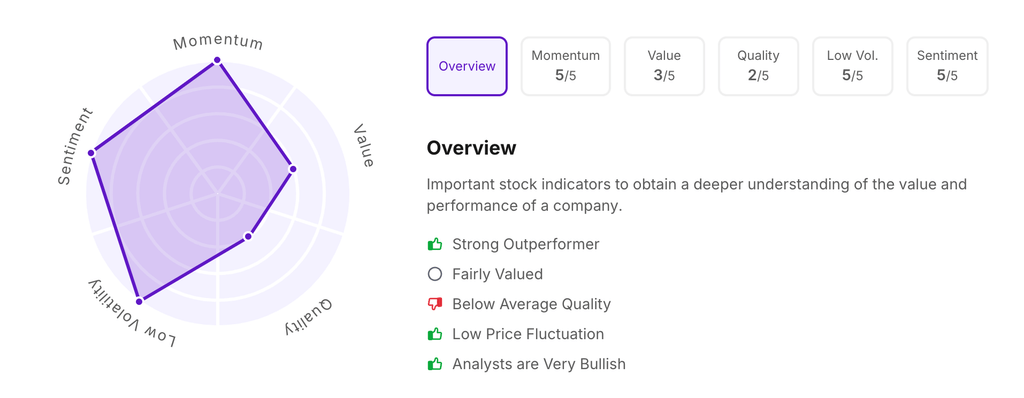

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 12:30 pm.