- Share.Market

- 3 min read

- Published at : 14 Aug 2025 04:21 PM

- Modified at : 14 Aug 2025 04:21 PM

reported its highest-ever first-quarter performance for the period ended June 30, 2025, and unveiled expansion plans for two of its wholly owned subsidiaries. The results highlighted record vehicle volumes, revenue, operating profit, and net profit, supported by market share gains and export growth.

Total sales volumes reached 44,238 units in Q1 FY26, marking the highest for any first quarter. Medium and heavy commercial vehicle (MHCV) truck sales, excluding defence vehicles, rose 2% year-on-year, increasing market share in this category from 28.9% to 30.7%. MHCV bus volumes, excluding electric vehicles, grew 5%, with the company maintaining its domestic market leadership. Light commercial vehicle (LCV) sales stood at 15,566 units, the highest-ever for a first quarter.

Revenue for the quarter stood at ₹8,725 crore, the highest Q1 revenue in the company’s history. This was driven by increased sales volumes, improved product realisations, and contributions from non-commercial vehicle segments such as power solutions, aftermarket services, and defence.

Earnings before interest, taxes, depreciation, and amortisation (EBITDA) came in at ₹970 crore, compared to ₹911 crore in Q1 FY25. EBITDA margin improved to 11.1% from 10.6% a year earlier, reflecting operational efficiency and cost management.

Profit after tax (PAT) rose to ₹594 crore from ₹526 crore in the same quarter last year, the highest PAT for any Q1 period. PAT represents net earnings after all expenses, taxes, and interest have been deducted from revenue.

Exports saw a 29% year-on-year increase to 3,011 units. The company ended the quarter with a cash surplus of ₹821 crore, underscoring its strong liquidity position.

Alongside the earnings, Ashok Leyland announced plans to invest in two wholly owned subsidiaries for business expansion. Vishwa Buses and Coaches Limited (VBCL), which builds bus bodies and coaches and reported ₹295.35 crore in revenue in FY25, will receive up to ₹5.70 crore in funding by March 31, 2026. OHM Global Mobility Private Limited (OHM), which operates and maintains electric buses and trucks under an e-mobility-as-a-service model and posted ₹50.37 crore in FY25 revenue, will receive up to ₹300 crore in multiple tranches by March 31, 2027. Both transactions are related-party deals conducted at arm’s length and will not alter Ashok Leyland’s 100% ownership in these companies.

Management said the record performance reflects effective market execution and disciplined cost control, while the new investments aim to strengthen the traditional bus and coach segment and scale up the company’s presence in electric mobility.

Over the last 5 years, this stock has given multibagger returns of more than 295%.

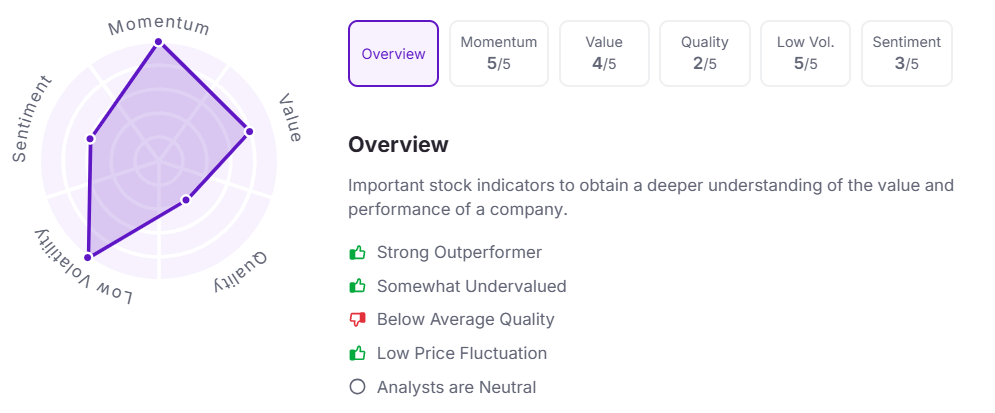

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:30 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.