- Share.Market

- 3 min read

- Published at : 21 May 2025 03:14 PM

- Modified at : 16 Jul 2025 07:41 PM

The shares of Ashok Leyland and Emami Limited are set for their record date on Thursday, May 22, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Ashok Leyland, manufacturer of commercial vehicles, has announced a second interim dividend of ₹4.25 per equity share. Its current dividend yield is 0.80%.

Ashok Leyland, the flagship of the Hinduja Group, is a US$4.5 billion commercial vehicle giant with a 75-year legacy and presence in over 50 countries. It is India’s second-largest commercial vehicle maker, the fourth-largest bus manufacturer globally, and ranks 19th in truck production worldwide. Headquartered in Chennai, it operates nine manufacturing plants, including facilities in the UAE and the UK. The company is a key defence partner, supplying the largest fleet of logistics vehicles to the Indian Army and collaborating with global armed forces.

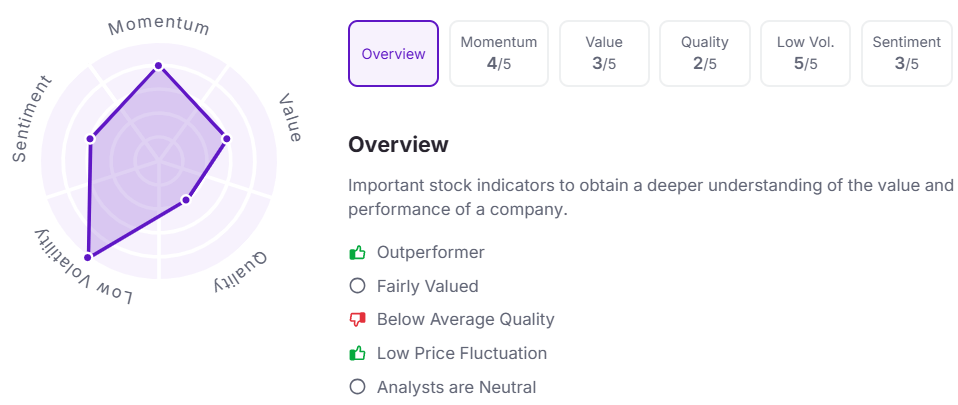

Let’s take a look at its Factor Analysis scores:

Emami Limited, a leading Indian FMCG company, has announced a third interim dividend of ₹2 per equity share. Its current dividend yield is 1.30%.

Founded in 1974, Emami is known for its strong personal care and healthcare brands like Navratna, BoroPlus, Fair & Handsome, Zandu Balm, and Kesh King. With over 550 products, a distribution network covering 5.4 million retail outlets, and a presence in more than 70 countries, Emami has built a wide and trusted consumer base.

Despite a challenging macro environment, Emami delivered an 8% YoY revenue growth in Q4FY25, led by a strong 11% rise in core domestic business and 7% volume growth. Key brands like Navratna and BoroPlus drove momentum, while international sales grew 6% amid geopolitical headwinds.

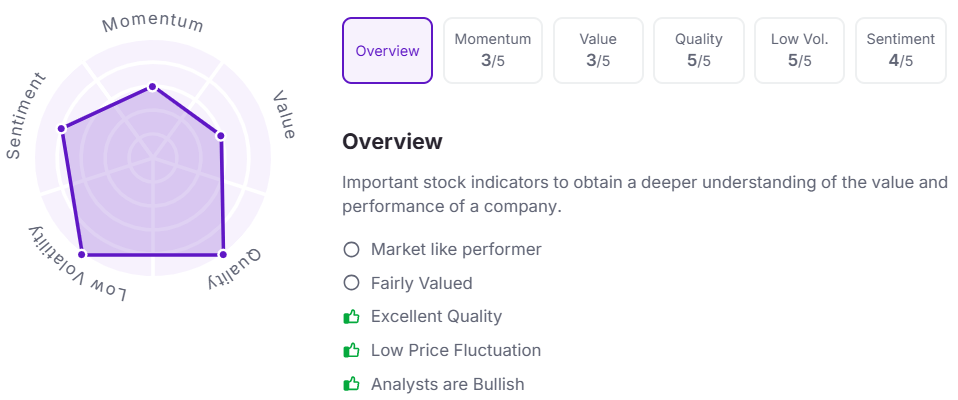

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 3:10 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.