- Share.Market

- 3 min read

- Published at : 29 Jul 2025 06:04 PM

- Modified at : 29 Jul 2025 06:04 PM

Shares of Apar Industries Ltd. rose as much as 13% on July 29 after the company reported robust financial performance for Q1 FY26, driven by broad-based growth across its conductor, cable, and specialty oil segments.

Apar reported consolidated revenue of ₹5,104 crores in Q1 FY26, a 27.3% increase over the same period last year. The growth was led by strong performance in the domestic market, which rose 38.3% year-on-year. Export contribution to revenue stood at 31.6%, slightly lower than 37% last year, though the US market stood out with 111.3% YoY growth.

Profit after tax rose 29.9% year-on-year to ₹263 crores, with a stable margin of 5.2%. The earnings growth was supported by high-margin order execution and a favourable shift in product and regional mix, especially in the conductor and cable businesses.

EBITDA (post forex) came in at ₹500 crores, up 27% YoY. The uptick was driven by volume acceleration, better mix of premium products, and strong performance in the US market.

Revenue from the conductor segment jumped 43.9% YoY to ₹2,785 crores. Domestic sales surged 62.9%, while export mix dropped slightly to 20.1%. US revenue rose 82.8% due to a low base. Premium products accounted for 43.5% of sales, up from 37.1% a year ago. EBITDA per MT rose to ₹43,688 from ₹38,532, driven by the stronger mix and US growth. The order book remains healthy at ₹7,779 crores.

While revenue remained flat YoY, the speciality oils segment volumes grew 8.1%. Global transformer oil and automotive oil volumes rose 7.4% and 8.4%, respectively. Export contribution moderated to 36.8% from 45% a year ago. EBITDA per KL improved to ₹7,004 from ₹6,935, reflecting better cost efficiency and product mix.

The cable business reported 36.3% revenue growth YoY, led by export growth of 69.7%. Domestic sales rose 19.7%, while the export mix increased to 41.3% from 33.2%. US sales grew sharply at 136.6% YoY. EBITDA rose 32.2% to ₹142 crores, with a margin of 10.0%, nearly flat compared to 10.3% a year ago.

Over the last three and five years, this stock has given exceptional multibagger returns of more than 800% and 3,110% respectively.

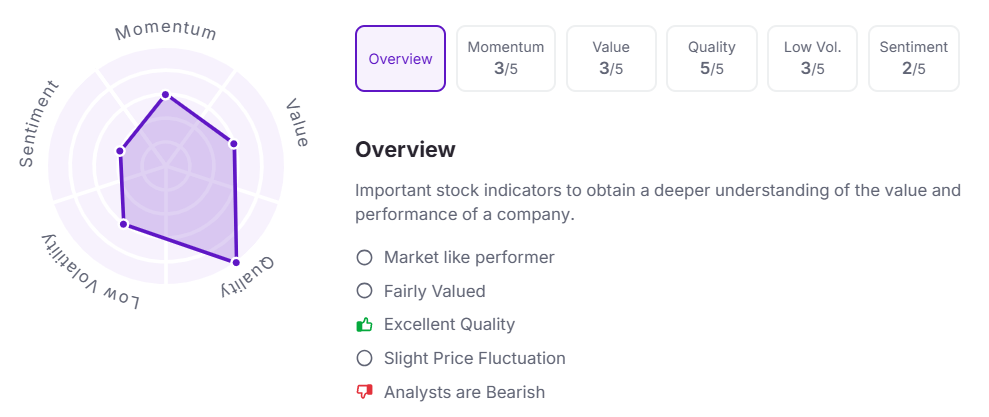

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:30 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.