- Share.Market

- 6 min read

- Published at : 28 Jul 2025 12:11 PM

- Modified at : 28 Jul 2025 01:04 PM

The shares of Apar Industries, Alembic Pharmaceuticals, Bosch, Punjab & Sind Bank, and SRF are set for their record date on Tuesday, July 29, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Apar Industries Ltd. has announced a final dividend of ₹51 per equity share. It has a dividend yield of 0.60%.

APAR Industries is the world’s largest aluminium alloy conductor manufacturer, the third-largest global producer of transformer oils, and India’s leading renewable cables maker.

The company posted record FY25 revenue of ₹18,581 crore, up 15% YoY. PAT stood at ₹821 crore, down 0.5% from the previous year. In Q4FY25, revenue rose 16.9% YoY to ₹5,210 crore, while PAT grew 5.9% to ₹250 crore. Growth was driven by strong demand across domestic and US markets, especially in the conductors and cable segments.

Over the last three years, this stock has delivered multibagger returns of more than 750%.

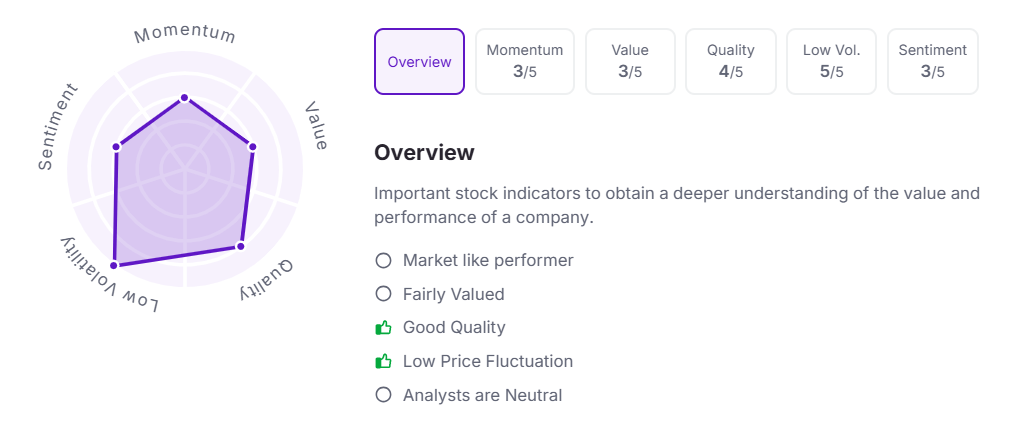

Let’s take a look at its Factor Analysis scores:

Alembic Pharmaceuticals Ltd. has announced a final dividend of ₹6 per equity share.

Alembic Pharmaceuticals is one of India’s leading pure-play pharmaceutical companies, with vertically integrated operations spanning formulations, international generics, and APIs across India. In Q4FY25, the company reported revenue of ₹1,770 crore, up 17% YoY, with EBITDA at ₹286 crore and net profit at ₹157 crore. Growth was driven by strong momentum in US and ex-US generics, which rose 20% and 43% YoY, respectively, along with an 8% increase in the India branded business.

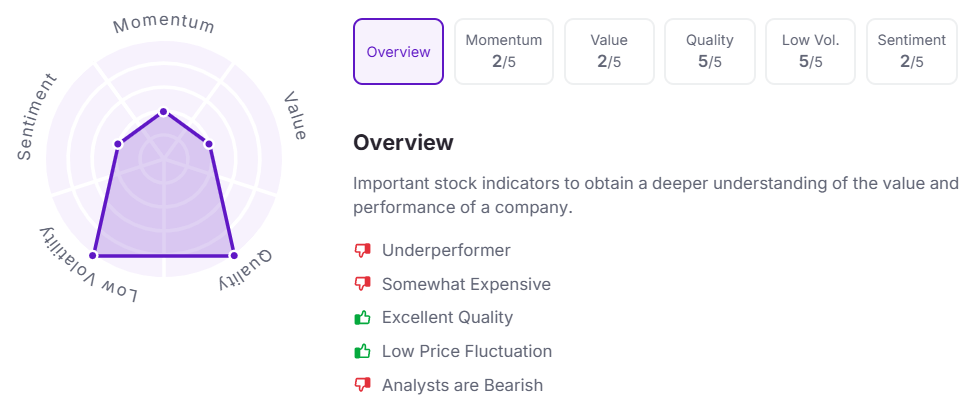

Let’s take a look at its Factor Analysis scores:

Bosch Ltd. has announced a final dividend of ₹512 per equity share.

Bosch Limited is a leading supplier of technology and services across the mobility, industrial technology, consumer goods, and energy and building technology sectors. In Q4FY25, the company reported revenue of ₹4,911 crore, up 16% YoY, with PAT at ₹554 crore. For the full year, revenue grew 8.1% to ₹18,087 crore and PAT stood at ₹2,013 crore, supported by strong demand in the passenger car, tractor, and aftermarket segments.

Over the last three years, this stock has given multibagger returns of more than 130%.

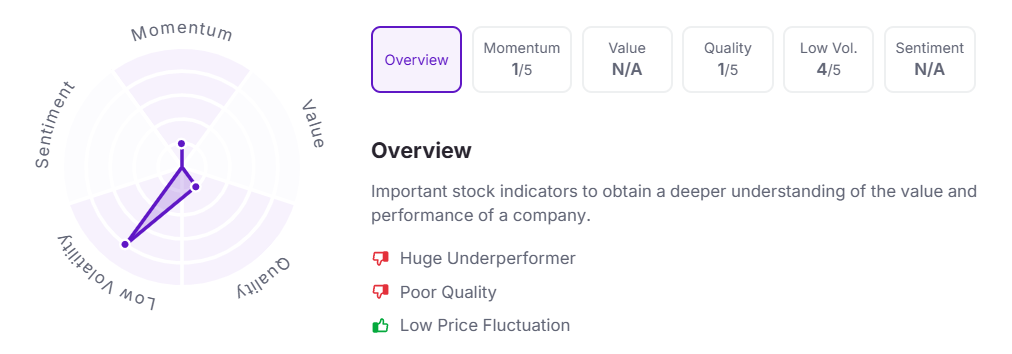

Let’s take a look at its Factor Analysis scores:

Punjab & Sind Bank has announced a final dividend of ₹0.07 per equity share.

Punjab & Sind Bank is a government-owned Indian bank offering a range of retail, corporate, and agricultural banking services, with a strong focus on financial inclusion and growth in retail lending. In Q1FY26, the bank reported a 48% YoY rise in net profit to ₹269 crore, supported by a 70% jump in operating profit. Net interest income grew 6% to ₹900 crore, while non-interest income surged 142%. Advances rose 14% YoY, led by robust growth in retail loans, especially vehicle (+41%), gold (+40%), and home loans (+24%).

Over the last three years, this stock has given multibagger returns of more than 100%.

Let’s take a look at its Factor Analysis scores:

SRF Ltd. has announced an interim dividend of ₹4 per equity share. It has a dividend yield of 0.20%.

SRF Limited is a diversified chemicals conglomerate, originally established as a tyre cord manufacturer and now a global player across industrial and specialty intermediates. In Q1FY26, the company posted a 10.2% YoY rise in gross operating revenue to ₹3,818.6 crore, with EBITDA growing 31.6% to ₹344 crore. Profit after tax surged 71.4% YoY to ₹432.3 crore, while PAT margin expanded to 11.3% from 7.3% last year. Strong operational performance and lower exceptional losses contributed to the improved earnings, with EPS rising to ₹14.58 from ₹8.51.

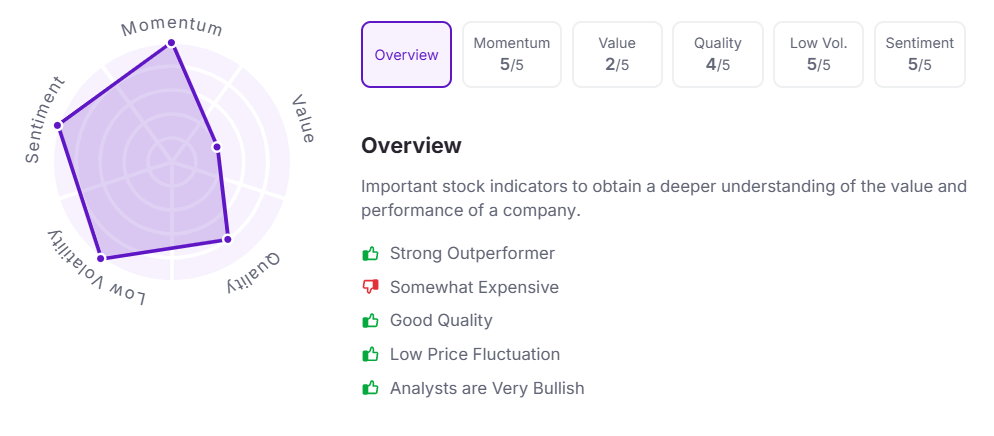

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 12:05 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.