- Share.Market

- 3 min read

- Published at : 12 Aug 2025 04:56 PM

- Modified at : 12 Aug 2025 04:56 PM

Alkem Laboratories Ltd., the fifth-largest pharmaceutical company in the Indian market, reported an 11.2% year-on-year (YoY) increase in revenue for the quarter ended June 30, 2025, driven by growth in both domestic and international businesses and improved operating margins.

Revenue from operations stood at ₹33,711 million in Q1FY26, up from ₹30,313 million in the same period last year. Domestic sales, which accounted for 68.3% of total revenue, grew 12.0% YoY to ₹22,650 million, supported by volume growth of 2.9%, which outpaced the Indian Pharmaceutical Market (IPM) volume growth of 1.5%.

According to IQVIA data, Alkem registered 9.7% YoY value growth in India, outperforming the IPM’s 8.5%, with above-market performance in seven key therapies including gastrointestinal, vitamins/minerals/nutrients, pain management, anti-diabetics, neuro/CNS, respiratory, and dermatology.

International sales rose 8.9% YoY to ₹10,539 million. The US market contributed ₹6,982 million, up 8.8%, supported by new launches and product approvals, while non-US markets delivered ₹3,556 million, up 9.1%, led by double-digit growth in Australia and key European markets. The company filed its first Biologics License Application (BLA) in the US during the quarter and received five ANDA approvals, including two tentative approvals.

Profit before tax before exceptional items rose 22.4% YoY to ₹7,581 million, while net profit (after minority interest) increased 21.8% to ₹6,643 million. Net profit margin for the quarter stood at 19.7%, compared to 18.0% in the prior-year period.

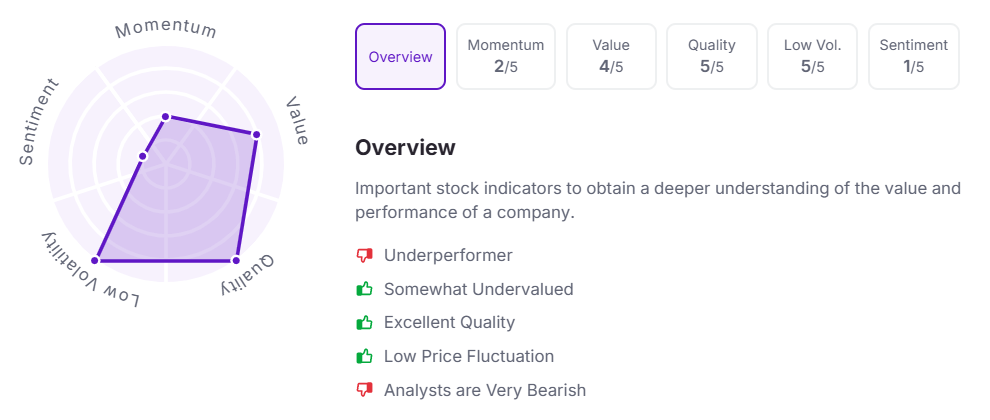

Let’s take a look at its Factor Analysis scores:

Note: The stock price mentioned is as of 3:30 pm.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.