- Share.Market

- 4 min read

- Published at : 29 Aug 2025 11:35 AM

- Modified at : 29 Aug 2025 01:00 PM

The shares of Alivus Life Sciences, Triveni Turbine and Triveni Engineering & Industries are set for their record date on Monday, September 01, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Alivus Life Sciences Ltd. has announced a final dividend of ₹5 per equity share.

Alivus Life Sciences Limited (formerly Glenmark Life Sciences) is a leading developer and manufacturer of specialized APIs in chronic therapeutic areas such as cardiovascular, CNS, pain management, and diabetes.

In Q1FY26, the company posted revenue of ₹6,018 million, up 2.2% year-on-year, with gross margins improving 400 bps to 55.1%. EBITDA rose 9.9% to ₹1,813 million, translating to a margin of 30.1%, while PAT stood at ₹1,215 million with a margin of 20.2%.

Over the last three years, this stock has given multibagger returns of more than 115%.

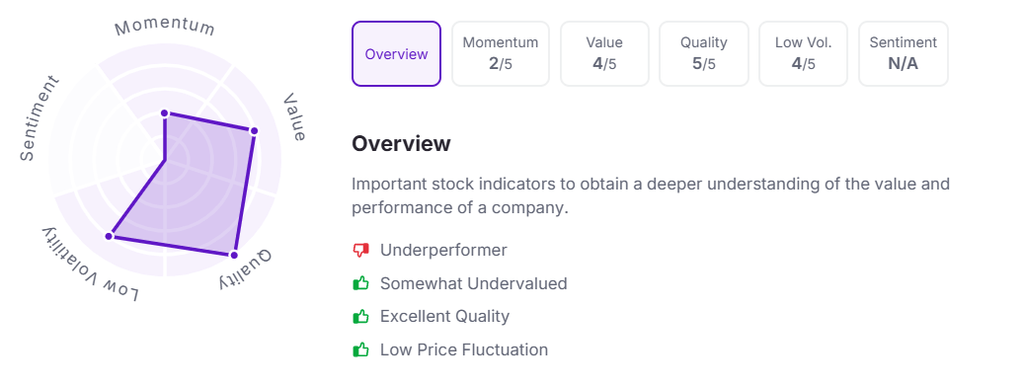

Let’s take a look at its Factor Analysis scores:

Triveni Turbine Ltd. has announced a final dividend of ₹2 per equity share. It has a dividend yield of 0.60% TTM.

Triveni Turbine Limited, a market leader in industrial steam turbines and decentralized steam-based renewable power solutions, reported a subdued

Q1FY26 performance impacted by deferred dispatches and lower export demand. Revenue declined 20% year-on-year to ₹3.71 billion, while EBITDA fell 17% to ₹958 million, though margins improved to 25.8%. Profit after tax stood at ₹644 million, down 20% from last year. Order booking slipped 16% to ₹5.36 billion; however, the company’s outstanding order book reached a record ₹20.74 billion, up 20% YoY, reflecting strong long-term demand visibility.

Over the last three and five years, this stock has given multibagger returns of more than 155% and 540%, respectively.

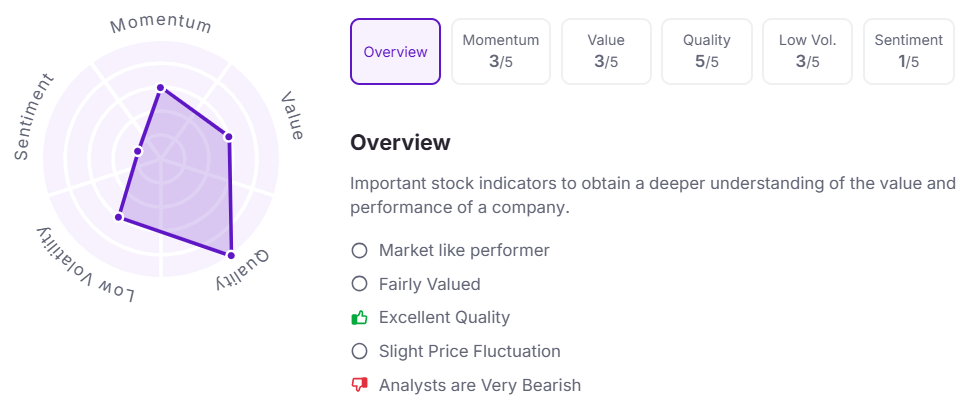

Let’s take a look at its Factor Analysis scores:

Triveni Engineering & Industries Ltd. has announced a final dividend of ₹2.50 per equity share. It has a dividend yield of 0.40% TTM.

Triveni Engineering & Industries Limited, a diversified industrial group with 23 world-class facilities including 8 sugar plants and 5 distillery units, has built a strong presence across sugar, alcohol, and power co-generation. The company has a crushing capacity of 70,500 tonnes of sugarcane per day, distillery capacity of 860 KLPD, and power generation capacity of 104.5 MW. With a market capitalization of around ₹8,308 crore and free float of 39.02%, Triveni has delivered robust revenue growth of 8.9% CAGR during FY2020–2025, supported by an increasing contribution from its non-sugar businesses.

Over the last five years, this stock has given multibagger returns of more than 370%.

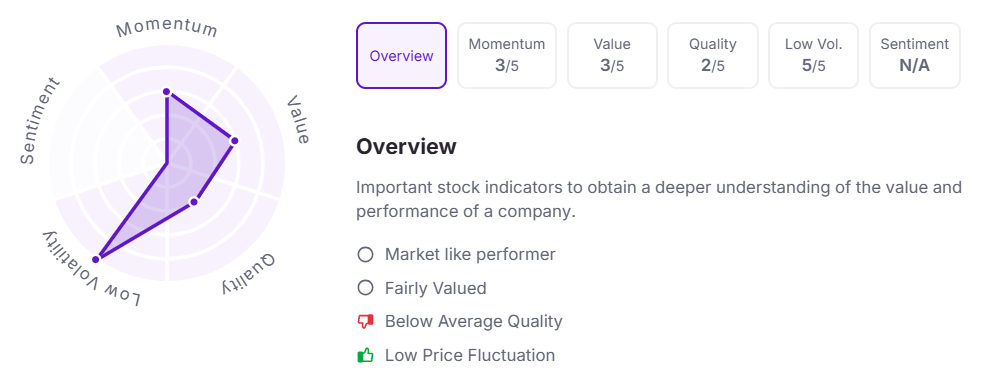

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 11:34 am.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.