- Share.Market

- 5 min read

- Published at : 08 Aug 2025 11:43 AM

- Modified at : 08 Aug 2025 12:17 PM

The shares of Akzo Nobel, Castrol India, Jio Financial Services, and KPI Green Energy, are set for their record date on Monday, August 11, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Akzo Nobel India Ltd. has announced a special dividend of ₹156 per equity share. Its current dividend yield is 2.80% TTM.

Akzo Nobel N.V., a global paints and coatings leader with brands like Dulux and Sikkens, operates in over 150 countries with a focus on sustainable solutions. In Q2 2025, revenue fell 6% to €2,626 million due to currency headwinds, though adjusted EBITDA margin rose to 15% on efficiency gains. The company signed a binding deal to sell its India business to JSW Group. For H1 2025, revenue declined 3%, while adjusted EBITDA reached €750 million. Akzo Nobel maintained its full-year EBITDA guidance and continues to focus on profitability and portfolio streamlining.

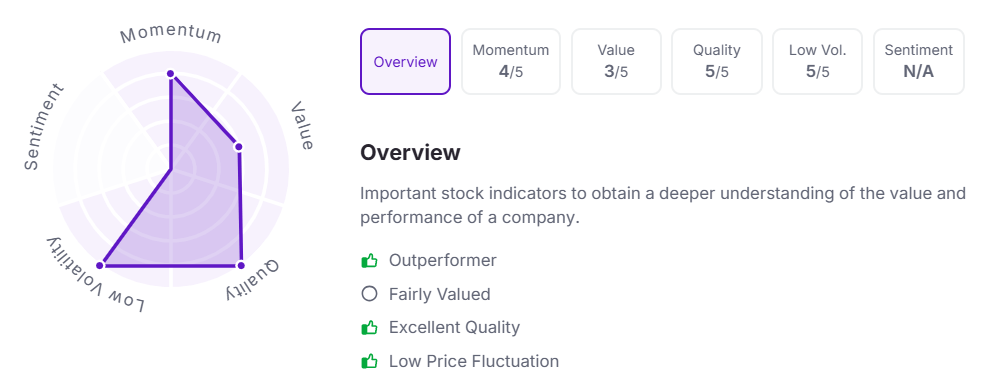

Let’s take a look at its Factor Analysis scores:

Castrol India Ltd. has announced an interim dividend of ₹3.50 per equity share. Its current dividend yield is 4.40% TTM.

Castrol India, a leading lubricant manufacturer under the bp group, reported a resilient Q1 2025 with revenue up 7% YoY to ₹1,422 crore and PAT rising 8% to ₹233 crore. Growth was driven by new product launches like the revamped Castrol Activ, expanded rural reach, and a wider retail network.

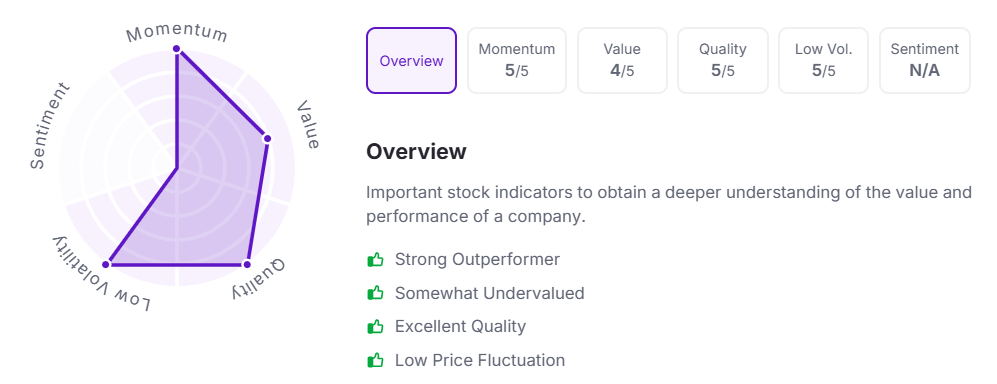

Let’s take a look at its Factor Analysis scores:

Jio Financial Services Ltd. has announced a final dividend of ₹0.50 per equity share.

Jio Financial Services, a digital-first financial services firm under Reliance, reported a 48% YoY rise in total income to ₹619 crore in Q1 FY26, with net income from business growing nearly 4x to ₹219 crore. PAT rose 4% to ₹325 crore, supported by strong growth across lending, asset management, and payment businesses. Its JV with BlackRock saw ₹17,800 crore in AUM post its NFO, and JFSL acquired full ownership of Jio Payments Bank during the quarter.

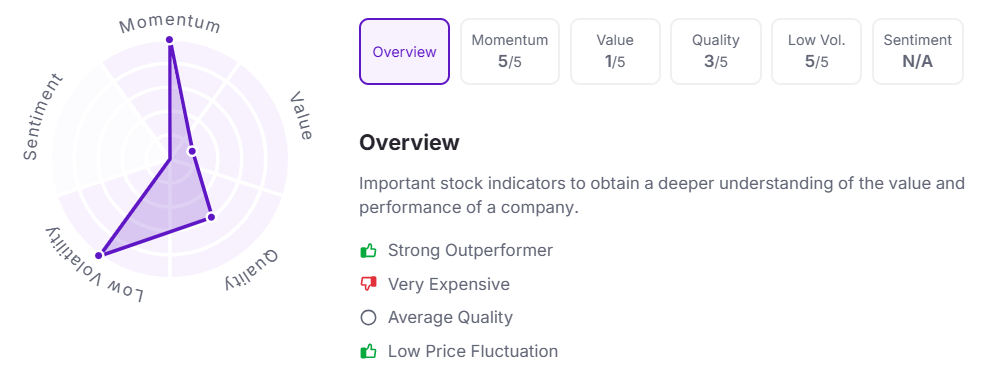

Let’s take a look at its Factor Analysis scores:

KPI Green Energy Ltd. has announced an interim dividend of ₹0.20 per equity share. Its current dividend yield is 0.10% TTM.

KPI Green Energy, a leading player in India’s renewable energy sector, reported its highest-ever quarterly revenue for the fifth straight quarter in Q1 FY26, with total income rising 75% YoY to ₹614 crore. PAT grew 68% to ₹111 crore, supported by strong execution across solar and hybrid projects. The company also secured major orders, including a 150 MW wind project from GUVNL and a 100 MW repeat solar order from Avichal Power. Strategic MoUs with Delta Electronics and recognition in an IBM global case study further reinforced its position in India’s clean energy space.

Over the last three years, this stock has given multibagger returns of more than 580%.

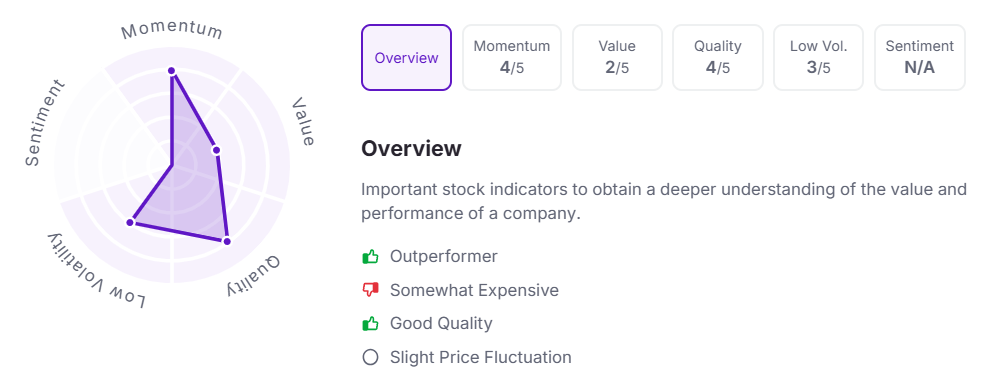

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 11:40 am.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.