- Share.Market

- 3 min read

- Published at : 12 May 2025 05:09 PM

- Modified at : 16 Jul 2025 07:26 PM

Adani Power, India’s largest private thermal power producer, has won a competitive bid to supply 1,500 MW (net) of electricity to the state of Uttar Pradesh. The company will build a greenfield 2×800 MW Ultra-supercritical thermal power plant in the state, with a total investment of approximately $2 billion (~₹16,700 crore).

The new plant will operate under the Design, Build, Finance, Own, and Operate (DBFOO) model and is expected to be commissioned by FY30. Adani Power secured the contract at the lowest discovered tariff of ₹5.383 per unit, following a closely contested bidding process. The Uttar Pradesh cabinet had cleared the project earlier this month.

Adani Power will now sign a long-term Power Supply Agreement (PSA) with the Uttar Pradesh Power Corporation Ltd. (UPPCL), based on the Letter of Award (LoA) issued today.

The greenfield project is expected to generate around 8,000 to 9,000 direct and indirect jobs during construction and about 2,000 jobs once operational.

Uttar Pradesh is projected to see a surge in thermal power demand of roughly 11,000 MW by FY34, driven by rising industrialisation, urban growth, and infrastructure development. The 1,500 MW allocation is part of the state government’s broader push to meet this future demand through long-term supply agreements.

In September 2024, the company was awarded a composite 6,600 MW allocation from Maharashtra State Electricity Distribution Company Ltd. (MSEDCL), which included 1,600 MW of thermal and 5,000 MW of solar capacity. That allocation has since been formalised into a Power Supply Agreement.

With this latest project, Adani Power continues to strengthen its position as a key player in India’s power sector, focusing on reliable baseload generation even as the company expands into renewable energy.

Over the last three years, Adani Power has given multibagger returns of more than 110%.

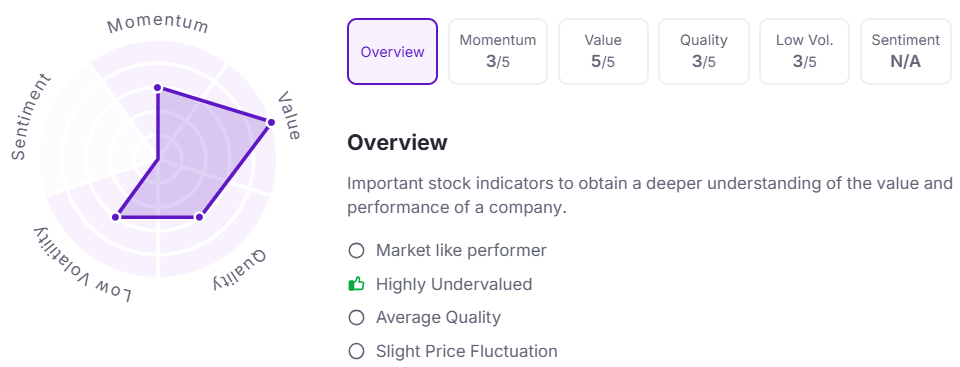

Let’s take a look at its Factor Analysis scores:

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.