- Share.Market

- 6 min read

- Published at : 12 Jun 2025 11:27 AM

- Modified at : 16 Jul 2025 07:45 PM

The shares of Adani Ports and Special Economic Zone, Adani Enterprises, Power Finance Corporation, Ambuja Cements, and Canara Bank are set for their record date on Friday, June 13, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Adani Ports & Special Economic Zone Ltd. has announced a final dividend of ₹7 per equity share. Its current dividend yield is 0.40% TTM.

APSEZ is India’s largest private port operator and an integrated logistics provider with a growing global presence. It delivered its strongest annual performance to date in FY25, with an all-time high PAT of ₹11,061 crore, up 37% YoY, and handled an all-time high 450 MMT cargo, with Mundra becoming India’s first port to cross 200 MMT in a year.

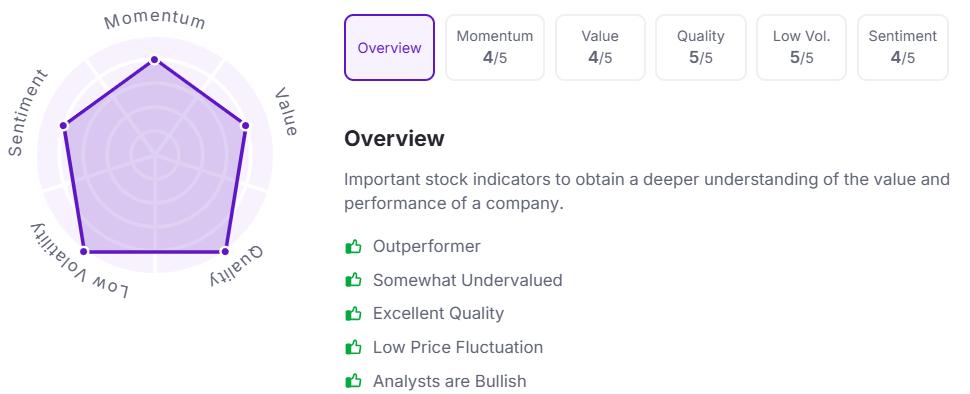

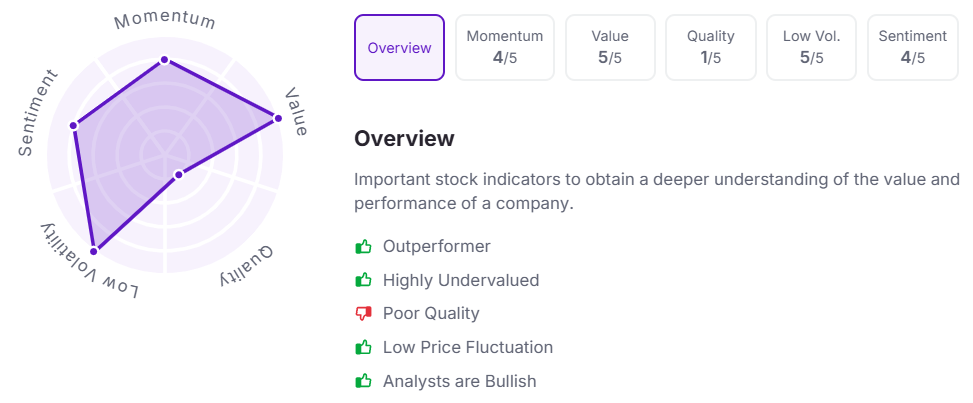

Let’s take a look at its Factor Analysis scores:

Adani Enterprises Ltd. has announced a final dividend of ₹1.30 per equity share. Its current dividend yield is 0.10% TTM.

Adani Enterprises Ltd (AEL) is the flagship incubator of the Adani Group, focused on building next-generation infrastructure businesses across green energy, airports, data centers, and mining. It delivered a strong performance in FY25 with EBITDA rising 26% YoY to ₹16,722 crore and PBT up 16% to ₹6,533 crore, led by a 68% jump in incubating business earnings and key milestones across solar, wind, mining, and data center operations.

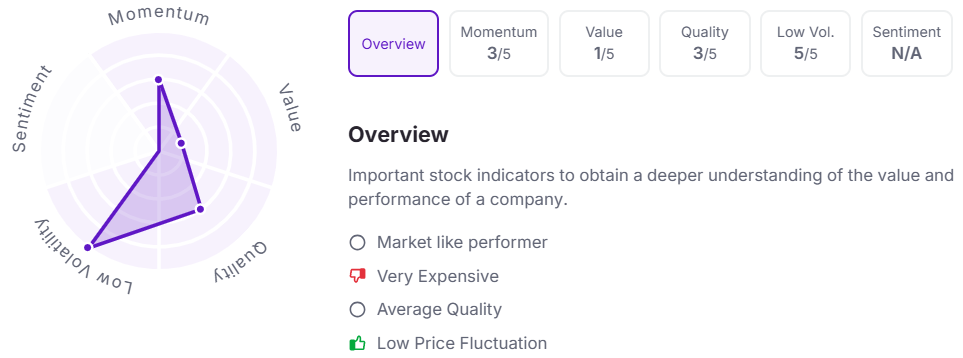

Let’s take a look at its Factor Analysis scores:

Power Finance Corporation Ltd. has announced a final dividend of ₹2.05 per equity share. It has a high dividend yield of 3.80%.

Power Finance Corporation is India’s leading power sector financier and the highest profit-making NBFC under the Ministry of Power. It reported its highest-ever annual profit in FY25, supported by a 13% growth in its loan portfolio and a 35% YoY surge in its renewable energy loan book, which now exceeds ₹80,000 crore, reinforcing its leadership in clean energy financing and infrastructure development.

Over the last three years, this stock has given multibagger returns of more than 390%.

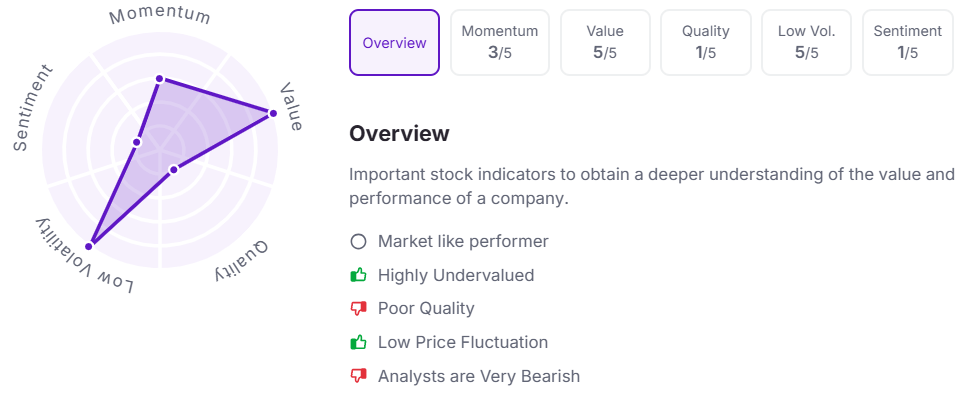

Let’s take a look at its Factor Analysis scores:

Ambuja Cements Ltd. has announced a final dividend of ₹2.00 per equity share. Its current dividend yield is 0.40% TTM.

Ambuja Cements is one of India’s leading cement companies and a key part of the Adani Group. Its total capacity now exceeds 100 MTPA, making it the 9th largest cement company globally. It delivered a record performance in FY25 with its highest-ever annual profit of ₹5,158 crore, revenue of ₹35,045 crore, and volumes of 65.2 MnT (up 10%), backed by strong operational efficiency, strategic acquisitions, and an expanding green power footprint.

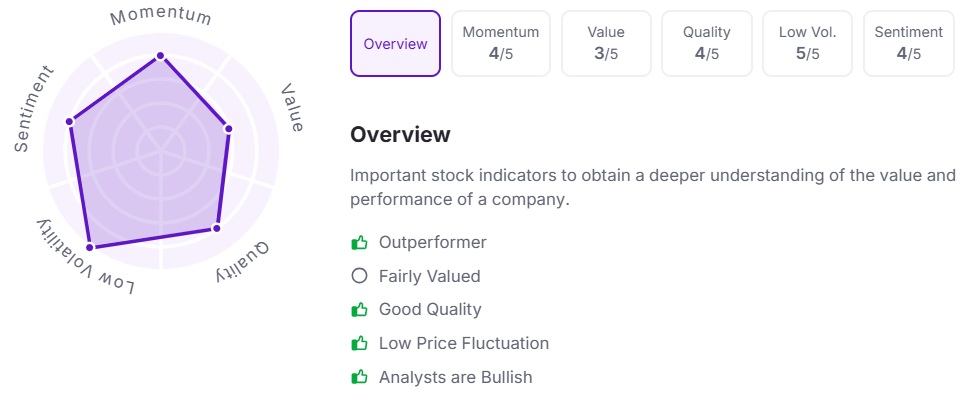

Let’s take a look at its Factor Analysis scores:

Canara Bank has announced a final dividend of ₹4.00 per equity share. Its current dividend yield is 2.70% TTM.

Canara Bank is one of India’s largest public sector banks, offering a wide range of financial services with a strong domestic and international presence. It reported a record net profit of ₹5,004 crore in Q4 FY25, up 33% YoY, alongside 11.3% growth in global business to ₹25.3 lakh crore and 42.8% surge in retail lending.

Over the last three years, this stock has given multibagger returns of more than 180%.

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 12:25 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.