- Share.Market

- 5 min read

- Published at : 19 Jun 2025 12:47 PM

- Modified at : 16 Jul 2025 07:33 PM

The shares of Bajaj Auto, HDFC Life Insurance Company, Tata Power, Punjab National Bank, and Torrent Pharmaceuticals are set for their record date on Friday, June 20, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Bajaj Auto Ltd. has announced a final dividend of ₹210 per equity share.

India’s leading two- and three-wheeler manufacturer, Bajaj Auto, delivered its strongest annual performance in FY25, with revenue crossing ₹50,000 crore for the first time, up 12% YoY. PAT also hit a record ₹8,000+ crore, rising 14% YoY, supported by steady margins and growth across ICE and electric segments.

Over the last three years, this stock has given multibagger returns of more than 135%.

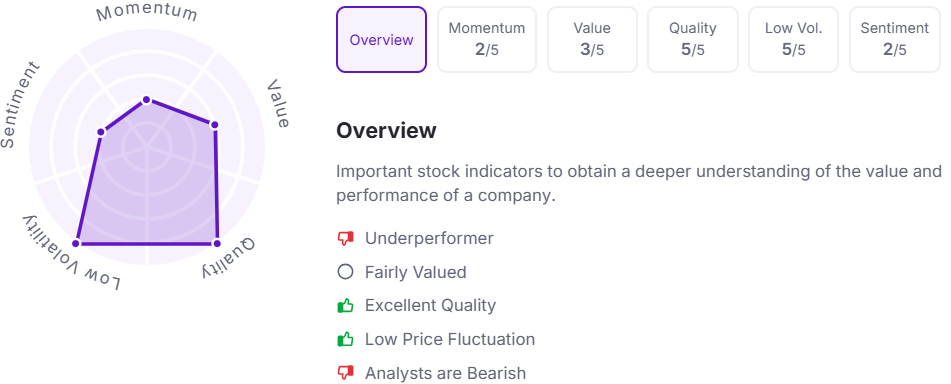

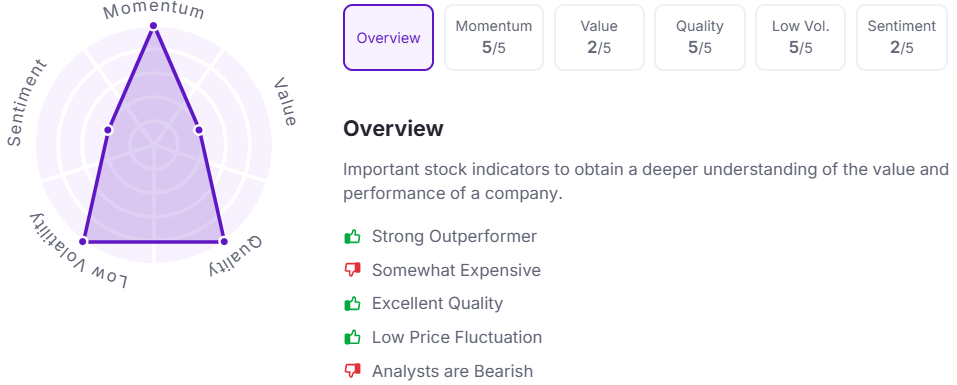

Let’s take a look at its Factor Analysis scores:

HDFC Life Insurance Company Ltd. has announced a final dividend of ₹2.10 per equity share. Its current dividend yield is 0.30% TTM.

HDFC Life, one of India’s leading private life insurers, delivered a strong FY25 with 18% growth in individual APE, 13% growth in value of new business to ₹3,962 crore, and a 70 bps rise in overall market share to 11.1%, backed by robust customer retention and sustained long-term value creation.

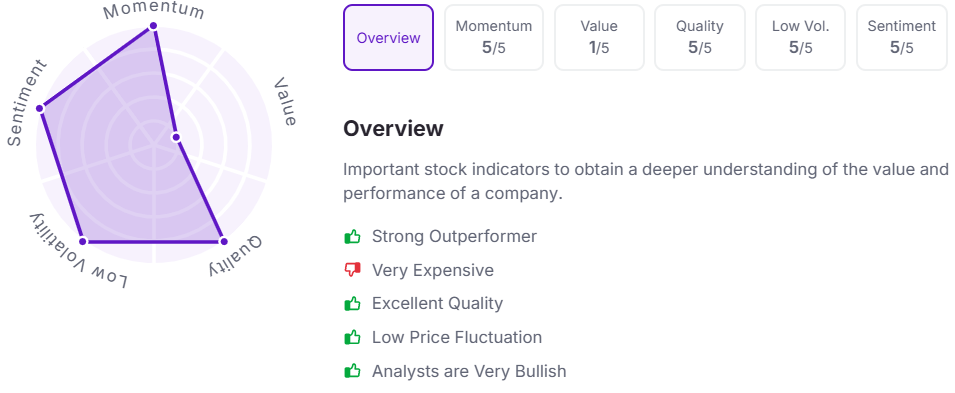

Let’s take a look at its Factor Analysis scores:

Tata Power Company Ltd. has announced a final dividend of ₹2.25 per equity share. It has a high dividend yield of 0.50%.

Tata Power, one of India’s largest integrated power companies, delivered a record FY25 with revenue of ₹64,502 crore, PAT of ₹5,197 crore (up 26% YoY), and 14% EBITDA growth, led by strong performance across renewables, T&D, and manufacturing, while maintaining its #1 rooftop solar position and 22 straight quarters of PAT growth.

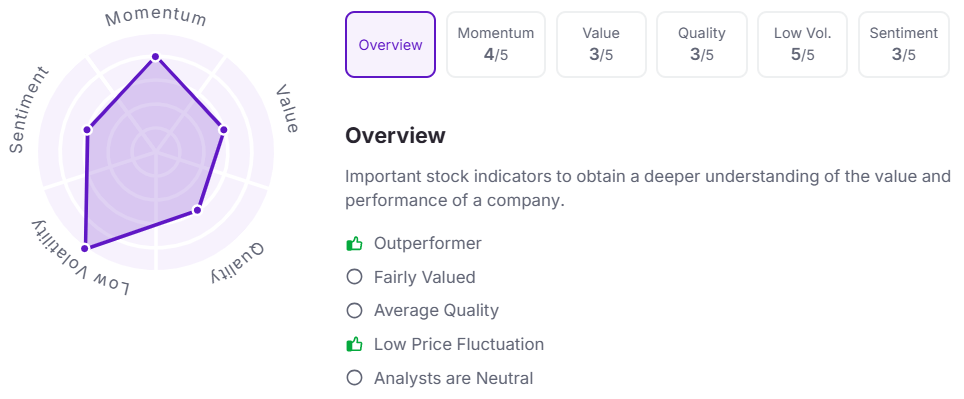

Let’s take a look at its Factor Analysis scores:

Punjab National Bank has announced a final dividend of ₹2.90 per equity share. Its current dividend yield is 1.40% TTM.

Punjab National Bank, one of India’s largest public sector banks, reported a record FY25 net profit of ₹16,630 crore (up 102% YoY) with RoA at 0.97% and GNPA down to 3.95%, marking a strong turnaround year backed by robust growth in retail advances, digital adoption, and asset quality improvement.

Over the last three years, this stock has given multibagger returns of more than 250%.

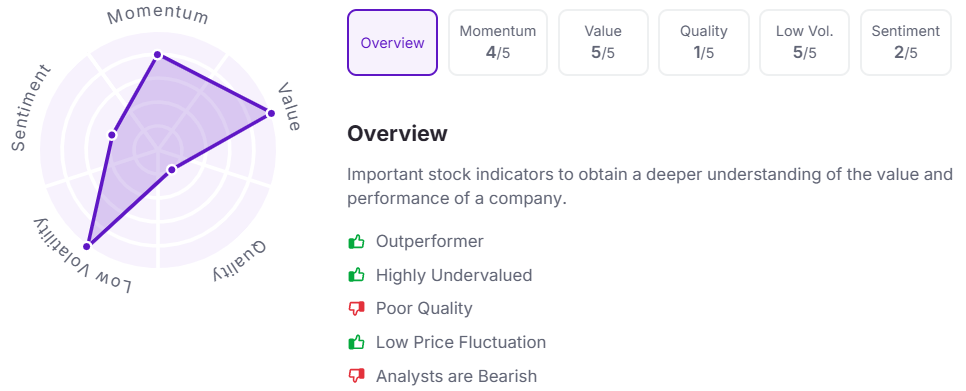

Let’s take a look at its Factor Analysis scores:

Torrent Pharmaceuticals Ltd. has announced a final dividend of ₹6.00 per equity share. Its current dividend yield is 1.00% TTM.

Torrent Pharmaceuticals, India’s 7th largest pharma company and a chronic therapy leader, reported ₹11,500 crore in FY25 revenue and announced Aman Mehta’s appointment as Managing Director from August 1, 2025, marking a new phase of strategic leadership amid strong domestic growth and global presence across Brazil, the US, and Germany.

Over the last three years, this stock has given multibagger returns of more than 130%.

Let’s take a look at its Factor Analysis scores:

Note: The stock prices mentioned are as of 12:45 PM.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.