- Share.Market

- 3 min read

- Published at : 14 May 2025 04:57 PM

- Modified at : 16 Jul 2025 07:34 PM

The shares of BEML, Great Eastern Shipping Company, and Manappuram Finance are set to trade ex-dividend on Thursday, May 15, 2025. Investors who wish to be eligible for the upcoming dividends, must have bought the shares before the ex-date and hold them at least till the record date.

BEML

BEML, an Indian PSU that manufactures a variety of heavy equipment, has declared its second interim dividend of ₹15 per equity share for FY 2024-2025. It has a dividend yield of 0.60% on a TTM basis. The company had previously announced an interim dividend of ₹5 per share on February 14, 2025, and a final dividend of ₹15.50 per share on September 13, 2024.

Over the last three years, this stock has given multibagger returns of more than 5140%.

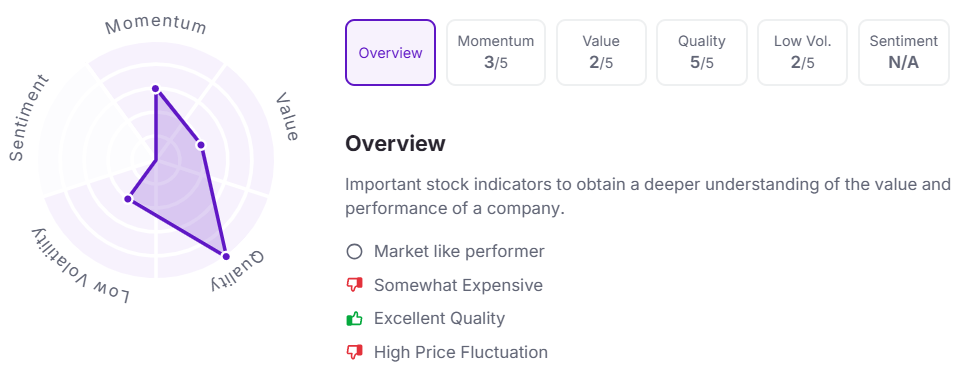

Let’s take a look at its Factor Analysis scores:

Great Eastern Shipping Company

Great Eastern Shipping Company has announced an interim dividend of ₹265 per equity share. The company previously announced an interim dividend of ₹240 on May 07, 2024.

Great Eastern Shipping is India’s largest private sector shipping company. It operates across two key segments – shipping and offshore services. Its shipping division handles the transport of crude oil, petroleum products, gas, and dry bulk cargo. The offshore business, run through its subsidiary Greatship (India) Limited, supports oil and gas exploration with services like offshore logistics and drilling support.

With over six decades of experience, the company has built strong technical expertise and a solid global reputation. Known for reliability and customer focus, it continues to deliver value while adapting to evolving industry needs.

Over the last three years, this stock has given multibagger returns of more than 140%.

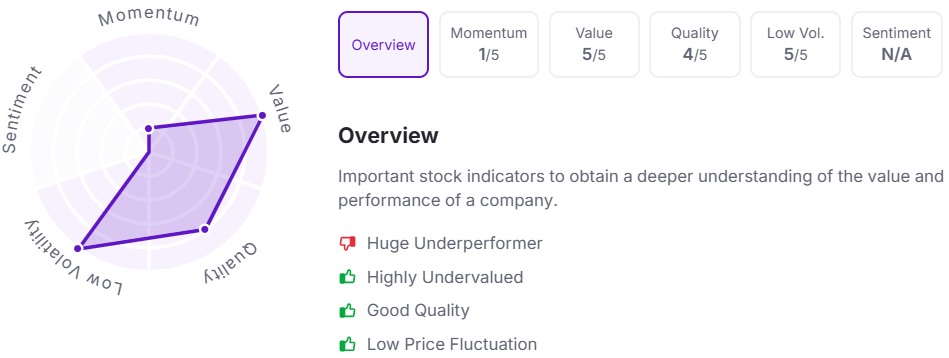

Let’s take a look at its Factor Analysis scores:

Manappuram Finance

Manappuram Finance, an NBFC, has announced an interim dividend of ₹0.5 per equity share. The company previously announced interim dividends of ₹1 on February 21, 2025, November 18, 2024, August 26, 2024, and June 05, 2024.

Manappuram Finance is one of India’s leading non-banking financial companies (NBFCs) with a legacy from 1949. Today, it operates over 5,000 branches across 28 states and union territories, offering products such as gold loans, microfinance, housing finance, vehicle loans, and SME loans.

Over the last three years, this stock has given multibagger returns of more than 135%.

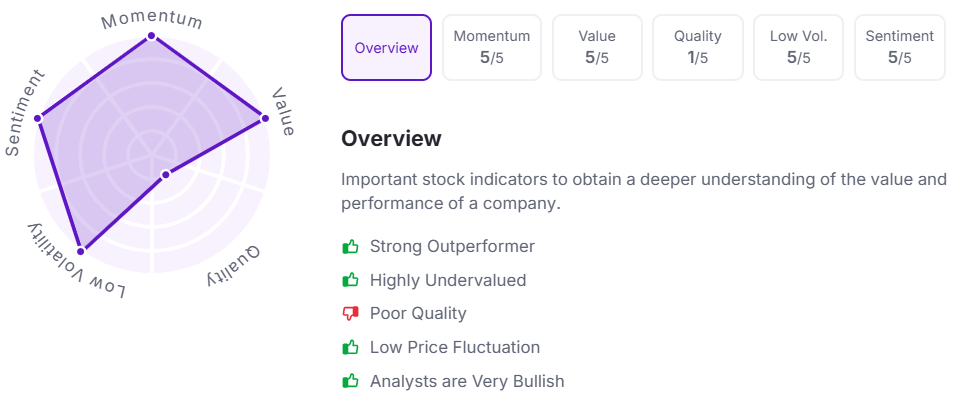

Let’s take a look at its Factor Analysis scores:

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.