- Share.Market

- 8 min read

- 01 Aug 2025

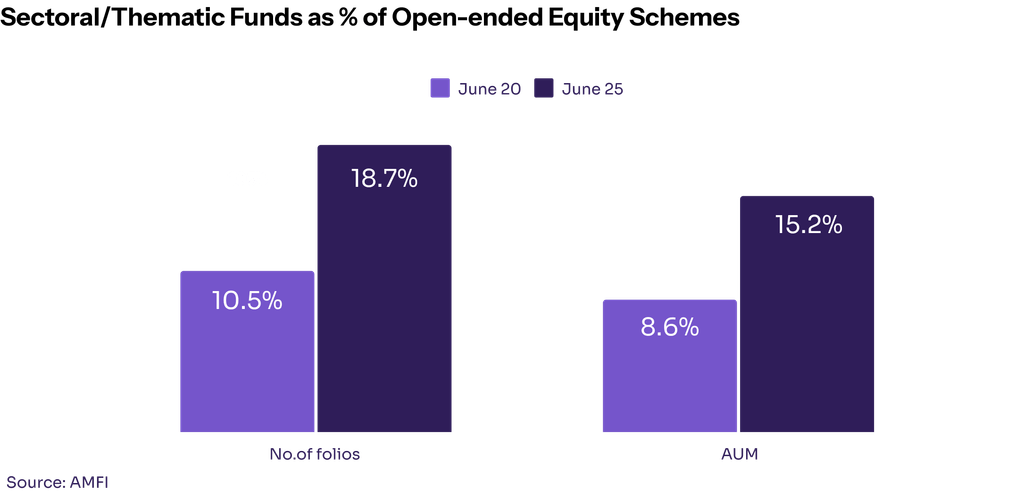

Over the past few years, there has been a dramatic rise in the number of investors in thematic and sectoral mutual funds – the number of investor folios with sectoral and thematic funds has increased from about 6.7 million in June 2020 to over 31 million in June 2025.

Within the equity category, the share of folios having thematic and sectoral funds has increased from about 10.5% to almost 19% during the same period. In terms of assets under management, thematic and sectoral funds now constitute 15.2% of the equity category assets, as compared to 8.6% about five years back.

Do Thematic and Sectoral Funds Really Deserve Such a Place in Investors’ Portfolios?

While this growth may seem impressive, the key question to ask here is, do such funds really deserve a place in so many investors’ portfolios, and are they aware of the risk-reward associated with such funds?

Here’s what we think.

Firstly, diversification is one of the most basic investing principles that every investor must follow to optimise the risk in their portfolios, aligned with their risk tolerance. This diversification has to be not just across asset classes and stocks but also across sectors and themes.

But don’t take our word for it. Let’s dive deep into some historical data to see why we believe diversification across sectors and themes is critical:

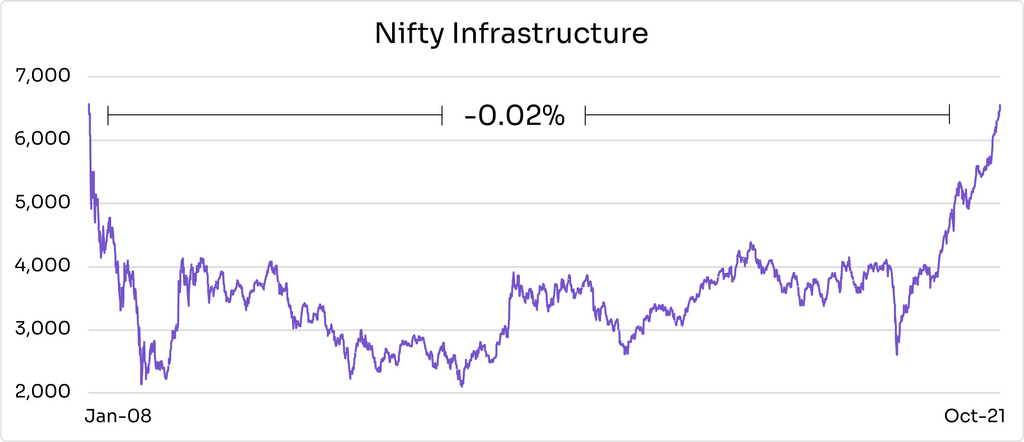

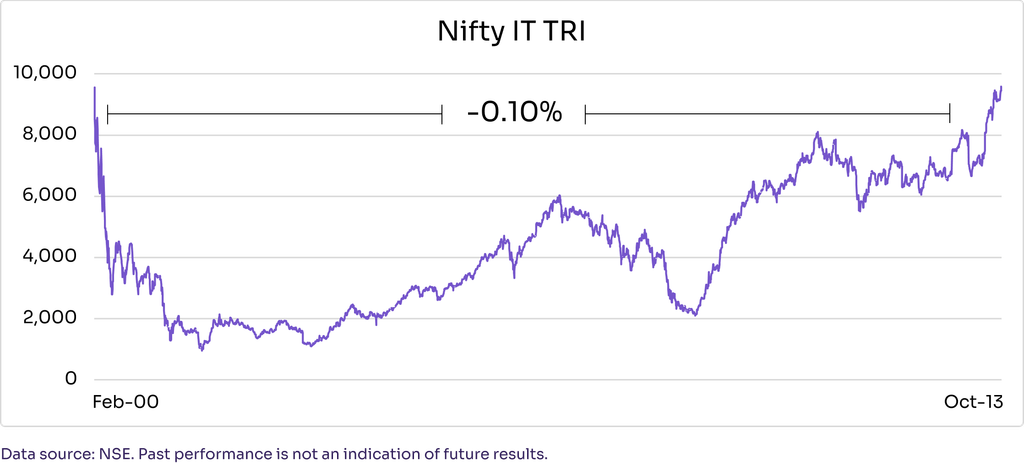

As you can see in the above charts, investments made in some of the sectors and themes that were “trending” at the time of investment have ended up underperforming for a prolonged period of time. Infrastructure was the most talked about theme in 2007-08, but the data suggests that it was one of the worst-performing themes for the next decade or so, with the Nifty Infrastructure Index taking more than a decade to recover to its 2007-08 levels. A similar behaviour was noticed in IT stocks when there was massive hype around this sector in 1999-2000.

These are not the only sectors and themes which have experienced such underperformance post the hype around them. Rajeev Thakkar, CIO and Director at PPFAS Mutual Fund, in a recent letter to PPFAS unitholders pointed out that “If an investor of today were to time travel back to the 1990s, there would have been excitement around the opening up of the civil aviation sector to private sector airlines and of the opening up of the telecom sector for private sector cellular operators. We all know that almost all the airlines of that era went bankrupt, and barring one, none of the other telecom companies of that era made any money for their investors.”

Even today, many investors are chasing themes such as Electric Vehicles, Defence, etc, based on the growth expectations in these sectors. But history suggests that mere growth expectations may not make a theme or sector investment worthy.

Why Chasing Sectoral and Thematic Funds Doesn’t Work?

A sector or theme often starts trending when the stocks in that sector or theme show strong recent performance, which may or may not be backed by the performance of underlying businesses. Typically, such a phase also coincides with hype around the future growth prospects in the sector.

But from an investment perspective, one needs to look beyond such noise and assess:

- The probability of such growth expectations materialising in the sector.

- If it does materialise, are there businesses which are in a strong position to capitalise on such a growth opportunity?

- How is this growth opportunity likely to drive competition, and are there businesses with necessary moats or competitive advantages that can help them deliver sustainable growth?

- How are the business fundamentals looking – growth, profit margins, capital structure, demand-supply equation and so on?

- The valuations or price that we pay for the business. Chasing a sector or a theme purely based on a fad often delivers negative outcomes.

- Needless to say, the management of the business and its corporate governance practices play an extremely critical role in the success of the business and its stock performance.

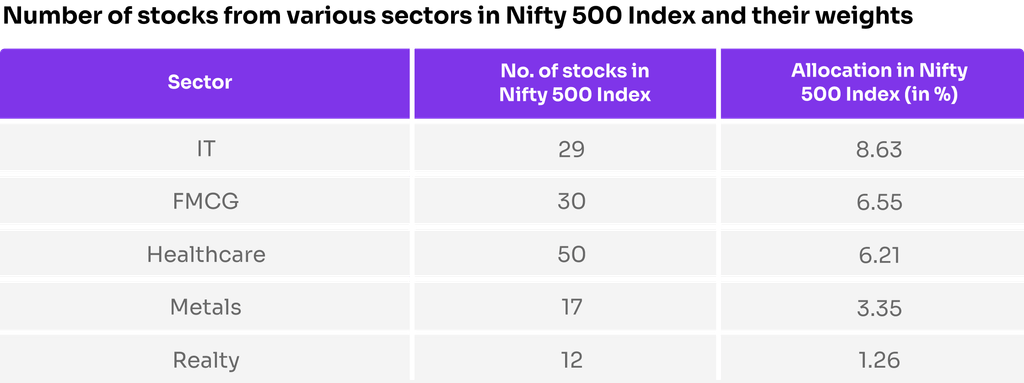

In a sectoral or thematic fund, the fund manager is forced to invest predominantly in stocks from a particular sector or theme, even when there are not enough attractive investment opportunities based on the above criteria. Also, many sectors or themes tend to be quite narrow in nature with a small number of investable stocks (refer table below), making it difficult for the fund manager to deploy funds when there is increased inflow. The onus, therefore, is on the investors to time the entry/exit in such funds.

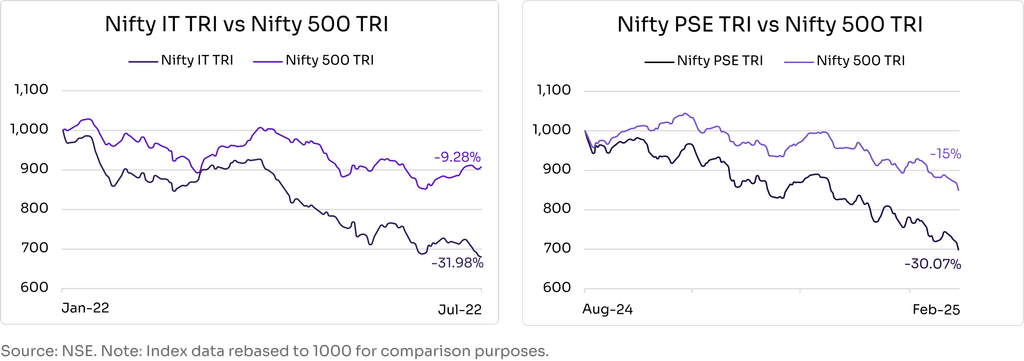

And if investors enter such funds at the wrong time, the consequences can be severe. For example, IT sector funds were in demand in 2021 due to its stellar performance, but in the first few months of 2022, the sector was down almost 32% vs a fall of 9% for the broader index Nifty 500. A similar trend was observed in PSU stocks more recently in 2024-25 (refer to charts below).

That said, you may come across some investors who have made great returns by investing disproportionately in specific sectoral or thematic funds. Their stories may make you question the diversification principle.

But what we as investors need to know is that, like most other spheres of life, investing also requires two important things – skill and luck. Making successful sectoral and thematic calls isn’t easy, and chasing sectors and themes that have done well in the recent past is definitely not the way to succeed.

Moreover, even the best of the investment professionals require luck to be successful in identifying the right sectors and themes to invest in and then exit at the right time. While you may hear of some success stories of how some investors made money investing in specific sectoral or thematic funds, no one talks about many not-so-lucky investors who fail miserably while following such an investment approach.

When you are investing your hard-earned money and when achieving your life goals is dependent on your investing success, you cannot simply rely on luck. Can you? Instead, you need to choose the strategy that has a higher probability of helping you create long-term wealth and achieve your financial goals. And that strategy is, of course, diversification.

But What Makes Sectoral and Thematic Funds so Popular?

There are several reasons, the most prominent ones being:

- Recent Performance: If you go back and check the sectors or investing themes that were trending at any point in time in history, you will likely notice that most of the stocks that are part of those themes would have done phenomenally well. There will be stories floating around about how people have made tons of money investing in those stocks. Such great recent performance obviously leads to increased interest among investors.

- New Fund Launches: Mutual fund houses typically try to capitalise on such trends by launching funds focused on such sectors and themes. Fund houses are manufacturers of mutual fund schemes, and as such, they will typically look to launch every kind of fund that is of interest to investors. That doesn’t necessarily mean it’s a great fund to invest in.

- Story Telling: As human beings, we often get attracted towards good stories as they are easy to understand and, more importantly, create the necessary excitement that grabs our attention. But investing is a lot more than stories. As mentioned earlier, a robust investment is one which takes into consideration not just the growth aspect but also the long-term business fundamentals, valuations and corporate governance of the business.

So, Who Should Invest in Sectoral and Thematic Funds?

Sectoral and thematic funds are typically meant for seasoned investors who have their core portfolio in place and who want to take a tactical bet based on their views on a specific sector or theme. Such views should not be based just on growth expectations but also on other factors, including business fundamentals and valuations of the stocks in the sector. Moreover, timing the entry and exit in such funds becomes extremely important, which most investors would struggle to do.

The only exception is certain thematic funds which are inherently diversified in nature – the likes of opportunities funds or business cycle funds – which follow a sector rotation strategy. Investors who have their core portfolio in place could consider such funds for long-term investing, without the need to make frequent entry/exit decisions or take a sectoral view, as such decisions are taken by the fund managers.

In Conclusion

As investors, we need to remember that an investment idea that is popular or exciting will rarely make us money. We don’t need to act out of FOMO (Fear of Missing Out) or seek excitement in investing. Successful investing is often quite boring. Like Paul Samuelson once said, “Investing should be more like watching paint dry or watching grass grow. If you want excitement, take $800 and go to Las Vegas.”

Disclaimer: Mutual Fund Investments are subject to market risks, read all scheme-related documents carefully.

PhonePe Wealth Broking Private Limited | AMFI – Registered Mutual Fund Distributor ARN- 187821