- Share.Market

- 2 min read

- 07 Aug 2025

‘Invest for the long-term’, ‘SIPs help you build wealth in the long run’, we’ve been hearing these since the time Mutual Funds have become a mainstay in our lives. We’ve come around to the idea that Mutual Funds do build wealth, but how does one define long term?

The interpretation of ‘long term’ varies among individuals. Perspective on a longer time horizon can be influenced by the person’s age. For instance, a 25-year-old might consider a period of 3 years as a significantly long term, as it encompasses more than 10% of their lifetime but is that really a long term in investment?

To avoid this confusion, we took a step back and tried to understand what exactly is defined as long-term.

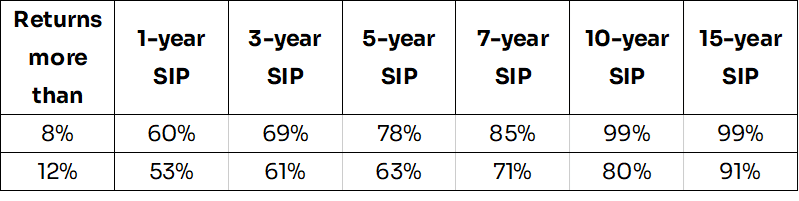

We looked at 1-year, 3-year, 5-year, 7-year, 10-year and 15-year rolling returns of SIPs and tried to find the probability of how likely it is that you would have made more than 8% and 12% in the past. Here’s what we found:

If you look at 8%, better than inflation and most FDs, your probability looks good once you cross the 5-year mark. For 10 and 15 years, the probability is 99%, a near guarantee if you had invested in that time period.

But what if you are a little more aspirational, looking at double-digit returns, let’s say 12%. Here your probability looks good once you cross the decade mark. In a 15-year timeframe your probability is as good as 91%.

To be clear, this doesn’t mean that to make 8% or 12% returns, you will take at least 10 years every time, our analysis says that based on past data your probability of making these returns is very good in the said time frame.

So the next time when someone says, SIPs reward patience and long-term investment, you truly know what they are talking about.