- Share.Market

- 9 min read

- 21 Oct 2025

If you’re trying to figure out market momentum or spot possible reversals, the Relative Strength Index (RSI) is one of the most popular tools for traders. It tells you how strong and how fast a price is moving, making it a reliable momentum oscillator.

Whether you’re a beginner or an experienced trader, learning what is RSI indicator and how to use RSI smartly can help you make better decisions in the stock market.

What is the Relative Strength Index (RSI)?

So, what is RSI exactly? The relative strength index is a technical indicator that measures recent price changes to spot if a stock is overbought or oversold.

Unlike indicators that only show price levels, RSI looks at the speed and strength of recent price moves. This is important because sudden jumps or drops can hint that a trend might pause, reverse, or lose strength. Simply put, RSI helps you tell if the market still has energy or if it’s starting to slow down.

RSI is an oscillator, meaning it moves within a fixed range (between 0 and 100). That makes it super easy to read, especially when you’re trying to spot extreme conditions.

How Can Traders Interpret RSI Signals?

When you look at the RSI on a chart, you’ll usually see a single line just below the main price chart. This line moves between 0 and 100, making it easy to spot possible market extremes.

Overbought and Oversold Levels: What They Really Mean

One of the most popular ways to use RSI is by watching the overbought and oversold zones.

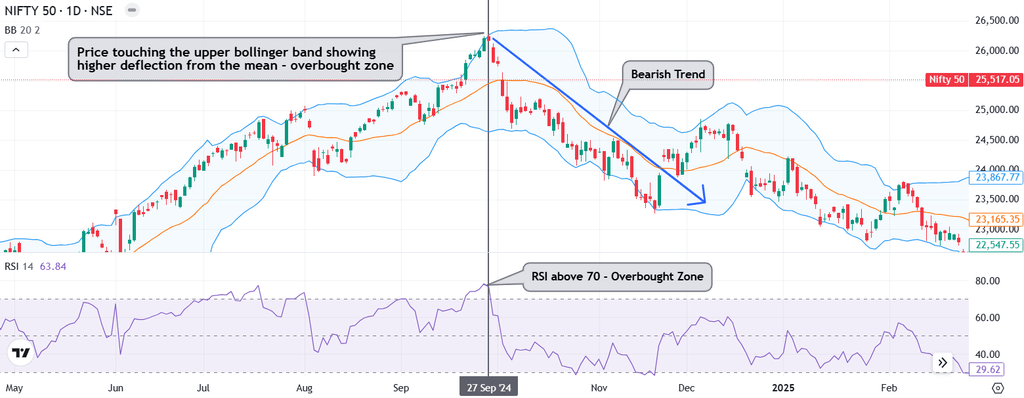

- If RSI goes above 70, it’s called overbought. That doesn’t mean prices will crash, but it suggests that buying has been intense, and a pullback could be on the cards.

- If RSI dips below 30, it’s considered oversold. This usually means that selling has been overdone, and a bounce or reversal may occur.

What happens when RSI is overbought? In strong trends, the RSI can remain overbought or oversold for an extended period, so it is essential to consider the overall trend. For example, selling just because the RSI crosses 70 in a bullish trend might make you miss out on more upside.

So, context is key. In trending markets, extreme RSI values might support the trend. In range-bound markets, they could signal reversals. That’s why pairing RSI with other indicators or price action makes your analysis stronger.

The Significance of the 50 RSI Level to Spot Trends Easily

Beyond the extreme levels, the 50-level centerline of the RSI holds significance. While most traders focus on the 30 and 70 levels, don’t overlook the 50 levels; it plays a key role in identifying trend direction.

- When the RSI moves above 50, it means that average gains are now greater than average losses, suggesting bullish momentum.

- If the RSI falls below 50, losses are taking the lead, indicating bearish sentiment.

In fact, during uptrends, RSI often finds support between 40 – 50, and in downtrends, it tends to face resistance in the 50 – 60 zone. A strong move above 60 during a downtrend, for example, could be an early signal of a potential trend reversal. Customising RSI for Your Trading Style

By default, RSI is calculated using a 14-period setting, a balanced option that works well for many traders across different timeframes. But one of the great things about RSI is that it’s highly customisable. You can tweak it based on your trading approach:

- Shorter Periods (e.g., 7 or 9): These make RSI more sensitive, generating more frequent signals. This works well for day traders and scalpers looking to catch quick moves. However, the increased sensitivity can also result in more false signals, making risk management crucial.

- Longer Periods (e.g., 14+): These offer smoother signals with fewer whipsaws, making them ideal for swing traders or those with a medium-term outlook.

That’s how to use the RSI indicator for trading effectively. A more sensitive RSI might give you early entries, but it also requires sharper judgment to avoid getting trapped in false moves.

How is RSI Calculated?

Understanding how to calculate the RSI of a stock makes its signals clearer. Here’s the formula:

| RSI = 100 – (100 / (1 + RS)) |

Here, RS stands for relative strength, the key to the whole calculation. It’s the ratio of average gains to average losses over a set period (usually 14). First, you add up all the gains from days when the price moved up and divide by the number of periods to get the average gain. Then, you do the same for losses, only counting days when the price dropped.

Once you’ve got both, you calculate RS and plug it into the formula above. That gives you a normalised number between 0 and 100. What’s great is that this single number reflects whether buyers or sellers have been stronger in recent price action. Closer to 100? Strong bullish momentum. Closer to 0? Sellers are in control.

In the end, RSI is a smart way to simplify complex price movement into something easy to read, helping you spot if an asset is overbought, oversold, or somewhere in between.

This is how the RSI indicator works.

How to Use the RSI Indicator Effectively in Your Trading Strategy?

Once you’re comfortable with the basics of RSI, it’s time to take things a step further. Advanced traders often use RSI to do more than just spot overbought or oversold zones. They analyse divergences and combine RSI with other tools to cut through market noise, confirm potential setups, and refine their decision-making.

Spotting Divergence: An Early Warning System

Knowing what RSI divergence is can give you an edge. Divergence happens when price and RSI start telling different stories. The price might be climbing or falling, but if RSI doesn’t follow along, that mismatch can be a warning sign that momentum is fading. It’s like the market quietly saying, “Something’s not right here.”

This isn’t just a contradiction; it’s a clue that momentum may no longer be backing the trend. And that can help you spot a potential shift before it becomes obvious on the price chart.

Here are the two key types of divergence to look out for:

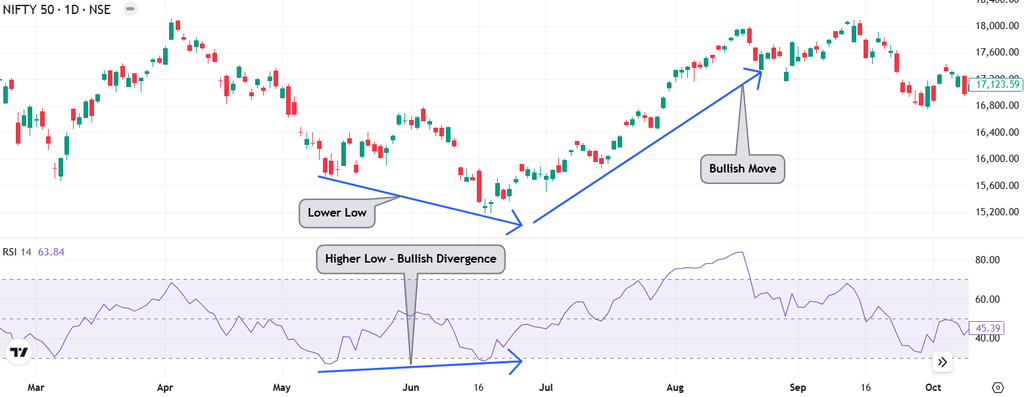

1. Bullish Divergence: This shows up when the price makes a lower low, but the RSI makes a higher low. It means selling pressure is easing, even if the price hasn’t turned yet. Spotting this near a support level could signal a buying opportunity.

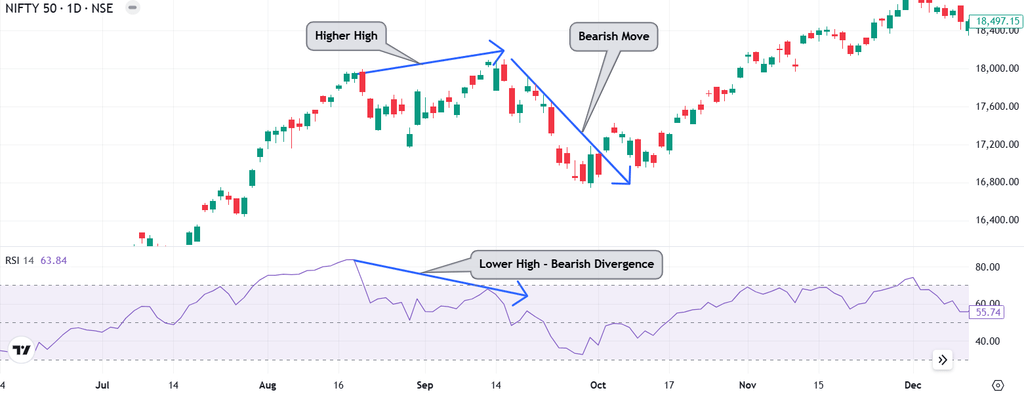

2. Bearish Divergence: This is when the price makes a higher high, but RSI prints a lower high. It’s a hint that buying strength is fading despite the price rising. If this happens near a resistance level, it might be time to watch for a reversal or pullback.

Divergences can serve as early signals of trend changes, helping you stay one step ahead instead of reacting after the move has occurred.

Using RSI with Other Indicators for Better Results

RSI is most effective when used with other indicators. Combine it with other indicators, such as Moving Averages, MACD, Bollinger Bands, or ADX, to confirm signals and improve timing. This gives you a clearer view of the market and more confidence in your trading decision.

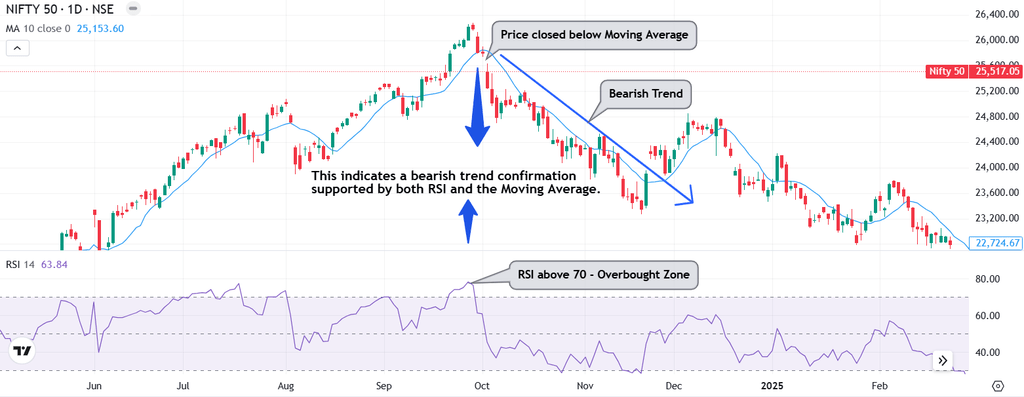

Moving Averages :

Moving averages help identify the overall trend and act as a filter for RSI signals. In a confirmed uptrend (like a Golden Cross), RSI below 30 can indicate a strong buying opportunity, while in a downtrend, RSI above 70 may signal potential selling pressure.

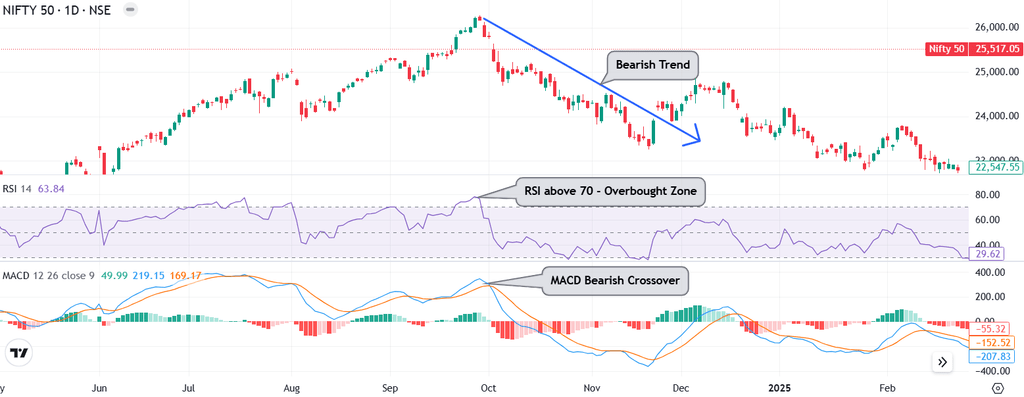

MACD (Moving Average Convergence Divergence):

MACD measures momentum and trend shifts, making it a strong companion to RSI. It helps confirm RSI divergence and momentum reversals. When RSI divergence aligns with a MACD crossover, it often signals a high-probability entry or exit point.

Bollinger Bands:

Bollinger Bands track market volatility and highlight price extremes, enhancing the accuracy of RSI signals. When RSI is above 70 near the upper band, it suggests overbought conditions; when below 30 near the lower band, it signals oversold levels.

Conclusion

The relative strength index is a simple yet powerful tool that shows how fast and how far prices are moving. It helps you spot overbought or oversold conditions, confirm trends using the 50-level, and detect early momentum shifts through divergence.

But to use RSI effectively, don’t rely on it alone. Combine it with other indicators like Moving Averages, MACD, Bollinger Bands, or ADX to confirm signals and improve timing.

Still, trading isn’t just about indicators. It’s about context, discipline, and risk management. Use stop-losses, size your trades wisely, and keep testing your strategies. The market evolves, and so should your approach. When paired with good judgment, RSI can be a real edge.

FAQs

RSI in the stock market is a momentum indicator that helps traders see if a stock is overbought or oversold.

A good RSI for a stock usually sits between 30 and 70. If RSI goes over 70, the stock might be overbought; under 30 means it could be oversold and due for a bounce.

You can check the RSI of a stock easily using most charting platforms or stock market apps, like Share. Market.

An RSI of 60 means momentum is still bullish but not yet overbought. It’s not a clear buy or sell by itself. Always check price trends and use other indicators as well.

The biggest limitation is that RSI can remain overbought or oversold during strong trends, resulting in false signals. This is why traders combine it with other tools to confirm what RSI indicates.

RSI tells you if buyers or sellers are dominating and if price moves are too stretched. It can warn of potential reversals or confirm that a trend is still healthy.