- Share.Market

- 7 min read

- 06 Oct 2025

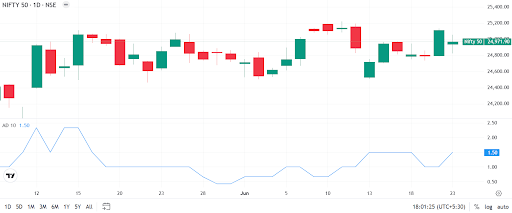

When you look at how the markets performed, your first instinct is probably to check the index. Did the Nifty close green? How much did the Sensex move? But the index alone doesn’t always tell you the full story.

That’s where the advance/decline ratio (ADR) helps. It lets you see what’s happening beneath the surface and how many stocks are truly participating in a rally or decline. And when you’re trying to understand market sentiment or identify a trend’s strength, that context makes all the difference.

What is the Advance/Decline Ratio?

The advance/decline ratio measures market breadth by comparing the count of rising stocks (advancers) to falling stocks (decliners) in a single trading session.

Instead of focusing on price alone, it tells you whether the broader market is moving in sync with the index. A rally supported by most stocks is more reliable than one led by just a few large players.

What Makes Up the Advance/Decline Ratio?

The ratio is built on two core data points:

- Advancing Stocks: Stocks that closed higher than their previous day’s close

- Declining Stocks: Stocks that closed lower than their previous day’s close

It does not include stocks that remained unchanged. This gives you a direct view of the market’s internal strength, showing whether gains or losses are widespread or isolated.

Why Does the Advance/Decline Ratio Matter?

Indices like the Nifty or Sensex are weighted averages. This means a handful of large-cap stocks can influence their direction disproportionately. For example, if Reliance and TCS perform well, the index may show gains, even if most other stocks are falling.

Checking the advance/decline ratio on NSE helps you avoid being misled by this. If the ratio aligns with the index’s direction, it confirms the trend. If it diverges, it may signal weakness or a potential reversal.

It’s especially useful on days when the index moves sharply or behaves unpredictably. The ADR offers clarity through broader participation data.

How is the Advance/Decline Ratio Calculated?

The calculation is straightforward. Here’s the advance/decline ratio formula:

Advance/Decline Ratio = Number of Advancing Stocks ÷ Number of Declining Stocks

Example:

Let’s say on a particular day:

- Advancing stocks = 1,250

- Declining stocks = 950

ADR = 1,250 ÷ 950 = 1.32

A ratio greater than 1 means more stocks advanced than declined. A ratio less than 1 means the opposite.

What Do the Values Represent?

Here’s what different ADR values represent:

| ADR | Market Interpretation |

|---|---|

| Above 1.0 | Bullish breadth, more advancers |

| Around 1.0 | Balanced market, neutral sentiment |

| Below 1.0 | Bearish breadth, more decliners |

It’s important to look at how this ratio behaves across days, not just in isolation. A falling advance/decline ratio over several sessions, while the index remains flat, might hint at a weakening market.

Connecting the Advance/Decline Ratio with Other Breadth Indicators

The advance/decline ratio is part of a family of market breadth indicators that use the same core data: advancing and declining stocks. Along with the ADR, traders often look at the advance/decline line, which plots the cumulative net difference between advancers and decliners to reveal long-term market trends, and the absolute breadth index, which measures overall market volatility by adding advancers and decliners regardless of direction.

Together, these tools offer a more complete picture of how many stocks are participating in market moves, helping traders confirm trends, spot divergences, and gauge the real strength behind index numbers.

How to Use the Advance/Decline Ratio?

You can use the advance/decline ratio in the following way:

1. Validate Market Trends

If the market is rising and the ADR is also above 1, the uptrend is considered broad-based. This confirmation adds confidence to your long positions.

2. Spot Weakness Before It Appears on the Index

If the Nifty moves higher but the ADR continues to fall, fewer stocks are participating. This hidden divergence can signal that the rally may not last.

3. Gauge Momentum During Sideways Markets

During consolidation phases, a gradually improving ADR can suggest accumulation and potential breakout. Conversely, a weakening ratio may hint at distribution and downside pressure.

How Traders Use This Ratio?

Traders use the advance/decline ratio to double-check what the index is showing. It’s often combined with other tools, such as moving averages, volume, and trendlines, to gain a clearer market picture. Many intraday and swing traders closely monitor the ratio to identify hidden strengths or weaknesses.

Pros of ADR

Here are some pros of using this ratio in technical analysis:

1. Easy to Understand

The ratio is simple to calculate; just divide advancing stocks by declining stocks. No complicated formulas or tools are required.

2. Checks Index Reliability

It helps confirm whether an index move is supported by a large number of stocks or just a few heavyweights, reducing the risk of being misled by headline numbers alone.

3. Early Signals

A sudden divergence between the index and the ADR can provide traders with an early warning of possible trend reversals or market exhaustion.

4. Flexible Across Timeframes

It can be used for intraday, daily, or longer-term analysis, making it useful for all kinds of traders and investors.

What are the Limitations of the ADR?

While the ADR is a handy tool, it has several drawbacks that you should consider before relying on it alone.

1. Does Not Show Magnitude of Moves

The ratio only considers the number of advancing and declining stocks, not how much each stock moved. A stock rising by ₹0.50 is treated the same as one rising by ₹100.

2. No Sector-Level Insight

The ratio does not differentiate between advances coming from strong sectors and weaker ones. Two stocks moving up from weak sectors may not have the same weight as a sector-wide rally.

Conclusion

The advance/decline ratio offers a simple yet powerful view of market sentiment. It goes beyond the surface and helps you understand whether the movement of the index is genuine or skewed by a few large stocks.

By using it alongside other indicators, like volume, trendlines, or moving averages, you’ll be better equipped to evaluate market strength, avoid false signals, and build a more confident strategy.

In fast-moving markets, clarity is your edge. The ADR gives you just that.

FAQs

It’s a market indicator that compares the number of advancing stocks to the number of declining stocks to show market breadth.

Unlike the ratio, the advance/decline line is a cumulative total: you add the daily net difference (advancers minus decliners) to the previous day’s total. This shows long-term market breadth trends.

A ratio above 1 suggests broad market strength; the higher above 1, the stronger the bullish sentiment.

The ADR shows the number of advancing vs. declining stocks. Whereas the Arms Index (TRIN) adds volume into the mix, comparing ADR with volume to show buying or selling pressure.

Use it to confirm index trends, spot divergences, and gauge whether rallies or declines are well-supported by the broader market.

A high advance/decline ratio means more stocks are rising than falling. A sign of strong, broad-based bullish sentiment.

Disclaimer and Disclosure

Investments in the securities market are subject to market risks, read all the related documents carefully before investing. Registration granted by SEBI, enlistment as Research Analyst with Exchange and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Kindly refer to https://share.market/ for more details.Investments in WealthBaskets are subject to the Terms of Service. All investors are advised to conduct their own independent research into investment strategies before making an investment decision. PPWB acts as a distributor of mutual funds and WealthBaskets and it is not an exchange traded product. Disputes with respect to the distribution activity of Mutual Funds and WealthBaskets will not have access to Exchange investor redressal or Arbitration mechanism. The securities are quoted as an example and not as a recommendation. This is for informational purposes and should not be considered as recommendations.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887 and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226. Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA. CIN: U65990KA2021PTC146954