- Share.Market

- 10 min read

- 30 Sep 2025

In 2019, WeWork was valued at $47 billion, making headlines as one of the fastest-growing startups in the world.

Its promise was simple yet ambitious: transform traditional real estate by offering flexible, shared office spaces for startups, freelancers, and global enterprises alike.

But within just a few years, the company became a textbook example of over-expansion, mounting losses, and failed governance.

The highly anticipated IPO was postponed, billions in investor value evaporated, and questions about the sustainability of its business model took center stage.

Now, after restructuring and rebranding efforts, the WeWork India Management Limited (WeWork India) IPO is once again back in the spotlight.

For the investors, this is more than just another stock listing; it’s a chance to understand how the coworking industry is evolving and whether WeWork’s comeback story can create lasting value in the flexible workspace market.

Before diving into the IPO details, let’s step back and look at the bigger picture: why the global demand for flexible office solutions is growing, and where WeWork fits into this changing landscape.

The Flexible Workspace Industry: Global Trends and India’s Growth Story

The global demand for flexible office solutions is expanding rapidly, driven by both macroeconomic changes and evolving workplace needs.

Once viewed as a niche segment for freelancers and startups, coworking has now become a mainstream strategy for Fortune 500 companies, startups, and Global Capability Centres (GCCs).

WeWork India Management Limited (WeWork India) is strategically positioned within this changing landscape as a premium operator that focuses on Grade A assets, enterprise clientele, and technology-led flexible solutions.

To understand its role, let’s first look at the broader industry dynamics shaping the sector.

1. Global and Macro Drivers of Flexible Workspace Demand

The shift toward coworking and flexible office solutions is not a short-term trend. It reflects fundamental changes in business strategy, cost management, and employee expectations worldwide.

Key Global Drivers

- Flexibility and Agility: Businesses increasingly want the ability to expand or contract office space without being tied to long leases.

- Capital Efficiency: Flexible workspaces reduce upfront capital investments in office fit-outs, freeing funds for core business growth.

- Hybrid Work Models: Post-pandemic, companies are adopting Core+Flex strategies, balancing traditional HQs with satellite offices.

- Operational Outsourcing: By outsourcing workspace management, companies save time and reduce administrative overhead.

- Employee Experience: Demand is rising for amenity-rich, collaborative, and tech-enabled offices that improve talent attraction and retention.

2. India’s Flexible Workspace Market: Size, Growth, and Opportunities

The Indian flexible workspace industry has moved from the fringes of real estate to the mainstream, contributing a significant share of office leasing activity.

Market Size & Growth

Market Size and Growth

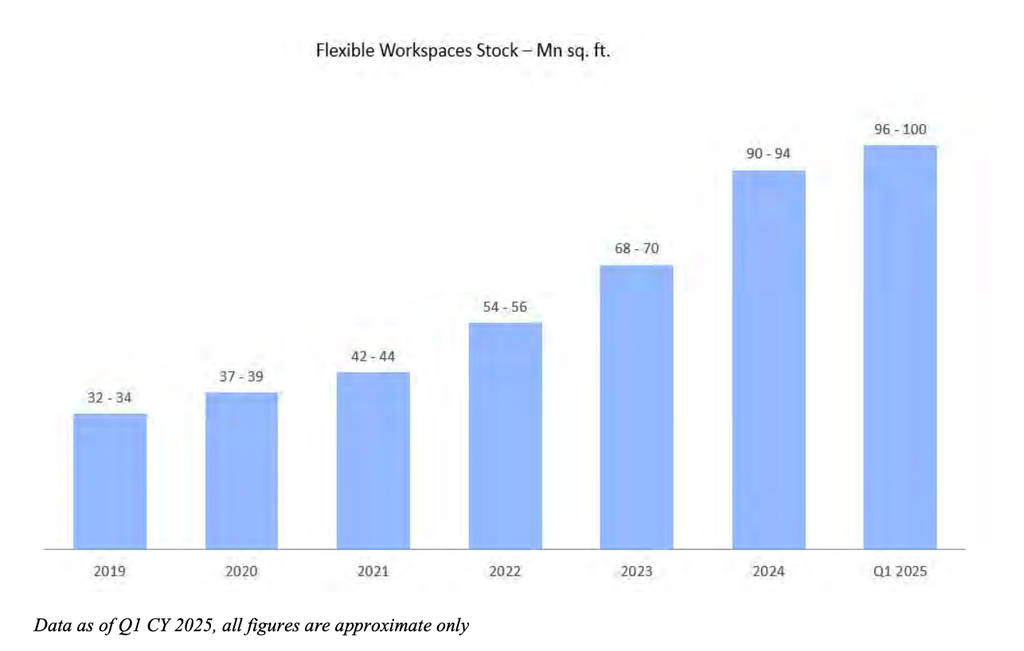

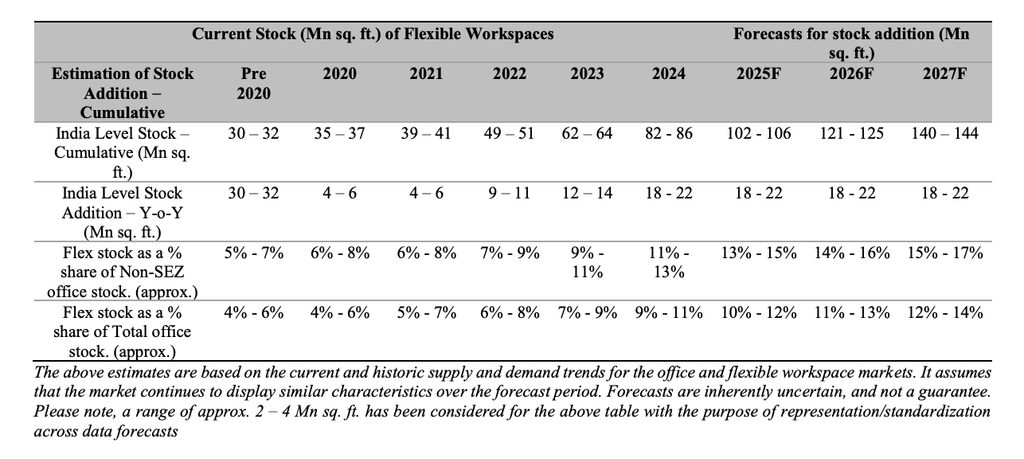

- Current Stock: Over 96 million sq. ft. as of Q1 CY2025, with Tier 1 cities contributing 88+ million sq. ft.

- Future Growth: Stock is projected to reach 140–144 million sq. ft. by CY2027, implying a CAGR of 18–20%.

- Total Addressable Market (TAM): Expected at 280–300 million sq. ft., valued at ₹730–960 billion by 2027.

- Penetration: Flexible workspace share of office stock is forecast to rise from 11–13% in 2024 to 15–17% by 2027.

India’s flexible workspace market is crowded, with nearly 500 operators.

Yet, the top 10 players, including WeWork India, Awfis, Smartworks, and IndiQube, dominate most of the supply.

Over the years, offerings have evolved from simple co-working desks to customized managed offices for startups, enterprises, and GCCs.

However, the sector isn’t without risks, from pricing pressure and economic cycles to the challenge of balancing long leases with short-term client contracts.

WeWork India: Business Overview

Founded in 2017, WeWork India Management Limited has grown into one of the largest premium flexible workspace operators in India, consistently leading the market by revenue over the past three fiscals.

Backed by Embassy Group, the company combines global brand recognition with local execution to capture India’s rapidly growing demand for Grade A flexible offices.

Business Model and Revenue Drivers

At its core, WeWork India leases commercial properties, invests in fit-outs, and transforms them into managed workspaces for enterprises, startups, and individuals. The company follows three operating models:

- Standard Lease Model (majority of centres): Long-term leases, with WeWork India managing fit-outs and directly collecting membership fees.

- Operator Model: Runs centres on behalf of landlords, earning a share of revenues while landlords bear most costs.

- Facility Management & Fit-Out Services: Provides infrastructure and management services for a fixed fee.

Key Revenue Streams

- Membership Fees: Primary revenue from private offices, enterprise suites, and co-working memberships.

- Value-Added Services (Ancillary): Customization, event spaces, F&B, printing, internet, parking, and advertising. Ancillary revenue crossed ₹2,161 million in FY2025, highlighting diversification.

- Digital Solutions: WeWork On Demand (pay-per-use desks/rooms), WeWork All Access (monthly global access), Virtual Office, and WeWork Workplace (workspace SaaS).

- Product Sales: Revenue from Zoapi’s SaaS platform, expanding into tech-enabled workspace services.

Scale and Market Presence

As of June 30, 2025, WeWork India has built significant operational scale in India’s Tier 1 cities:

- Operational Centres: 68

- Desk Capacity: 114,000+ desks

- Leasable Area: 7.67 million sq. ft.

- Occupancy Rate: 76.5%

- Portfolio Quality: ~94% of assets are in Grade A developments

The company’s operations are concentrated in major urban hubs, with Bengaluru and Mumbai contributing over 70% of membership fees.

This focus on premium Tier 1 cities aligns with demand from GCCs, Fortune 500 firms, and high-growth startups.

Client Base and Diversification

WeWork India serves a broad client portfolio, minimizing dependence on any single industry or member:

- Enterprise Members Dominate: ~76% of net membership fees (Q1 FY26) came from large corporates, Fortune 500s, and GCCs.

- Industry Spread: Technology, finance, professional services, media, and manufacturing form the largest client segments.

- Diversification: No single client contributed more than 10% of membership fees. The top 10 clients collectively accounted for ~23% (Q1 FY26).

- Tenure: Average membership tenure stood at 26 months, showing sticky enterprise demand.

After looking at the industry backdrop and the company’s positioning, let’s now turn to the part every investor wants to know: the IPO details.

WeWork India IPO Date, Price Band & Key Details

The Initial Public Offering (IPO) of WeWork India is designed as an Offer for Sale (OFS), meaning existing shareholders are selling their stake rather than the company raising fresh capital.

| IPO Date | October 3, 2025, to October 7, 2025 |

| Sale Type | Offer For Sale |

| Issue Price Band | ₹615 to ₹648 per share |

| Face Value | ₹10 per share |

| Minimum Lot Size | 23 Shares |

| Minimum Investment | ₹14,145 |

| Total Issue Size | ₹3,000.00 Cr |

To encourage participation from employees, the IPO includes a small reservation portion (up to ₹35 million worth of equity shares) for eligible employees.

Purpose of the Funds

Unlike IPOs that raise fresh capital for business growth, this issue is purely an Offer for Sale. That means:

- WeWork India will not receive any proceeds from this IPO.

- All the proceeds will go directly to the selling shareholders, Embassy Buildcon LLP, and 1 Ariel Way Tenant Limited.

From an investor perspective, this means the IPO will not immediately fund WeWork India’s expansion or technology investments.

Instead, the key benefits are listing gains, brand visibility, and liquidity for current shareholders.

WeWork India Financial Performance Analysis

WeWork India’s consolidated financial numbers for the past three fiscal years demonstrate significant challenges in revenue and profitability.

WeWork India Financial (FY23 to FY25)

| Particular (₹ in million) | FY23 | FY24 | FY25 |

| Revenue from Operations | 13,145.18 | 16,651.36 | 19,492.11 |

| EBITDA | 7,956.10 | 10,437.91 | 12,359.51 |

| EBITDA Margin (%) | 63.41% | 62.69% | 63.41% |

| Net Profit | -1,468.10 | -1,357.73 | 1,281.85 |

| Return on Adjusted Capital Employed (ROCE) (%) | 30.32% | 54.05% | 37.52% |

The company’s financial trajectory reflects rapid scale-up with improving unit economics, but profitability remains nuanced.

Revenues rose steadily on the back of capacity expansion, higher desk additions, and improved pricing realization, supported by growing ancillary and digital revenues.

However, reported profits in FY2025 were largely aided by a one-time deferred tax credit, masking underlying pressures from high depreciation, finance costs, and lease liabilities.

EBITDA margins stayed stable, while Adjusted EBITDA margins improved to 21.6%, signaling stronger operational efficiency.

Overall, the company shows progress toward sustainability, but true profitability depends on consistent occupancy gains and cost discipline.

Key Strengths of WeWork India

- Market Leadership and Strong Brand: WeWork India is the largest premium flexible workspace operator by revenue in India for the last three fiscals. Backed by the global WeWork brand, it enjoys the highest brand awareness and strong recall among enterprises, startups, and freelancers.

- Embassy Group Backing and Global Network: Majority-owned by the Embassy Group, WeWork India benefits from access to prime real estate, marquee tenants, and execution expertise. As the exclusive licensee of the WeWork brand in India, it also attracts global enterprises seeking consistency with their overseas offices.

- Premium Assets in Tier 1 Cities: With 94% of its portfolio in Grade A developments, WeWork India has a strong presence across India’s top office hubs, Bengaluru, Mumbai, Gurugram, and other Tier 1 cities. Its strategic focus on high-quality clusters strengthens demand from Fortune 500s and GCCs.

- Comprehensive and Flexible Offerings: From private offices and managed floors to digital solutions like WeWork On Demand, All Access, Virtual Office, and Workplace SaaS, the company offers one of the widest product ranges in the industry. This flexibility allows members to scale up or down seamlessly.

- Diverse and Sticky Enterprise Client Base: With over 87,000 members as of June 2025, WeWork India derives nearly 76% of revenues from enterprises and GCCs. High client retention (average tenure of 26 months) and expansion from existing members underline its strong, recurring demand base.

Key Risks of WeWork India

- Profitability and Cash Flow Challenges: Despite revenue growth, WeWork India has a history of net losses, negative cash flows, and high fixed costs from long-term leases and fit-outs. Future profitability is uncertain, and the IPO (structured entirely as an OFS) will not bring fresh capital to support growth or debt reduction

- Heavy Dependence on the WeWork Brand: The company operates as the exclusive licensee of the WeWork brand in India. Any disruption with WeWork Global, especially given its U.S. bankruptcy filing, could impact brand perception, revoke licensing rights, and disrupt access to global tech systems that power operations.

- Geographic and Client Concentration: A large share of revenue comes from just two cities (Bengaluru and Mumbai) and a relatively small set of large enterprise clients. Any loss of key clients or unfavorable local developments could significantly dent revenues, given the high reliance on multi-center occupiers.

- Legal, Regulatory, and Governance Concerns: The company faces ongoing legal proceedings against its promoter, auditor qualifications on internal controls, and post-DRHP complaints over disclosures and lease disputes. These governance challenges raise investor concerns around compliance, transparency, and long-term credibility.

- Lease and Landlord Dependency: With most centres under long-term fixed leases, WeWork India bears the risk of paying rentals regardless of occupancy. Moreover, reliance on a few major landlords increases vulnerability; non-renewals or unfavorable terms could disrupt a significant part of its operational portfolio.

Conclusion

From its launch in 2017 to becoming India’s largest premium flexible workspace operator, WeWork India’s journey mirrors the larger shift in how businesses and people work.

What started as a global idea of shared spaces has found deep roots in India’s Tier 1 cities, serving enterprises, startups, and individuals alike.

Yet, just like the ups and downs that defined WeWork’s global story, the Indian business too stands at a crossroads, balancing rapid growth with structural risks.

For investors, the IPO marks not just a listing, but the next chapter in this evolving workspace narrative.

Disclaimer and Disclosure

Investments in the securities market are subject to market risks, read all the related documents carefully before investing. Registration granted by SEBI, enlistment as Research Analyst with Exchange and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Kindly refer to https://share.market/ for more details.Investments in WealthBaskets are subject to the Terms of Service. All investors are advised to conduct their own independent research into investment strategies before making an investment decision. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. PPWB acts as a distributor of mutual funds and it is not an exchange traded product. PPWB acts as a distributor of mutual funds and WealthBaskets and it is not an exchange traded product. Disputes with respect to the distribution activity of Mutual Funds and WealthBaskets will not have access to Exchange investor redressal or Arbitration mechanism. The securities are quoted as an example and not as a recommendation. This is for informational purposes and should not be considered as recommendations.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887 and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226. Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA. CIN: U65990KA2021PTC146954