- Share.Market

- 12 min read

- 04 Aug 2025

Investing in Real Estate Without Buying a Flat? That’s Exactly What This IPO Lets You Do.

Imagine owning a piece of a commercial building, like a swanky IT park in Bengaluru or a high-tech office tower in Pune, without ever having to deal with tenants, maintenance, or paperwork.

That’s the power of a REIT, or Real Estate Investment Trust. And now, with the Knowledge Realty Trust REIT IPO, investors get a fresh opportunity to step into India’s booming commercial real estate sector.

In this article, we’ll walk you through everything you need to know about the Knowledge Realty Trust REIT IPO – from the company’s business model and property portfolio, to IPO details, financials, risk factors, and what makes this REIT stand out in a growing but selective Indian REIT market.

But before diving into the company’s details, let’s quickly understand what a REIT is, because this will help you grasp everything that follows.

What is a Real Estate Investment Trust (REIT)?

Think of a REIT like a mutual fund for real estate. Instead of pooling money to invest in stocks, a REIT pools money from investors to buy high-value commercial properties, like office parks, warehouses, or tech campuses.

These are income-generating properties, professionally managed, and usually too expensive for individuals to buy directly.

But with a REIT, you can own a slice of these buildings and earn a share of the rental income, all without being a landlord.

REITs make it easier for everyday investors to participate in India’s booming commercial real estate market with the same ease as buying a stock.

What Makes REIT Investment Important?

- Regular Income: REITs in India are required to distribute at least 90% of their income as dividends. So investors often get steady payouts, just like earning rent, but without owning a flat.

- Diversification: REITs behave differently from stocks or bonds, so adding them to your portfolio can balance your risk, especially during market ups and downs.

- Liquidity: Unlike owning physical property, REIT units are listed on stock exchanges like the NSE and BSE. You can buy or sell them simply.

- Transparency and Regulation: REITs are tightly regulated by SEBI, which ensures clear disclosures, biannual property valuations, and financial transparency. This makes them a safer and more trustworthy way to invest in real estate.

With the basics in place, let’s look at the star of this IPO, Knowledge Realty Trust, and understand what it brings to the table.

Knowledge Realty Trust (KRT) REIT: The Company Behind the IPO

When it comes to real estate, trust is everything. And that’s how Knowledge Realty Trust (KRT) began: as a formally registered company in Mumbai in October 2024.

Just eight days later, KRT was officially registered as a SEBI-approved Real Estate Investment Trust. This lightning-fast setup shows that the team behind KRT wasn’t new to the game; they had the experience, clarity, and regulatory know-how to get things moving smoothly from Day 1.

But what exactly does Knowledge Realty Trust do?

At its core, KRT raises money from investors and uses those funds to buy income-generating commercial properties – think large office parks, corporate campuses, and tech hubs.

These properties are either directly owned or held through SPVs (Special Purpose Vehicles) and Investment Entities.

The aim is simple: generate rental income and pass a major share of it back to investors.

The trust was settled with an initial contribution of ₹0.1 million and is sponsored by two well-known giants in the real estate and investment space:

- BREP Asia SG L&T Holding (NQ) Pte. Ltd. (also known as the Blackstone Sponsor)

- Sattva Developers Private Limited (the Sattva Sponsor)

These sponsors have partnered in a 50:50 joint structure to manage the REIT through a professionally set-up entity called Knowledge Realty Office Management Services Private Limited.

This Manager is held equally by both sponsor groups, ensuring balanced oversight and decision-making.

The trust itself is overseen by Axis Trustee Services Limited, which acts as the official Trustee under SEBI guidelines.

KRT’s entire asset structure is designed to comply fully with SEBI’s REIT regulations, and the properties in its portfolio are proposed to be held through the appropriate SPVs and holding companies to ensure tax and operational efficiency.

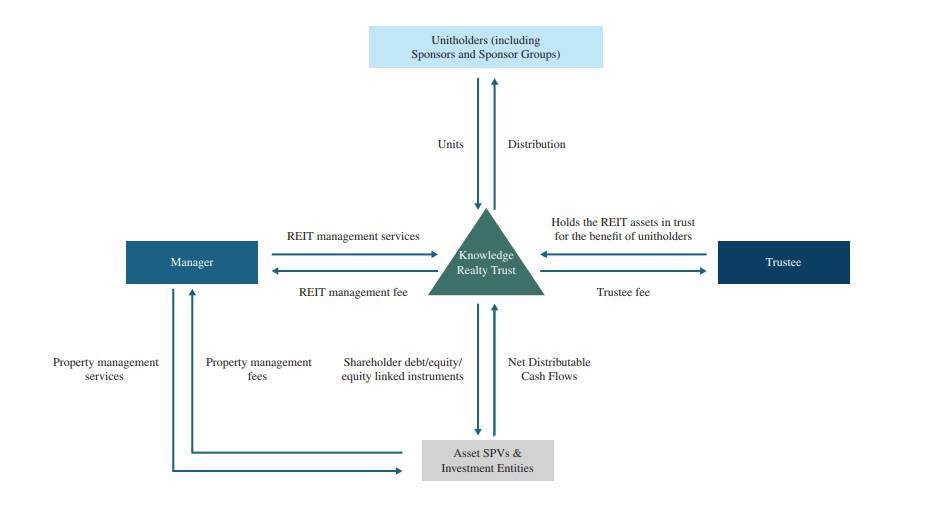

If you’re wondering who owns what and how it all connects, from sponsors to trustees to unitholders, let’s look at the structure below:

This structure shows how KRT REIT works, pooling investor money, managing properties through SPVs, and distributing income back to unitholders, all under regulated oversight.

Who Powers KRT?

KRT is backed by two giants: Blackstone and Sattva Group. Together, they bring the perfect mix of global financial muscle and local real estate expertise.

- Sattva Group: Headquartered in Bengaluru, Sattva has been shaping skylines for over three decades, with 74+ million sq. ft. developed across seven Indian cities. Their deep roots in the Indian market give KRT unmatched insights into location trends, tenant needs, and development potential.

- Blackstone: A name that needs no introduction, Blackstone is one of the world’s largest investment firms, with a robust track record in Indian real estate. Backing KRT through its portfolio arm (BREP Asia SG L&T Holding (NQ) Pte. Ltd.), Blackstone brings international best practices, long-term capital, and a strategic network to the table.

This partnership is being called transformative, pairing Sattva’s local dominance with Blackstone’s global investment expertise to create and manage world-class office spaces across India.

But here’s what truly stands out:

Even after the IPO, both Blackstone and Sattva will continue to hold about 80% of the REIT.

Their large stake means they benefit only when public investors do too. This alignment of interests adds a layer of trust and accountability, giving retail investors greater confidence in the REIT’s long-term focus, stability, and income potential.

So, what have Blackstone and Sattva built together under KRT’s umbrella? Let’s walk through the properties you could indirectly own.

KRT’s Property Portfolio: Where Your Money Might Go

Upon listing, KRT is set to become India’s largest office REIT, both in terms of Gross Asset Value (GAV) and Net Operating Income (NOI) for FY25.

As of March 31, 2025, its GAV is estimated at a massive ₹61,998.9 crore, and the portfolio spans 29 premium Grade A office assets.

So, what does “Grade A” mean? Think of state-of-the-art buildings in top locations, modern architecture, robust infrastructure, and facilities that attract blue-chip tenants and global corporations.

In total, KRT’s portfolio covers a whopping 46.3 million sq. ft., including:

- 37.1 million sq. ft. of completed, rent-generating properties

- 1.2 million sq. ft. currently under construction

- 8.0 million sq. ft. earmarked for future development

And these assets aren’t scattered randomly; they’re strategically located across six powerhouse cities: Mumbai, Bengaluru, Hyderabad, Chennai, Gurugram, and GIFT City (Ahmedabad).

Notably, 95.6% of the portfolio’s value is concentrated in Mumbai, Bengaluru, and Hyderabad – India’s most active and resilient office markets.

This isn’t just a coincidence. These cities are hubs for multinational companies (MNCs) and Global Capability Centers (GCCs), which means stronger, more stable rental demand and better potential for long-term value growth.

In fact, if you’ve ever passed by some of India’s most iconic office buildings, you might already be familiar with a few in KRT’s portfolio:

- One BKC and One World Center in Mumbai

- Knowledge City and Knowledge Park in Hyderabad

- Cessna Business Park and Sattva Softzone in Bengaluru

These business landmarks, and now, as a unitholder, you could own a share of them.

Now that we know what the REIT owns, let’s get into how it’s being offered to investors and what the IPO structure looks like.

Understanding the KRT REIT IPO: Key Details

The Knowledge Realty Trust REIT IPO is hitting the market as a book-building issue, where the final price per unit is decided based on demand from investors. This market-driven pricing approach gives a fair valuation based on actual interest.

The total issue size stands at ₹4,800 crore, and it’s a 100% fresh issue, which means all proceeds go directly into the trust to fund operations, acquisitions, or debt repayments.

Initially, KRT completed a ₹1,400 crore pre-IPO placement with large institutional investors.

This acted as a vote of confidence from seasoned players, showing that KRT already had strong backing even before opening its doors to retail investors.

Here’s more information:

| IPO Date | August 5, 2025 to August 7, 2025 |

| Sale Type | Fresh Capital |

| Issue Price Band | ₹95 – ₹100 per unit |

| Minimum Bid Size | 150 units |

| Minimum Investment | ₹14,250 |

| Public Issue Size | ₹4,800 Cr |

How the Units Are Allocated

Here’s a breakdown of the allocation structure:

- Institutional Investor Portion: Up to 75% of the issue goes to Institutional Investors. These include Qualified Institutional Buyers (QIBs), large family trusts, and SEBI-registered intermediaries with a net worth of over ₹5,000 crore. Within this category, the manager may allocate up to 60% to Anchor Investors, which are institutions that commit funds before the IPO opens and help build early confidence in the issue.

- Non-Institutional Investor Portion: At least 25% of the remaining issue is reserved for Non-Institutional Investors. This category welcomes: Indian resident individuals, Hindu Undivided Families (HUFs), Companies, NRIs, Certain FPIs, Eligible trusts and societies.

Allocation within this bucket is done on a proportionate basis, meaning that if the issue is oversubscribed, you’ll receive fewer units than you applied for.

This structure ensures that all types of investors get a fair share of the IPO, while also securing long-term commitment from key institutional players.

Purpose of the IPO: Where Will the Money Be Used?

The main goal of the Knowledge REIT IPO is to raise money to reduce debt and strengthen the REIT’s finances.

As of March 2025, KRT had loans worth nearly ₹19,800 crore. A large part of the IPO money will be used to repay some of this debt, which was taken by its holding companies (called Asset SPVs and Investment Entities).

Apart from debt repayment, some of the funds will go towards general corporate needs, like day-to-day operations, working capital, and any other strategic growth plans.

Debt reduction is part of the story, but how exactly does KRT plan to make money going forward?

KRT’s Business Model: How Does It Generate Returns?

KRT’s main goal is simple: Buy high-quality properties and earn rental income from them.

Their current portfolio includes:

- Completed, income-generating assets

- Under-construction properties that will start earning in the future

These assets are held either directly or through holding companies and SPVs (Special Purpose Vehicles).

And what kind of properties do they focus on?

Grade A commercial office spaces – these are the best-in-class buildings, with modern infrastructure, top amenities, and located in prime commercial hubs.

These premium properties are more attractive to large, stable companies and help ensure long-term, growing rental income.

Of course, even the best buildings need good tenants. Let’s look at who’s actually renting space in KRT’s portfolio.

Who Are KRT’s Tenants?

KRT has 450+ tenants as of March 31, 2025 – a well-diversified, high-quality tenant base that includes:

- Multinational Corporations (MNCs)

- Global Capability Centers (GCCs)

- Leading Indian companies

Some well-known names in the tenant list are Amazon, Google, Cisco, and Goldman Sachs.

Here’s how the rental contribution looks:

- 74.1% from MNCs

- 43.6% from GCCs

- 38.2% from Fortune 500 companies

These are typically long-term tenants with strong credit ratings, so rental income is steady and less likely to be disrupted.

Knowing the tenant list is one thing, what matters more is whether they stick around and pay rent consistently

Occupancy and Retention – How Steady Is the Cash Flow?

KRT’s portfolio shows strong performance:

- Committed occupancy: 91.4% (as of March 31, 2025) – highest among listed Indian REITs

- WALE (Weighted Average Lease Expiry): 8.4 years – shows long-term contracts with tenants

- Tenant retention: 61.7% (FY23–FY25)

Why this matters:

Because Higher occupancy + longer lease durations + loyal tenants = predictable, long-term income for investors.

Also, KRT has what’s called “mark-to-market” potential – many old lease agreements are priced below today’s market rates.

As these expire, rents can be revised upwards, helping grow income without needing new buildings.

Strong tenants and high occupancy rates are good signs, but how does that translate to financial results? Let’s examine the numbers.

KRT’s Financial Health: A Look at the Numbers

KRT has shown solid financial performance across key metrics, underlining the strength of its rental-generating portfolio. Let’s break down the key indicators:

Here’s how KRT’s revenue and profitability have evolved:

| Metric (₹ Cr) | FY23 | FY24 | FY25 |

| Revenue | 2,900.30 | 3,339.39 | 3,930.10 |

| Expenses | 621.95 | 758.12 | 853.84 |

| Net Income (PAT) | 2,192.40 | 3,396.59 | 2,225.16 |

| Net Margin (%) | 7.04% | 9.47% | 5.37% |

Revenue has grown steadily over the last three years. However, net income dipped in FY25, despite higher revenue, mainly due to one-time exceptional losses of ₹350 crore and a sharp 182% rise in tax expenses due to accounting adjustments on some older assets.

As of FY25-end, KRT had total borrowings of ₹19,792 crore. A large part of the IPO proceeds will be used to repay debt.

Post-IPO, the Loan-to-Value (LTV) ratio is expected to drop to just 19% of GAV, a strong indicator of financial prudence.

But like any investment, REITs come with risks. Here’s what to watch out for before making a move.

Risks to Consider: What Could Go Wrong?

- Real Estate is a Cyclical Game: Commercial real estate moves in cycles. If the economy slows down or there’s too much office supply, it can reduce rental income and lower the value of KRT’s properties.

- Rising Interest Rates Can Hurt Returns: When interest rates go up, borrowing becomes expensive. This can reduce KRT’s profits and the money left to distribute to investors. Higher interest rates may also make other investments more attractive than REITs.

- Tenant Dependence and Empty Offices: Even though KRT has 450+ tenants, a few big ones contribute a large chunk of the rent. If any of them leave or if too many offices remain empty, rental income may drop. Some major leases are also set to expire soon.

- Policy and Regulation Risks: Any change in SEBI rules, taxation laws, or foreign investment policies can impact how the REIT functions or distributes profits.

- New Kid on the Block: KRT was only set up in October 2024. While it’s backed by experienced people, it doesn’t have a long track record as a REIT. Investors will need to wait and watch how it performs post-listing.

- Past Financial Losses: KRT has reported losses in the past, even though its rental income has grown; repeated losses could impact cash flows and future profits.

- Tough Competition: There are already established REITs in India like Embassy, Brookfield, and Mindspace. To stand out, KRT will need to stay competitive in acquiring new properties and keeping tenants happy.

- Payout Promises vs Reality: While KRT says it will pay out 100% of available cash to investors, some REITs in India have shown slower dividend growth than expected. It’s worth keeping an eye on whether KRT lives up to its promise.

Taking all of this into account, opportunities and concerns, here’s a summary of what the KRT REIT IPO represents.

Final Thoughts

The Knowledge Realty Trust REIT IPO opens a gateway for retail investors to access India’s growing commercial real estate market through a regulated and professionally managed structure.

With a large portfolio of premium office properties in key cities and strong backing from Blackstone and the Sattva Group, KRT is set to make a significant mark in the REIT space.

Its high occupancy levels, long-term leases, and potential for rental growth offer visibility into future income. Plus, the planned reduction in debt post-IPO adds to financial flexibility, giving KRT room to grow further.

At the same time, it’s important to keep in mind the usual risks tied to the real estate sector, like market cycles, interest rate changes, and tenant turnover. The recent dip in profits, despite steady revenue growth, also highlights the need to look beyond surface numbers and understand the details.

For those exploring new asset classes, it’s important to weigh both the potential and the risks with a long-term perspective before taking any financial decision.