- Share.Market

- 12 min read

- 10 Oct 2025

In an economy where financial stability and long-term security are paramount, the life insurance sector in India has always been a cornerstone of trust.

For years, the industry was dominated by a few major players, with public sector bank-backed insurers representing a unique blend of government trust and essential services.

Now, one of the biggest names in this space, Canara HSBC Life Insurance Company(CHLI ), is set to tap the public market with its eagerly awaited Initial Public Offering (IPO).

This isn’t just a standard listing; it’s a major step by one of the largest bank-led private insurers, backed by the solid foundations of Canara Bank and the global expertise of HSBC.

For investors, this life insurance IPO provides an opportunity to participate in India’s growing financial services story.

More importantly, it offers a chance to evaluate the future of the bancassurance model, where insurance products are sold through bank branches which is the key to this company’s success.

Before we dive into the Canara HSBC Life IPO details, let’s first understand the bigger picture: why the demand for life insurance is rapidly expanding across India and what competitive edge this powerful joint venture brings to the market.

Decoding the Indian Life Insurance Landscape

The life insurance market is dynamic, highly regulated, and currently characterized by significant untapped potential.

Underinsured and Ready for Growth

Compared to global peers, India remains significantly “underinsured,” highlighting substantial growth potential for providers:

- Low Penetration: In calendar year 2023, India’s life insurance penetration (premiums as a percentage of GDP) stood at 2.80%. This is notably lower than Thailand (3.40%), South Korea (5.00%), and Singapore (7.40%).

- Low Density: Insurance density (premium per capita) in India was only US$ 70.00 in CY 2023.

- The Protection Gap: In 2019, India’s protection gap (the amount of coverage needed versus the coverage held) was the highest in the Asia-Pacific region at 83%. This gap suggests that many people need financial protection that they currently lack, offering huge potential for life insurers.

Key Industry Trends and Player Dynamics

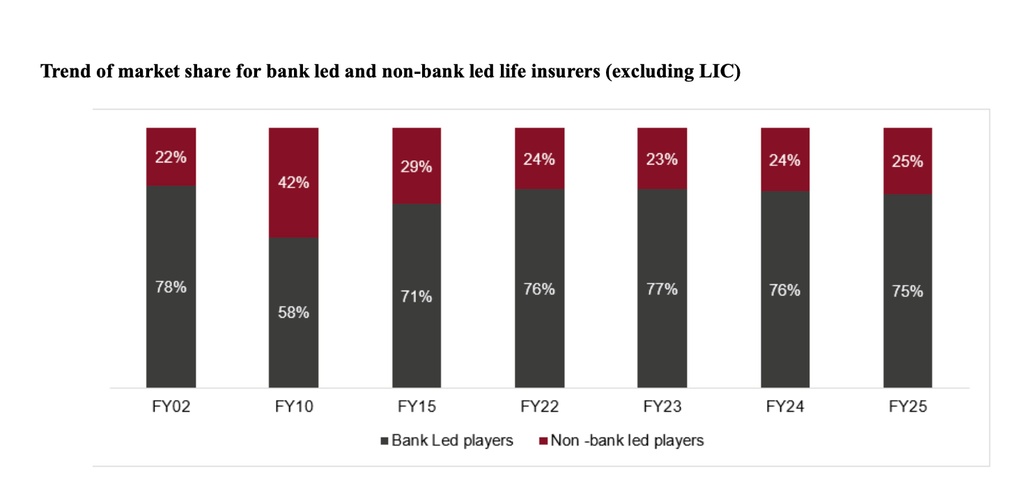

The industry is divided into players led by banks (“Bank-Led”) and those led by non-banking entities (“Non-Bank Led”), excluding the state-owned LIC.

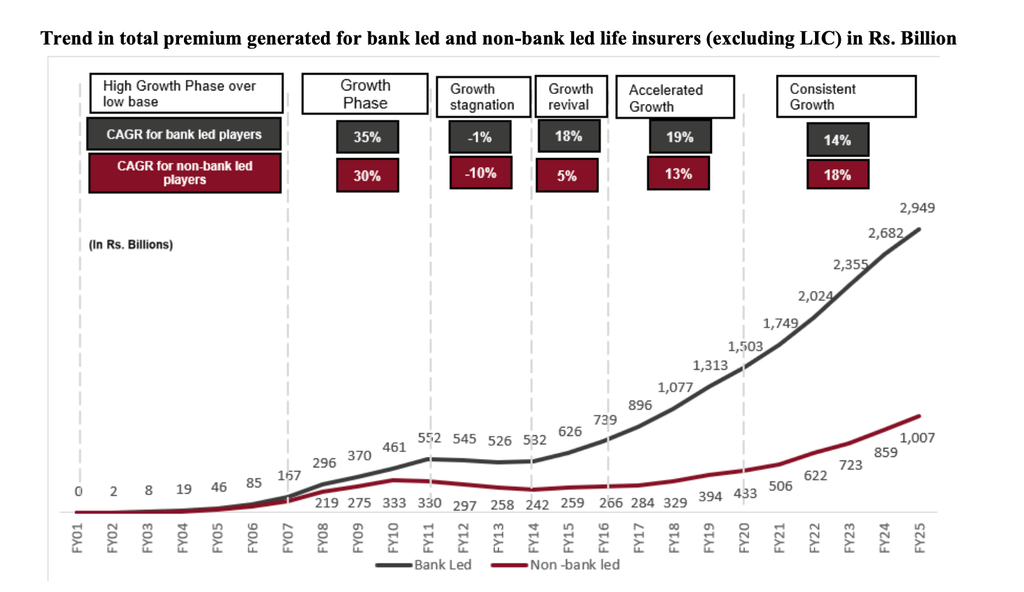

- Bank-Led Dominance: Bank-led players have maintained a strong market share in terms of Annualized Premium Equivalent (APE), consistently holding 70% to 75% over the last decade.

- Growth Comparison (FY23-FY24): Total premium growth for Bank-led life insurers was 16.4% (Fiscal 2023) and 13.9% (Fiscal 2024), while Non-Bank led players saw higher growth at 16.2% (Fiscal 2023) and 18.9% (Fiscal 2024).

- Efficiency: Bank-led insurers typically have lower operating expense ratios than non-bank led players. This is because they can leverage the established branch network and technology of their partner banks to optimize operating costs.

Product Evolution and Focus Areas

The type of products customers want is changing, leading to shifts in how insurers design and sell policies:

- Shift to Protection and Savings: Insurers are increasing their focus on protection, non-par savings (non-participating savings), and annuity products.

- Demand for annuity products (retirement income) has picked up, driven by increased awareness of long-term financial stability.

- The share of non-linked products (as a % of new business premium) for private life insurers increased significantly, reaching 72% in Fiscal 2024 (up from 56% in Fiscal 2018).

- Digital Convenience: Digital platforms and mobile apps are crucial in modernizing the industry, improving efficiency, and enhancing customer experience.

- In Fiscal 2024, approximately 10% of individual NBP (New Business Premium) for the overall industry came through direct and online channels, a percentage expected to increase in the coming years.

- Customer-Centricity (Persistency): Customer retention is critical for long-term profitability. Persistency ratios (the percentage of policies that remain in force) are widely tracked.

- For example, one major insurer, Canara HSBC Life, saw its 13th month persistency ratio improve by about 721 basis points between Fiscal 2023 and Fiscal 2025, the highest improvement among bank-led life insurance players during that period.

Regulatory Environment Changes

The industry operates under the strict regulation of the IRDAI (Insurance Regulatory and Development Authority of India). Recent changes are aimed at promoting growth and protecting consumers:

- Tax Exemptions: The GST Council recently exempted individual life and health insurance policies from the 18% GST rate, making these products more affordable.

- FDI Increase: The Foreign Direct Investment (FDI) cap was proposed to increase to 100% via the automatic route.

- New Licensing Framework (Proposed): Proposed amendments to the Insurance Act aim to allow insurers to seek a single composite license, enabling them to work across multiple lines of insurance (e.g., life and non-life). This is expected to spur diversification and competition.

Competitive and Operational Challenges

While the opportunity is immense, the industry faces headwinds:

- Competition from Alternatives: Life insurance products compete fiercely with other financial savings instruments such as mutual funds, bank fixed deposits, and government schemes, which may offer different features like liquidity or returns.

- Market Volatility: Fluctuations in market interest rates and equity markets can negatively impact profitability, especially for products with guaranteed returns or those linked to capital markets (ULIPs).

- Digital Competition: The entry of financial technology (Fintech) and insurance technology (Insurtech) companies is increasing competition, especially for attracting younger, tech-savvy customers.

- Expense Management: Controlling operational costs while expanding distribution (such as launching new agency channels) and investing heavily in technology remains a balancing act for profitability. Canara HSBC Life, for instance, had the second highest information technology expenses among its peers for Fiscal 2025, reflecting a focus on automation to reduce costs per transaction.

Overall, the Indian life insurance industry is moving toward a more transparent, digitally integrated, and diversified market, strongly supported by favorable demographics and a growing economy, which presents significant opportunities for long-term value creation.

Canara HSBC Life Insurance: Understanding the Business

Canara HSBC Life is a key player in India’s private life insurance market. Its credibility and brand value are amplified by its strong founding parent companies:

The company is backed by two major financial institutions: Canara Bank (CB) and HSBC Insurance (Asia-Pacific) Holdings Limited (INAH), a member of the global HSBC group.

Canara Bank is one of the company’s Promoters and ranks as the fourth largest public sector

The Company was originally incorporated on September 25, 2007, as ‘Canara HSBC Oriental Bank of Commerce Life Insurance Company Limited’.

The name was officially changed to ‘Canara HSBC Life Insurance Company Limited’ on June 15, 2022.

The company was one of the fastest life insurers to report profits amongst its peers, achieving profitability by its fifth year of operations (Fiscal 2013).

The Business Model: Leveraging Bank Branches (Bancassurance)

magine an insurance company that combines the rock-solid trust of a massive public sector bank with the global expertise of an international finance leader. That’s exactly what Canara HSBC Life Insurance is.

Its credibility is amplified by its founding parents:

- Canara Bank (CB): One of the promoters and the fourth-largest public sector bank in India, giving CHLI deep national roots.

- HSBC Insurance (Asia-Pacific) Holdings Limited (INAH): A member of the global HSBC group, bringing world-class practices to the table.

This partnership has proved highly successful. In fact, CHLI was one of the fastest life insurers in the country to become profitable, hitting that milestone just five years after its start in 2007. (You might remember their earlier name, which included Oriental Bank of Commerce, before they officially rebranded in 2022).

The Business Engine: The Power of Bancassurance

If you want to know how CHLI gets its customers, the answer is simple: they are practically built into the bank’s system. Their entire business model revolves around Bancassurance—the practice of selling insurance products through bank branches.

- The Main Channel: Bancassurance is absolutely key for CHLI. It accounts for a massive 87% of the company’s new business premium.

- Massive Reach: Through non-exclusive agreements with Canara Bank, HSBC India, and several regional rural banks, CHLI gets a direct line to over 15,700 branches across the country. The agreement with Canara Bank alone grants access to approximately 117 million customers.

This banking partnership is a brilliant business move: it helps the company acquire new customers at a much lower cost because they don’t have to build expensive, separate infrastructure like other insurance players.

Beyond the Bank: A Multi-Channel Approach

While banks are their powerhouse, CHLI isn’t putting all its eggs in one basket. They are diversifying their distribution through a multi-channel strategy:

- Digital & Tech-Savvy: They are heavily committed to modernization, using advanced AI and data to predict renewals and manage risk. They even have the second-highest IT spending among their peers, focusing on automation to cut costs and make things easier for customers.

- Brokers and Direct Sales: They also partner with various insurance brokers and corporate agents, and maintain a dedicated field force for personalized, face-to-face services when needed.

The Product Line: What They Sell to Earn

CHLI’s offerings cover the full spectrum of financial needs, from protection to long-term savings:

| Product Types | What It Does Simply |

| Protection (Term Plans) | Pure, straightforward life insurance coverage. |

| Savings/Endowment Plans | Combines insurance protection with a savings component. |

| ULIPs | Protection combined with investment, linked to market performance. |

| PMJJBY | They are also actively involved in offering the government’s flagship insurance scheme. |

Currently, they are pushing toward more non-participating policies (which offer fixed, guaranteed returns or protection only).

This shift is specifically designed to help enhance their profit margins for the future, even though their market-linked ULIPs still form a large chunk of their revenue.

Canara HSBC Life IPO Date, Price Band & Key Details

The IPO of Canara HSBC Life I is structured entirely as an Offer for Sale (OFS), designed to list the company’s existing shares on the stock exchanges.

This means that the company itself will not receive any new capital from the transaction; instead, the money raised will go directly to the existing shareholders who are selling a portion of their stake

If we go into deep:

| IPO Date | October 3, 2025, to October 7, 2025 |

| Sale Type | Offer For Sale |

| Issue Price Band | ₹100 to ₹106 per share |

| Face Value | ₹10 per share |

| Minimum Lot Size | 140 Shares |

| Minimum Investment | ₹14,000 |

| Total Issue Size | ₹2,517.50 Cr |

Canara HSBC Life Financial Performance Analysis

| Particular (₹ in million) | FY23 | FY24 | FY25 | Q1 FY 2026 |

| Revenue from Operations | 71,973.83 | 71,287.01 | 80,274.62 | 17,472.31 |

| Premiums Earned (Net) | 70,297.22 | 69,326.39 | 78,502.41 | 16,534.33 |

| Assets Under Management (AUM) | 302,044.00 | 373,804.4g | 411,664.11 | 436,394.98 |

| EBITDA | 1,188.18 | 1,465.64 | 1,499.10 | 312.80 |

| Net Profit | 911.94 | 1,133.17 | 1,169.81 | 234.13 |

| Net Profit Margin | 1.27% | 1.59% | 1.46% | 1.34% |

Canara HSBC Life’s financials show consistent health driven by smart decisions, not just raw sales.

The company shifted its focus away from lower-margin group products to higher-margin individual and credit life policies.

This strategic change, combined with cost control and the removal of a specific regulatory expense, helped their Net Profit (PAT) grow consistently.

Total premium income saw strong recent growth, fueled by better renewal business.Crucially, their Assets Under Management (AUM) expanded significantly and their persistency ratio improved, confirming better customer retention and long-term stability.

Key Strengths of Canara HSBC Life:

- Established Parentage and Trusted Brand: CHLI benefits from the strong parentage of Canara Bank, India’s fourth-largest public sector bank, and the globally recognized HSBC group. This backing enhances credibility and brand value, driving significant customer attraction, reflected by improving Net Promoter Scores (NPS).

- Multi-Channel Distribution Network: The paramount distribution channel is Bancassurance, leveraging over 15,700 branches of partners, notably Canara Bank and HSBC India. This extensive pan-India reach across Tier 1, 2, and 3 cities grants access to vast customer segments and optimizes operational expenses.

- Long-term Value Creation and Consistent Profitability: The company focuses on long-term value, evidenced by being one of the fastest life insurers to report profits by the fifth year of operations. This is highlighted by consistent Embedded Value (EV) growth, reaching ₹61,107.40 million in Fiscal 2025, and a strong Operating Return on EV of 19.53%.

- Diversified Product Portfolio and Customer Centricity: The comprehensive product portfolio offers 20 individual and seven group products, addressing protection, savings, and retirement needs across key life stages. This strategically balanced mix minimizes concentration risk and enables the business to operate efficiently across varying business cycles.

- Technology Integration and Risk Management: CHLI operates on a technology-integrated platform, using advanced AI and analytics for predictive modeling and risk management. High automation levels, including approximately 67% straight-through processing for new applications, enhance operational efficiency and reduce the cost per transaction.

Key Risks of Canara HSBC Life

Here are some key risks investors should carefully consider before making an investment decision:

- Reliance on Bancassurance Partners: The Company is highly reliant on distribution agreements, especially with Canara Bank and HSBC India. Termination or adverse changes to these key arrangements, or a decline in partner performance, would severely impact product sales and business growth.

- Market Price Volatility (First Offer): This being the first public offering, there is no formal market for the Equity Shares. The Offer Price is not indicative of the market price after listing, and there is no assurance of active or sustained trading in the shares.

- Interest Rate and Investment Risk: Fluctuations in interest rates could significantly impact profitability, especially for guaranteed return products. Regulatory restrictions and limited long-term fixed income products in India constrain the ability to align assets with long-term liabilities.

- Regulatory Compliance and Solvency: The complex regulatory environment means adverse changes or failure to comply with IRDAI requirements could disrupt business operations or expose the Company to significant penalties. The solvency ratio has decreased in recent years, requiring adherence to minimum statutory levels.

- Policy Retention and Surrender Risk: Adverse variations in persistency (policy retention) metrics or concentrated surrenders by customers may materially impact the Company’s financial condition, results of operations, and cash flows. Policy surrender events may compel the liquidation of investment assets at unfavorable prices.

Conclusion

From its humble beginnings in 2007 to achieving profitability faster than many of its peers, the journey of Canara HSBC Life is a story of enduring trust and financial discipline.

Built upon the stable foundations of Canara Bank and the global reach of HSBC, this company has become a symbol of security for policyholders across India.

What this IPO truly represents is not just a stock listing, but the ultimate public validation of the bancassurance model proving that combining banking reach with insurance expertise is the future of securing India’s growing middle class.

However, as the company enters the volatile public market, it stands at a crucial crossroads, balancing its commitment to stability with the market’s demand for aggressive growth.

Ultimately, like any public offering, this investment carries inherent risks, including its heavy reliance on a few banking channels and the intense competition within the insurance sector.

Therefore, before taking any investment decision, investors must carefully evaluate these factors and ensure the IPO aligns perfectly with their own risk appetite and long-term investment objective.