- Share.Market

- 6 min read

- 01 Aug 2025

Intelligence-Driven Investing, Simplified!

July 2025

July 2025 tested investor confidence with persistent Foreign Institutional Investor (FII) outflows, muted earnings, and trade uncertainty. Despite equity market declines, strong Domestic Institutional Investor (DII) support and multi-year low inflation signaled macro resilience. Manufacturing remained robust, while the rupee weakened. Key developments included India’s trade tension with the US and FTA with the UK, the increase in AI and machine learning job postings, and a strategic push for rare-earth magnet production.

Let’s take a closer look at everything that shaped the markets this month:

Market Barometers

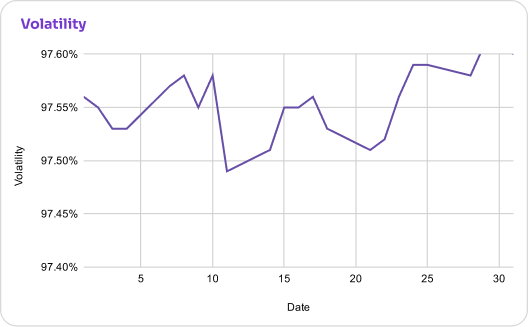

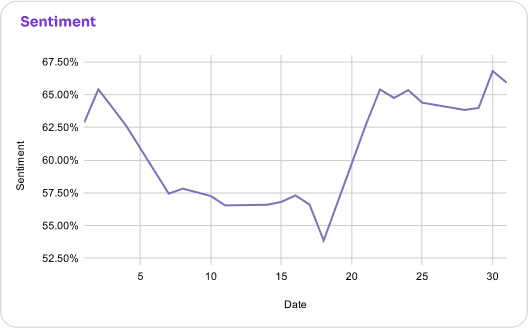

Indian key market indices declined in July, with the Nifty 50 and the BSE Sensex both falling over 3%. Midcaps and smallcaps also slipped more than 2%, reflecting broader selling pressure. Volatility persisted due to sustained FII outflows, mixed Q1 earnings, and trade uncertainty.

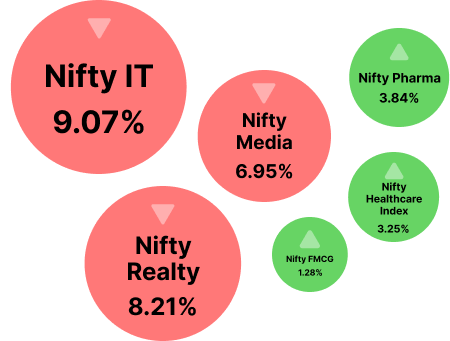

Sector Radar

See how the key sectors moved this month

Why? Pharma, Healthcare, and FMCG rose on strong Q1 results and defensive buying amid global uncertainty. The reality sector dipped on profit booking after prior gains. IT faced continued struggle due to global macroeconomic risks, a sluggish deal pipeline, and persistent outflows from FIIs.

Corporate Moves

The key announcement you shouldn’t miss.

- Tata Consultancy Services Ltd. announced its plans to cut 2% of its global workforce, citing skill mismatch. Management clarified the move isn’t AI-driven, but restructuring-focused.

- Bharti Airtel Ltd partners with Perplexity to offer a free ₹17,000 annual Pro subscription to all 360 million customers via the Airtel Thanks App.

- Sumitomo Mitsui Financial Group (SMFG) is considering an additional $1.1 billion investment in YES Bank Ltd., potentially increasing its stake to 25%, following a $1.6 billion infusion in May, which signals strong confidence in the bank’s turnaround.

Market Spotlight

Headlines and important updates from the markets

- Crisil Intelligence estimated total revenue growth for India Inc. at a moderate 4-6% for Q1 FY26, a downward revision from previous quarters.

- Domestic Institutional Investor (SIP) inflows hit a record ₹27,269 crore in June 2025 with 8.64 crore accounts, as mutual fund AUM rose 3% to ₹74.14 lakh crore, reflecting robust retail participation.

Macro View

Zooming out to key rates, trends, and global moves driving India’s economic story

- Trump imposed a 25% tariff and additional penalties on Indian exports, citing unfair trade practices and ties with Russia. However, both sides are currently engaged in further negotiations.

- India Ratings and ADB cut India’s FY26 GDP growth forecasts to 6.3% and 6.5%, citing US tariffs and weak investment, though India remains the fastest-growing economy.

- Gross NPAs of PSU banks dropped to 2.58% in March 2025 from 9.11% in 2021, reflecting successful financial clean-up and credit discipline.

- India launched a ₹1,345 crore plan to scale rare earth magnet production, supporting EV and electronics growth while reducing dependence on China.

- AI/ML job postings rose 42% YoY in June, while overall hiring grew 10.5%, signaling rising demand in India’s digital and tech sectors.

- The new India-UK trade deal, signed in May, is expected to boost bilateral trade by €25.5 billion annually with reduced tariffs.

- The American central bank kept rates unchanged at 4.25%–4.50% for the fifth time, despite Trump’s calls for cuts, as economic activity moderates and inflation stays slightly elevated.

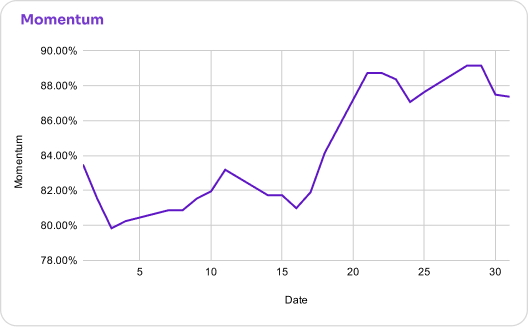

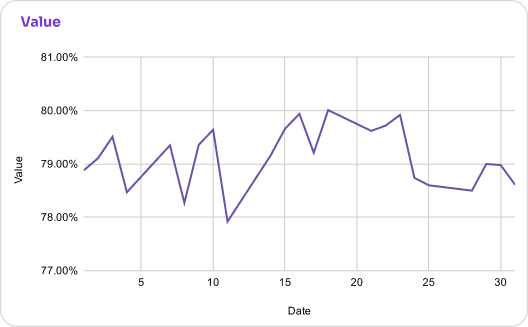

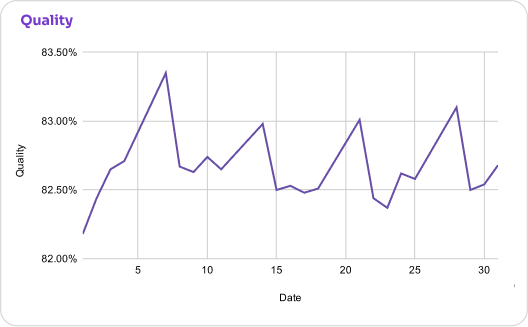

Factor Flow

How Nifty 50’s Factor Scores moved this month

Beyond Expectations

Nifty 50 stocks beating results expectations in Q1 FY26

| Name | Revenue Q1 (Estimated) | Revenue Q1 (Actual) | Growth(%) |

| Axis Bank Ltd. | ₹20,498 Cr | ₹32,348 Cr | 🔼 58% |

| Mahindra & Mahindra Ltd. | ₹33,987 Cr | ₹45,529 Cr | 🔼 34% |

| Coromandel International Ltd. | ₹5,782 Cr | ₹7,042 Cr | 🔼 22% |

FII vs DII Trends

Tracking India’s evolving market ownership trends

- DIIs made net purchases of ₹60,939 crore in July. This is slightly lower than June’s ₹72,674 crore, but shows consistent investment activity from Indian institutions.

- FIIs made net sales worth ₹47,667 crore in July, compared to net buying of ₹7,489 crore in June, indicating reduced participation due to global concerns.

What Moved the Needle

The headline that set the tone this month

SEBI Bans Jane Street Over Market Manipulation

SEBI has banned global trading firm Jane Street after discovering alleged manipulation in India’s derivatives market. The firm reportedly influenced prices of indices like NIFTY and BANKNIFTY to profit from options trading, earning up to ₹734 crore in a single day. SEBI identified over ₹4,800 crore in unfair gains and froze the company’s accounts. The total profits under scrutiny exceed ₹36,500 crore. This case highlights why strong regulations and fair market conduct are crucial to protect investor trust and ensure a level playing field.

IPO Watch

| Company | About | Issue Price | Subscription |

| National Securities Depository Ltd | NSDL is India’s largest depository, enabling secure digital storage and transfer of securities like shares and bonds, while offering tech-driven services. | ₹800 | 40.98x |

| Anthem Bioscience Ltd | It is a CRDMO that supports global pharma and biotech firms with drug discovery, development, and manufacturing, offering end-to-end services from research to commercial-scale production. | ₹570 | 63.85x |

| Travel Food Services Ltd. | An Indian airport QSR and lounge operator with 397 outlets and 117 brands across India and Malaysia (as of June 2024). | ₹1,100 | 2.88x |

Aditya Infotech Ltd. | It offers video security solutions under the ‘CP Plus’ brand, supported by 41 branches, 13 RMA centers, 1,000+ distributors, and 2,100+ system integrators across India. | ₹675 | 100.67x |

| Crizac Ltd | A B2B education platform connecting agents with global institutions, offering student recruitment solutions for international higher education opportunities. | ₹245 | 58.41x |

Risks to Watch

Here’s what could shake market moods ahead

- 25% US tariffs on Indian exports have raised trade uncertainty, with ongoing negotiations between both countries being closely monitored for potential resolution.

- The RBI’s August MPC meeting will be key in shaping future interest rate expectations.

That’s a wrap for July!

From sector moves to macro trends and market risks, we’ve covered what mattered.

See you next month. Till then, stay informed and invest intelligently with Share.Market.

Disclaimer and Disclosure

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887 and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst with Exchange and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954