- Share.Market

- 9 min read

- 30 Jun 2025

The milk stayed the same. The rent didn’t.

Every time inflation cools in the headlines, we cheer. CPI is down. Tomatoes are cheaper. Great.

But then your broadband bill goes up. Your kid’s school fees jump. That gym membership? Quietly hiked.

Enter core inflation, the kind that doesn’t shout but stays.

And right now, it’s rising.

While food and fuel do the drama, core inflation sticks to the essentials: housing, education, healthcare, services, the stuff you can’t cut back on.

So if you’re wondering why your monthly budget feels heavier or why the RBI isn’t cutting rates yet, this piece is for you.

Let’s break down what core inflation really means, and what it does to your portfolio when you’re not looking.

What is Core Inflation?

Before we dive into core vs headline, let’s start with the basics.

We’ve all felt it, that weird frustration when your ₹60 momo plate becomes ₹80, or when that shampoo bottle you swore after sometimes looks like travel size.

That’s inflation in real life.

Inflation = the consistent rise in prices of goods and services over time.

In simpler terms, the stuff you buy keeps getting more expensive. Not just once, but again and again.

It’s not always bad.

A bit of inflation means the economy’s alive and kicking. But when it crosses a limit, it eats into your salary or savings.

Now, there are two types you’ll hear the RBI, economists, and news anchors talk about…

Headline Inflation: The One That Makes Headlines

This is the total inflation; it tracks the prices of everything in your monthly spending list:

Starting from Food & beverages, Fuel & electricity, Clothes, Education, rent, and medical costs, even that fancy perfume bottle

India uses CPI (Consumer Price Index) to measure it.

If headline inflation is 4%, it means the average prices in the CPI basket are up 4% over the last year.

This is what the RBI officially targets: to keep inflation between 2% and 6%.

Now here’s the twist.

Core Inflation: The Silent Mover

Core inflation = headline inflation MINUS food & fuel.

Why cut out food and fuel?

Because their prices are volatile..

- One bad monsoon → veggie prices shoot up

- One global uncertainty → crude oil started rising

These things mess up the data. Core inflation removes the drama and shows what’s actually happening underneath, the slow, sticky rise in prices of things like: Education, rent, healthcare, personal care, travel, and communication

This gives a cleaner signal of the real cost pressure in the economy.

Why Core Inflation is Sticky, and Why RBI Stares at It So Hard?

You know how once your house rent goes up, it never really comes down?

That’s core inflation for you. It moves slowly, but once it goes up, it stays there.

So What Does Sticky Mean?

Core inflation includes stuff like rent, school fees, medical bills, transport fares, salon, and personal care prices

These don’t fluctuate every month like onions or petrol.

When they increase, it’s often due to rising wages, strong consumer demand, long-term cost hikes (manufacturing, logistics, etc.)

And businesses rarely reduce them once raised.

That’s what makes core inflation sticky; it doesn’t bounce up and down; it climbs and clings.

Why Does RBI Obsess Over Core?

Because it’s a demand-side signal.

Food price spikes might be seasonal. But if school fees, doctor visits, and cab fares are rising steadily, it means people are spending, and the economy’s heating up.

And when that happens, RBI says: Time to cool things down.

That’s when interest rates rise. That’s when your EMIs go up. That’s when the stock market gets jittery.

Core inflation tells the RBI how deep the fire runs, not just the smoke on the surface.

Why Is Core Inflation Rising in 2025?

Just when the headline numbers were cooling off, core inflation is on the rise.

Here’s what’s heating it up under the hood:

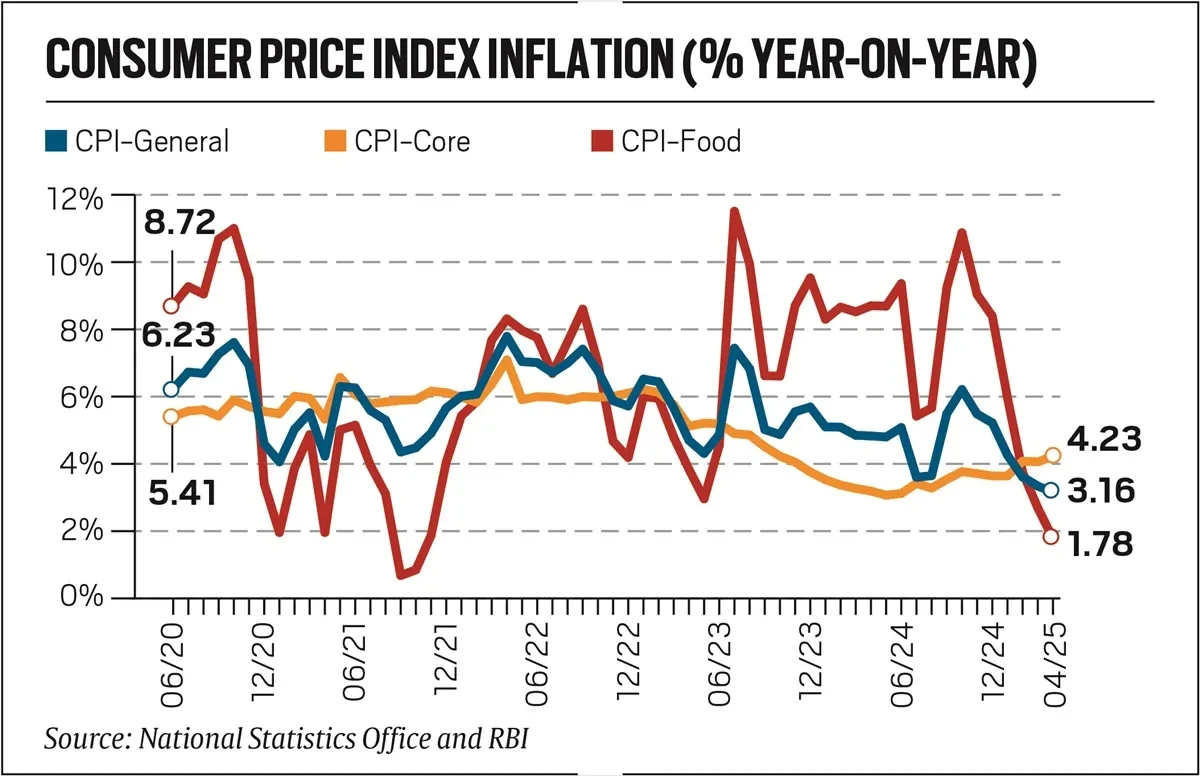

In April 2025, rural CPI fell to 2.92%, urban CPI stayed firm at 3.36%, and headline CPI eased to 3.16%, the lowest since 2019.

But hold that celebration.

Because food inflation CFPI (Consumer Food Price Index, which tracks inflation in food items only) just nosedived from 10.87% to 1.78%, pulling down the overall average.

But the real villain? That sneaky orange line, core inflation, is back at 4.23%.

Here’s where the heat’s coming from:

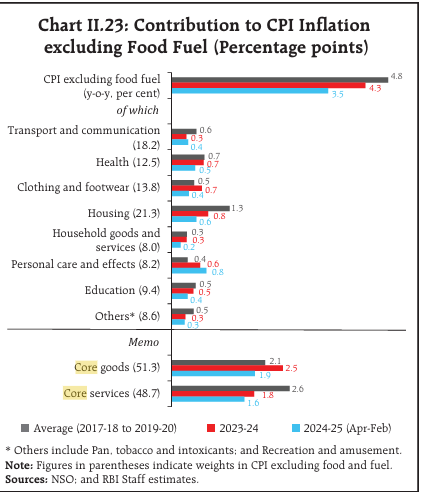

This chart shows that in 2024–25, core inflation stayed elevated, with personal care and effects, housing, health, and transport leading the rise.

Core services inflation rose to 1.6%, signalling stubborn price pressures beyond food and fuel.

In April 2025 alone, the inflation rate of education (+4.13%), Healthcare (+4.25%), and Housing (3%) shows, if your salary hike felt underwhelming, that’s mostly because of core inflation.

Global Factor:

When global supply chains get messy or metal prices shoot up, our input costs rise too, especially for stuff we import like chemicals, gold, or machine parts.

That’s called imported inflation. And yep, it creeps into your rent, medicine, and more.

Now add this twist:

While the government is smartly giving us subsidies for food and fuel, core costs are sneaking up quietly, because your school fees, doctor bills, and broadband plans don’t come with discounts.

So yeah, headline inflation looks chill, but core is still doing pushups in the background.

But wait…when core inflation sticks around like that one guest who won’t leave the party…The RBI.

What the RBI Is Watching, And Why You Should Too?

Inflation is cooling on the surface, but deep down, the pressure’s still building.

And now, the RBI has a tough job: keep growth going and stop inflation from getting out of hand. Let’s break it down.

Let’s look at it from the macro perspective.

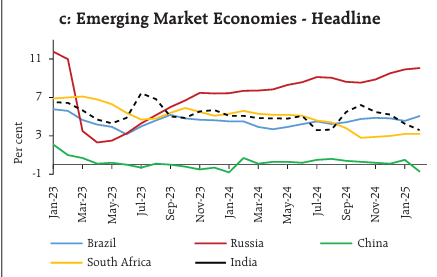

Russia’s still flying solo above 7%. China? Looks like it’s running on cruise control.

India (that dotted line)? Slid under 5%, cooling like summer lassi.

But don’t get too comfortable, headline inflation may have softened, but now you know, it’s the core you should watch.

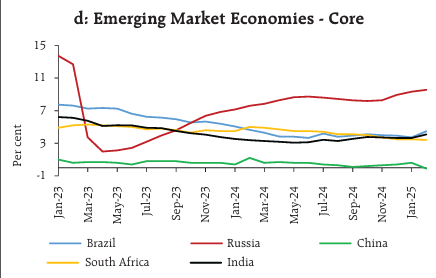

Russia’s core inflation? Running its own marathon above 7%. India’s (black line)? Flat, but sticky, refusing to dip below the comfort zone.

Brazil and South Africa? Slid a bit, but still staying above 4–5%.

And China? Quiet, calm, almost suspiciously low.

While India’s inflation looks better than Russia’s and definitely more believable than China’s, it doesn’t mean we can chill.

Because for the RBI, the job isn’t done yet.

RBI’s goal is to keep inflation around 4% (with some room between 2–6%), and April’s inflation is well within the RBI’s comfort zone.

But core inflation is the concern.

In April 2025, the RBI cut the repo rate by 25 bps (to 6.00%) and shifted its stance to accommodative (a fancy way of saying, Let’s support growth for now).

But here’s the real tea: RBI’s watching core. While the headlines cooled, the underlying heat isn’t going anywhere yet.

Future Impact on RBI Decision

Back in March, a PIB release flagged core inflation rising to 4.08%, a level that screams persistent price pressure.

And while the RBI cut rates by 25 bps in April and switched to an accommodative stance, this isn’t a full green light for rate cuts.

Here’s the catch: core inflation might not be done yet.

So what does this mean?

- The RBI wants to nudge growth while inflation is low.

- But if core inflation stays stubborn, it could spoil the party, pausing or even reversing rate cuts.

- Think of it as the RBI walking a tightrope: lean too far into growth, and inflation might bounce back stronger.

Moral of the story? The RBI’s playing it cool, but the heat underneath still needs watching.

Core Inflation’s Real Impact: What It Means for You?

You’ve seen the charts. You’ve followed the RBI drama. Now, the big question: how does this affect your money?

When core inflation stays high, it’s not just a macro story. It’s a personal finance story.

Let’s break it down, asset by asset.

Equities

When core inflation stays sticky for the long term, it silently squeezes stock valuations in sectors like NBFCs, autos, and real estate.

Even FMCG, the usual safe zone, feels the pinch if input costs rise faster than pricing power.

If raw materials or packaging costs go up and companies can’t fully pass them on to consumers, profits may take a hit.

Debt Funds & Bonds

Everyone expects falling rates to boost debt funds.

But if core inflation overstays its welcome, the rate cut party might get delayed.

Long-term bonds get edgy, while short-term and floating ones start looking less nervous.

The bond market’s mood right now? Watching the RBI, not celebrating yet.

Gold

When real interest rates shrink, gold doesn’t just sit there; it whispers, I’m your inflation shield.

Not flashy, not fast, but in a world where returns barely beat rising costs, gold quietly holds ground.

Especially when inflation eats into everything else that was supposed to feel ‘safe.’

Real Estate

Core inflation seeps into rents, construction costs, and home prices.

If you already own, you’re watching your asset quietly appreciate.

But if you’re looking to buy? Loan rates and sky-high prices could make that dream feel a bit distant.

Final Word: Core Inflation May Be Silent, But It’s Not Harmless

Let’s be honest, when food prices fall, we all feel a little lighter. Groceries cost less, headlines cheer up, and the mood improves.

But if your hospital bills, school fees, rent, and broadband plans are still inching up, it’s quietly eating into your real returns.

Core inflation’s like that silent roommate, doesn’t make noise short-term, but eats into your budget long-term. It’s been sticky, so maybe… don’t ignore it.

This piece wasn’t just about decoding jargon.

It was about tuning into the signals that don’t flash every day, but shape your wealth journey all the same.

Because intelligent investing today isn’t about timing the next FOMO wave. It’s about preserving purchasing power and protecting progress.

So don’t just ask, How much will this fund give me? Ask, What will it still buy me 5 years later?

Because inflation isn’t a number. It’s the cost of staying where you are when everything else moves on.