- Share.Market

- 5 min read

- 02 May 2025

Intelligence-Driven Investing, Simplified!

April 2025

April was quite a month! The US announced a comprehensive tariff policy that rattled stock markets globally. Gold hit a fresh record high. Back home, multiple companies reported robust results as the earnings season kicked off. On the flipside, the Gensol-Blusmart fiasco that wiped out investors’ wealth was uncovered.

Let’s take a closer look at everything that shaped the markets this month:

Market Barometers

The bulls charged for 11 sessions, and the bears were on the prowl for 8 this month. Nifty 50 (24,334.20 🔼 3.46%) and Sensex (80,242.24 🔼 3.65%) settled in the green as investors regained confidence.

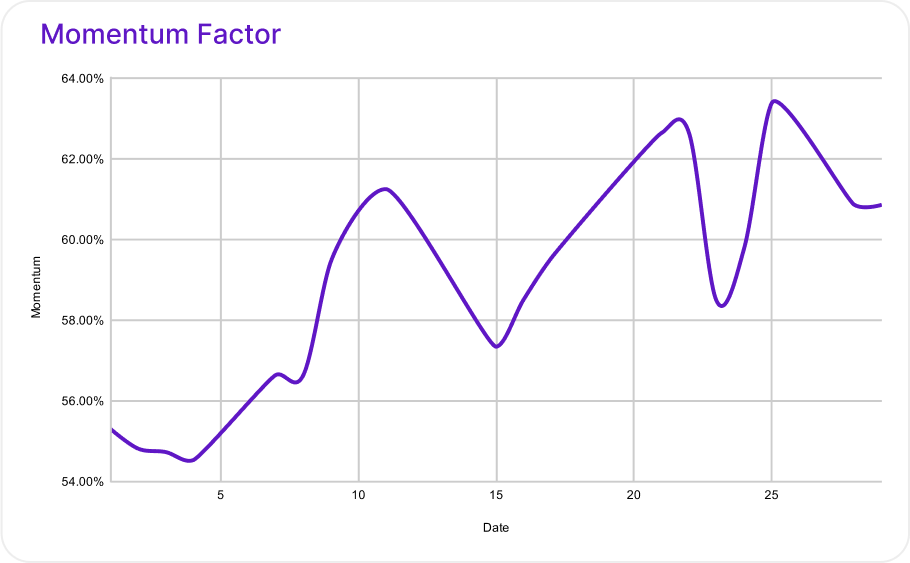

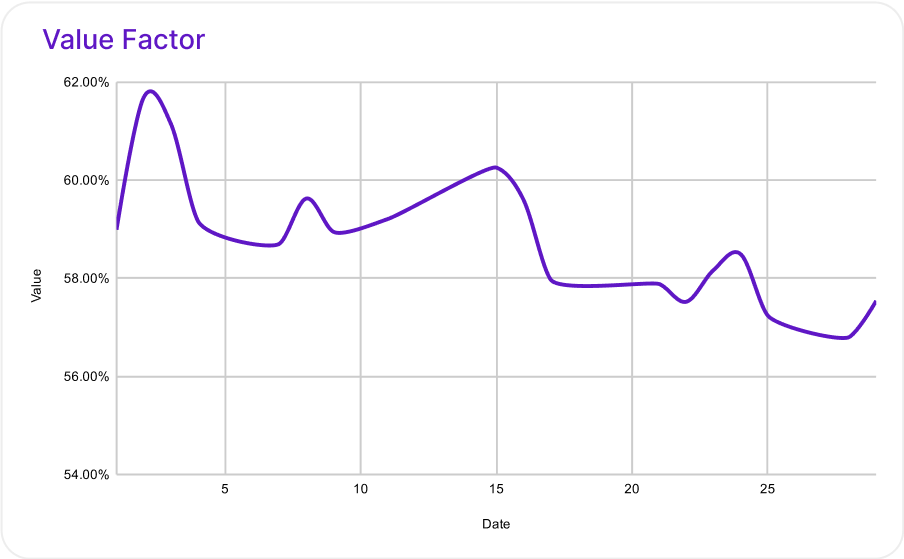

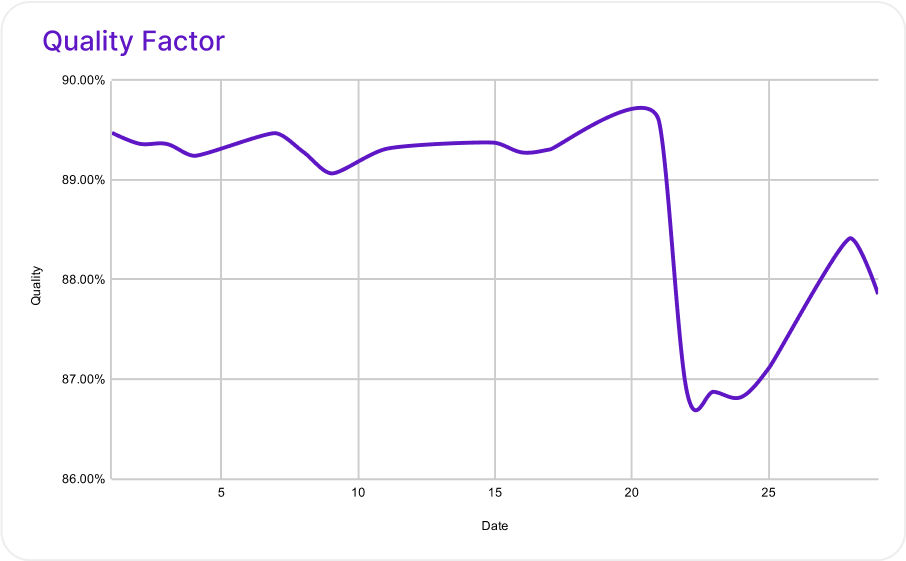

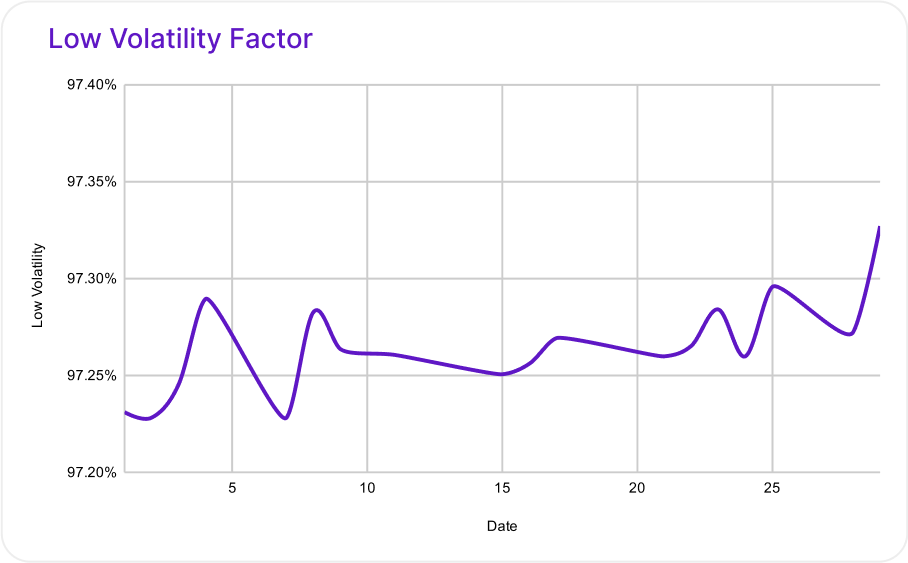

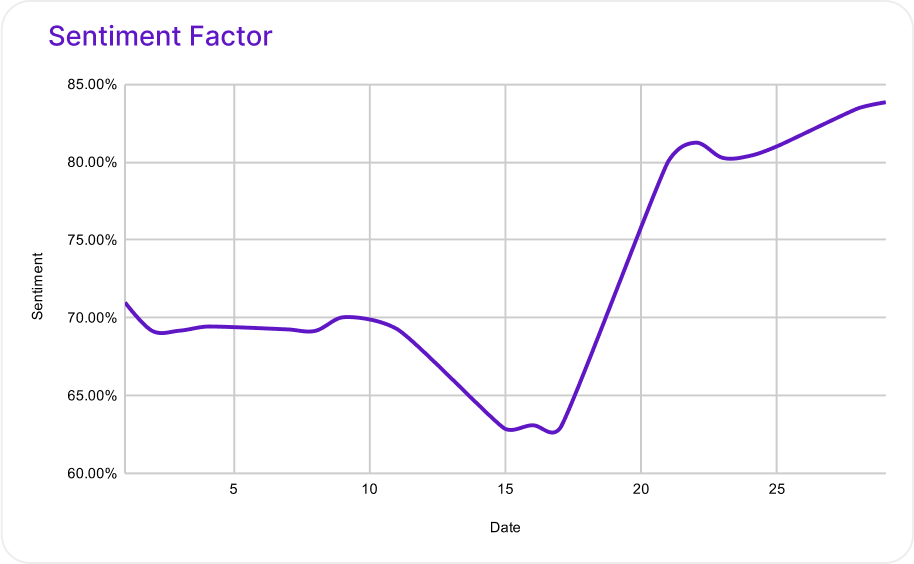

Factor Flow

How Nifty 50’s Factor Scores moved this month

Macro View

Zooming out to key rates, trends, and global moves driving India’s economic story

- The US imposed 26% tariffs on India, paused for 90 days; a 10% base tariff remains. High-level talks push for faster bilateral trade deal.

- Gold prices in India crossed ₹1 lakh/10g, driven by global uncertainty, US-China tensions, and a weak dollar.

- India’s retail inflation fell to 3.34% in March, a 6-year low, driven by lower food prices and easing rural inflation.

- RBI cut repo rate by 25 basis points to 6% and adopted an accommodative stance to spur growth. GDP is forecast at 6.5%, and inflation is seen at 4%.

- India’s FY24-25 trade deficit with China hit $99.2B, while March’s overall deficit stood at $3.63B on imports.

- RBI made forex rules simpler — no more % fines. Now, a flat penalty up to ₹2L for delays in export payments, overseas transfers, or gifting pricey shares.

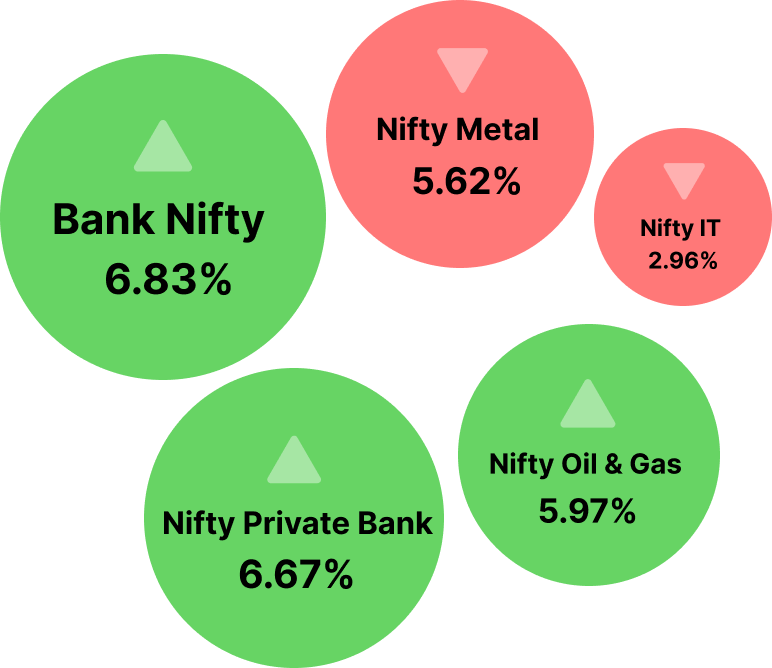

Sector Radar

Top Gainers and Losers

| Top Gainers | Top Losers |

| Bank Nifty 🔼 6.83% | Nifty Metal 🔻 5.62% |

| Nifty Private Bank 🔼 6.67% | Nifty IT 🔻 2.96% |

| Nifty Oil & Gas 🔼 5.97% | |

| Why? Strong Q4 earnings, favorable monetary policy, robust credit growth, and seasonal trends drove the banking sector rally. | Why? IT fell on weak global demand; metals dropped due to US-China tariffs, Chinese exports, and recession risks. |

Beyond Expectations

Nifty 50 stocks beating expectations in Q4 FY25 (so far)

Net profit came in at ₹22,611 crore — over 101% higher than expected (₹11,217 crore).

Net profit stood at ₹1,167 crore — roughly 64% higher than expected (₹710.4 crore).

Reported a net profit of ₹19,284.57 crore — about 9.6% more than the estimate (₹17,589.29 crore).

Market Spotlight

Headlines and hidden trends shaping market moves

Gensol Engineering, a solar and EV leasing firm, is under SEBI probe for diverting ₹262 Cr from funds meant to buy 6,400 EVs. The company secured ₹663.89 Cr in loans from IREDA and PFC, and added 20% equity (₹166 Cr) from its own funds, totaling ₹829.86 Cr. However, only ₹567.73 Cr was spent. The missing ₹262 Cr was allegedly used for personal luxuries, triggering a stock crash, SEBI action, and fraud investigations.

Risks to Watch

Here’s what could shake market moods ahead

- IMF cuts global growth forecast to 2.8%; trade tensions, weak US/China demand may hit exports and key sectors.

- India is negotiating to avoid a 26% US tariff set to return in July; failure could hurt exports, cause market ups and downs, and weaken the rupee.

- Rising service costs and core inflation above 4%, coupled with skill shortages, are slowing urban demand, threatening GDP growth, and increasing market volatility.

Corporate Moves

- Siemens demerged its Energy Business into Siemens Energy India Limited (SEIL), allotting 35.61 crore shares and making SEIL an independent energy-focused entity.

IPO Watch

- Ather Energy – An EV company, backed by Hero MotoCorp received 1.43x subscription. | Issue Price: ₹304–₹321.

That’s a wrap for April!

From sector moves to macro trends and market risks, we’ve covered what mattered.

See you next month. Till then, stay informed and invest intelligently with Share.Market.