- Share.Market

- 10 min read

- 09 Oct 2025

Imagine lighting your first diya on Diwali night. It’s not just about the lamp, it’s about inviting positivity, prosperity, and hope into your home.

Similarly, Indian investors light their financial diya every year through Muhurat Trading.

Muhurat Trading 2025, scheduled for October 21, is a one-hour special trading session conducted by the NSE and BSE on the occasion of Diwali.

Just as families across India exchange sweets and gifts, they also buy a few shares during this time, not always for profit, but as a symbol of wealth and good luck.

But beyond the rituals, there’s a fascinating market story.

Historically, the Diwali stock market session has often witnessed a positive trend because of festive optimism, higher trading volumes, and the belief that starting the year with an investment brings prosperity.

While not a guarantee of returns, this cultural tradition has shaped investor sentiment for decades, making Muhurat Trading a unique blend of tradition and finance in India.

In this article, we will discuss Muhurat Trading in detail. Most importantly, we’ll dive into a 20-year performance analysis of Muhurat Trading to understand whether it’s just a symbolic ritual or if it really influences long-term returns for investors.

What is Muhurat Trading?

Muhurat Trading is a one-hour special trading session conducted by the NSE and BSE on Diwali.

It is considered an auspicious time for making the first investment of the year, as per Hindu traditions.

The word Muhurat means “auspicious time.”

On Diwali evening, stock exchanges open briefly to allow investors to buy or sell shares during this window.

For many families, this isn’t about chasing short-term profits; it’s about beginning their financial year on a positive note, much like how people buy gold on Dhanteras.

This tradition goes back decades.

The Bombay Stock Exchange (BSE) started Muhurat Trading in 1957, and the National Stock Exchange (NSE) followed in 1992.

Stockbrokers would perform Chopda Pujan (worship of account books) and mark Diwali as the start of a new financial year.

Today, investors across India continue the practice by investing during this session, often with the idea of holding them for the long term.

Muhurat Trading 2025 Date & Timings

Muhurat Trading in 2025 is scheduled for Tuesday, October 21, coinciding with Diwali / Lakshmi Pujan.

On this day, the regular market remains closed, and only the special Muhurat hour is open.

This year, the stock exchanges have announced a shift from the traditional evening slot; the Muhurat session will be held in the afternoon.

| Session / Activity | Time (IST) | Notes |

| Block Deal Session | 1:15 pm – 1:30 pm | Large trades (buyer & seller agree on price) before the official opening |

| Pre-open / Price Discovery | 1:30 pm – 1:45 pm | Price equilibrium is decided before trading begins |

| Muhurat Trading (Main Session) | 1:45 pm – 2:45 pm | The core one-hour trading window for investors & symbolic buying/selling |

| Trade Modification Cut-off | Up to 2:55 pm | Orders can be modified within this post-session window |

| Closing / Settlement Activities | 2:55 pm – 3:05 pm | Final procedures, confirmations, and settlements of executed trades |

* All trades executed during Muhurat Trading carry full settlement obligations, the same as any regular trading day.

* While many past years had Muhurat Trading in the evening (for example, 6:00-7:00 pm or 6:15-7:15 pm), this year the session is shifted to 1:45-2:45 pm

Research Analysis: How Stocks Perform After Muhurat Trading

When it comes to Muhurat Trading, many investors wonder: Does buying on Diwali really lead to better returns?

To answer this, we studied the performance of the Nifty 50 index around Muhurat Trading sessions from 2005 to 2024. We tracked four data points:

- 1 day before Muhurat Trading

- 3 months after Muhurat Trading

- 6 months after Muhurat Trading

- 12 months after Muhurat Trading

Here’s what the data reveals:

*Returns calculated using the next trading day’s closing price for non-trading days.

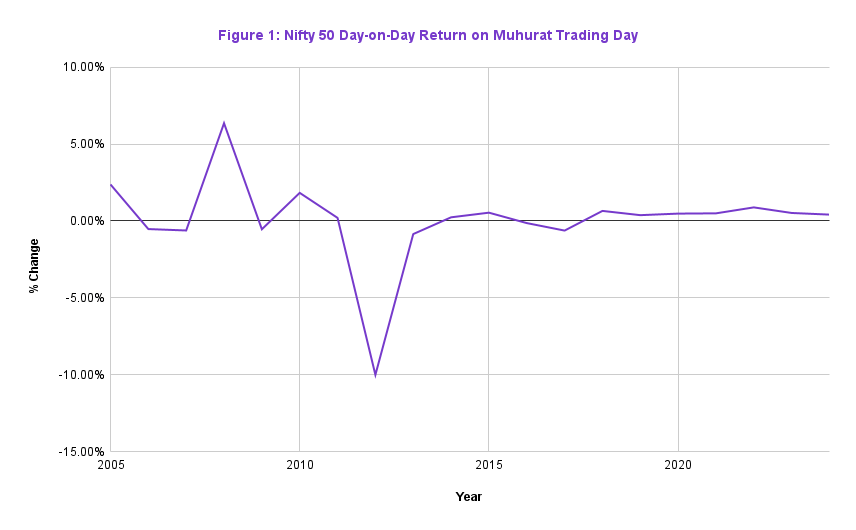

One Day Before Muhurat Trading

The session has been largely positive, closing higher in 14 of the 20 years.

However, the returns are typically modest (below 1%).This suggests that short-term investors don’t get big benefits, but the sentiment is largely positive.

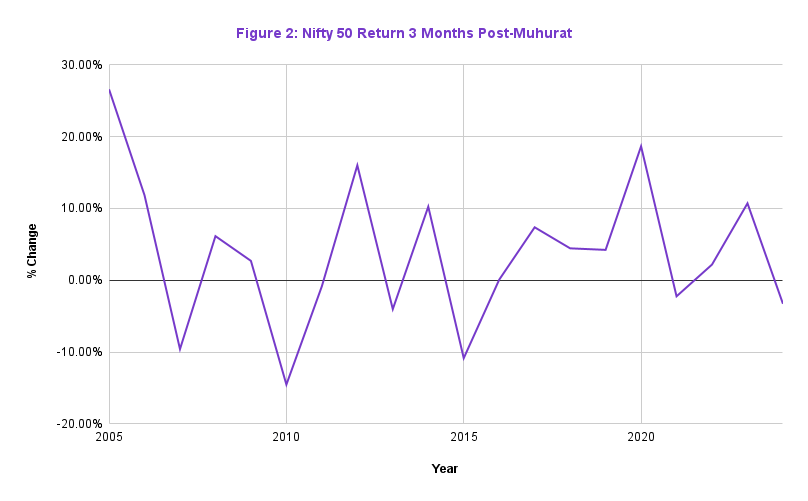

Three Months After Muhurat Trading

Based on the Nifty 50’s 3-Month Post-Muhurat returns are mixed but often stronger compared to 1-day results. Some years show sharp rallies while others had corrections

On average, festive optimism tends to hold up in the short-to-mid term, but global/macro events often dominate.

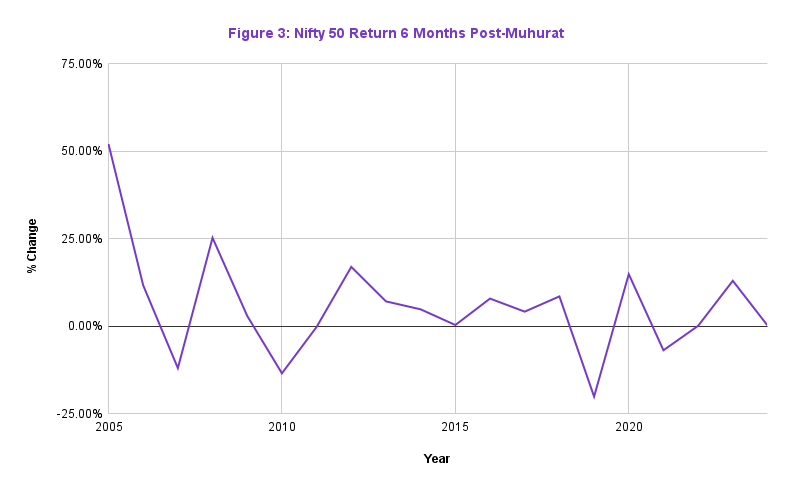

Six Months After Muhurat Trading

Trends get even more scattered: some years saw double-digit gains, while others faced steep corrections.

This shows that festive sentiment doesn’t shield investors from market realities, earnings, interest rates, and global news take over.

And it shows that participation during the Diwali hour does not influence or guarantee market returns over the subsequent 6-month period.

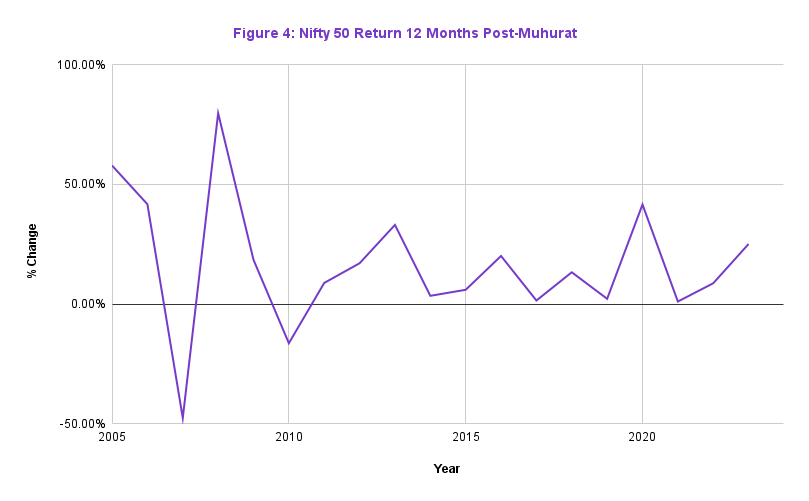

Twelve Months After Muhurat Trading

Based on the Nifty 50’s 1-Year Post-Muhurat returns, the long-term trend is overwhelmingly positive, with gains in 17 of 20 years.

The returns are often substantial, exceeding 25% in seven years. The two major negative outliers were during the Global Financial Crisis and its aftershocks emphasizing long-term gains are subject to global economic cycles.

Who Should Participate in Muhurat Trading?

First-Time Investors

The Muhurat Trading session functions as a traditional and symbolic first-entry marker for many new investors. Aligning with the custom of buying gold on Dhanteras as a sign of prosperity, individuals often purchase a small, token quantity of shares in a fundamentally strong company. This practice connects the beginning of the investment journey with the auspicious cultural significance of Diwali, potentially fostering a commitment to long-term wealth building.

Long-Term Investors

For individuals already engaged in regular investing, Muhurat Trading is often utilized as an opportunity for portfolio re-alignment or topping up existing positions. Many investors choose this period to add to long-term holdings in fundamentally strong companies. While historical data suggests long-term returns following the session are often positive, the participation is primarily viewed as a way to align wealth creation discipline with cultural traditions, rather than a market-timing strategy.

Families and Generational Investors

Muhurat Trading holds significant value as a financial tradition within Indian families. It is a common practice for parents to open Demat accounts for their children or make symbolic investments in their name. For these families, the session serves as a tangible way to inculcate and pass down the importance of saving and investing to the next generation, creating a memorable financial milestone tied to the Diwali festival.

Conservative Investors

Even for investors cautious about market risks, the short, sentiment-driven nature of the Muhurat session allows for small, token investments without significant market exposure. The goal for this group is often not to maximize profit but to participate in the tradition and align a minor financial action with their personal goals of welcoming prosperity.

Symbolic and Ritual Investors

A segment of the investor community approaches Muhurat Trading purely as a gesture of good luck and faith. Their focus is often detached from market trends, valuations, or expected returns. For them, any small purchase, be it a single share, a mutual fund unit, or a bond—is a meaningful financial ritual, akin to a puja, expressing gratitude and hope for financial well-being in the new Samvat year.

Things to Keep in Mind Before Investing in Muhurat Trading

For many investors, Muhurat Trading 2025 is less about chasing quick gains and more about starting the financial year on a positive note.

Still, it’s important to be mindful before making your Diwali investments. Here are a few things to keep in mind:

It’s a Symbolic Session, Not a Guarantee

The one-hour Diwali stock market session is considered auspicious, but it does not guarantee profits. Short-term moves are often driven by festive optimism rather than fundamentals.

Stick to Quality, Long-Term Stocks

If you’re buying during Muhurat Trading, treat it as a chance to add high-quality, fundamentally strong companies to your portfolio, just like buying gold on Diwali. Avoid speculative or low-quality picks, even if they seem popular.

Expect Higher Volatility in a Short Window

Because the market is open for only one hour, price swings can be sharper than usual. Don’t get carried away by sudden up or down movements—focus on your long-term investment plan.

Settlement Rules Still Apply

Even though it’s a special session, all trades are settled like any regular trading day. Make sure you’re comfortable with your positions and don’t overextend.

Avoid Rumours and “Hot Tips”

Festive euphoria often brings in a flood of recommendations from friends, WhatsApp groups, or TV channels. Stay cautious, invest based on research and fundamentals, not short-lived buzz.

Think of It as a Beginning, Not the Destination

For long-term investors, Muhurat Trading is about starting the year with discipline. Your real wealth creation depends on consistent investing, diversification, and patience, not on what happens in a single hour.

Conclusion: Tradition Meets Market Reality

Just like lighting a diya on Diwali is less about brightness in that moment and more about inviting prosperity into the year ahead, Muhurat Trading carries meaning beyond a one-hour market session.

Our research shows that while the day-after and short-term moves are often small or unpredictable, the longer horizon, especially one year after Muhurat Trading has historically rewarded investors more often than not.

This makes the practice less about chasing instant profits and more about starting an investing journey on an auspicious note.

At its heart, Muhurat Trading is a blend of culture, optimism, and disciplined investing. For many families, it’s a symbolic ritual of welcoming Goddess Lakshmi into their portfolios. For the markets, it reflects how faith and finance come together in India.

So whether you see it as tradition or strategy, Muhurat Trading 2025 on October 21 is another reminder that wealth creation isn’t about one hour, it’s about the discipline and patience that follow long after the festive lamps are extinguished.

Disclaimer and Disclosure

Investments in the securities market are subject to market risks, read all the related documents carefully before investing. Registration granted by SEBI, enlistment as Research Analyst with Exchange and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Kindly refer to https://share.market/ for more details.Investments in WealthBaskets are subject to the Terms of Service. All investors are advised to conduct their own independent research into investment strategies before making an investment decision. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. PPWB acts as a distributor of mutual funds and it is not an exchange traded product. PPWB acts as a distributor of mutual funds and WealthBaskets and it is not an exchange traded product. Disputes with respect to the distribution activity of Mutual Funds and WealthBaskets will not have access to Exchange investor redressal or Arbitration mechanism. The securities are quoted as an example and not as a recommendation. This is for informational purposes and should not be considered as recommendations.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887 and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226. Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA. CIN: U65990KA2021PTC146954