- Share.Market

- 6 min read

- 04 Jul 2025

Intelligence-Driven Investing, Simplified!

June 2025

In June, Indian markets reached a 9-month high. S&P Global Ratings raised India’s economic growth forecast to 6.5% for FY26. The RBI cut the repo rate to 5.5% and shifted to a neutral stance. Additionally, India’s retail inflation declined to a six-year low of 2.82%. Major demergers and announcements also kept investors busy.

Let’s take a closer look at everything that shaped the markets this month:

Market Barometers

The Indian equity market surged with Nifty 50 touching 25,500 marks, and BSE Sensex crossed 83,500 after 266 days. Both indices delivered positive returns despite mid-month volatility due to Middle East tensions. India VIX declined from elevated levels of 15+ to more manageable ranges. The month concluded with strong momentum, driven by easing geopolitical tensions, robust domestic flows, and supportive monetary policy.

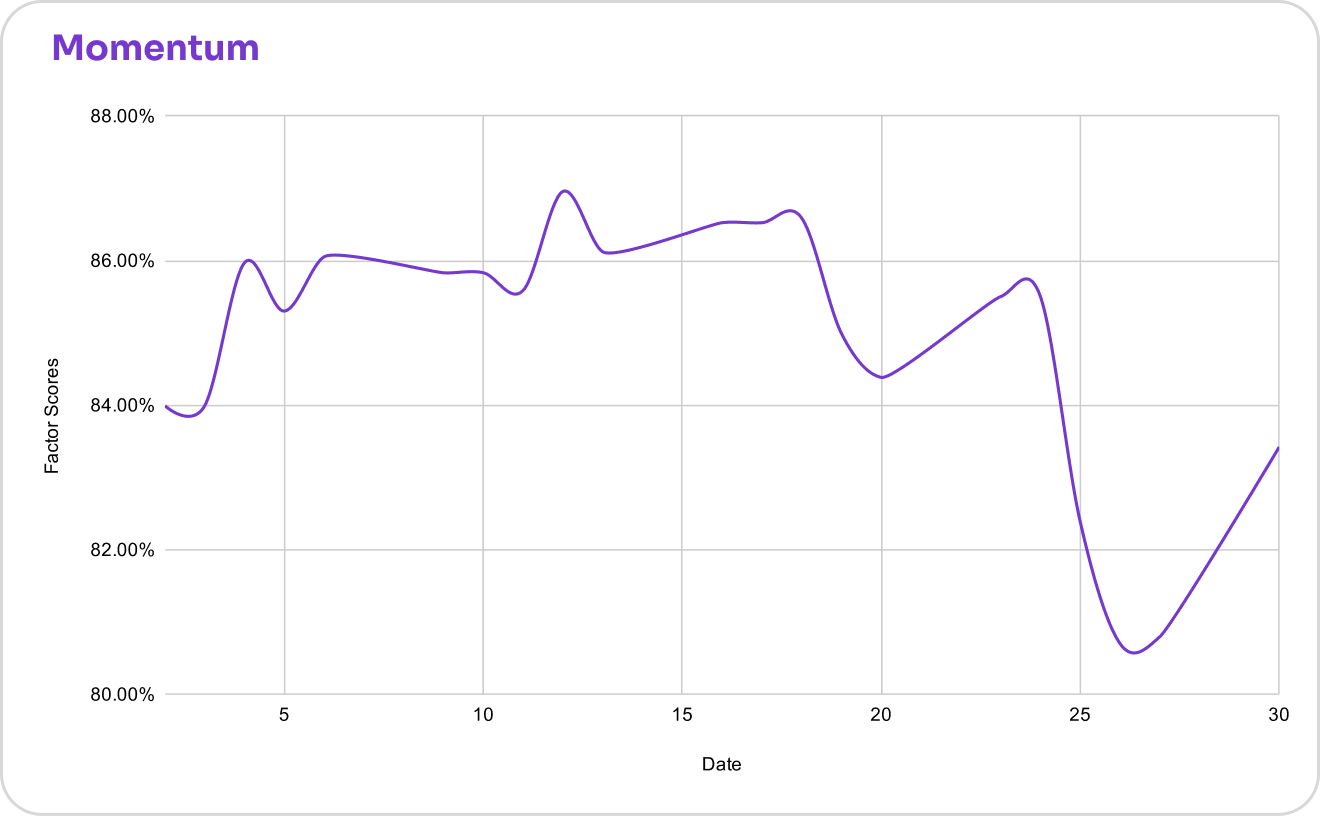

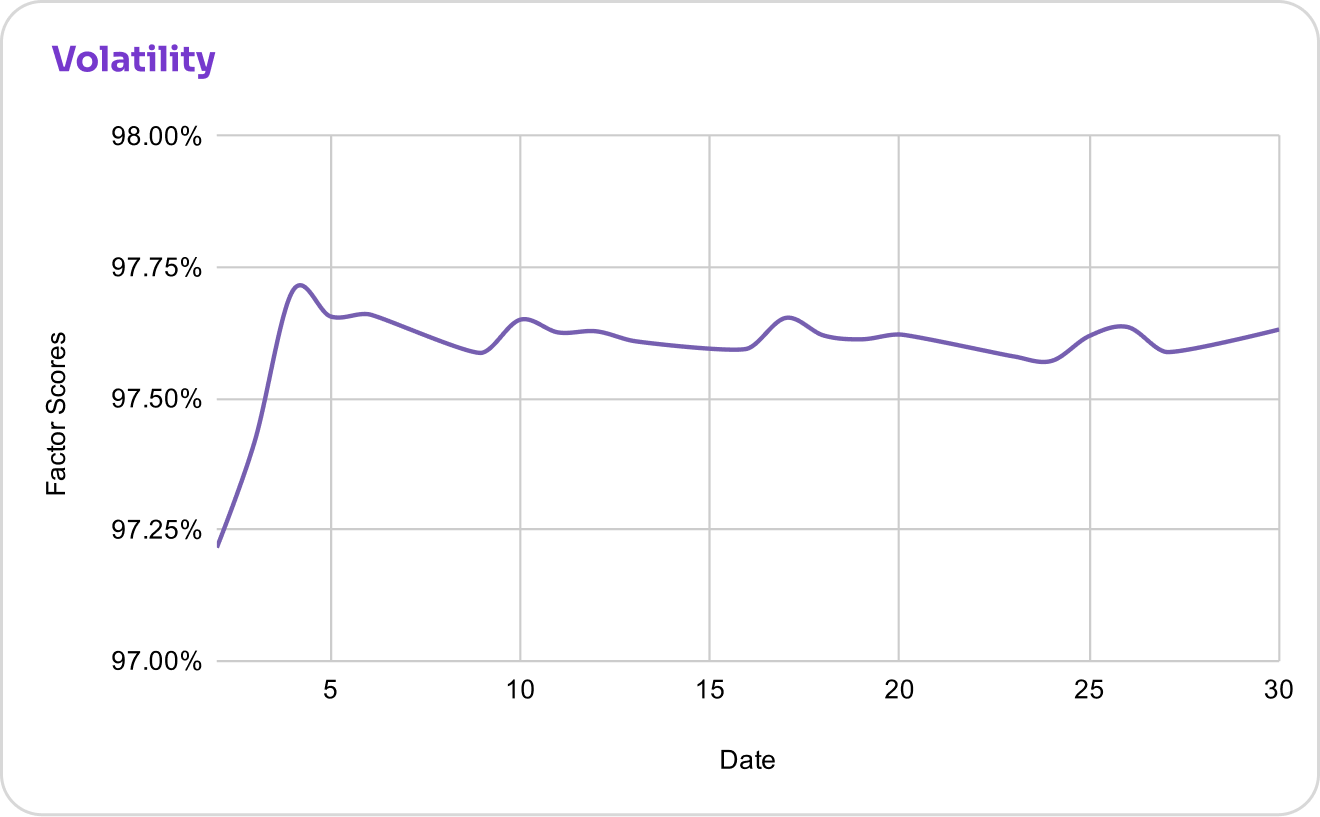

Factor Flow

How Nifty 50’s Factor Scores moved this month

Macro View

Zooming out to key rates, trends, and global moves driving India’s economic story

- RBI cut repo rate to 5.5%, shifted to neutral stance, and pushed for growth. CRR cut to 100 basis points to boost liquidity and forecasted FY26 GDP growth to 6.5%.

- India’s forex reserves rose $2.3 billion to nearly $699 billion, enough to cover 11 months of imports and shield against uncertainties.

- S&P Global raised India’s FY26 growth forecast to 6.5%, citing normal rains, lower oil prices, tax cuts, and supportive monetary policy.

- India’s extreme poverty fell to 5.3% in 2022–23 from 27.1% in 2011–12, lifting 171 million people above the poverty line, says the World Bank in its latest report.

- ICRA downgraded India’s hospitality outlook to ‘stable’ from ‘positive’, expecting 6–8% FY26 growth, with domestic travel driving demand amid weak foreign tourist arrivals.

- Centre slashes import duty on crude edible oils from 20% to 10% to lower retail prices, curb inflation, and boost domestic refining.

- India’s trade deficit was $21.88 billion in May 2025, stable from the previous year. Imports fell 1.7% to $60.61 billion while exports dropped 2.2% to $38.73 billion.

- India’s wholesale inflation eased to 0.39% in May, while retail inflation hit a six-year low of 2.82% on softer commodity prices.

- The World Bank has cut its 2025 global growth forecast to 2.3% amid rising trade barriers; India remains resilient, with 6.3% growth expected in FY26.

Sector Radar

Nifty PSU Bank led June gains as RBI rate cuts, relaxed infra provisioning, and global cues like softer dollar and Fed cut hopes boosted lending, infra, housing, and Indian IT export outlook.

Who Owns the Market?

Tracking India’s Evolving Market Ownership Trends

- DIIs kept markets strong with ₹72,674 crore net buying, showing steady domestic investor confidence in June.

- FIIs’ net purchase is ₹7,489 crore in cash, but their inflows slowed compared to May, signaling cautious optimism.

Corporate Moves

The key announcement you shouldn’t miss

- JSW Paints acquired 74.76% of Akzo Nobel India Ltd. for ₹8,986 crore, marking a major move in India’s paints sector

- Bharat Electronics Ltd. and Trent Ltd. join BSE Sensex, replacing Nestle India Ltd. and IndusInd Bank Ltd. a reshuffle likely to attract fresh passive inflows

- Siemens Energy India Ltd. began trading after its demerger from Siemens Ltd. with existing shareholders receiving shares in a 1:1 ratio

IPO Watch

| Company | About | Issue Price | Subscription |

| Oswal Pumps Ltd. | It makes pumps and solar systems, serving agricultural and industrial needs across India | ₹614 | 34.31x |

| Arisinfra Solutions Ltd. | It is a B2B tech platform simplifying construction material procurement and finance management for infrastructure companies across India. | ₹222 | 2.65x |

| Globe Civil Projects Ltd. | A Delhi-based Engineering, Procurement, and Construction company delivering projects across 11 Indian states. | ₹71 | 85.93x |

| Kalpataru Ltd. | It develops residential, commercial, and township projects across major Indian cities like Mumbai, Pune, and Bengaluru. | ₹414 | 2.48x |

| Ellenbarrie Industrial Gases Ltd. | It supplies industrial, medical, and specialty gases and offers turnkey air separation and medical gas pipeline solutions. | ₹400 | 22.18x |

| HDB Financial Services Ltd. | A retail-focused NBFC offering loans, insurance distribution, and BPO services like collections and sales support. | ₹740 | 16.69x |

| Sambhv Steel Tubes Ltd. | It manufactures electric resistance welded steel pipes and tubes at its Chhattisgarh plant, sourcing raw materials from top PSU mines nearby. | ₹82 | 28.43x |

| Indogulf Cropsciences Ltd. | It makes crop protection products, nutrients, and biologicals, and pioneered manufacturing key agrochemical technicals in India. | ₹105 to ₹111 | 25.94 x |

Risks to Watch

Here’s what could shake market moods ahead

- US tariff decisions due in July could impact global trade and the direction of US monetary policy, potentially affecting global liquidity.

- Market trading at premium valuations with a CAPE of Nifty 50 greater than 50, requiring strong earnings support to justify these levels.

That’s a wrap for June!

From sector moves to macro trends and market risks, we’ve covered what mattered.

See you next month. Till then, stay informed and invest intelligently with Share.Market

Disclaimer and Disclosure

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887 and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst with Exchange and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954