- Share.Market

- 5 min read

- 07 Nov 2025

Intelligence-Driven Investing, Simplified!

October 2025

Indian markets witnessed renewed vigour in October amid strong corporate earnings, a slew of IPOs, supportive monetary policy and regulatory reforms. Nifty 50 rose 4.51% and closed at 28,050.65 points for the month, while Sensex surged 4.7% and closed at 83,938.71 points.

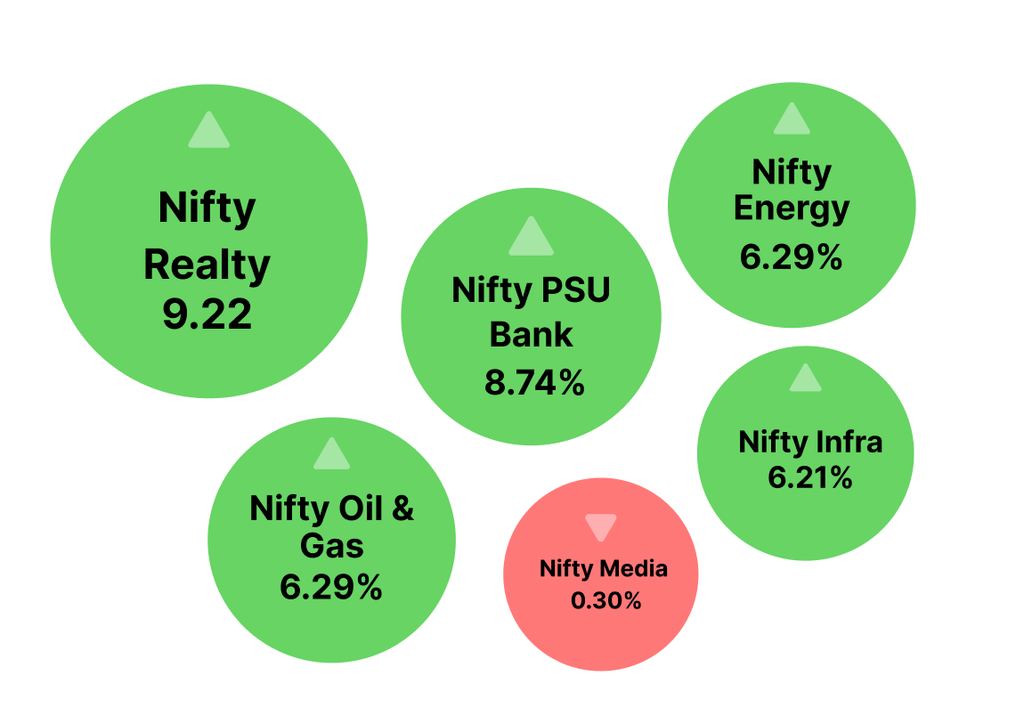

Sector Radar

See how the key sectors moved and why

| Why? Realty and Infra stocks gained amid the festive season and hopes of an interest rate cut. State-owned Oil & Gas and Energy companies reported stellar results, and the Cabinet approved a ₹30,000 crore compensation package to oil marketing companies for losses in Domestic LPG. PSU Banks rose on speculation that the government might raise the FII cap in PSUs from 20% to 49%. In contrast, Media fell on disappointing Q2 results. |

Corporate Moves

The key announcements you shouldn’t miss

- Automobiles manufacturer Ford announced plans to restart operations at its Chennai plant with a ₹3,250 crore investment to produce next-generation engines for global markets.

- SEBI capped the weight of top stocks in non-benchmark indices such as bank Nifty to 20%, while the combined weight of the top three stocks is capped at 45%. This move aims to reduce concentration risk and ensure broader market representation.

- Reliance Industries through its subsidiary has partnered with Google to accelerate AI adoption across India. Accordingly, Google will roll out its AI Pro Plan to eligible Jio users free of cost for 18 months.

- Hindustan Aeronautics Limited (HAL) and Russia’s United Aircraft Corporation (PJSC-UAC) signed an MoU to jointly produce the SJ-100 civil commuter aircraft in India. HAL said this will be a “game changer” for short-haul connectivity under the UDAN scheme.

- Bondada Engineering secured a ₹1,050 crore contract from Adani Group for a 650 MW solar project at Khavda in Gujarat, covering design, engineering, and supply work.

Macro View

Zooming out to key rates, trends, and global moves driving India’s economic story

- RBI kept the repo rate unchanged at 5.50% with a neutral stance, indicating a balanced approach that supports economic momentum while ensuring financial stability.

- RBI Data showed that bank deposit growth slowed to 9.5% year-on-year as of October 17, down from 9.9% earlier, while credit growth remained steady at 11.5%.

- India’s REIT market is projected to grow to ₹19.7 lakh crore by 2030 from ₹10.4 lakh crore in 2025, as per a Knight Frank India–CII report.

- The US Federal Reserve cut the federal funds rate by 25 bps to 3.75% – 4.00% at its October 2025 meeting, citing rising employment risks and still-elevated inflation.

- US and Singapore together accounted for over one-third of India’s total foreign direct investment (FDI) in FY25 as per RBI data.

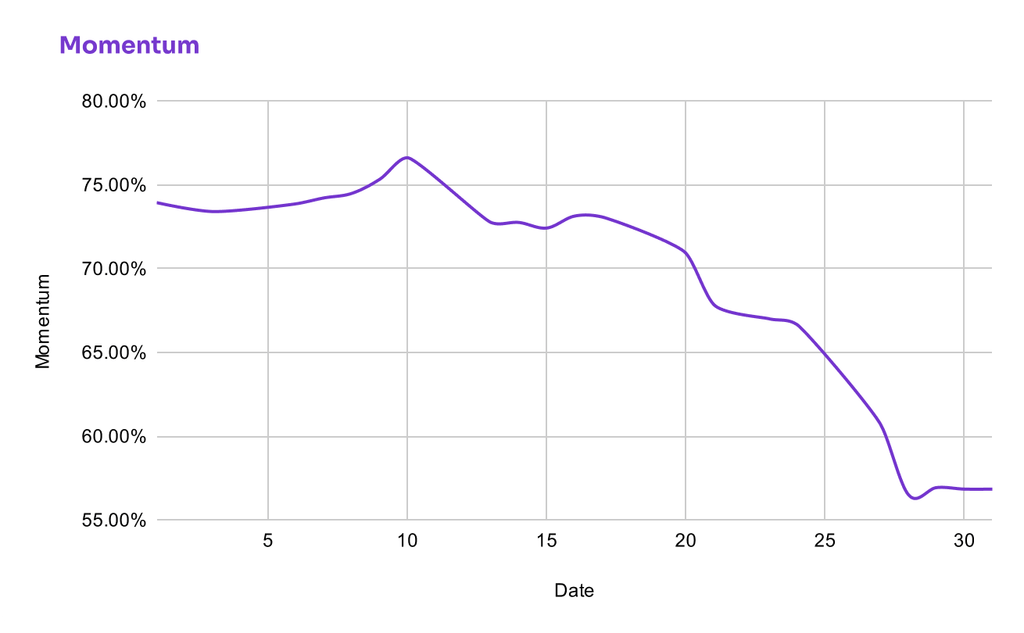

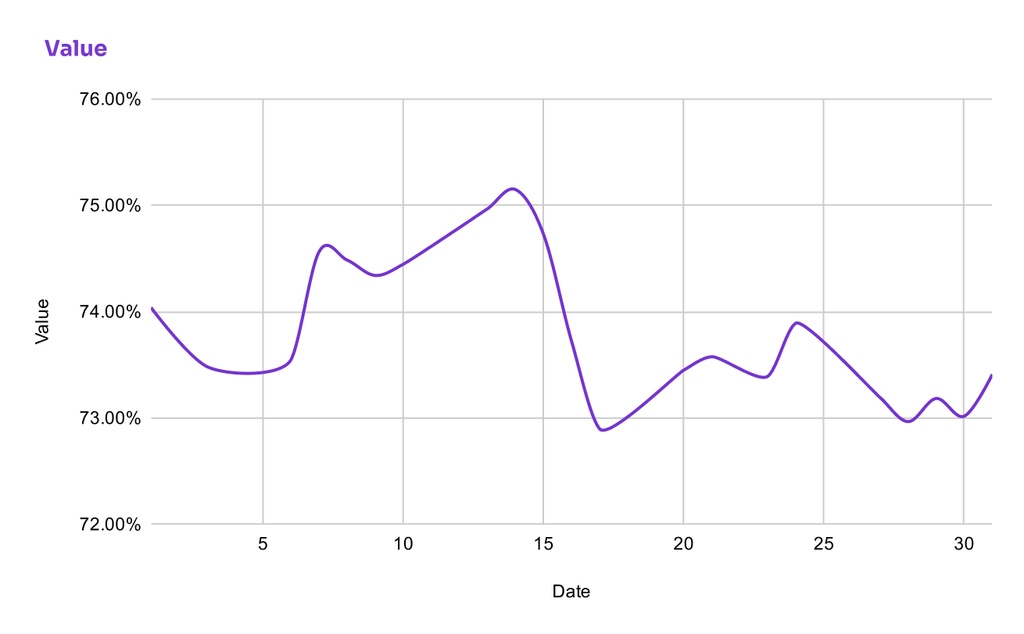

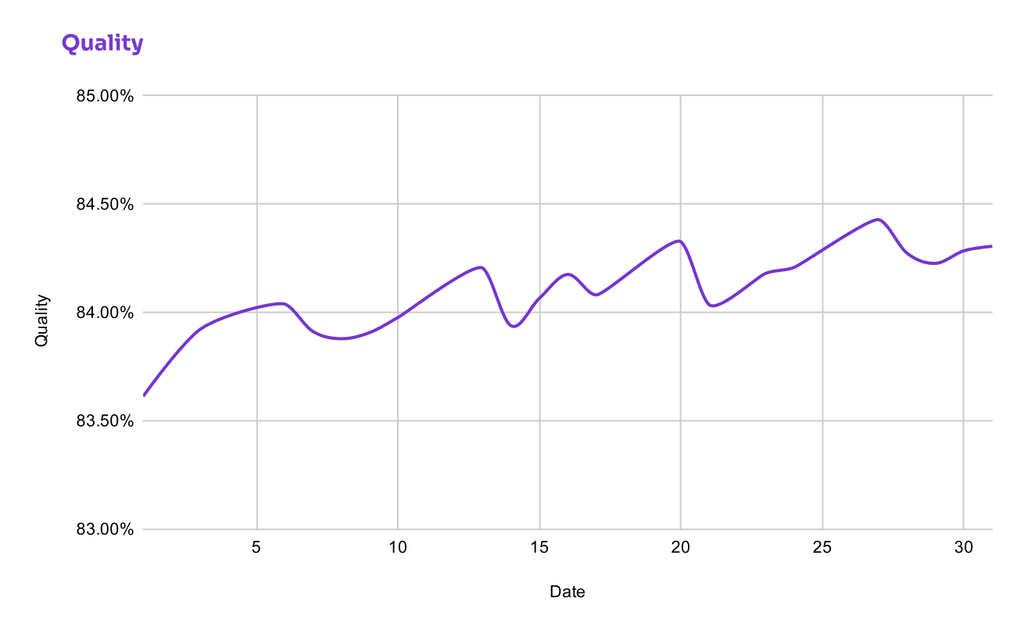

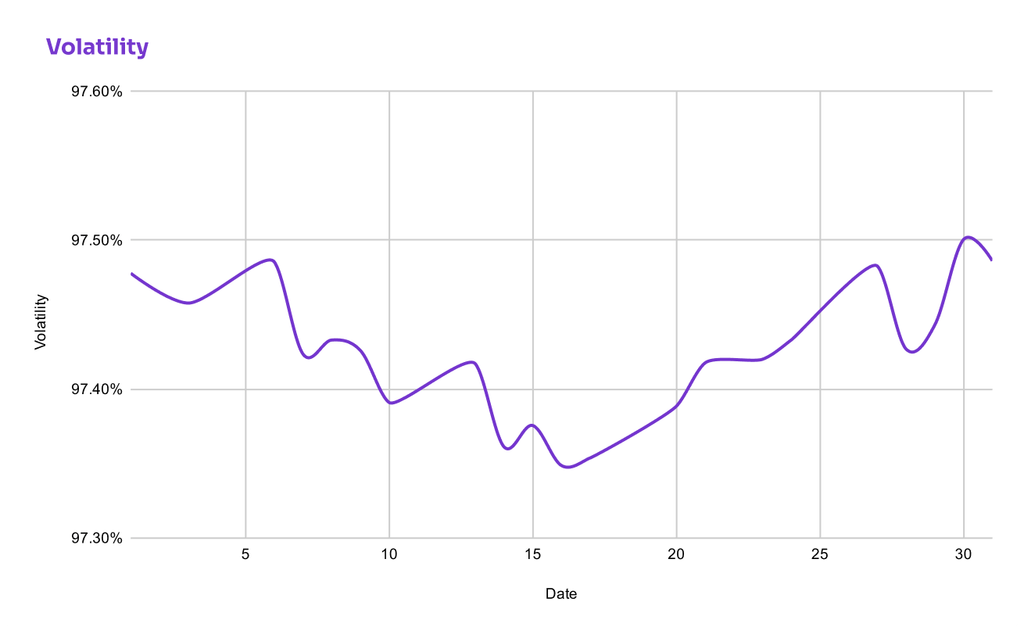

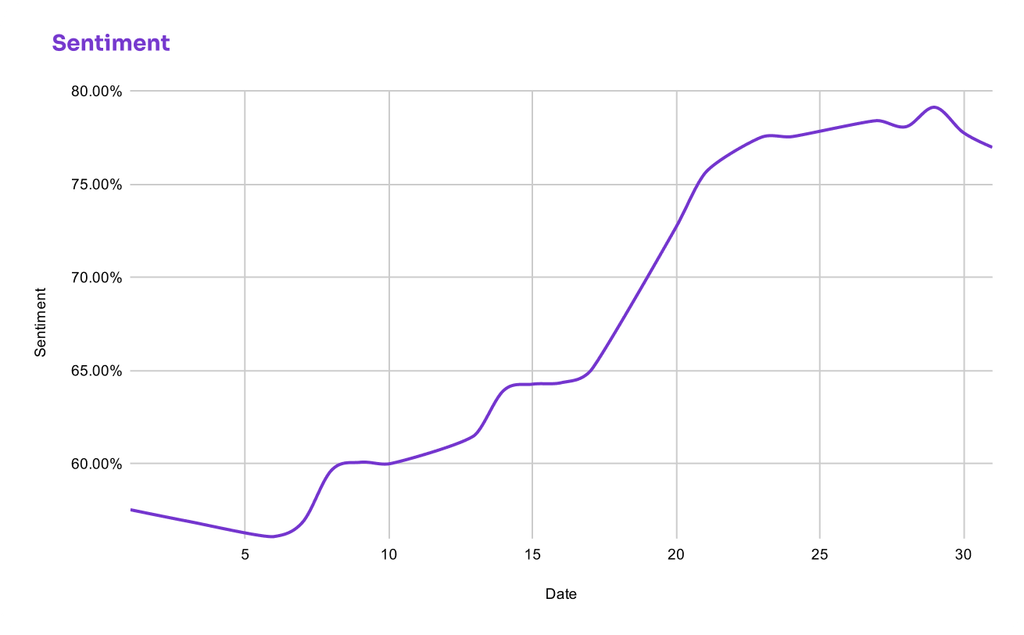

Factor Flow

How Nifty 50’s Factor Scores moved this month

FII vs DII Trends

Tracking India’s evolving market ownership trends

- Foreign Institutional Investors (FII) selling slowed down in October to ₹2,346.89 crore, suggesting a slight relief from the aggressive foreign selling in the past three months

- In contrast, Domestic Institutional Investors (DIIs) continued their buying momentum with net purchases at ₹52,794 crore.

What Moved the Needle

The headline that set the tone this month

Gold and Silver hit fresh lifetime highs in October

The precious metals experienced a notable rally during the month. Gold showed renewed upward momentum amid demand driven by global economic uncertainties, geopolitical tensions and fluctuating US Dollar. Silver mirrored this trajectory supported by robust industrial demand from sectors like electric vehicles and solar energy.

IPO Watch

| Company | Issue Size(In Crores) | Subscription |

| WeWork India Management Ltd. IPO | 3,000.00 | 1.15x |

| Tata Capital Ltd. IPO | 15,511.87 | 1.91x |

| LG Electronics India Ltd. IPO | 11,607.01 | 54.01x |

| Rubicon Research Ltd. IPO | 1,377.68 | 103.88x |

| Canara Robeco Asset Management Co.Ltd. IPO | 1,326.13 | 9.74x |

| Canara HSBC Life Insurance Co.Ltd. IPO | 2,517.50 | 2.29x |

| Midwest Ltd. IPO | 451.10 | 87.84 |

| Orkla India Ltd. IPO | 1,667.54 | 48.73x |

| Studds Accessories Ltd. IPO | 455.49 | 73.23x |

| Lenskart Solutions Ltd. IPO | 7,278.76 | 28.25x |

That’s a wrap for October!

From sector moves to macro trends and market risks, we’ve covered what mattered.

See you next month. Till then, stay informed and invest intelligently with Share.Market.