- Share.Market

- 8 min read

- 02 Oct 2025

Intelligence-Driven Investing, Simplified!

September 2025

September was a month of contrasts for Indian equities. For most of the month, markets held steady, supported by strong economic indicators and healthy domestic demand. But this calm was shaken in the final week, when global uncertainties, ranging from fresh tariff threats to policy changes in the US, sparked a sharp sell-off led by foreign investors.

What could have been a deeper correction was softened by the growing strength of domestic investors. Mutual fund inflows, SIPs, and institutional buying together created a “DII shield,” absorbing much of the foreign selling and preventing larger market damage.

The bigger picture remains clear: India’s market is no longer moving in lockstep with volatile foreign capital. Low inflation, resilient growth, and improving participation from local investors continue to provide stability. As we move into the earnings season, this balance between global headwinds and domestic strength will define the road ahead.

Let’s take a closer look at everything that shaped the markets this month:

Market Barometers

September initially appeared calm, but the details revealed a different story. The BSE Sensex and Nifty 50 managed small monthly gains of 0.23% & 0.45%, yet both suffered steep weekly drops of over 2.8% in the final week.

Though mid- and small-cap indices rose 0.80%, the final week brought sharper pain, with a drop of over 3%. This decline reinforced the narrative of a “reset year” for smaller stocks.

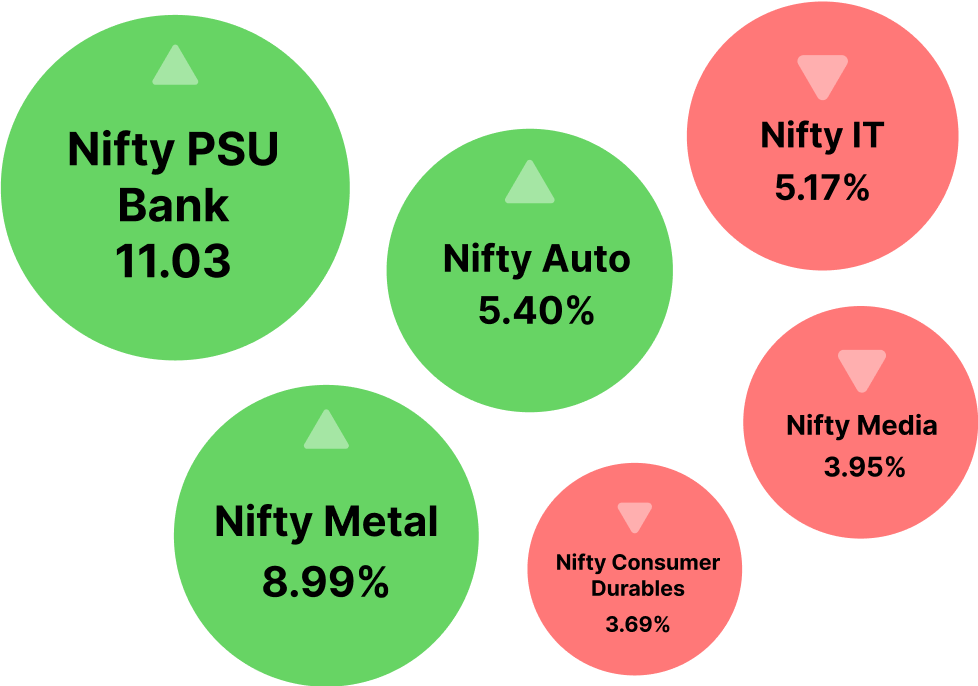

Sector Radar

See how the key sectors moved and why

Why? Sector performance in September reflected clear policy-driven shifts. PSU Banks, Metals, and Autos gained from supportive reforms, festive demand, and global tailwinds. In contrast, IT stocks slumped on US visa fee hikes, while Media and Consumer Durables lagged amid weak consumption trends, digital disruption, and caution over advertising spends.

Corporate Moves

The key announcement you shouldn’t miss

- State Bank of India completes sale of 13.18% stake in YES Bank Ltd. to Japan’s SMBC for ₹8,889 crore; it retains 10.8% holding, marking India’s biggest cross-border banking investment

- SEBI dismissed Hindenburg’s allegations, giving the Adani group a clean chit; the probe found no rule violations, rejecting claims of stock manipulation and related-party transactions

- Poonawalla Fincorp Ltd. promoter Rising Sun Holdings infuses ₹1,500 crore to strengthen the balance sheet, boost capital adequacy, and fund growth in the competitive NBFC sector

- Aditya Birla Fashion and Retail Ltd. launches OWND!, a Gen Z-focused value fashion brand, aiming for 100 stores by FY-end to tap India’s fast-growing youth fashion market

- Infosys Ltd. board approves ₹18,000 crore buyback at ₹1,800 per share, covering up to 2.41% equity, its largest ever offering premium to investors

Market Spotlight

Headlines and important updates from the markets

- Nifty 500 companies posted 5.9% revenue growth YoY in Q1 FY26, with profitability boosted mainly by margin gains rather than strong topline expansion

- The Energy sector contributed 45.7% of EBITDA growth in Q1, followed by Communication Services (20.5%) and Materials (19.3%), underscoring sector-specific strength despite broader estimate downgrades

- SEBI has given large companies more time, five years instead of three, to meet the 25% public shareholding rule, easing pressure from forced share sales

- Domestic mutual funds get a bigger role in IPOs now, with their anchor quota raised from 33% to 40%, reducing reliance on foreign investors

Macro View

Zooming out to key rates, trends, and global moves driving India’s economic story

- India’s foreign exchange reserves crossed $700 billion for the first time, giving the economy a strong buffer against global shocks and currency volatility

- From September 22, GST rates were cut on 391 items. Expect cheaper goods, more consumption, and easier compliance—a welcome boost for households and businesses

- India’s trade deficit narrowed as exports jumped 9% while imports fell 7% in August, cutting India’s trade deficit sharply. Strong electronics and pharma exports drove this positive turnaround

- S&P raised India’s sovereign rating to BBB, and OECD lifted growth forecast to 6.7%, signaling global confidence in India’s stability and growth story

- To ease tariff pain from the US, India announced a support package with credit guarantees for SMEs, especially in textiles and jewellery, protecting jobs and trade

- Global firms are reducing reliance on China. Backed by PLI schemes and FTAs, India is emerging as a key hub in shifting supply chains

- NITI Aayog says AI can add $500–600 billion to India’s GDP by 2035. That’s a huge opportunity powering the “Viksit Bharat” vision.

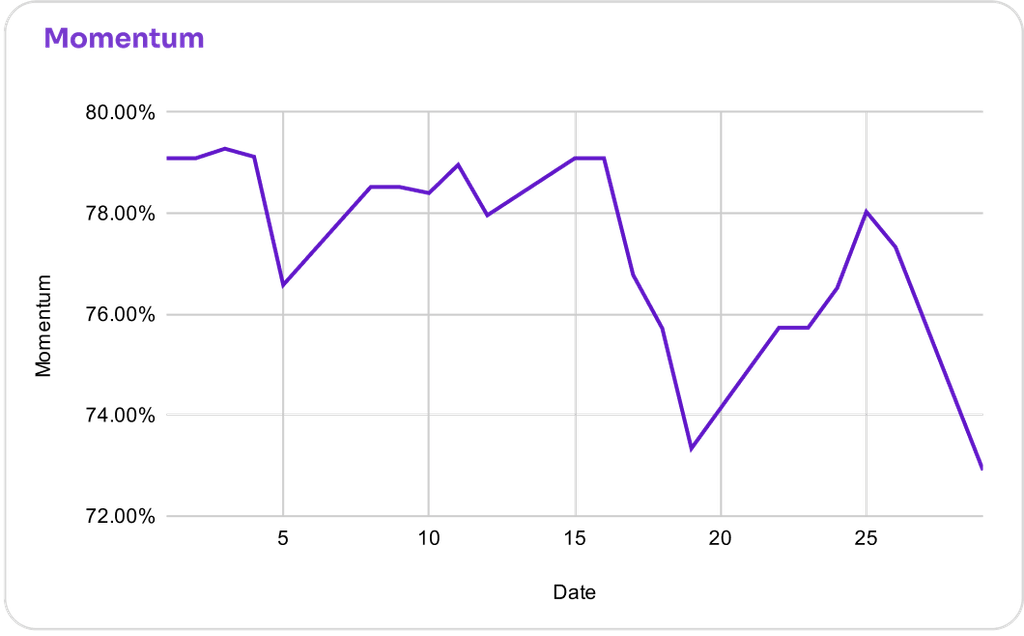

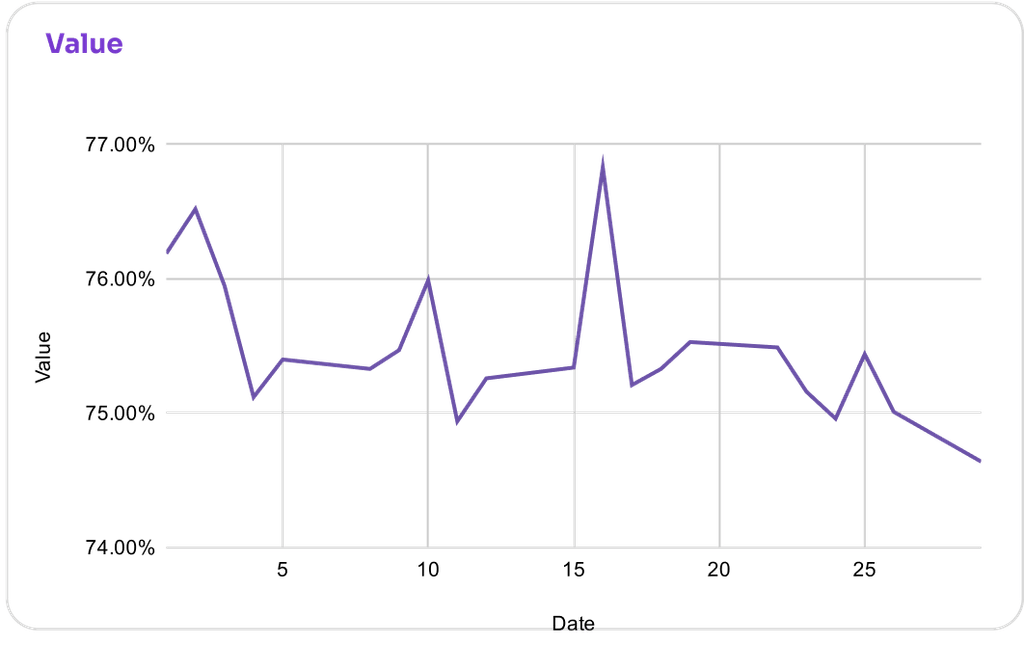

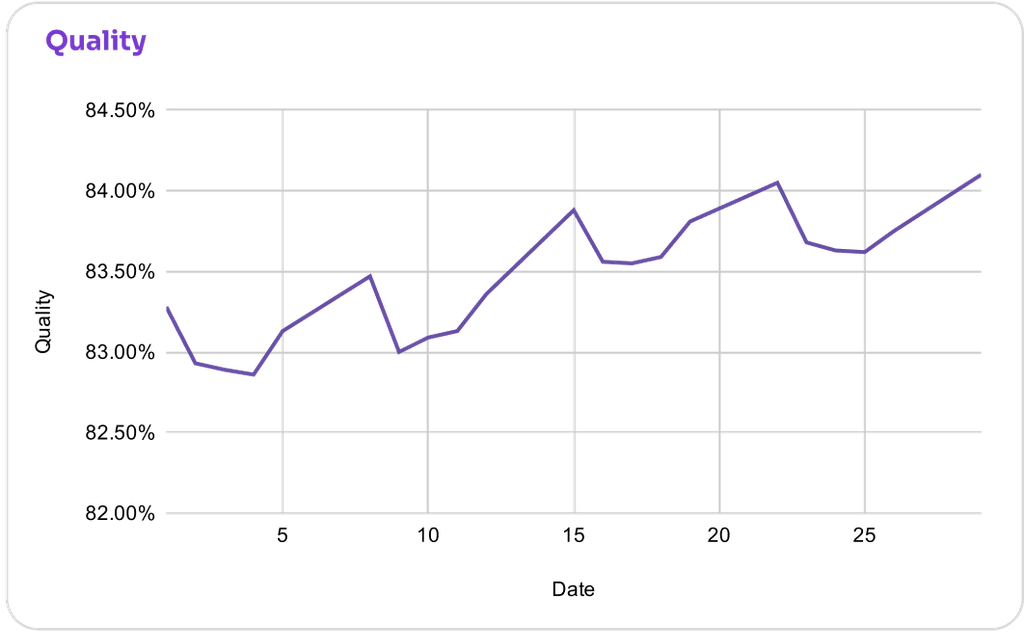

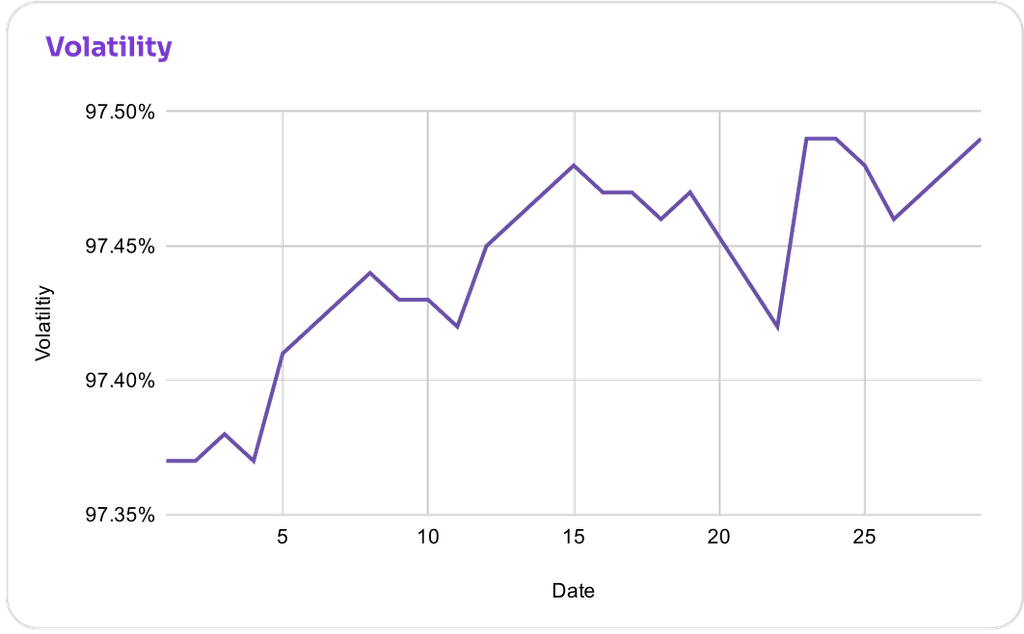

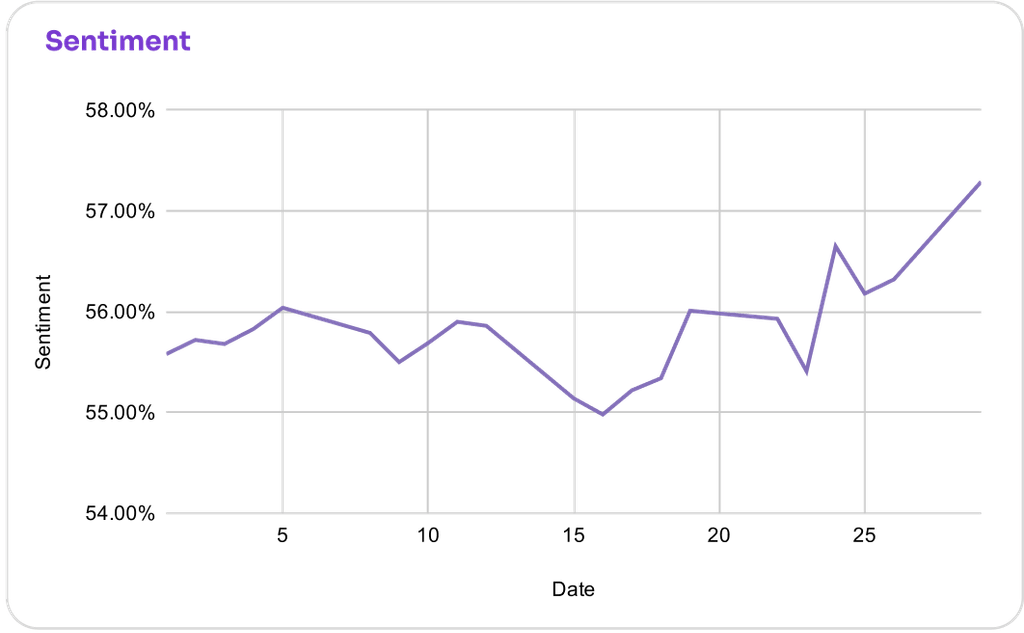

Factor Flow

How Nifty 50’s Factor Scores moved this month

FII vs DII Trends

Tracking India’s evolving market ownership trends

- Foreign Institutional Investors (FIIs) showed a significant moderation in their selling activity in September, with net outflows of ₹35,301.36 crore. This marks a decrease of approximately 24.8% compared to the ₹46,902.92 crore net selling witnessed in August, suggesting a slight relief from the aggressive foreign selling that dominated the previous month

- In contrast, Domestic Institutional Investors (DIIs) maintained their role as strong market stabilizers but with a reduced quantum of buying. Their net purchases of ₹65,343.59 crore in September were notably lower than August, representing a decrease of approximately 31.1%. Despite the drop, DII net buying comfortably cushioned the FII outflows

What Moved the Needle

The headline that set the tone this month

A Simple Guide for Investors: Why Are So Many Companies Going Public?

IPOs are everywhere, while markets struggle, companies are rushing to list. Why now? From GST reforms to shifting investor demand and looming mega-IPOs, the buzz isn’t random. Curious about the real drivers and the risks for retail investors?

IPO Watch

| Company | About | Issue Size | Subscription |

| Urban Co. Ltd. | Urban Company, founded in 2014, is India’s leading home and beauty services marketplace, operating across 51 cities. From plumbing to beauty, it connects customers with trained professionals and is rapidly expanding. | ₹1,900.24 Cr | 103.61x |

| Jain Resource Recycling Ltd. | Founded in 2022, Jain Resource Recycling makes lead, copper, aluminium, and alloys from scrap. With global clients and facilities in India and the UAE, it serves batteries, electronics, auto, and more. | ₹1,250.00 Cr | 15.89x |

Saatvik Green Energy Ltd. | Founded in 2015, Saatvik Green Energy makes high-efficiency solar modules and EPC solutions. With two Haryana plants and 3.8 GW capacity, it’s now among India’s leading solar manufacturers. | ₹900.20 Cr | 6.57x |

| Trualt Bioenergy Ltd. | Trualt Bioenergy, India’s largest ethanol producer by capacity, makes biofuels and CBG. With five distilleries, global tie-ups, and new green projects ahead, it’s tapping sustainable energy’s next big wave. | ₹839.28 Cr | 71.89x |

Risks to Watch

Here’s what could shake market moods ahead

- The RBI meets in early October. Its commentary on GST reforms, inflation, and consumption will be key signals for markets

- The Fed’s October 28–29 policy meeting is crucial. Any move or hint on rates could sway foreign investor flows, directly impacting liquidity in India’s markets

- Q2 results begin mid-October. Investors will closely track the sectors to see if growth holds up against global headwinds and recent policy changes

- The US has imposed 100% tariffs on patented drugs, 25% on heavy trucks, and 30% on furniture, posing risks to India’s pharma and auto sectors.

That’s a wrap for September!

From sector moves to macro trends and market risks, we’ve covered what mattered.

See you next month. Till then, stay informed and invest intelligently with Share.Market.

Disclaimer and Disclosure

Investments in the securities market are subject to market risks, read all the related documents carefully before investing. Registration granted by SEBI, enlistment as Research Analyst with Exchange and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Kindly refer to https://share.market/ for more details.Investments in WealthBaskets are subject to the Terms of Service. All investors are advised to conduct their own independent research into investment strategies before making an investment decision. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. PPWB acts as a distributor of mutual funds and it is not an exchange traded product. PPWB acts as a distributor of mutual funds and WealthBaskets and it is not an exchange traded product. Disputes with respect to the distribution activity of Mutual Funds and WealthBaskets will not have access to Exchange investor redressal or Arbitration mechanism. The securities are quoted as an example and not as a recommendation. This is for informational purposes and should not be considered as recommendations.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887 and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226. Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA. CIN: U65990KA2021PTC146954