- Share. Market

- 6 min read

- 04 Dec 2025

Intelligence-Driven Investing, Simplified!

November 2025

While the headline indices, Nifty 50 and Sensex, finally scaled to fresh all-time highs, the rally was far from uniform.

This volatility was once again anchored by the unwavering “DII shield.” Foreign investors remained net sellers for the fifth consecutive month, pulling out over ₹17,500 crore amid global realignments. However, this supply was effortlessly absorbed by domestic institutions, which injected a massive ₹77,000 crore into the market.

The focus shifted from expectations to reality as the earnings season ended. Corporate report cards for the September quarter presented a mixed picture; while heavyweight sectors like Technology and Banking delivered steady growth, margin pressures weighed on the broader industrial segments.

Market Barometers

November initially seemed destined to continue the 14-month consolidation that has tested our patience since late 2024, but the final week delivered a breakout! The BSE Sensex and Nifty 50 finally surpassed their previous all-time highs, scaling to 86,055 points and 26,310 points respectively.

While the benchmarks managed monthly gains of nearly 2%, fueled largely by expectations of a US Fed rate cut and relentless SIP inflows, the broader market did not join the rally. The euphoria was conspicuously absent in the mid and small-cap segments.

Let’s take a closer look at everything that shaped the markets this month:

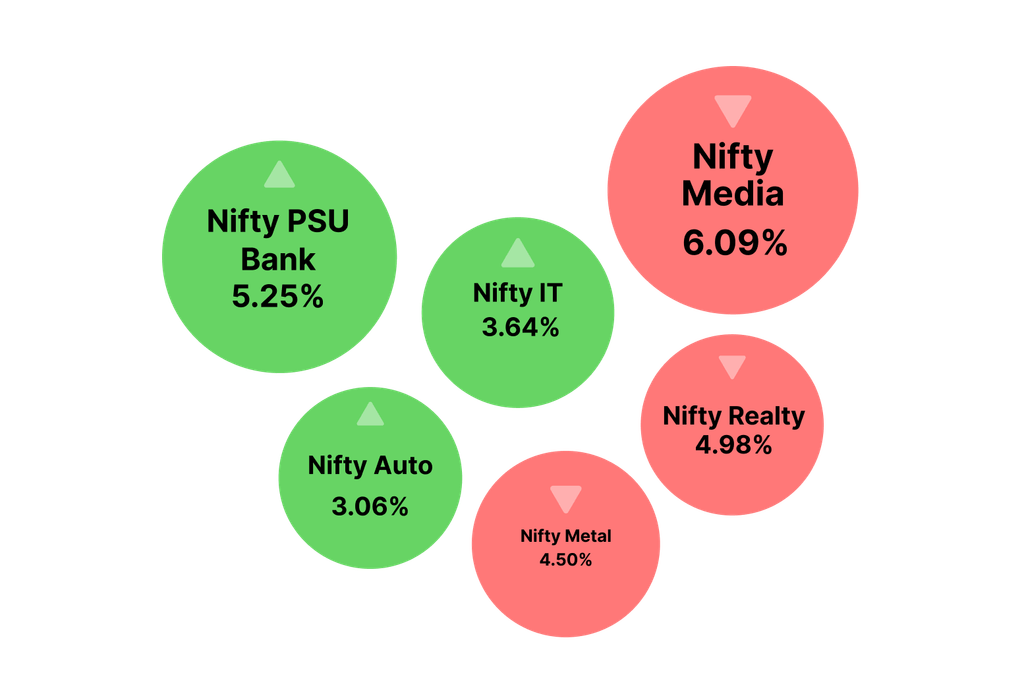

Sector Radar

See how the key sectors moved and why

| Why? Sector performance in November reflected a market decisively positioning itself for the impending monetary pivot, while ruthlessly punishing cyclical headwinds. PSU Banks, IT, and Auto emerged as the leaders, capitalizing on falling bond yields, the much-awaited rural consumption revival, and positive global cues. In contrast, Media, Realty, and Metals faced significant drag, weighed down by structural disruptions, profit-booking after a multi-year run, and persistent weakness in China’s industrial demand. |

Corporate Moves

The key announcements you shouldn’t miss

- Tata Consultancy Services (TCS) signed a 5-year deal with SAP to modernise the German software company’s cloud and AI operations.

- Sobha entered Mumbai’s housing market by launching its inaugural project ‘SOBHA Inizio’ comprising 310 apartments. This marks a significant expansion for the Bengaluru-based firm.

- Adani Enterprises launched a ₹24,930 crore 3:25 Rights Issue to fund infrastructure expansion.

- Infosys successfully closed its ₹18,000 crore share buyback program, offering shares at ₹1,800 apiece; the offer was oversubscribed by over 8 times.

- Maruti Suzuki reported its highest-ever monthly wholesales of 229,021 units in November 2025; the record performance was driven by a sharp 19% jump in domestic sales and sustained export demand.

Market Spotlight

Headlines and important updates from the markets

- The Indian Government objected to the International Monetary Fund’s (IMF) baseline assumption that the U.S.’ 50% tariffs would continue, saying they would not remain in place “indefinitely”. The IMF had estimated that the tariff hit would reduce India’s GDP growth rate by 0.4% in the current year and by 0.3% next year.

- Vehicle registrations recorded a 40.9% year-on-year increase in October 2025, marking the highest level on record.

- Average monthly SIP inflows continued to rise, up 206% YoY to Rs 28,691 crore in Q2 FY26.

- Three sectors—Financials, Consumer Discretionary, and Industrials—led the IPO market, accounting for 73% of all funds raised so far in FY26.

Macro View

Zooming out to key rates, trends, and global moves driving India’s economic story

- India’s economy recorded a robust 8.2% growth in Q2 FY 2025-26, fastest growth in six quarters and surpassing the 5.6% growth seen in the same quarter last year.

- Gold traded above $4,200 per ounce, heading for a monthly gain on rising expectations of a December Federal Reserve rate cut. Meanwhile Silver was also trading near record highs.

- The Union Cabinet approved a ₹7,280 crore scheme to manufacture rare earth magnets in India. At present the current demand is met primarily through imports.

- India’s Russian oil imports are set to hit their lowest in at least three years in December, as domestic refiners turned to alternatives to avoid breaching Western sanctions amid US trade tariffs, as per a Reuters report.

- For the first time in 15 years, foreign investors own less of Indian companies (dropping to 16.9%), while Indian mutual funds have increased their stake to a record high of 10.9%.

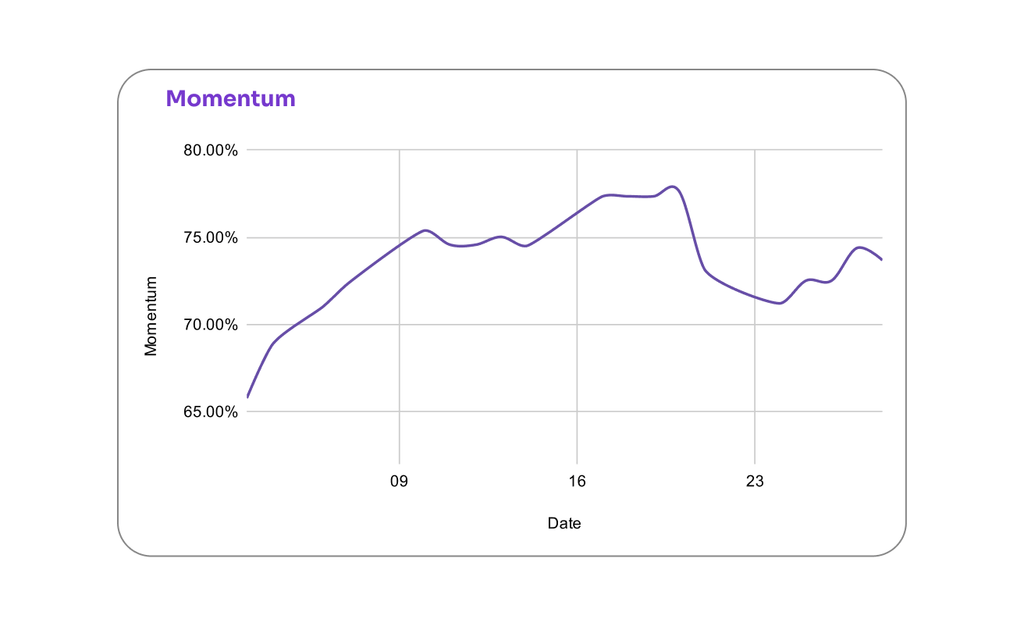

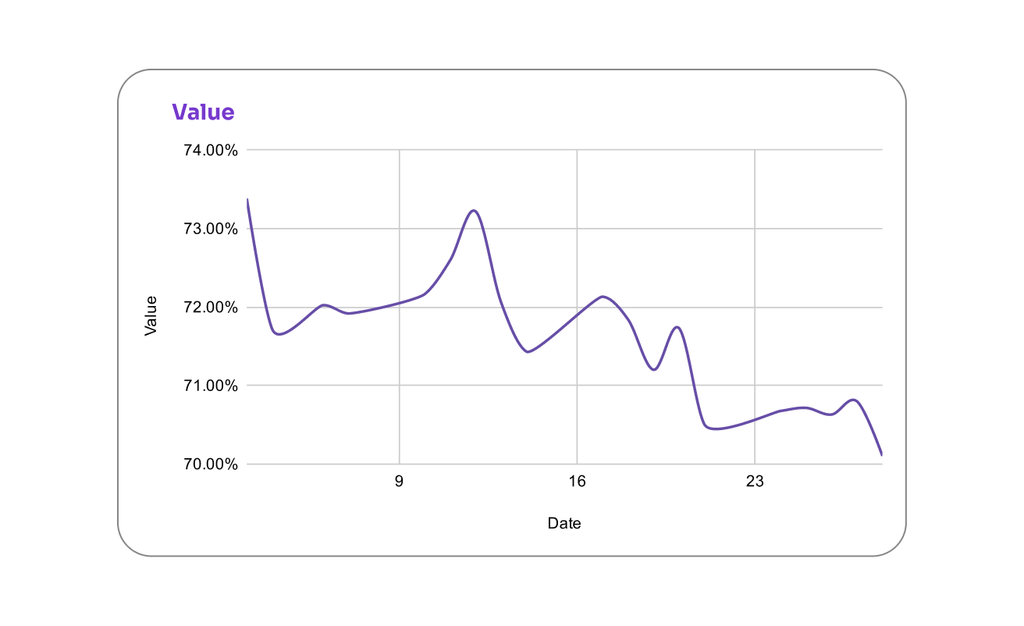

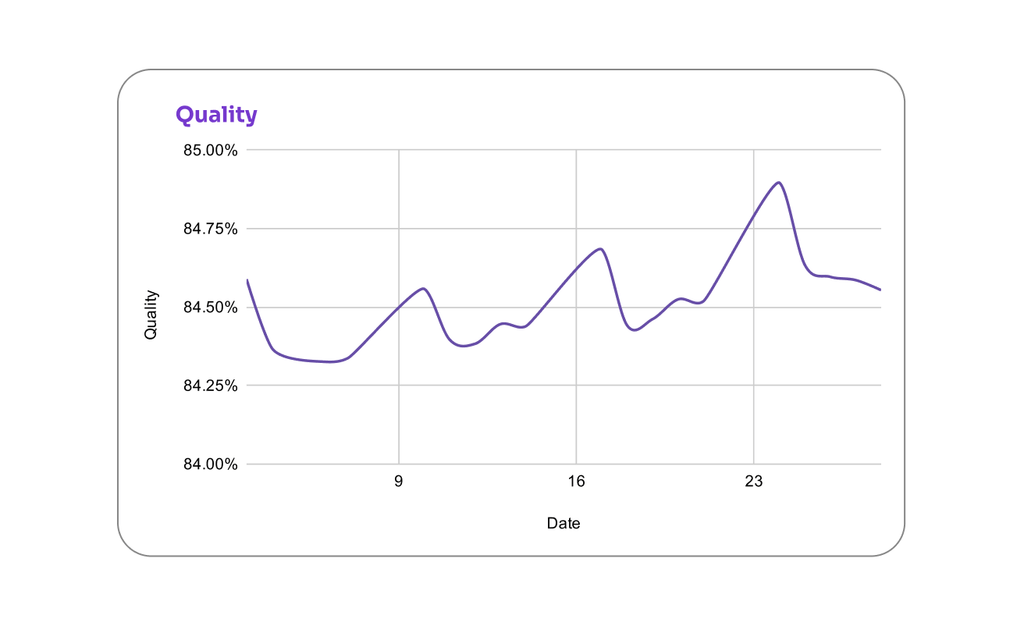

Factor Flow

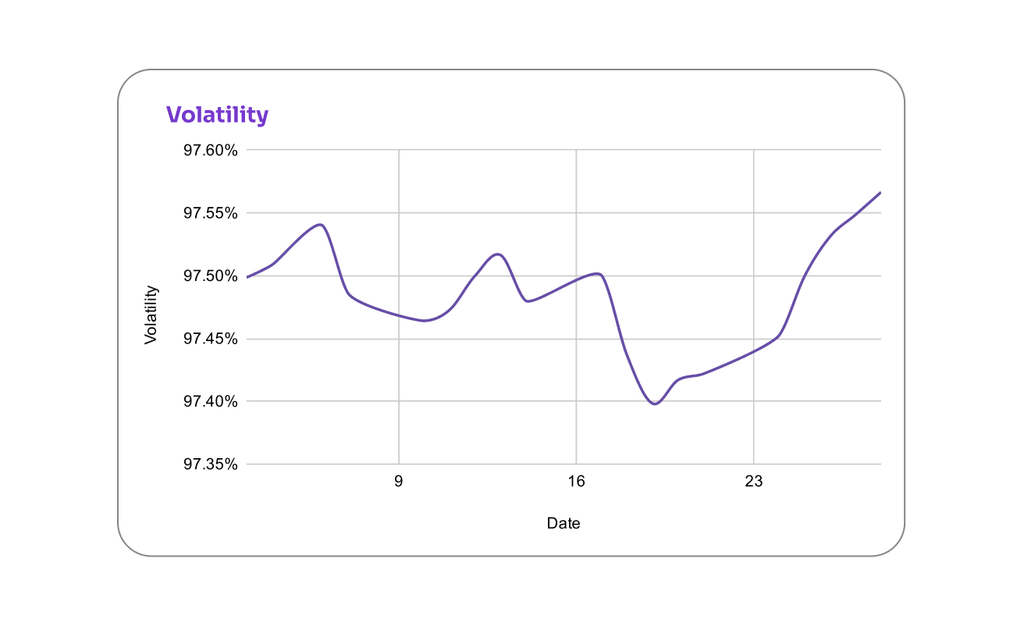

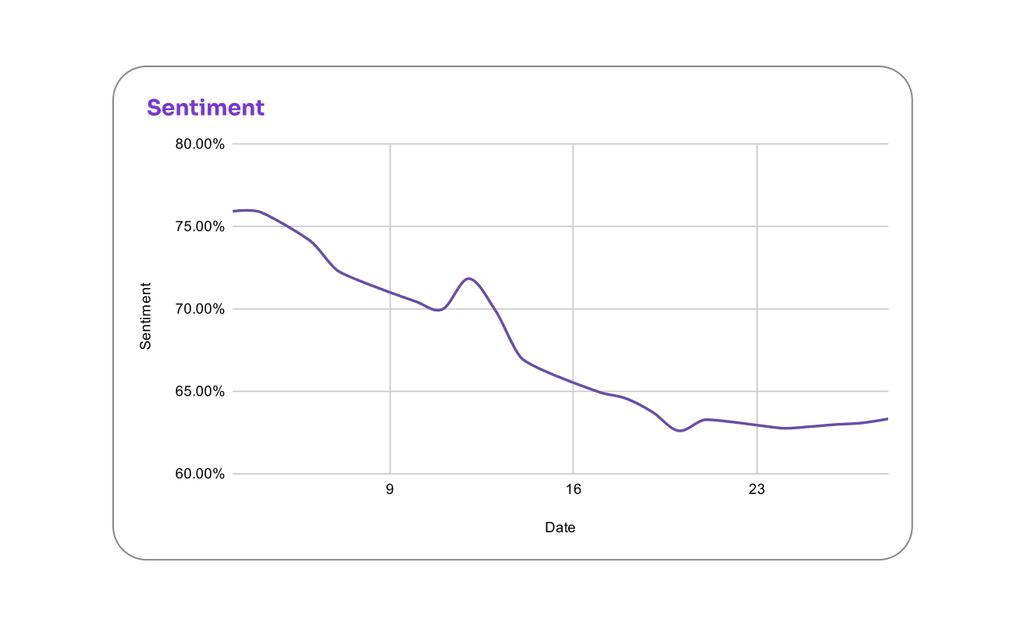

How Nifty 50’s Factor Scores moved this month

FII vs DII Trends

Tracking India’s evolving market ownership trends

- Foreign Institutional Investors (FIIs) reversed their brief optimistic stance in November, turning net sellers again with outflows of ₹17,500 crore. FIIs sold merely ₹2,346 crore in October.

- In contrast, Domestic Institutional Investors (DIIs) increased their buying intensity significantly. Their net purchases surged to a massive ₹77,083 crore in November, overshadowing their October inflows of ₹52,794 crore.

IPO Watch

| Company | Issue Size | Listing Gains/Subscription status |

| Billionbrains Garage Ventures Ltd. (Groww) | ₹6,632.30 Cr | 12.00% |

| Pine Labs Ltd. | ₹3,900.17 Cr | 9.50% |

| Emmvee Photovoltaic Power Ltd. | ₹2,900.00 Cr | 0.00% |

| PhysicsWallah Ltd | ₹3,480.00 Cr | 31.28% |

| Tenneco Clean Air India Ltd. | ₹3,600.00 Cr | 25.44% |

| Fujiyama Power Systems Ltd. | ₹828.00 Cr | -3.51% |

| Capillary Technologies India Ltd. | ₹877.50 Cr | -0.88% |

| Excelsoft Technologies Ltd. | ₹500.00 Cr | 12.50% |

| Sudeep Pharma Ltd. | ₹895.00 Cr | 23.10% |

Risks to Watch

Here’s what could shake market moods ahead

- With CPI inflation falling to a record low of 0.3% in October, expectations have strengthened for a 25 bps rate cut to 5.25% at the upcoming December MPC meeting to further support domestic growth.

- Emerging prospects of a trade agreement with the US—potentially reducing tariffs to 15-16%—are expected to aid market sentiment and temper downward pressure on the rupee’s forward premium.

- Global headline inflation is projected to decline to 4.2% in 2025 and further to 3.7% in 2026, aided by easing energy prices.

That’s a wrap for November!

From sector moves to macro trends and market risks, we’ve covered what mattered.

See you next month. Till then, stay informed and invest intelligently with Share.Market.