- Share.Market

- 7 min read

- 05 Feb 2026

January was a month of major geopolitical events. The year began on a positive note with the Nifty 50 scaling to a fresh record high, fueled by the lingering new year rally and optimism around domestic growth. However, this euphoria was quickly met by a wave of global volatility that tested the mettle of even the most seasoned investors.

The USA launched Operation Absolute Resolve, a military strike on Venezuela that rattled oil markets, as a long-term supply glut was priced in. This also triggered a global safe-haven scramble, pushing Gold and Silver to historic highs. The Indian Rupee fell to a record low of 92.02 per USD towards the end of the month.

Foreign Institutional Investors (FIIs) continued to sell, while Domestic Institutional Investors (DIIs) continued to buy, but in moderation.

Let’s take a closer look at everything that shaped the markets this month:

Market Barometers

On January 05, 2026, the Nifty 50 touched a record intraday peak of 26,373.20 points. The rally was driven by robust corporate earnings expectations and sustained buying in banking heavyweights, with the Nifty Bank crossing the psychological 60,000 mark for the first time.

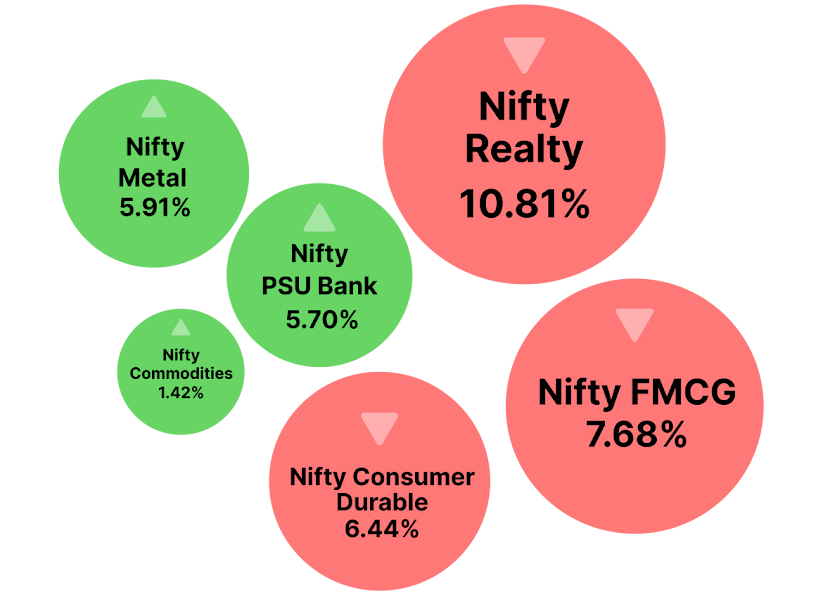

Sector Radar

See how the key sectors moved and why

Broader markets faced volatility leading up to the Union Budget.

- Nifty Metal soared, driven by a global commodity rally.

- PSU Banks reported credit growth and improved asset quality. Investors sought comfort in defensive stocks.

- Global uncertainty and currency volatility led investors to prefer companies with tangible commodity-linked revenues.

- Nifty Realty faced pressure due to weak Q3 pre-sales, lack of new launches and rising affordability challenges.

- Nifty FMCG was impacted by urban demand fatigue and limited pricing power.

- Nifty Consumer Durables fell amid a lack of immediate demand triggers post-festive season.

Corporate Moves

The key announcement you shouldn’t miss

- Tobacco stocks such as ITC Ltd. and Godfrey Phillips India Ltd. fell sharply after the government notified additional excise duty on tobacco products effective February 01, replacing the GST compensation cess.

- Devyani International Ltd. announced a $934 million merger with Sapphire Foods India Ltd., creating a combined fast-food operator with over 3,000 KFC and Pizza Hut outlets in India and abroad.

- Maruti Suzuki India Ltd. posted an annual production of 22.55 lakh vehicles in calendar year 2025, a new high and a double-digit gain over the previous year. This is the second consecutive year that the company exceeded an annual production of 20 lakh units.

- Vedanta Ltd. reported a 61% year-on-year increase in Q3 net profit to ₹5,710 crore, with revenue rising 19% year-on-year to ₹45,899 crore. It approved an offer for sale to divest up to 6.7 crore shares, or a 1.59% stake, in Hindustan Zinc Ltd.

- JSW Steel Ltd. reported a sharp 198% year-on-year jump in consolidated net profit to ₹2,139 crore for the December quarter. Its revenue rose 11% YoY to ₹45,991 crore.

Market Spotlight

Headlines and important updates from the markets

- India and the European Union signed a free trade agreement, also referred to as the “Mother of all deals.” This creates the world’s largest free trade zone, encompassing two billion people and nearly 25% of global gross domestic product.

- Gold reached record highs of $5,595/oz (₹1.75 lakh/10g), and silver peaked at $122/oz (₹4.10 lakh/kg), fueled by intensifying geopolitical tensions in Iran, a weakening US dollar, and aggressive global trade tariffs driving massive safe-haven demand.

- Copper prices rose to fresh record highs as markets priced in tighter global supply and strong demand from energy and infrastructure projects.

Macro View

Zooming out to key rates, trends, and global moves driving India’s economic story

- The Economic Survey outlined three broad global scenarios for 2026

– The “best-case scenario”, assigned a probability of 40-45%, forecasts 2025-like economic conditions, with a thinner margin of safety and minor shocks escalating into larger reverberations.

– A second scenario, also carrying a 40-45% probability, involves a disorderly multipolar breakdown, where geopolitical rivalries could intensify.

– A third, lower-probability scenario, estimated at 10-20%, could have consequences worse than the 2008 global financial crisis. - The government approved 22 new proposals under the Electronics Components Manufacturing Scheme, with a projected investment of ₹41,863 crore and production worth ₹2.58 trillion.

- On January 30, 2026, the Indian Rupee plunged to a historic low of ₹92.02 against the US Dollar amid foreign outflows and surging oil prices amid intensifying US-Iran geopolitical tensions.

- India’s fiscal deficit stood at ₹8.6 lakh crore, or 54.5% of the full-year target, during April–December, slightly lower than 56.7% a year ago. Net tax receipts rose to ₹19.4 lakh crore, while non-tax revenue increased to ₹5.4 lakh crore during the period.

- The US Federal Reserve kept interest rates unchanged at 3.5-3.75%, citing low job gains and elevated inflation as primary factors.

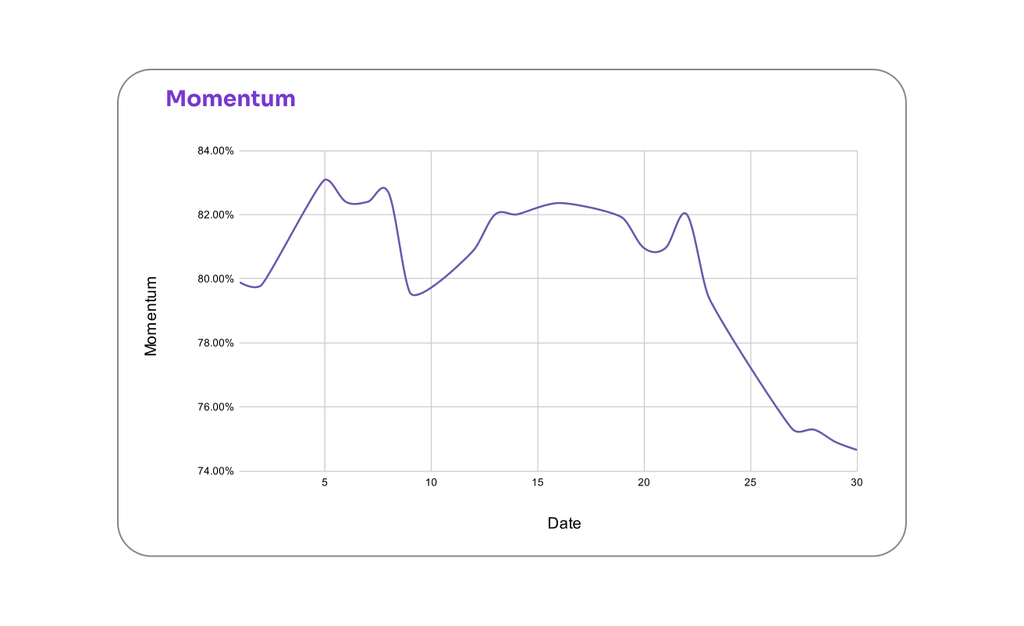

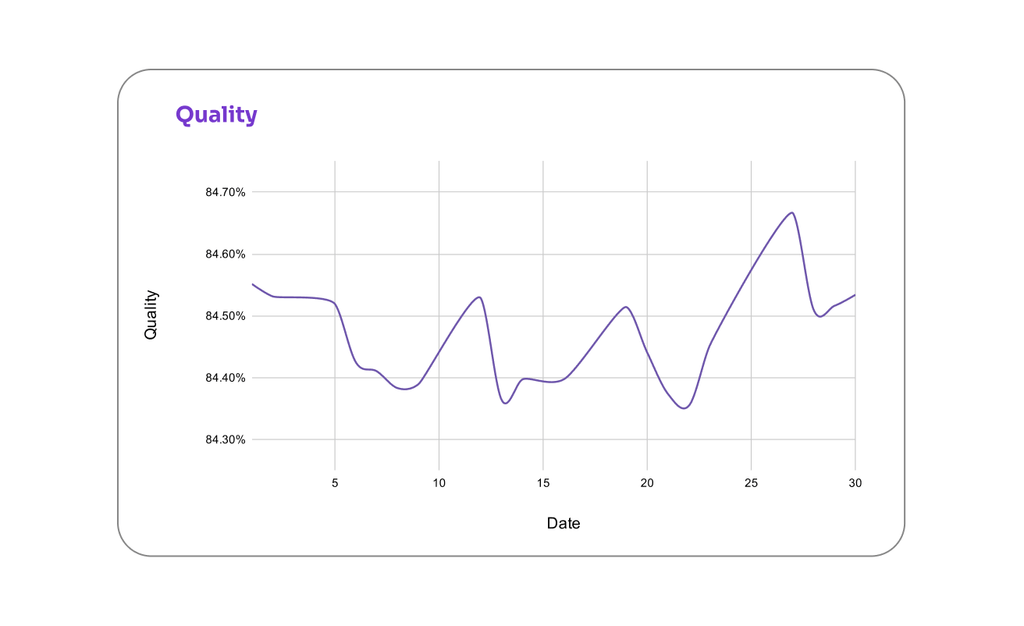

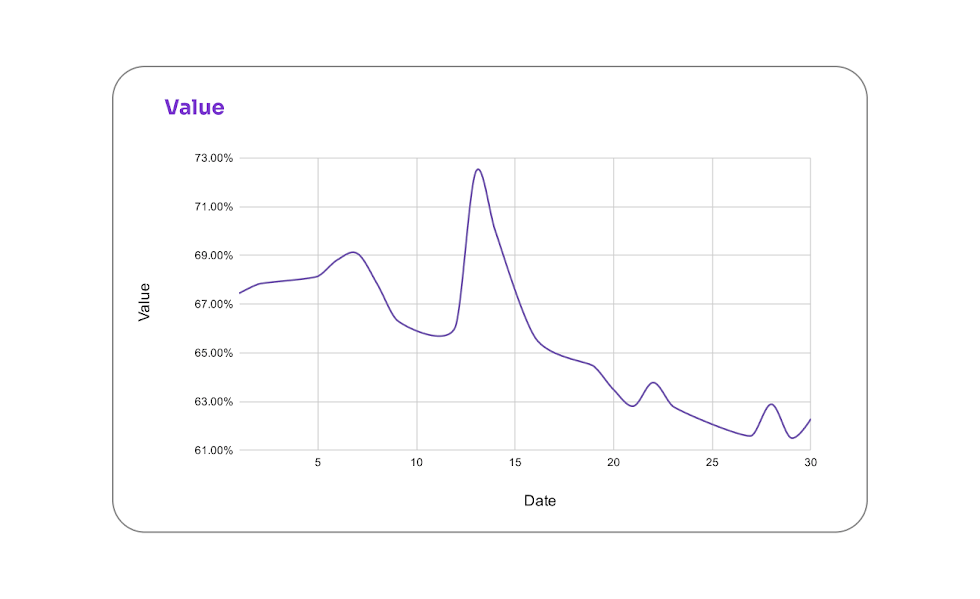

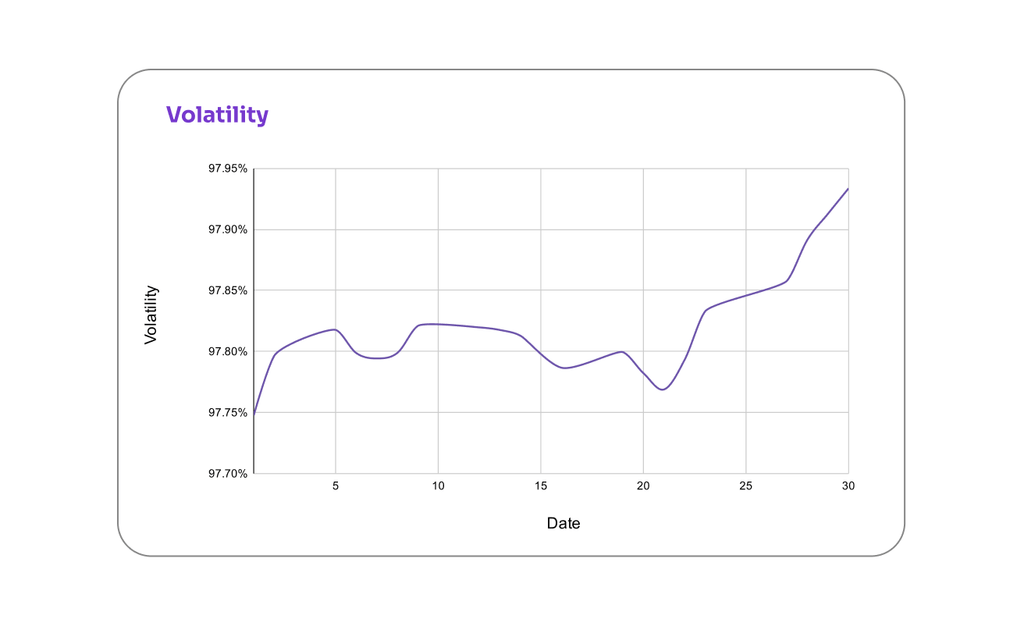

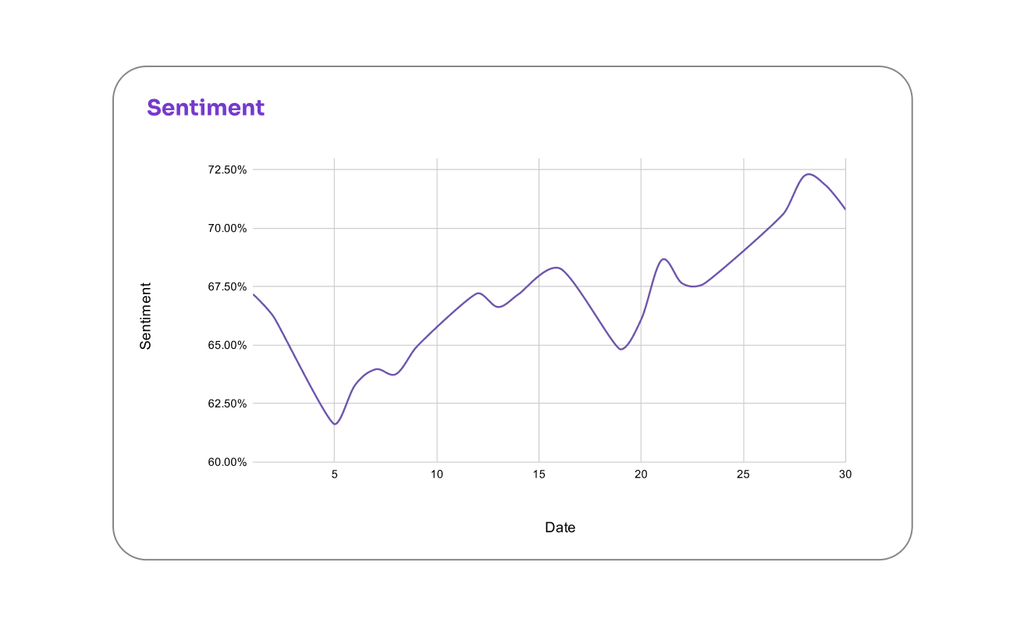

Factor Flow

How Nifty 50’s Factor Scores moved this month

FII vs DII Trends

Tracking India’s evolving market ownership trends

- Foreign Institutional Investors (FIIs) intensified their selling pressure in January, recording net outflows of ₹41,435.22 crore. This represents a 20.63% increase in selling activity compared to the ₹34,349.62 crore offloaded in December 2025. The spike in foreign exits was largely fueled by lingering uncertainties regarding the U.S.–India trade deal and a “risk-off” sentiment globally, as investors adopted a cautious stance ahead of the Union Budget 2026.

- In contrast, Domestic Institutional Investors (DIIs) continued to act as the primary buffer for the Indian markets, though their support showed signs of moderation. Their net purchases for January 2026 stood at ₹62,220.74 crore, a notable 21.85% decrease from the robust ₹79,619.91 crore buying witnessed in December. While the quantum of domestic buying remains significantly higher than foreign outflows, the narrowing gap reflects a tactical “wait-and-watch” approach by fund managers amid heightened market volatility.

What Moved the Needle

The headline that set the tone this month

India-EU Trade Deal: Automobiles, Alcohol & Other Key Highlights

After nearly two decades of negotiations, India and the European Union (EU) finally sealed the deal on the ‘biggest ever FTA’. Touted as the “mother of all deals,” this Free Trade Agreement (FTA) is ambitious, commercially significant and the largest such deal ever concluded by either side.

IPO Watch

| Company | About | Issue Size | Listing Gains |

| Bharat Coking Coal Ltd. | Bharat Coking Coal, a subsidiary of Coal India Ltd. and a Miniratna PSU, is the primary producer of prime coking coal for the steel industry, operating mainly in the Jharia and Raniganj coalfields. | ₹1,069 Cr | 95.65% |

| Amagi Media Labs Ltd. | Amagi is a global media-tech unicorn and India’s first listed cloud-native SaaS company. It provides cloud broadcasting and monetisation for FAST channels on platforms and manages distribution for 400+ content providers across 40 countries. | ₹1,789 Cr | -12.19% |

| Shadowfax Technologies Ltd. IPO | Flipkart-backed Shadowfax Technologies specializes in last-mile delivery. It uses an asset-light gig-based model to serve over 14,700 pincodes. It powers deliveries for giants like Flipkart and Meesho, among others. | ₹1,907 Cr | -9.19% |

That’s a wrap for January!

From sector moves to macro trends and market risks, we’ve covered what mattered.

See you next month. Till then, stay informed and invest intelligently with Share.Market.