- Share.Market

- 7 min read

- 04 Sep 2025

Intelligence-Driven Investing, Simplified!

August 2025

August 2025 told two different stories for the Indian stock markets. While foreign investors continued to sell Indian stocks and new US trade restrictions created pressure, Indian investors remained confident and continued to buy. This support from local investors helped prevent major market declines, demonstrating that India’s economy remains resilient despite global challenges.

The economic data also brought good news. India’s GDP beats expectations. Inflation rates in July were very low, meaning prices of goods weren’t rising much. Overall, while external factors created some turbulence, India’s domestic strength and low inflation provided a solid foundation for the markets.

Let’s take a closer look at everything that shaped the markets this month:

Market Barometers

August was tough for Indian stock markets. The main market indices (BSE Sensex and Nifty 50) fell by over 1.5%. While Nifty 50 briefly touched 25,000 points for the first time since July, it couldn’t hold those levels. Smaller company stocks performed even worse, with Nifty Midcap 150 and Nifty Smallcap 250 indexes dropping over 3%.

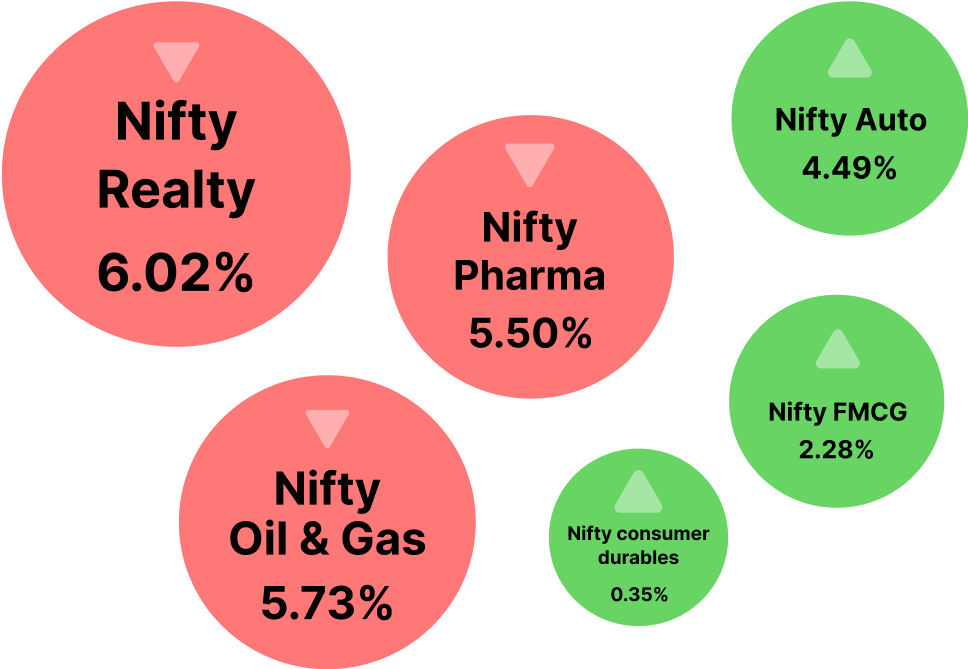

Sector Radar

See how the key sectors moved and why

Why? Consumer goods companies and auto stocks performed better as investors preferred businesses focused on Indian customers rather than exports. However, real estate, oil, and pharma sectors suffered most from disappointment over unchanged interest rates, US sanctions concerns, and aggressive drug pricing policies, respectively.

Corporate Moves

The key announcement you shouldn’t miss

- Wipro Ltd. and Google Cloud launched 200 AI tools for sectors like healthcare, banking, and retail. These will improve customer service, cut costs, and speed up digital transformation.

- Reliance Consumer Products bought a majority stake in Naturedge Beverages. With this, it enters the herbal drinks market, adding Ayurveda-based brand Shunya to its portfolio.

- Tata Motors Ltd. announced that the NCLT (National Company Law Tribunal) has approved its corporate restructuring plan. The scheme involves merging and demerging its passenger and commercial vehicle units, aimed at simplifying operations.

Market Spotlight

Headlines and important updates from the markets

- In Q1 FY26, Indian company sales grew 5.5%, slower than last quarter’s 7.1%. Manufacturing and IT struggled due to weak demand and global uncertainty, as revealed by data from the Reserve Bank of India (RBI).

- According to data from the Association of Mutual Funds in India (AMFI), monthly Systematic Investment Plan (SIP) inflows hit a record ₹28,464 crore with 9.11 crore accounts. Equity mutual fund inflows also surged 81% to ₹42,702 crore.

- SEBI (Securities and Exchange Board of India) may launch a pilot platform for trading company shares before IPOs. The move aims to deepen India’s growing capital markets and expand investment opportunities.

- Female participation in India’s stock market has been increasing, as per NSE reports. Maharashtra leads with 28.4% women investors, up from 25.6% in FY23, while the share of under-30 investors slipped to 39% by June 2025.

Macro View

Zooming out to key rates, trends, and global moves driving India’s economic story

- India’s GDP grew 7.8% in Q1 FY26, driven by consumption and investments, though higher imports outweighed export gains amid U.S. tariff concerns

- India’s inflation cooled to 1.55% in July 2025, slipping below RBI’s 2–6% comfort zone for the first time since 2019, mainly due to cheaper food and transport

- India’s trade deficit widened to $27.35 billion in July, the highest since Nov 2024. Exports rose as firms rushed shipments ahead of upcoming U.S. tariffs, which may impact auto, chemicals, metals, and refining sectors

- S&P Global Ratings upgraded India’s credit rating to ‘BBB’ from ‘BBB-’ with a stable outlook, citing strong growth, fiscal prudence, and resilient fundamentals despite U.S. tariff pressures

- India and China will restart direct flights and border trade, ease visas, and hold high-level visits to improve ties strained since 2020, boosting economic cooperation amid global uncertainty

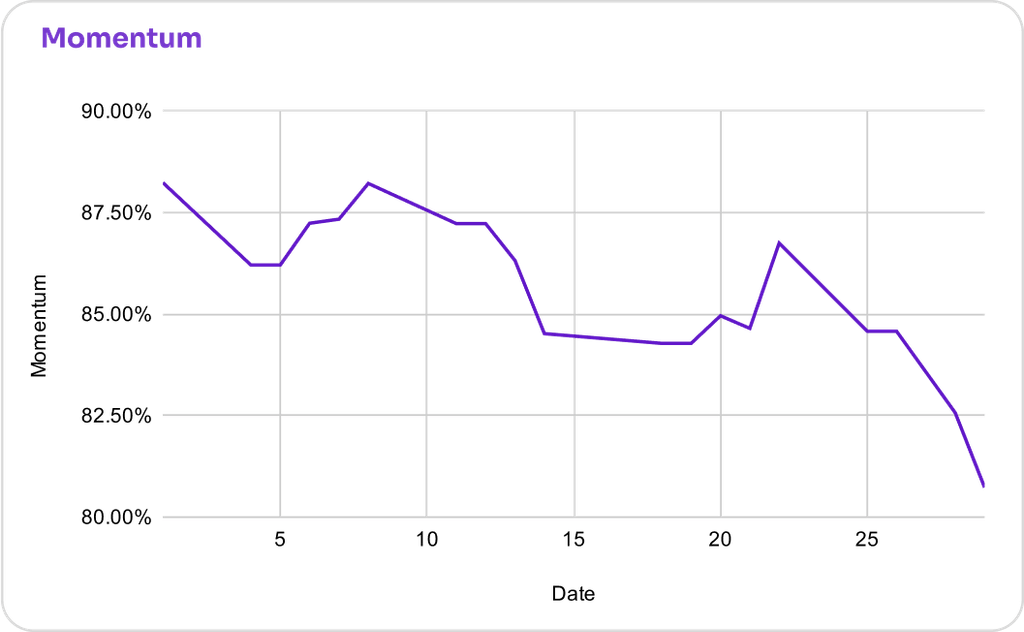

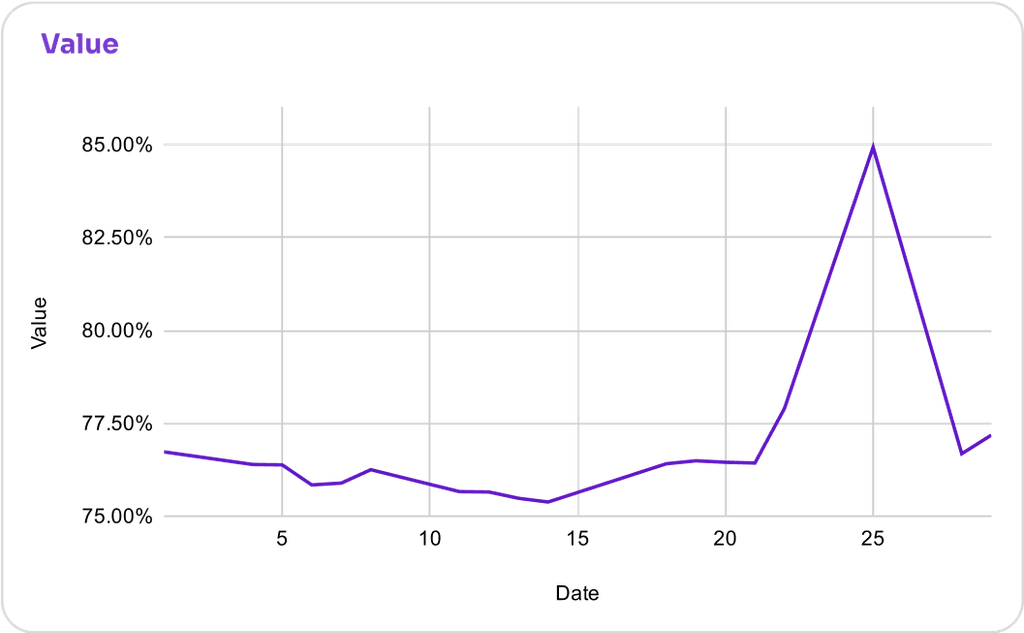

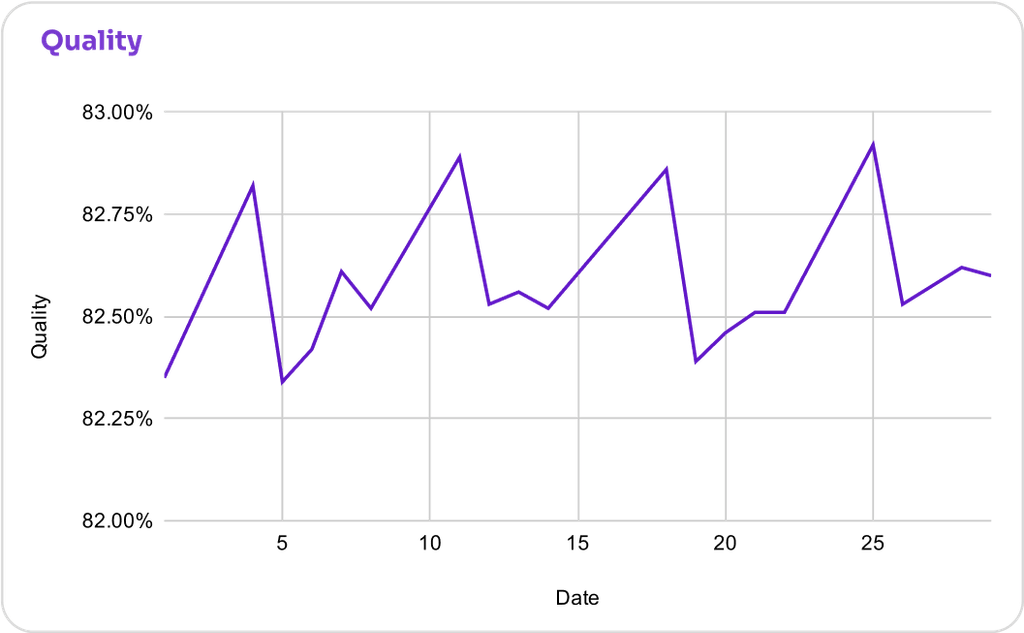

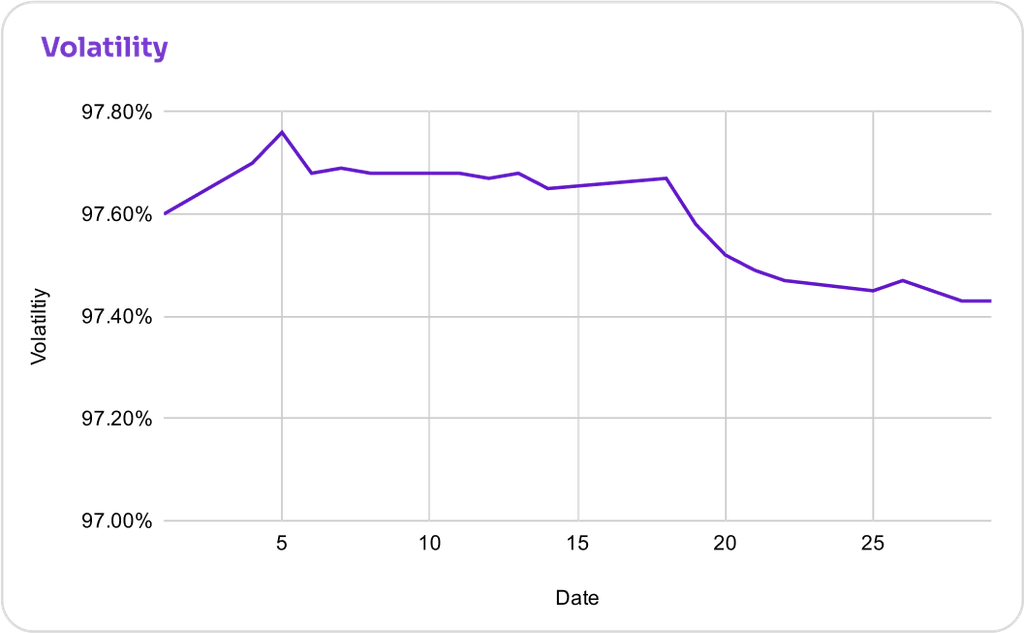

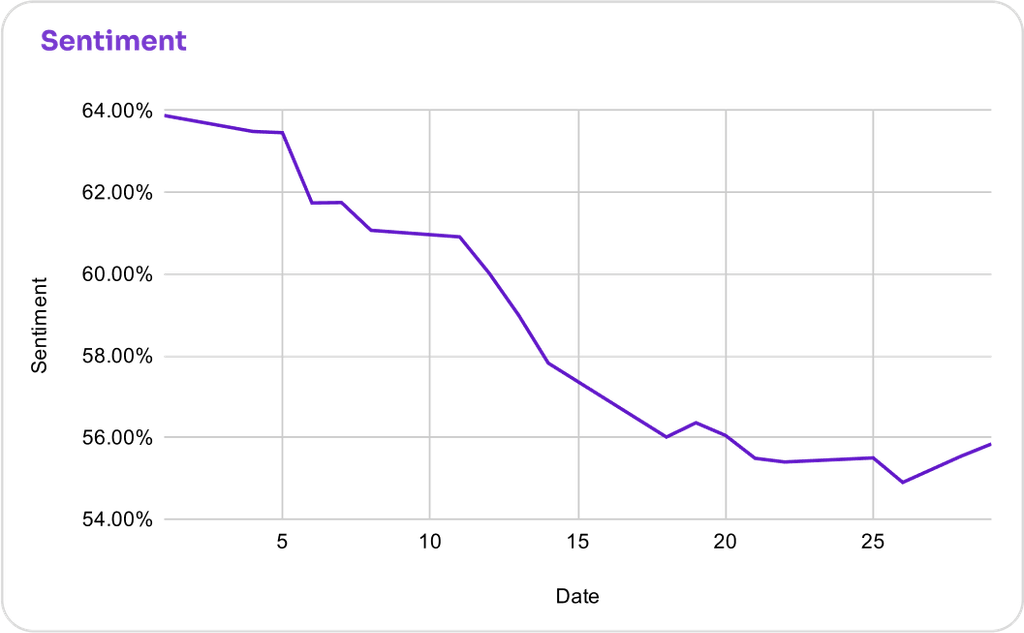

Factor Flow

How Nifty 50’s Factor Scores moved this month

Beyond Expectations

Nifty 50 stocks beating results expectations in Q1 FY26

| Name | Revenue Q1 (Estimated) | Revenue Q1 (Actual) | Growth(%) |

| Muthoot Finance Ltd. | ₹3,152.9 Cr | ₹6,450.13 Cr | 🔼 104.58% |

| Ashok Leyland Ltd. | ₹8,771.05 Cr | ₹11,708.54 Cr | 🔼 33.49% |

| Indian Oil Corporation Ltd. | ₹1,78,260.35 Cr | ₹2,21,849.02 Cr | 🔼 24.45% |

FII vs DII Trends

Tracking India’s evolving market ownership trends

- August saw a tug-of-war between FIIs and DIIs. FIIs remained aggressive sellers, offloading ₹46,902.92 crore, down 1.6% from July’s ₹47,666.68 crore, driven by global dollar strength, rates, and tariff concerns

- In contrast, DIIs emerged as strong buyers, with net purchases jumping 55.6% from ₹60,939.16 crore in July to ₹94,828.55 crore in August. Backed by robust SIP inflows, DIIs provided the cushion against FII selling, highlighting India’s shift toward strong domestic-driven resilience

What Moved the Needle

The headline that set the tone this month

GST Reforms: Impact on Indian Stock Market, Key Industries, and Your Investments

India’s GST reforms (GST 2.0) are set to cut tax rates, moving from four slabs to two – 5% and 18%. This makes cars, two-wheelers, consumer durables, cement, and insurance premiums cheaper, boosting demand. FMCG firms could benefit from higher rural and semi-urban consumption, while real estate and hospitality may see renewed growth. The reforms are expected to trigger a ₹1.98 lakh crore annual consumption boost, potentially adding 1.6% to GDP. For investors, the key takeaway is that GST 2.0 strengthens India’s domestic consumption base, reshaping demand patterns across multiple sectors tied to consumer spending.

IPO Watch

| Company | About | Issue Size | Subscription |

| Knowledge Realty Trust | Knowledge Realty Trust is India’s largest office REIT, offering Grade A office spaces across major cities with premium amenities, diversified tenants, and strong backing from renowned global and domestic sponsors. | ₹4,800.00 Cr | 12.48x |

| JSW Cement Ltd. | JSW Cement, part of the JSW Group, is a green cement manufacturer in India with strategically located plants, diverse cementitious products, strong distribution, sustainability focus, and a proven growth track record. | ₹3,600.00 Cr | 7.76x |

Vikram Solar Ltd. | Vikram Solar Ltd., founded in 2005, manufactures high-efficiency solar PV modules and provides EPC and O&M services, with pan-India presence, global reach, and advanced facilities in Kolkata and Chennai. | ₹2,079.37 Cr | 54.62x |

| Bluestone Jewellery and Lifestyle Ltd. | BlueStone Jewellery and Lifestyle Limited is a digital-first jewellery brand in India, offering diverse collections through an omni-channel presence, advanced manufacturing, and strong pan-India reach backed by marquee investors. | ₹1,540.65 Cr | 2.70x |

Risks to Watch

Here’s what could shake market moods ahead

- A major trigger on the global front is the upcoming US Federal Reserve policy meeting. Any commentary or decision on future interest rate actions will be closely watched, as it could impact global liquidity and the flow of capital to emerging markets like India

- However, the most pressing concern for India remains the new US tariffs, which are now fully in effect. These tariffs, which now total 50% on a range of Indian goods, are expected to have a “lasting impact” on export-oriented sectors and create a structural risk for the Indian economy

That’s a wrap for August!

From sector moves to macro trends and market risks, we’ve covered what mattered.

See you next month. Till then, stay informed and invest intelligently with Share.Market.

Disclaimer and Disclosure

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887 and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst with Exchange and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954