- Share.Market

- 11 min read

- 16 May 2025

In April, the headlines were all about rising US tariffs.

Now, in May, India’s flipped the script, signing a big-ticket Free Trade Agreement (FTA) with the UK.

One country’s tightening borders, the other’s opening new ones.

And guess what? This isn’t just good news for exporters, it’s a quiet power-up for investors too.

From lower duties to easier talent movement, this deal could supercharge sectors tied to global demand.

So if you’re investing for the next decade, not just the next market dip, this FTA deserves your full attention.

Let’s decode it smartly, not with boring jargon.

What’s the Big Deal, and Why Now?

First up, let’s clear the basics.

A Free Trade Agreement (FTA) is like two countries deciding to stop charging entry fees on each other’s goods and services. Fewer import duties, simpler regulations, smoother business.

Think of it as shifting from outsider to priority guest in a global market.

Now, this isn’t India’s first rodeo.

But this UK-India FTA is special not just because of what’s inside it but also because of everything it took to get here.

So, how did we get here?

It all started back in May 2021, when the Prime Ministers of India and the UK launched something called the Enhanced Trade Partnership, basically the first official swipe right.

The goal? Double bilateral trade by 2030.

By January 2022, talks for a full-blown Free Trade Agreement had begun in New Delhi.

What followed was a full-on negotiation drama:

- 14 intense rounds of discussions

- Leadership changes in the UK

- General elections in both countries

- And a missed Diwali deadline in 2022

But despite pauses, potholes, and policy pivots, both sides kept the dialogue going because the stakes were high.

And finally, on May 6, 2025, after four years of back-and-forth, the deal was signed.

Why did both sides want this so badly?

For the UK, this is their biggest bilateral trade deal since Brexit (the UK’s exit from the European Union), part of their Global Britain reboot.

Cut off from the EU trade club, they needed new markets, and India, the world’s fastest-growing major economy, was the prize.

For India, it’s another power move in its “Make in India” and “Act East” playbook, getting better access to big global markets, attracting investment, and showcasing itself as a serious player in global trade.

Plus, after walking out of the Regional Comprehensive Economic Partnership (RCEP) deal in 2019, India has been on a bilateral FTA mission with the UAE, Australia, EFTA, and now, the UK.

Each deal is a step closer to its Viksit Bharat 2047 vision, a future where India isn’t just making for the world, but also shaping how the world trades.

What Exactly Did We Sign?

Okay, so we know this FTA took years and a dozen policy experts to stitch together. But what’s actually inside this deal?

Let’s break it down like we’re passing notes in an economics class.

Trade Taxes: Mostly Gone

The biggest flex of this deal? Tariffs, the taxes that countries charge on imports, are being cut, slashed, or removed on both sides.

For Indian goods heading to the UK, it’s almost a free pass; 99% of exports by tariff lines will now enter duty-free.

That’s huge for everything from clothing and gems to auto parts and medicines.

On the flip side, India is dropping import duties on 90% of UK goods, though it’s doing this a bit more slowly.

Some stuff becomes tax-free now, others over 10 years.

In short, our exports just got cheaper in the UK, and UK goods are about to become more affordable here, in stages.

Services & Skilled Workers: Movement Made Easy

This FTA isn’t just about products, it’s about people too.

There’s a new rule called the Double Contribution Convention (DCC).

In plain terms, it means Indians working temporarily in the UK (think IT, finance, design) won’t have to pay UK social security if they’re already contributing in India.

That’s a saving of nearly ₹4,000 crore annually. Nice, right?

Plus, the UK is loosening up visa categories for Indian professionals, especially in fields like healthcare, consulting, and tech.

It’s not open borders, but it’s definitely smoother access and less friction.

It’s Not a Free-for-All

Before you imagine luxury cars and Scotch flooding the Indian market overnight – hold up.

There are quotas and timelines built in. For example:

- UK cars entering India at lower tax rates will be capped under a quota system.

- Some UK goods, like perfumes, cosmetics, and high-end medical equipment, will go duty-free, but only after a few years.

- Both countries have kept sensitive items out of this deal, things like dairy, rice, and meat. No surprises there. Each side protected its farmers and food producers.

This ensures it’s a balanced deal, not a race to the bottom.

Rules of Origin

To make sure no third country piggybacks on this deal, the FTA includes Rules of Origin.

Translation: for any product to enjoy tariff cuts, it must be mostly made in the UK or India.

So, if a shirt is stitched in India but fabric comes from five other countries, it still needs to meet a certain local-value threshold to qualify.

Why? To prevent backdoor imports through loopholes. Smart and standard practice.

Red Tape Reduction: Faster, Smarter, Smoother.

Trade isn’t just about taxes, it’s also about time and tech.

This agreement promises:

- Faster customs clearances (aiming for within 48 hours)

- Electronic paperwork

- Digital contracts and data protection

- Recognition of professional qualifications (hello, engineers and accountants!)

- Copyright rules that protect creative work on both sides

This FTA isn’t just about lowering the cost of trade, it’s about lowering the friction of doing business.

So, What Does It All Mean?

Think of this deal as opening a giant two-way express lane, with lower tolls, fewer checks, and more travel passes.

Indian goods and services can now enter the UK faster and cheaper.

UK products will gradually enter India with less cost and more structure.

It’s not just a win for governments.

It’s a big green flag for investors, especially those tracking export potential, global exposure, and policy-backed tailwinds.

Where We Stand: India-UK Trade Before the FTA

Before we dive into who gains what, let’s take a quick look at the trade scoreboard, where things stood before the FTA shook hands in 2025.

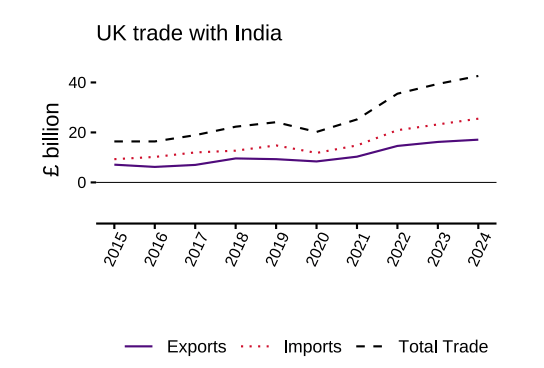

In the year leading up to December 2024, the total trade (that’s exports + imports) between India and the UK hit £42.6 billion, up 8.3% from the previous year.

Not bad, but clearly still warming up.

Let’s break that down.

Here’s what each side is shipping?

What Goods Are Moving?

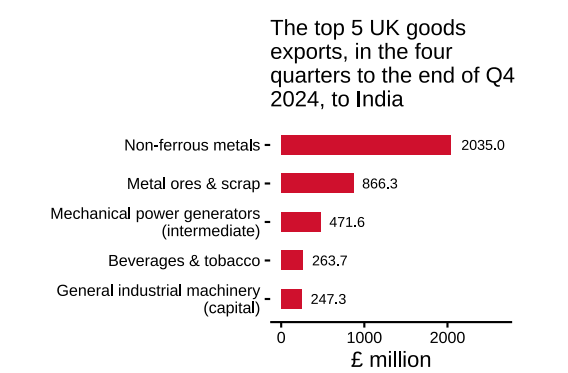

In 2024, the UK exported over £7 billion worth of goods to India, led by non-ferrous metals and machinery, with mixed growth across categories.

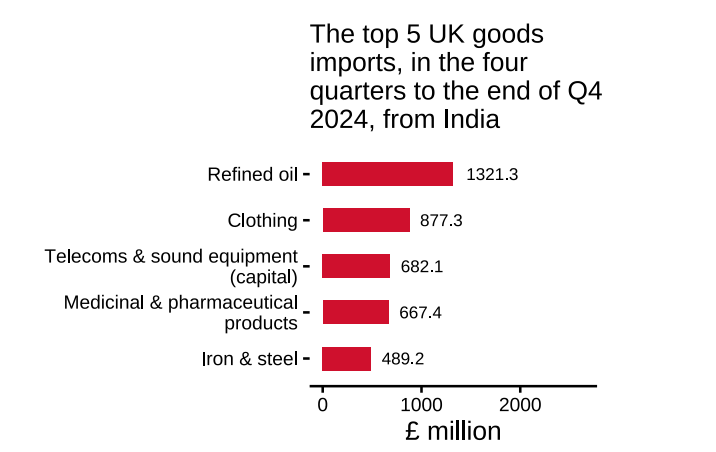

India, meanwhile, shipped £10.8 billion worth of goods to the UK, with refined oil, clothing, telecom gear, and pharma leading the pack. Iron & steel exports stood out, jumping nearly 67%.

What Services Are Moving?

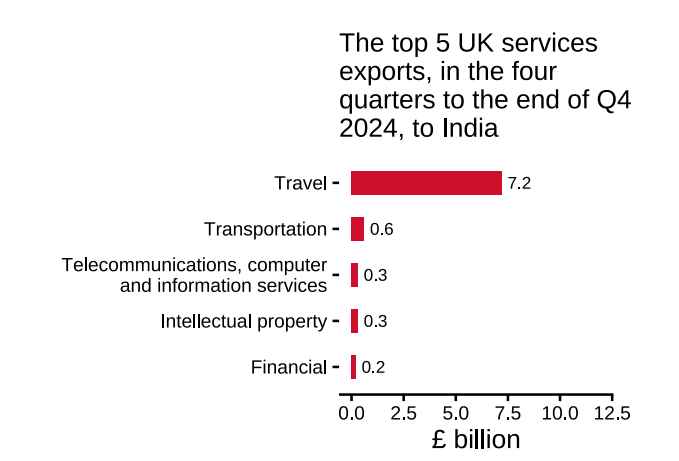

In 2024, the UK exported over £10 billion worth of services to India, led by travel, transportation, and tech.

Travel alone made up a huge chunk (£7.2 billion), while intellectual property services took a hit, dropping over 55%.

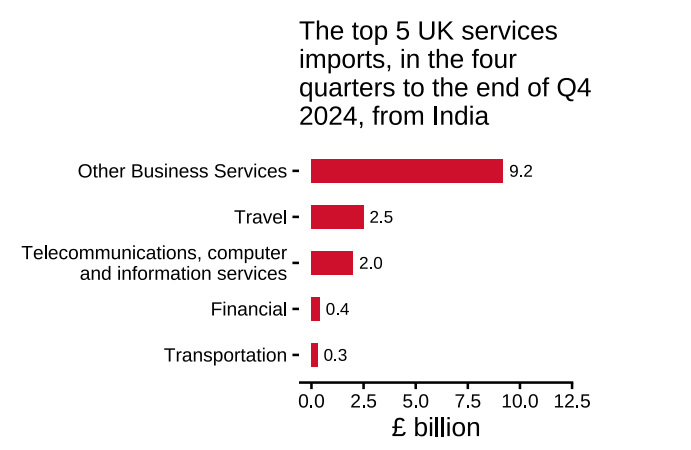

India, meanwhile, sent £14.7 billion worth of services to the UK, with business services, IT, and consulting dominating.

Tech and telecom services saw a sharp rise, jumping nearly 28% year-on-year.

From consulting calls to coding contracts and global flights to financial flows, services are where the real cross-border action is heating up.

So now that we’ve seen what’s already flowing between India and the UK, let’s zoom in on the industries that are set to benefit the most from this FTA.

Who Benefits from the FTA?

Textiles & Apparel

Indian garments, which earlier faced up to 12% UK import duties, now walk in duty-free.

That’s a game-changer for exporters from hubs like Tiruppur and Surat, especially in knitted clothes and home textiles.

Exports in this space could see a 3-4% bump, with an extra $1 billion added by 2030.

And for SMEs running on razor-thin margins, this could mean fatter profits, finally.

India will also reduce its own 10-20% duties on UK-origin textiles.

That could bring some high-end UK brands into the local market, but India’s strength in scale and cost still makes it a volume winner.

Jewellery & Gems

Indian jewellery exports just got a sparkling upgrade. This sector was already a heavyweight, now it’s got the red carpet treatment.

The UK is a high-value, design-conscious market.

With tariffs gone, Indian jewellers can ship faster, cheaper, and scale bigger.

Industry bodies estimate exports could touch $2.5 billion in just two years. That’s not just a boost, it’s a diamond-studded jump.

Pharma & Medical Devices

The FTA clears a smoother path for Indian generic drugs and medical devices. From syringes to surgical implants, many of these products now enter the UK tariff-free.

India will also start importing more UK-made high-end medical tech, like MRI machines and cancer therapeutics, at lower duties.

That means more competition at the top end, especially for Indian SMEs.

IT & Services Mobility

This is one of the biggest FTA wins.

From easier business travel to reduced social security costs (thanks to the Double Contribution Convention), Indian IT and services professionals are getting both access and savings.

With an expected 60,000 professionals benefiting each year, and $2 billion in additional IT exports projected by 2030, this deal gives India’s service sector serious firepower.

UK firms may face more competition from Indian consultants and coders, but hey, that’s not our problem.

Whether it’s tech, finance, or management, Indian talent just got a smoother runway into one of the world’s biggest service markets.

Auto Components & Engineering

India shipped ₹1,590 crore worth of auto parts to the UK in 2024.

Thanks to this FTA, that number could zoom higher, with projections showing an extra $500 million in exports by 2030.

India will gradually cut its import duties on UK cars, down to 10% under a quota system.

So while high-end vehicles roll in more easily, the phased rollout gives Indian manufacturers time to prep.

Components go global. Luxury cars come locally. The real test will be who levels up faster, our exporters or their imports.

Spirits, Beverages & Food Processing

Indian exports like tea, spices, marine products, and packaged foods will now reach UK shelves with fewer cost barriers.

We’re not just exporting goods, we’re exporting culture. This deal helps desi flavours find more takers in British households, restaurants, and supermarkets.

But There’s a Twist

India is slashing duties on Scotch whisky and gin slowly, but surely.

From 150% to 75% now, then 40% over the next decade. Domestic spirit makers aren’t thrilled that cheaper imported brands could stir up some competition.

Key agri items like dairy, rice, and meats have been kept out of the deal, a protective move for local farmers and food producers.

But Wait… Who Should Worry?

Some sectors are winning big, others need to buckle up.

- UK luxury vehicles are now getting a discount ticket into India, with tariffs dropping to 10% (under quotas). Expect more competition in the premium segment.

- Imported Scotch duty is on its way down from 150% to 40% over the next decade, and homegrown premium liquor brands may feel the heat.

- With UK-made advanced equipment like MRI and surgical tools entering duty-free, local manufacturers will need to level up tech and pricing.

- The UK plays by strict quality and safety rules. Many Indian SMEs, especially in food, pharma, and textiles, may struggle with compliance, paperwork, and certifications.

Investor Takeaways: How to Use This Deal to Your Advantage

This isn’t just a government-to-government handshake. The India-UK FTA opens up real investment opportunities if you know where to look.

Exporters Just Got a Boost

Companies that export a lot to the UK, especially in textiles, pharma, IT, and auto components, now have a tailwind behind them. Lower tariffs = better margins = stronger earnings.

Don’t Sleep on INR-GBP

Post-FTA, INR-GBP (Great British Pound) isn’t background noise, it’s front and centre.

With tariffs gone, even small currency moves can swing exporter margins big time. Smart investors now track forex like fundamentals.

Think Beyond the Obvious

You don’t have to only pick the big-name exporters. Logistics firms, packaging suppliers, raw material players, even cold storage businesses, they’ll benefit too, quietly.

This isn’t a one-quarter rally, it’s a long-term shift.

Retail investors who research, not react, will ride the real gains.

Final Word: This Is More Than Just a Trade Deal

This isn’t just about cheaper Scotch or more shirts crossing borders.

It’s about India showing up on the global stage with confidence, cutting smarter deals, and giving our industries, from IT to textiles, a real shot at scale.

For the investors, this FTA isn’t noise, it’s a signal.

The kind that shows where policy is headed, where the money might flow, and where opportunity quietly compounds.

So watch the movers, track the shift and back the real builders.