- Share.Market

- 10 min read

- 30 Aug 2025

When you first heard “GST 2.0,” your reaction was probably, Great, another tax reform. How does this affect my investment?

Here’s the thing – this isn’t just another policy announcement.

When taxes on cars drop from 28% to 18%, when your health insurance might become cheaper, and when everyday items might get more affordable, it creates a ripple effect in your investment journey, too.

If you’re investing, understanding this “Diwali gift” is essential for making smart decisions in the months ahead.

What’s Actually Happening?

Before moving forward, let’s first understand what GST is.

GST (Goods and Services Tax) is the tax you pay when you buy almost anything in India.

It replaced dozens of different taxes in July 2017, making one unified system instead of the chaos that existed before.

Now, coming to what’s going on.

Remember this August 15th, when you were probably celebrating Independence Day, India’s Prime Minister announced that India would get a “Diwali gift” – a massive overhaul of our GST system.

The Group of Ministers gave it the green light on August 21st, and now we’re waiting for the final GST Council decision.

But why do we see GST so confusing?

Because its four-slab system (5%, 12%, 18%, 28%) and now it’s becoming a simple two-slab structure: 5% and 18%.

What This Means:

- 99% of items are currently at 12% → dropping to 5%

- 90% of goods at 28% → moving to 18%

- Small cars and two-wheelers → from 28% to 18%

- Health insurance premiums → possibly from 18% to 5% (or tax-free)

Think of it like your favorite store simplifying from four different discount tiers to just two – making everything clearer.

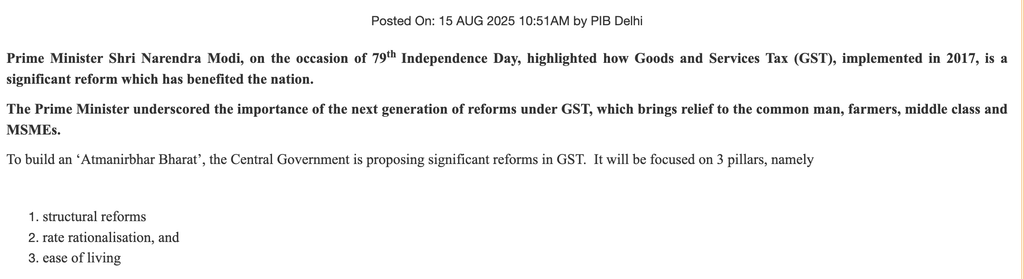

How Did We Get Here? The GST Journey So Far

This reform didn’t happen overnight. GST itself was a 17-year journey from concept to reality.

The GST journey spans over two decades – first proposed in 2000, it took 17 years of negotiations, state consultations, and constitutional amendments before finally launching in 2017, replacing a complex web of dozens of central and state taxes with one unified system.

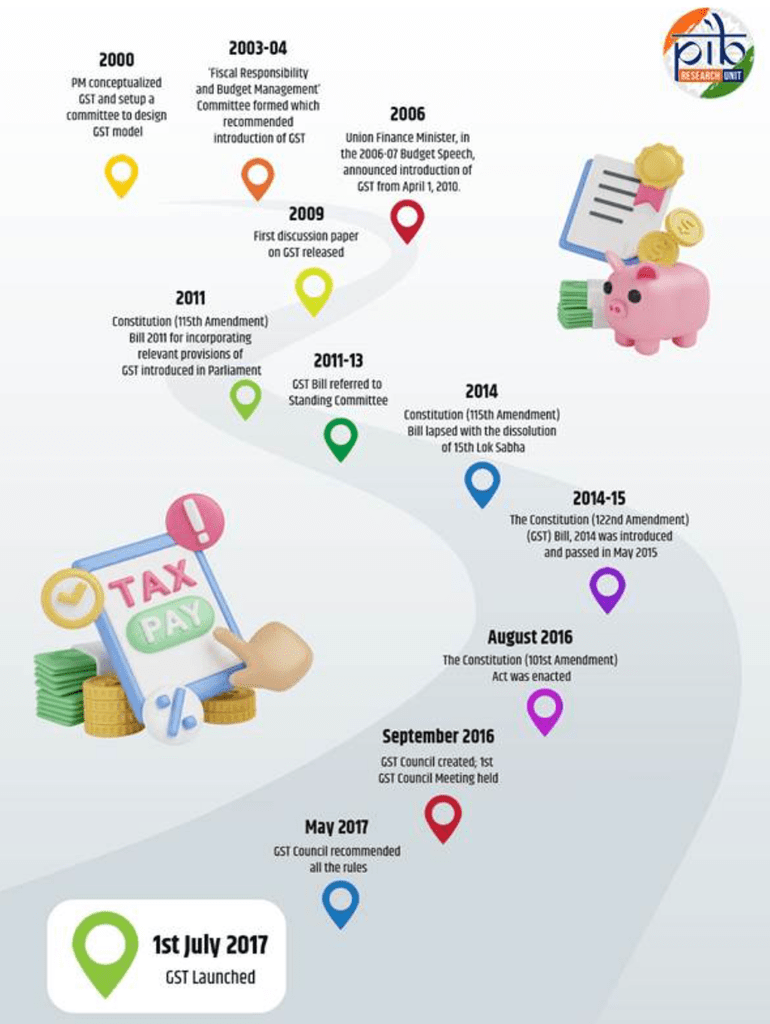

In 2024–25, GST recorded its highest-ever gross collection of ₹22.08 lakh crore, reflecting a year-on-year growth of 9.4 percent. The average monthly collection stood at ₹1.84 lakh crore.

But here’s the key insight – the original four-slab system was a compromise. It was designed to get all states on board, even if it meant keeping things complex.

Now, with the GST Compensation Cess ending in October 2025 and tax collections proving robust, the government has the “fiscal space” to be bold. They can afford some revenue loss in exchange for economic growth.

Why Now Makes Sense:

- GST is mature and working well

- India’s economy needs a consumption jumpstart, especially with inflation hitting multi-year lows.

- Timing with Diwali maximizes impact

This isn’t just tax tinkering – it’s the government’s taxes, and lower prices will unleash a wave of consumer spending that benefits everyone, including your investment.

Who Actually Benefits?

Here’s the reality – not all sectors will benefit equally.

The government strategically picked which tax slabs to cut for maximum impact.

The 12% slab (just 5% of total GST revenue) includes essentials that benefit common people.

The 28% slab (11% of revenue) covers “aspirational goods” – the targeted approach maximizes economic impact without breaking the fiscal bank.

Automotive Sector

The GST cut on small cars and two-wheelers from 28% to 18% is genuinely transformative for this sector.

Mass-market players in the Automotive car-making segment stand to gain. However, there’s a strategic concern – cheaper internal combustion engine vehicles could narrow the price gap with electric vehicles, potentially slowing EV adoption and affecting government subsidies’ effectiveness.

For investors, this creates an interesting dynamic between traditional auto stocks and the clean mobility story.

Consumer Durables

Air conditioners, televisions, and refrigerators moving to lower tax slabs means immediate relief for middle-class aspirations.

This 10% point reduction could cut prices by 8-9%, making these goods accessible to families who’ve been waiting for the right moment to upgrade.

Industry experts expect the demand surge to be particularly strong during the festive season when consumer sentiment peaks.

Companies working in this field will benefit from both higher volumes and potentially better margins.

The timing with Diwali is strategic – it’s when Indian families traditionally buy appliances, and lower prices could trigger a consumption boom that sustains beyond the festive period.

Cement

Cement’s shift from 28% to 18% might seem modest given its commodity nature, but the expectation of price reduction carries broader implications.

While direct demand elasticity is limited – construction projects don’t suddenly double because cement is cheaper – the sentiment boost is significant.

Cheaper cement translates to margin expansion, which could revive stalled housing projects and make new launches more viable.

Companies will benefit directly, while real estate developers see improved project economics.

FMCG (Fast Moving Consumer Goods)

This sector gets a double boost – many products moving from 12% to 5%, plus some high-taxed items potentially getting relief.

The impact is particularly pronounced in rural and semi-urban markets where every rupee matters.

Companies in the FMCG could see volume growth as products become more affordable for price-sensitive consumers.

Additionally, as raw materials also move to lower tax slabs, input costs decrease, providing margin comfort.

This creates a virtuous cycle – lower costs enable companies to invest in market expansion while consumers benefit from affordable pricing. The rural consumption story, which has been muted, could see a significant revival.

Insurance

The proposed reduction of GST on health and life insurance premiums from 18% to 5% (or complete exemption) addresses a critical policy objective.

Insurance penetration in India remains low compared to global standards, partly due to affordability concerns.

Making premiums cheaper could accelerate adoption among middle-class households who’ve been deferring insurance purchases.

While this costs the government ₹9,700 crore annually, states support the move, recognizing its social benefits.

Insurance companies could see faster customer acquisition, though the government will need mechanisms to ensure companies pass on the full benefit to policyholders rather than absorbing it as margin improvement.

Hospitality/Hotels

The GST on hotels with tariffs below ₹7,500 is currently 12% but could be rationalized to 5% making domestic tourism significantly more affordable.

This particularly benefits mid-market hotels that cater to business travelers and middle-class families.

The 7% rate reduction on room charges could boost occupancy rates and encourage longer stays.

With the overall consumption stimulus creating more disposable income, this could trigger a domestic tourism boom.

Business travel, which has been recovering post-COVID, gets another shot in the arm as corporate travel budgets stretch further.

Quick Commerce

The current maze of GST rates affecting quick commerce – groceries at 5%, packaged foods at 12%, delivery services at 18% – gets simplified under the two-slab structure.

This reduces compliance complexity and potentially lowers costs across a broader product range.

Companies operating the quick commerce business could see improved unit economics as more products become affordable.

The GST destination-based system already works well for this sector, and simplified rates could boost customer retention as savings get passed on.

With urban consumers increasingly price-conscious, lower costs on everyday items could drive higher order frequencies and basket sizes.

Logistics

While logistics doesn’t get direct rate cuts, it’s a massive indirect beneficiary.

The 2017 GST rollout eliminated state checkpoints and multiple taxes, revolutionizing goods movement.

The current simplification builds on this by reducing classification disputes and compliance complexity.

As consumption surges across sectors due to lower prices, logistics companies could see increased volumes of goods to transport and store.

Simplified tax structures mean faster goods movement, optimized supply chains, and reduced administrative costs.

This sector essentially rides the wave of increased economic activity triggered by GST reforms.

The Macro Picture: Why This Matters for India’s Economy

This reform isn’t just about individual sectors – it’s reshaping India’s entire economic strategy.

The numbers are compelling: experts project a massive ₹1.98 lakh crore annual consumption boost, potentially adding 1.6% to GDP growth.

That’s real money flowing through the economy, creating a multiplier effect that touches every business.

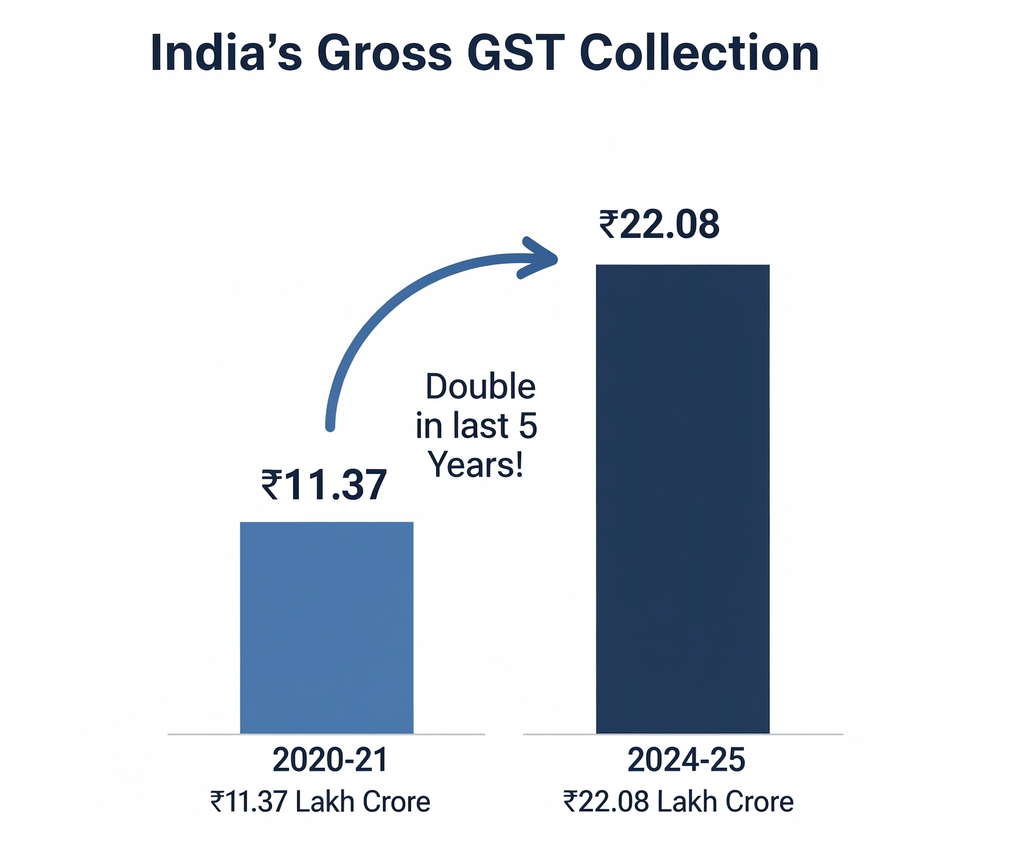

Here’s what makes this particularly powerful – India’s private consumption now represents 64.8% of Nominal GDP, n Dec 2024, compared with a ratio of 61.8 % in the previous quarter.

India’s Private Consumption: % of GDP

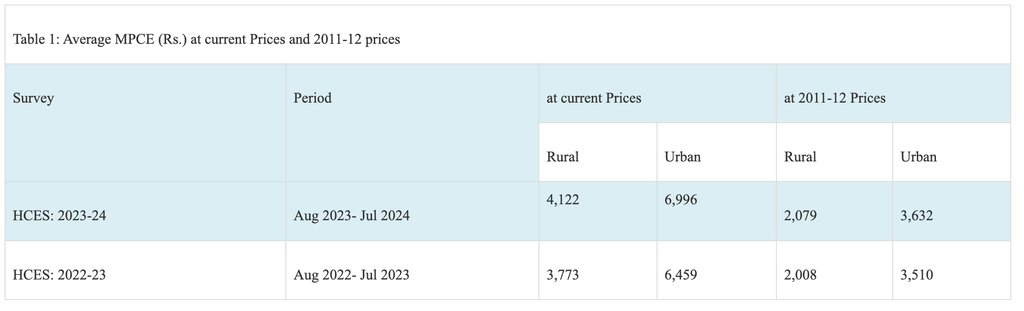

With average household spending at ₹4,122 in rural areas and ₹6,996 in urban areas, there’s substantial purchasing power waiting to be unleashed.

The timing couldn’t be better given external headwinds.

Trump’s 50% tariffs on Indian exports are forcing a strategic pivot.

Rather than see this as purely negative, smart policymakers are using GST reforms to redirect production toward domestic consumption.

Companies lose export margins but avoid complete sunk costs while building domestic market share.

The deflationary impact is equally important.

Lower GST rates could reduce inflation, potentially creating space for RBI rate cuts.

Combined with the GST Compensation Cess ending in October 2025, the government has fiscal flexibility to absorb short-term revenue losses estimated at ₹85,000 crore annually.

However, center-state coordination remains the biggest risk.

States worry about sustained revenue shortfalls, and the GST Council’s consensus model gives them significant veto power.

What This Means for Your Investment Journey

Let’s be real – no one can predict exactly how markets will react to GST 2.0.

But understanding the moving pieces helps you make smarter decisions about where to focus your attention and what questions to ask.

The Timeline Reality Check: The GST Council meets in September-October for final approval, with implementation targeted for Diwali. That’s a tight timeline that could face delays if states push back on revenue concerns. Watch those signals closely – any hint of resistance from major states could postpone the entire reform.

What to Monitor in Company Results: Don’t just look at stock prices jumping on GST news. Dig deeper into quarterly results to see which companies are actually benefiting from lower input costs versus those just riding sentiment. Look for businesses that can demonstrate real volume growth, not just margin expansion from absorbing tax cuts.

The Short-term vs Long-term Trade-off. Some sectors might see temporary sales dips as consumers wait for lower prices. Others might rally immediately on optimism. The real winners will be companies that use this transition period to build market share and strengthen their domestic distribution networks.

Questions Worth Asking

- Are companies passing tax benefits to consumers or keeping them as margins?

- How are businesses preparing for higher domestic demand while export markets shrink?

- Which management teams have clear strategies for navigating both the consumption boom and the Trump tariff challenges?

This reform represents India’s strategy for becoming a consumption powerhouse rather than just an export hub.

If successful, it changes the entire investment landscape – from infrastructure plays to consumer stories, from export-oriented businesses to the domestic market.

But remember, even the best policies can face implementation challenges. So stay informed, but don’t chase headlines.

The companies that benefit most from GST 2.0 will be those with strong fundamentals, clear domestic market strategies, and management teams that understand this isn’t just about lower taxes – it’s about India’s economic transformation.

The opportunity is real. The execution will determine whether it becomes the Diwali gift the government promises or just another policy announcement that takes years to show results.

Either way, understanding these dynamics puts you ahead of investors who see GST reforms as just another tax change.

Because this isn’t just about taxes – it’s about the future of how India grows.

Disclaimer and Disclosure

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst with Exchange, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954