- Share.Market

- 11 min read

- 23 Sep 2025

Have you noticed that suddenly your newsfeed is flooded with IPO headlines? It feels like every other day, a new company is going public. If you’re wondering, “Why are so many IPOs happening this week?” – you’re not alone.

Interestingly, this IPO rush comes at a time when the broader stock market hasn’t exactly been shining.

For example, the Nifty 50 has delivered only about 3.2% returns in US dollar terms so far this year, placing India among the bottom three global performers.

Yet, the IPO market is buzzing with life – almost like an oasis in the middle of a desert.

So, what’s behind this sudden surge?

It’s not just random luck.

A mix of reasons is driving this rush. Domestic investors are showing a strong appetite for new listings. Regulatory deadlines are pushing companies to speed up their plans. Foreign investors are also shifting strategies.

And with big “mega-IPOs” around the corner, smaller firms don’t want to get lost in the crowd later.

In this article, we’ll keep things simple. We’ll explain why so many companies are choosing to list right now.

We’ll also explore who is actually investing in these IPOs, the key risks you need to be aware of, and a quick checklist that every investor should review before investing.

The Big Picture: Why India is a Hotspot for IPOs Right Now

While global markets have been shaky, India has been playing a very different tune.

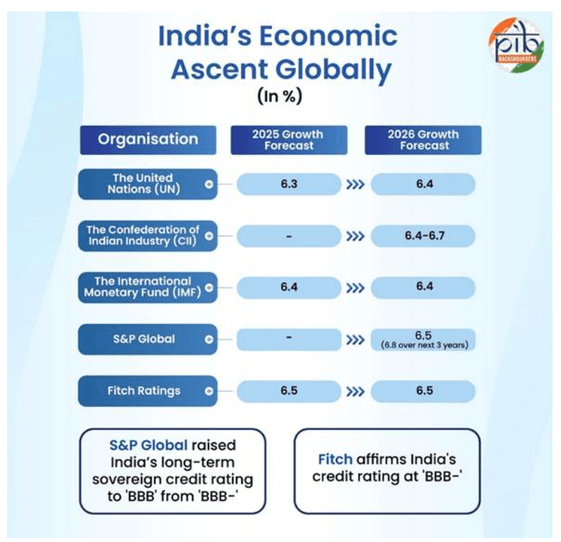

The country is still the world’s fastest-growing major economy, with GDP expected to grow 6.4% – 6.7% in FY26.

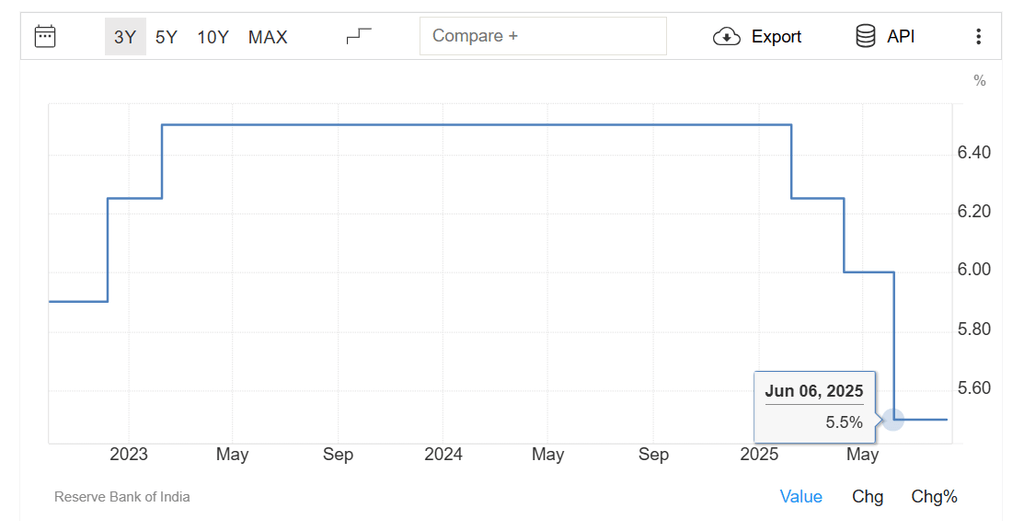

On top of that, inflation has been cooling, and the Reserve Bank of India (RBI) has kept the repo rate steady at 5.50%.

Think of it like this: when the RBI reduces the repo rate (the rate at which it lends to banks), money becomes cheaper for both companies and investors.

Between February and June 2025, the repo rate was cut from 6.25% to 5.50%.

Lower rates = lower borrowing costs for businesses + more money flowing into the system.

That extra liquidity makes it easier and more attractive for companies to raise money through IPOs instead of relying on loans.

But Wait – The Stock Market Isn’t Exactly Booming

Here’s the twist: even though IPOs are making headlines, the Sensex has delivered a low return in 2025 (in USD terms) – the weakest among 17 major global indices.

So, the IPO rush is not happening because the entire stock market is flying.

What’s interesting is that companies are still lining up to raise money, and investors are still showing up with strong demand.

This tells us that the IPO market is running on its own set of factors, like lower interest rates, strong domestic participation, and attractive pricing, rather than simply following the mood of the stock market.

Who’s Buying These IPOs? The Investor Mix Changed, And That Matters

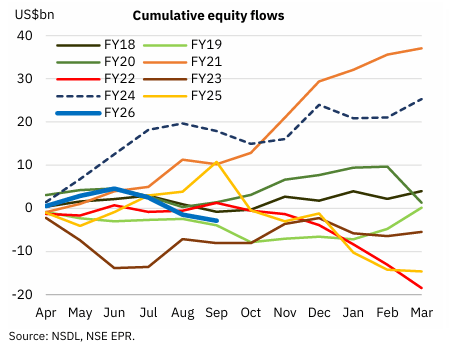

A big reason IPOs are holding strong is that who’s investing has changed.

Earlier, IPOs depended heavily on Foreign Portfolio Investors (FPIs). If they pulled out, IPO activity almost died.

Now? The tables have turned. Domestic Institutional Investors (DIIs) and retail investors are taking center stage.

Now, they contribute more than 50% of anchor book allocations in IPOs, a big shift from just 5–7 years ago when FPIs dominated with over 60%.

This rise of local investors makes the IPO market less fragile.

The FPI Paradox: Selling Stocks, but Buying IPOs

Here’s something surprising. FPIs have pulled out nearly ₹1.4 lakh crore from Indian stocks in 2025.

Yet, they’ve also tripled their investment in IPO anchor books, putting in about ₹26,500 crore in FY25.

Why would they do that?

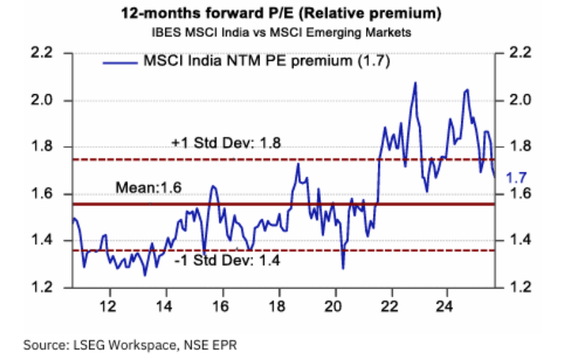

Because the secondary market looks expensive, MSCI India currently trades at a premium of 67% to MSCI EM on 12-month forward P/E, falling from 91% in April, but still higher than the long-term average premium of 55%.

FPIs are shifting money to those cheaper markets for quick value.

From the above figure, you can see India’s stock market trades at higher valuations than other emerging markets, showing consistent premium pricing.

But IPOs? They’re often priced more reasonably to attract investors. That gives FPIs a better entry point to India’s growth story with priority allocations and attractive pricing.

Basically, they’re saying: “We may not like the current stock market valuations, but IPOs still give us a sweet deal.”

The Engine Room: Regulatory and Financial Drivers

Imagine you’re a student who has to submit an assignment by September 30. If you miss the deadline, your old notes won’t count, and you’ll have to start fresh.

That’s exactly what’s happening with IPOs right now.

SEBI, the market regulator, has a rule: the financial numbers that companies submitted in their IPO draft (for example, from March 2025) will turn “stale” after September 30.

If they don’t launch before then, they’ll need to update their documents with newer numbers, which takes time and adds cost.

That’s why many companies are scrambling to go public before the clock runs out. It’s less about “this week looks lucky” and more about “beat the deadline or refile.”

But there’s more: small and mid-sized companies don’t just want to avoid stale data. They’re also trying to get listed before big, headline-grabbing IPOs arrive next quarter.

When a mega company like Tata Capital or PhysicsWallah comes to market, it tends to attract a lot of investor attention and money. Smaller firms know this, so they’re rushing to squeeze in now.

SEBI’s New Rules: Making IPOs Easier (and Bigger)

Deadlines are only part of the story. SEBI has also been tweaking rules to encourage IPOs and make the market deeper.

Think of it like adjusting the rules of a cricket match to make sure more teams can play without the game getting messy.

Here are the key changes explained simply:

- Minimum Public Shareholding (MPS): Earlier, very large companies had to sell 25% of their shares to the public within 3 years. Now they get 5 years. That extra time makes life easier for giants who don’t want to flood the market with too many shares too quickly.

- Minimum Public Offer (MPO): For really huge firms (over $57 billion market cap), SEBI cut the required IPO size from 5% to 2.5%. Why? So mega-IPOs don’t cause a market shock.

- Anchor Investors: Earlier, 33% of anchor allocations went to Indian institutions. Now it’s 40%, meaning big domestic players get a larger slice. This helps reduce dependence on foreign money and makes IPO demand more stable.

- Startups & Founders: Founders can now keep their ESOPs (employee stock options) even during IPO listing. That’s a small but smart move to support India’s startup ecosystem.

Private Equity and Mega-IPOs: Why Small Companies are in a Hurry

Another engine behind the IPO rush? Private Equity (PE) and Venture Capital (VC) investors are cashing out.

Think of PE/VC investors as early backers who helped a startup grow.

After a few years, they look for an exit, a way to turn their paper profits into real money. IPOs give them that chance.

And right now, public markets are offering better valuations than private markets, so PE/VC firms are rushing to list their portfolio companies.

According to an EY report, PE-backed IPO exits touched $13.7 billion in 2025 alone, a record high.

But here’s where it gets competitive: everyone knows that big IPOs are coming soon (think Tata Capital or PhysicsWallah).

Once those giant lists, investors’ money, and attention flow there.

So, smaller and mid-sized firms are speeding up their listings in September to avoid being overshadowed.

This makes it super clear why September is packed with IPOs.

Which Sectors are Hot, and Which Did Well on Listing Day?

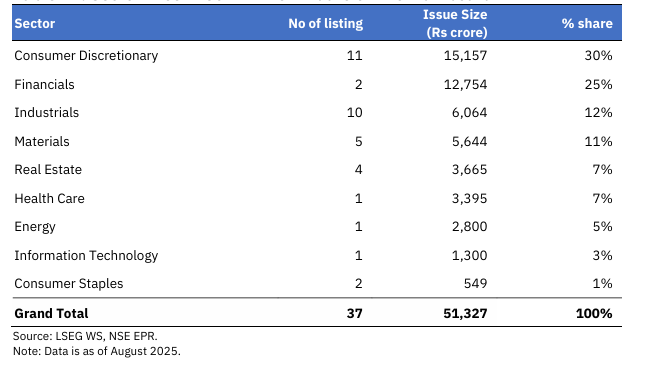

Now, when we look at which sectors are driving this IPO boom, the picture gets even more interesting.

The bulk of the money raised this financial year has come from consumer discretionary, financial, and industrials.

This shows investors are betting on India’s rising middle-class consumption and the growing strength of its financial system, alongside industrial expansion.”

But when it comes to listing-day gains (the jump in share price on the first trading day), a different set of sectors is stealing the spotlight.

Information technology (IT) led the pack with an average 43% jump, followed by telecom and financial services.

There’s also a clear green energy story playing out.

Within industrials, IPOs linked to renewable and clean energy delivered an average gain of nearly 36% on listing day.

This indicates that investors aren’t only pursuing short-term profits, but also aligning with India’s long-term priorities, such as sustainability and the global clean energy initiative.

In short, manufacturing-heavy sectors are raising the most funds, while digital and green sectors are yielding the highest returns to investors on debut day.

Together, they highlight how India’s IPO market is balancing the “old economy” growth engines (factories, cars, infrastructure) with the “new economy” drivers (tech, telecom, green energy).

So… is this a Bubble? The Risks You Must Know

Every coin has two sides, and the IPO market is no different. While the current rush of IPOs creates exciting opportunities, it also hides some big risks.

The biggest red flag? Overvaluation.

- On average, Qualified Institutional Buyers (QIBs) have bid 102 times the available shares, while retail investors have bid 35 times in FY25. That’s a clear sign of market exuberance.

- Companies like Urban Company, which debuted at a 57.5% premium, show how intense demand can push valuations sky-high, sometimes beyond what the fundamentals justify.

But here’s the catch: India’s stock market is already expensive, which is higher than most other emerging markets. That means new IPOs are often priced at a premium to an already stretched benchmark.

And reality check: about 47% of the listed organisations are trading below their listing price, and only 42% have outperformed the benchmark index.

In simple terms, if you chase IPO hype (like oversubscription numbers or grey market premiums), you could end up with losses when the post-listing excitement fades.

Now, the good news: despite the risks, the IPO pipeline still looks strong.

- Many companies are lining up to go public, thanks to steady domestic demand and SEBI’s supportive regulations.

- In FY25 so far, each quarter has shown resilient fundraising, proving that India’s IPO market isn’t just a short-term craze.

Looking forward, experts believe corporate earnings will pick up by Q3 FY26 as the benefits of fiscal and monetary policies start flowing into company profits.

If that happens, it could give much-needed support to today’s high valuations.

What This Means for Investors

If you’re an investor, here are three golden rules before jumping into any IPO:

- Focus on Fundamentals: look at what the company does, how it makes money, its debt levels, and the quality of its management

- Ignore the Hype: oversubscription numbers, grey market premiums, or media buzz aren’t guarantees of long-term success

- Think Long Term: IPO investing isn’t a quick lottery. If you hold through short-term ups and downs, you’re more likely to benefit from the company’s real growth

Closing Thought

India’s IPO market is transforming from being foreign-investor driven to increasingly powered by domestic capital.

This shift, combined with a strong corporate pipeline, could make India one of the global IPO powerhouses in the coming years.

But remember: liquidity and sentiment may drive the market today, yet only real earnings growth will justify valuations tomorrow.

Disclaimer and Disclosure

Investments in the securities market are subject to market risks, read all the related documents carefully before investing. Registration granted by SEBI, enlistment as Research Analyst with Exchange and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Kindly refer to https://share.market/ for more details.Investments in WealthBaskets are subject to the Terms of Service. All investors are advised to conduct their own independent research into investment strategies before making an investment decision. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. PPWB acts as a distributor of mutual funds and it is not an exchange traded product. PPWB acts as a distributor of mutual funds and WealthBaskets and it is not an exchange traded product. Disputes with respect to the distribution activity of Mutual Funds and WealthBaskets will not have access to Exchange investor redressal or Arbitration mechanism. The securities are quoted as an example and not as a recommendation. This is for informational purposes and should not be considered as recommendations.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887 and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226. Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA. CIN: U65990KA2021PTC146954