- Share.Market

- 7 min read

- 04 Apr 2025

Introduction

In options trading, bullish strategies like buying a Call Option or setting up a Bull Call Spread are commonly used when you expect upward movement in the market. However, both come at a cost—either a high premium or limited returns. So, what if you’re confident the market will rise only slightly or remain within a specific range, or may show some pull back and you’d prefer to utilize that view without paying a heavy premium upfront?

That’s when the Call Ratio Spread comes into play.

This strategic play involves buying one in-the-money or at-the-money Call and selling two higher strike out-of-the-money Calls, all with the same expiry. The goal? To enter at low or no cost, position yourself to benefit from a narrow bullish move, and take advantage of time decay—all while being mindful of the risks if the market moves sharply upward.

Let’s explore how this strategy works, when to use it, and how to manage it effectively.

Key Takeaways

- Call Ratio Spread Basics: Involves buying one Call and selling two higher strike Calls.

- Best Use Scenarios: Ideal when you expect limited upside, range-bound movement, or resistance near the short call strike.

- Trade Setup & Payoff: Learn breakeven points, profit zones, and worst-case outcomes.

- Strategy Advantages & Risks: Get a comprehensive understanding of the key benefits and potential risks involved in using this strategy.

What is a Call Ratio Spread?

A Call Ratio Spread is an advanced options strategy that consists of:

- Buying 1 Call Option at a lower strike (ITM or ATM)

- Selling 2 Call Options at a higher strike (OTM)

All options must have:

- The same underlying (e.g., Nifty, Bank Nifty)

- The same expiry date

Core Characteristics:

- Can be a net credit, zero-cost, or small debit trade

- Profits from sideways to moderately bullish movement

- Profit zone is capped, but beyond a certain level, losses can begin

Scenario 1: Resistance Ahead

The index or stock is trending upward but approaching a key resistance zone, such as Nifty moving toward the 23,000 level after a steady rally from 22,000. You anticipate limited upside and a possible short-term pullback. In this scenario, a Call Ratio Spread allows you to benefit if the market consolidates, pauses near resistance, or edges higher within a defined range.

Scenario 2: Overbought with Mild Bullish Bias

The asset is technically overbought after a strong move—say, a 10% jump in a week—and now shows signs of consolidation. You still hold a positive outlook, but want protection if the price stalls or dips. The Call Ratio Spread lets you stay bullish with better risk-reward.

Scenario 3: Volatility Drop Expected

Implied volatility is elevated due to upcoming events like earnings or policy announcements. If you expect IV to drop, selling extra Calls can benefit from this decrease. For example, ahead of an RBI policy announcement, IV on Bank Nifty spikes, making it an ideal time for a Call Ratio Spread with a mildly bullish view or during a consolidation phase.

How Does a Call Ratio Spread Work?

Strategy Setup

- Buy 1 ATM/ITM Call Option

- Sell 2 OTM Call Options (same expiry)

Key Calculations

- Net Premium = Premium Received from Short Calls − Premium Paid for Long Call

- Maximum Profit = Difference between the higher and lower strike (if expired at the higher strike)

- Maximum Loss = Unlimited above the second short strike (if not adjusted)

- Breakeven Point = Higher Strike + (Net Debit or Net Credit)

Real Example: Nifty Call Ratio Spread (Expiry 30 April 2025)

Let’s say Nifty is trading at 22,600, and you believe it may reach 23,000, a known resistance zone, but not surpass 23,400 by expiry.

Trade Setup

| Action | Strike | Premium |

| Buy 1 Call | 22,600 | ₹190 |

| Sell 2 Calls | 23,000 | ₹110 each |

- Net Premium = (2 × 110) − 190 = 30 points credit

- Lot Size = 75

- Total Net Credit = 30 × 75 = ₹2,250

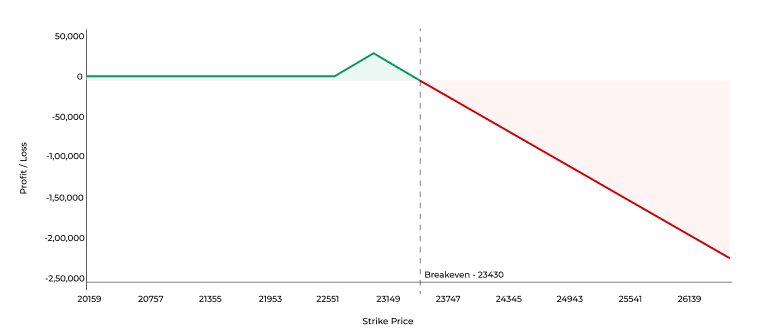

Payoff Chart

Payoff Scenarios at Expiry

Scenario 1: Nifty closes at 22,600 or below (No Movement)

- All options expire worthless

- You retain the entire premium collected

- Profit = ₹2,250

Scenario 2: Nifty closes at 23,000 (Max Profit)

- 22,600 CE intrinsic value = 400

- 23,000 CE intrinsic value = 0

- Net Payoff = 400 + 30 (net credit) = 430

- Total Profit = 430 × 75 = ₹32,250

Scenario 3: Nifty closes at 23,100

- 22,600 CE intrinsic value = 500

- 23,000 CE intrinsic value = 100 × 2 = 200

- Net Payoff = 500 − 200 + 30 = 330

- Total Profit = 330 × 75 = ₹24,750

Scenario 4: Nifty closes at 23,400

- 22,600 CE intrinsic value = 800

- 23,000 CE intrinsic value = 400 × 2 = 800

- Net Payoff = 800 − 800 + 30 = 30

- Profit = 30 × 75 = ₹2,250

Although both legs are deep ITM, the profit remains limited to the initial credit received. Beyond this point, losses begin to accrue.

Scenario 5: Nifty closes at 23,430 (Breakeven Point)

- 22,600 CE intrinsic value = 830

- 23,000 CE intrinsic value = 430 × 2 = 860

- Net Payoff = 830 − 860 + 30 = 0

- Total Profit/Loss = 0 × 75 = ₹0

This is the true breakeven point—beyond this, the strategy moves into loss territory.

Scenario 6: Nifty closes at 23,800 (Loss Accelerates)

- 22,600 CE intrinsic value = 1,200

- 23,000 CE intrinsic value = 800 × 2 = 1,600

- Net Payoff = 1,200 − 1,600 + 30 = −370

- Total Loss = 370 × 75 = −₹27,750

Risk-Reward Ratio

- Maximum Profit = ₹32,250

- Maximum Loss = Unlimited (starts beyond upper breakeven)

Payoff Summary Table

| Nifty Expiry Level | Outcome | Net P&L per Lot |

| ≤22,600 | Max Profit from Credit | +₹2,250 |

| 23,000 | Maximum Profit | +₹32,250 |

| 23,100 | Partial Profit | +₹24,750 |

| 23,300 | Reduced Profit | +₹9,750 |

| 23,400 | Declining Profit | +₹2,250 |

| 23,430 | Breakeven Point | ₹0 |

| 23,800 | Loss Accelerates | -₹27,750 |

Advantages & Risks of Call Ratio Spread

Advantages

- Cost-Efficient Entry: The strategy can often be initiated at zero cost or even a small credit, making it ideal for capital-efficient setups.

- Defined Profit Zone: Clearly defined target range where the trade offers maximum profitability, especially when the price reaches the short Call strike.

- Time Decay Benefit (Theta): Time decay works in your favor due to the two short Calls, especially in a stagnant or slow-moving market.

Risks

- Unlimited Upside Risk: It carries unlimited risk beyond the breakeven point if the market rallies sharply. Risk can be managed with hedges or adjustments.

- Margin and Assignment Risk: Since you’re selling two Calls, the margin requirement is higher. Additionally, the unhedged short Call exposes you to unlimited loss.

- Active Management Required: This strategy requires constant monitoring. If the underlying breaks out strongly beyond the short strike, adjustments or exits must be made promptly to avoid steep losses.

- Volatility Risk Post-Entry: A spike in volatility after initiating the trade can inflate the value of short Calls, temporarily worsening your mark-to-market position.

Comparison: Call Ratio Spread vs Bull Call Spread

| Feature | Call Ratio Spread | Bull Call Spread |

| Market View | Mildly Bullish to Range Bound | Bullish |

| Options Used | 1 Long Call + 2 Short Calls | 1 Long Call + 1 Short Call |

| Max Profit | At the short strike | Difference in strikes – net debit |

| Max Loss | Unlimited (if unhedged) | Defined |

| Capital Outlay | Credit / Zero-cost | Debit |

Conclusion

The Call Ratio Spread is a smart strategy when you’re moderately bullish to sideways, but not expecting a runaway rally. It lets you take advantage of range-bound action, offers low-cost entry, and rewards you if the price moves to your target zone without breaching it.

However, this strategy isn’t for set-and-forget traders. It needs active monitoring, and in cases of strong uptrends, adjustments or hedges may be required to protect from rising risk.

FAQs

It involves buying 1 lower strike Call and selling 2 higher strike Calls with the same expiry, often executed for zero or small credit.

When you’re moderately bullish and expect the market to face resistance after a small upmove.

It carries unlimited risk beyond breakeven if the market rallies sharply. Risk can be managed with hedges or adjustments.

Yes, you can exit or adjust anytime before expiry, depending on your view and P&L.

It’s best for intermediate traders who understand multi-leg strategies and risk management.