Share Market Weekly

- Share.Market

- 5 min read

- 07 Mar 2025

07th March 2025

Nifty 50₹22,552.50 +0.03%

| Monday | – 0.02% |

| Tuesday | – 0.17% |

| Wednesday | +1.15% |

| Thursday | +0.93% |

| Friday | +0.03% |

What moved the market?

6 sectors (top 3, bottom 3)

| Nifty Metal | +7.64 | Nifty IT | -3.35% |

| Nifty Commodities | +3.93 | Nifty Auto | -3.01 |

| Nifty Oil & Gas | +2.55 | Nifty Realty | -1.25% |

Markets this week

| Nifty Midcap 150 | 18,290.66 (- 0.64%) |

| Nifty Smallcap 250 | 14,602.95 (+1.12) |

| India VIX | 13.47 (-1.82%) |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Jyoti CNC Automation | 🔼 21.33% | 3/5 | N/A | 3/5 | 2/5 | NA |

| India Cements | 🔼 20.41% | 1/5 | 1/5 | 2/5 | 4/5 | NA |

Top Losers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| BSE | 🔻19.06% | 5/5 | 1/5 | 5/5 | 2/5 | 5/5 |

| Multi Commodity Exchange of India | 🔻13.18% | 5/5 | 1/5 | 3/5 | 5/5 | 3/5 |

Technical Analysis

Nifty 50

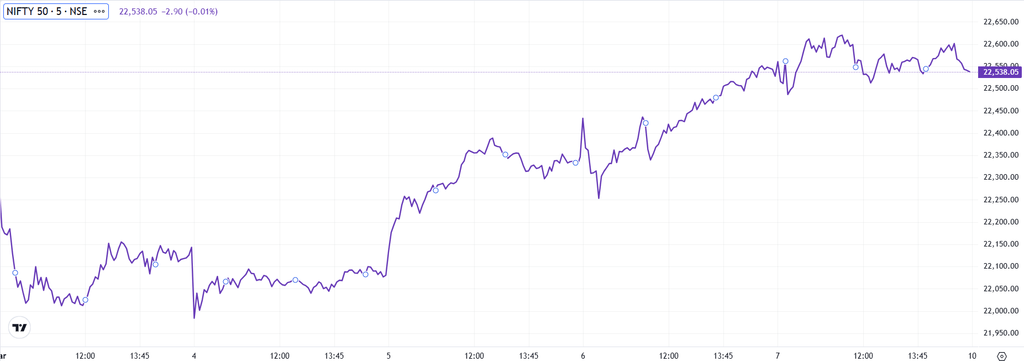

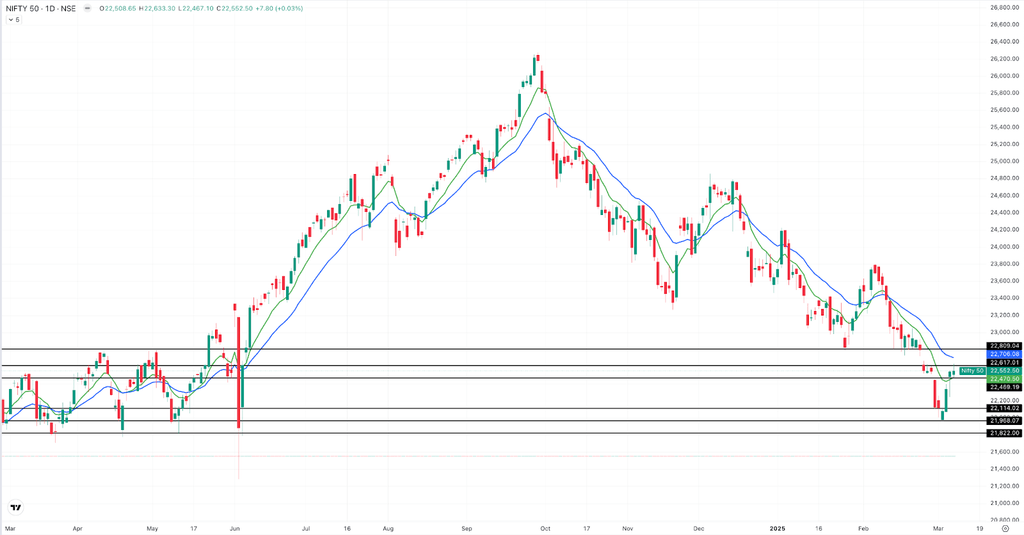

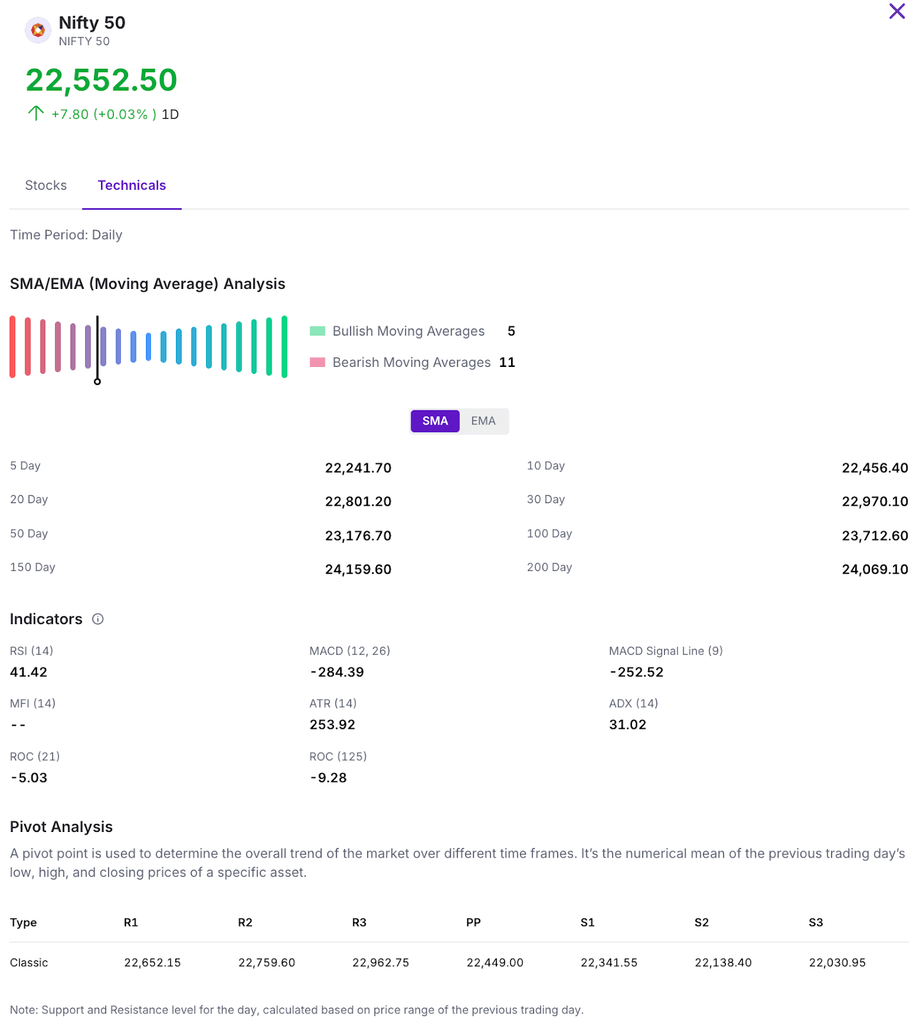

Nifty 50 gained 1.87% this week and is currently trading at Nifty 50 gained 1.87% this week and is currently trading at its pre-election levels. The index experienced an uptrend, with its next support level around the 21,900 – 22,000 range. Additionally, Nifty traded within a range of 21,965 – 22,633 this week.

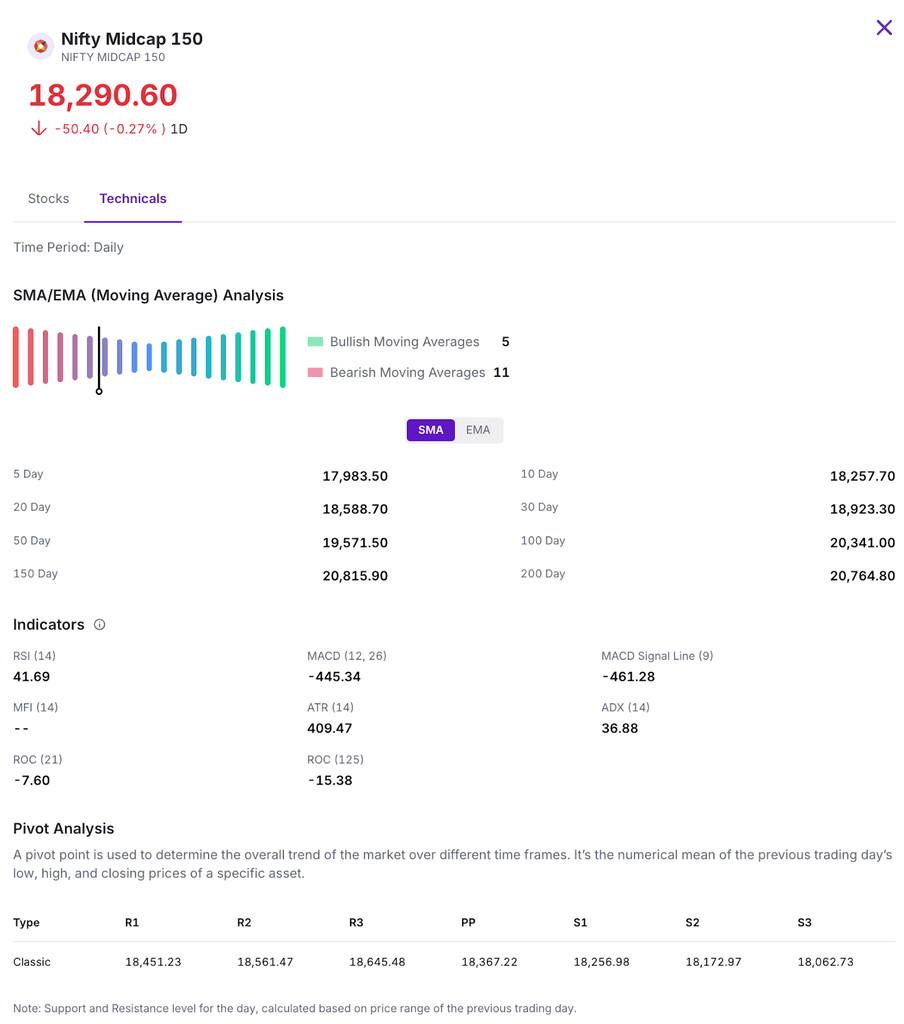

Nifty Midcap 150

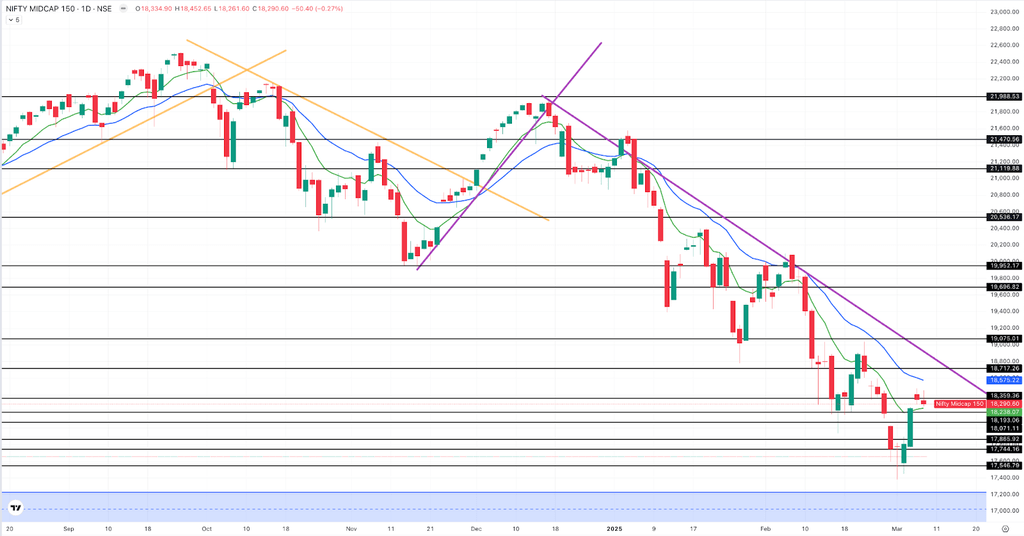

The Nifty Midcap 150 ended the week on a positive note, gaining 540 points. The index started the week with uncertainty but managed to gain 3% by the end, closing at 18,290 on Friday.Looking ahead, a strong support level is seen in the 17,750 – 17,850 range, while resistance is at 18,600 – 18,700, which could be tested in the coming sessions.

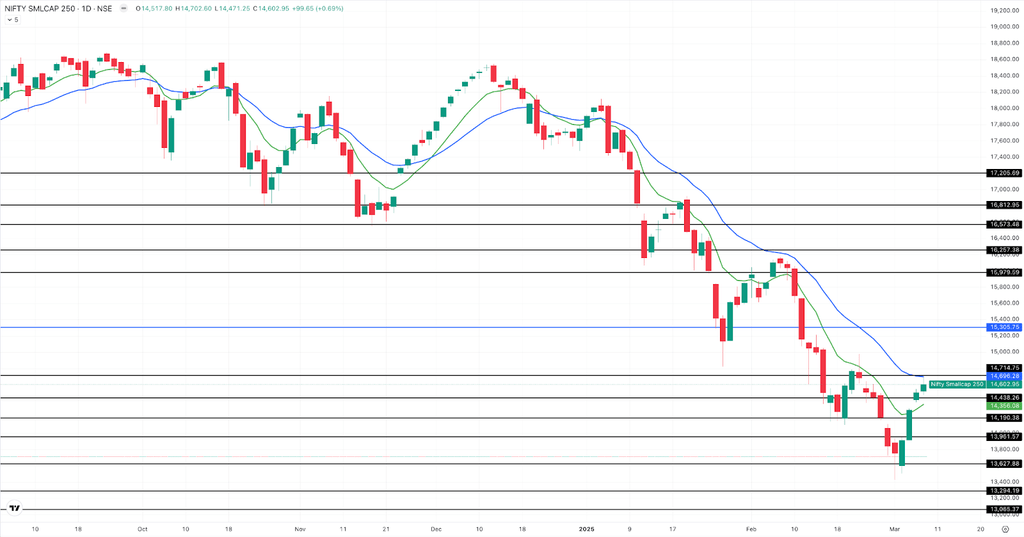

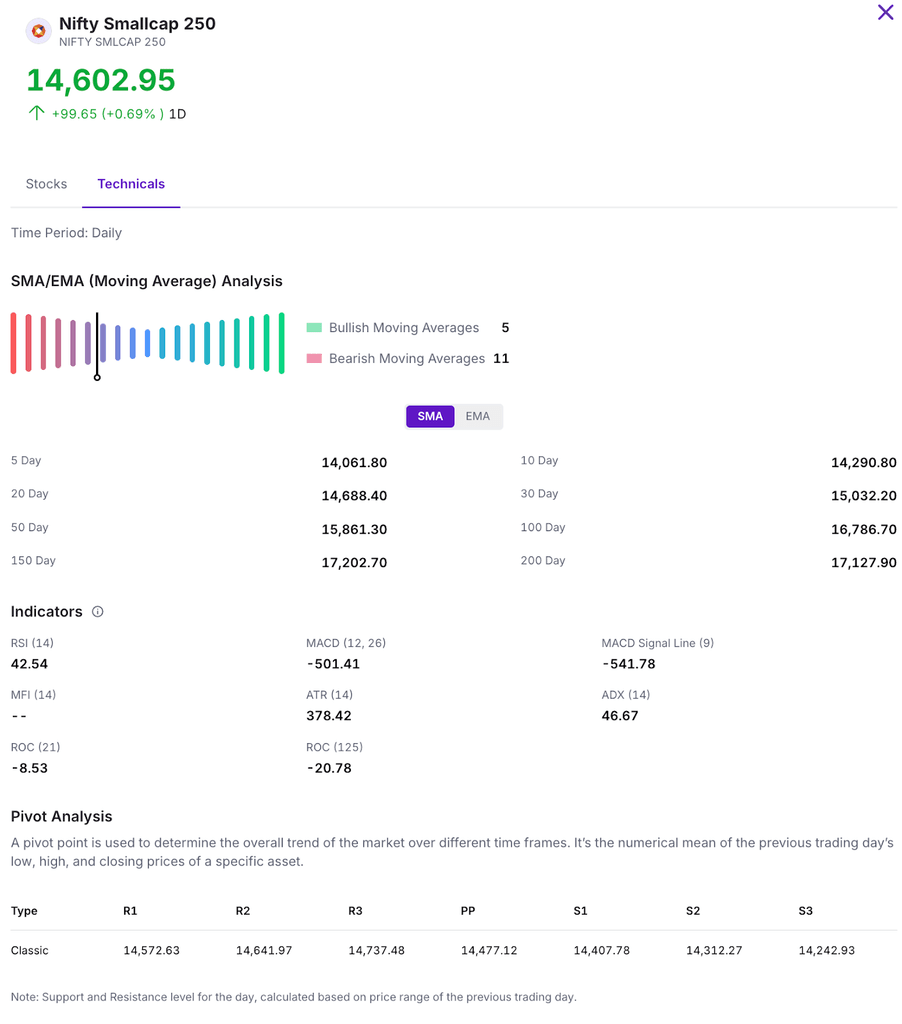

Nifty Smallcap 250

The Nifty Smallcap 250 surged 5.50% this week, gaining 758 points. The index has strong support at the 14,000 – 14,200 levels and faces immediate resistance at 14,800 – 15,000 levels.

What made headlines?

FMCG Sector Struggles with Inflation, but Urban Demand Shows Signs of Recovery

India’s FMCG sector is under pressure, with stocks hitting a two-year low due to weak demand and rising costs. The FMCG index closed at 18,317 on March 4, its lowest since June 2023.

A key challenge is soaring commodity prices—coffee has doubled in a year, while wheat and palm oil rose 31% and 20%, respectively. To offset costs, companies have raised prices, with the impact expected in Q4 earnings.

Despite these struggles, urban demand is improving, rising from 2.6% in August to 5% in December. This recovery could strengthen further with government tax relief and potential RBI rate cuts boosting consumer spending.

Not all FMCG categories are slowing. Non-food items like personal care and home care are growing steadily—personal care volume grew from 4.3% to 5.7% in a year, and home care improved to 3.8%. However, Food & Beverages growth slowed from 6.3% to 4.7%. As a result, overall FMCG sector growth declined to 4.1% in Q3 from 6.3% last year.

While inflation and weak demand persist, urban recovery, government support, and resilience in non-food FMCG indicate gradual stabilization. However, a full recovery will depend on broader economic conditions and consumer sentiment.

Buzz

This Too Shall Pass: Why Market Downturns Are Just Another Chapter In The Investing Journey

Your portfolio is bleeding, headlines scream disaster, and every instinct says, “Sell before it’s too late.” You’re not alone – we feel it too. The fear, the frustration, the uncertainty. But take a deep breath. This too shall pass. Every crash feels like the worst, yet history proves markets bounce back stronger, but that’s not the end of the story.