Share Market Weekly

- Share.Market

- 5 min read

- 04 Jul 2025

Highlights

Nifty 50 24,461.00 216.25 (+0.86%)

| Monday | – 0.47% |

| Tuesday | + 0.10% |

| Wednesday | – 0.35% |

| Thursday | – 0.19% |

| Friday | + 0.22% |

What moved the market?

Top Gainers & Top Losers

| Nifty Oil & Gas | +4.53% | Nifty Realty | –4.68% |

| Nifty Consumer Durables | +3.29% | Nifty Private Bank | -0.22% |

| Nifty Healthcare Index | +3.23% | Nifty Media | -0.08% |

Markets this week

| Nifty Midcap 150 | 21,973.15 (+1.54%) |

| Nifty Smallcap 250 | 17,762.20 (+1.76%) |

| India VIX | 12.32 (-4.94%) |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Raymond Ltd. | 🔼 19.02% | 1/5 | 5/5 | 4/5 | 3/5 | NA |

| Asahi India Glass Ltd. | 🔼 17.95% | 2/5 | 5/5 | 2/5 | 5/5 | NA |

Top Losers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Sammaan Capital Ltd. | 🔻 14.08% | 2/5 | 1/5 | 1/5 | 4/5 | NA |

| Raymond Realty Ltd. | 🔻 10.88% | – | – | – | – | – |

Technical Analysis

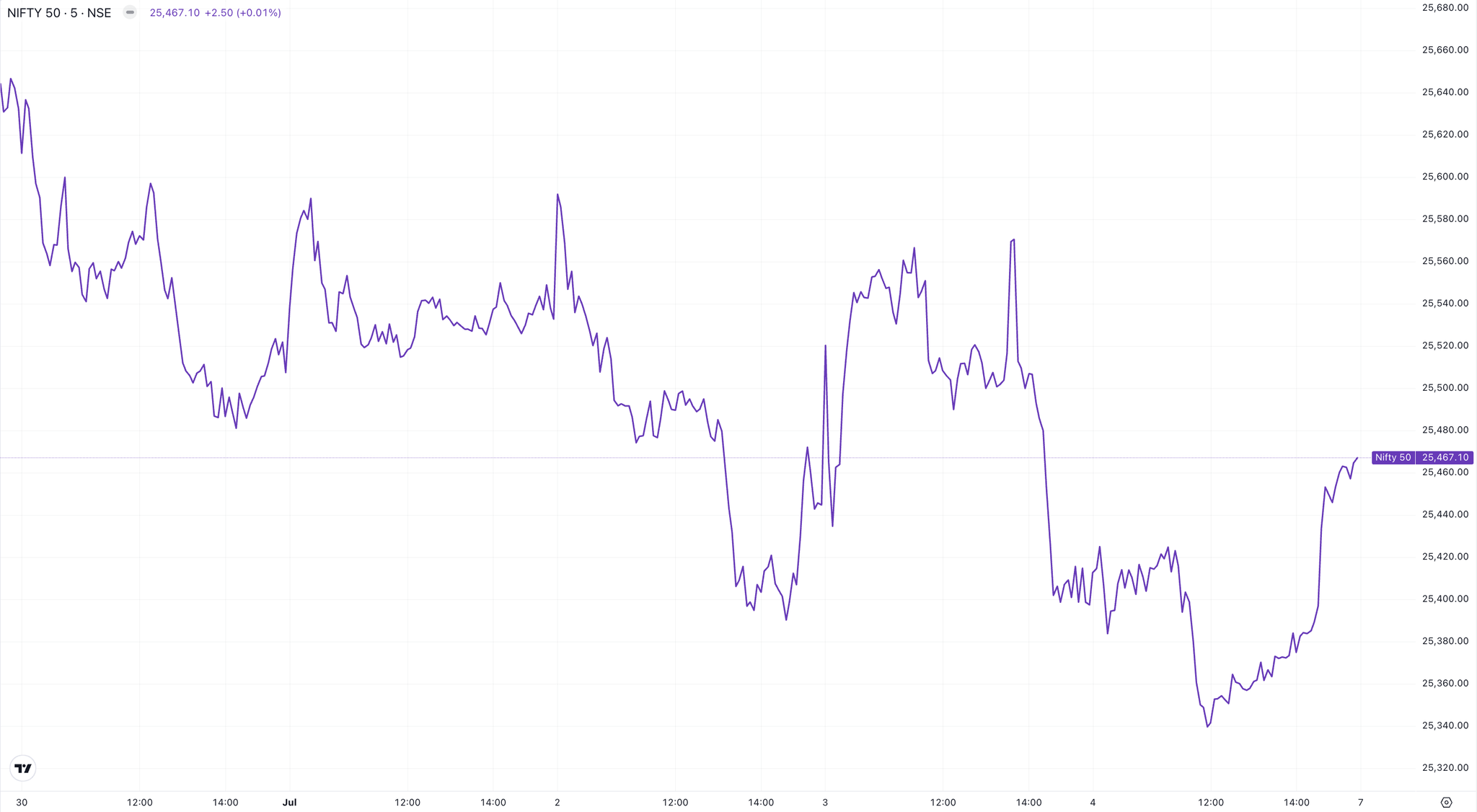

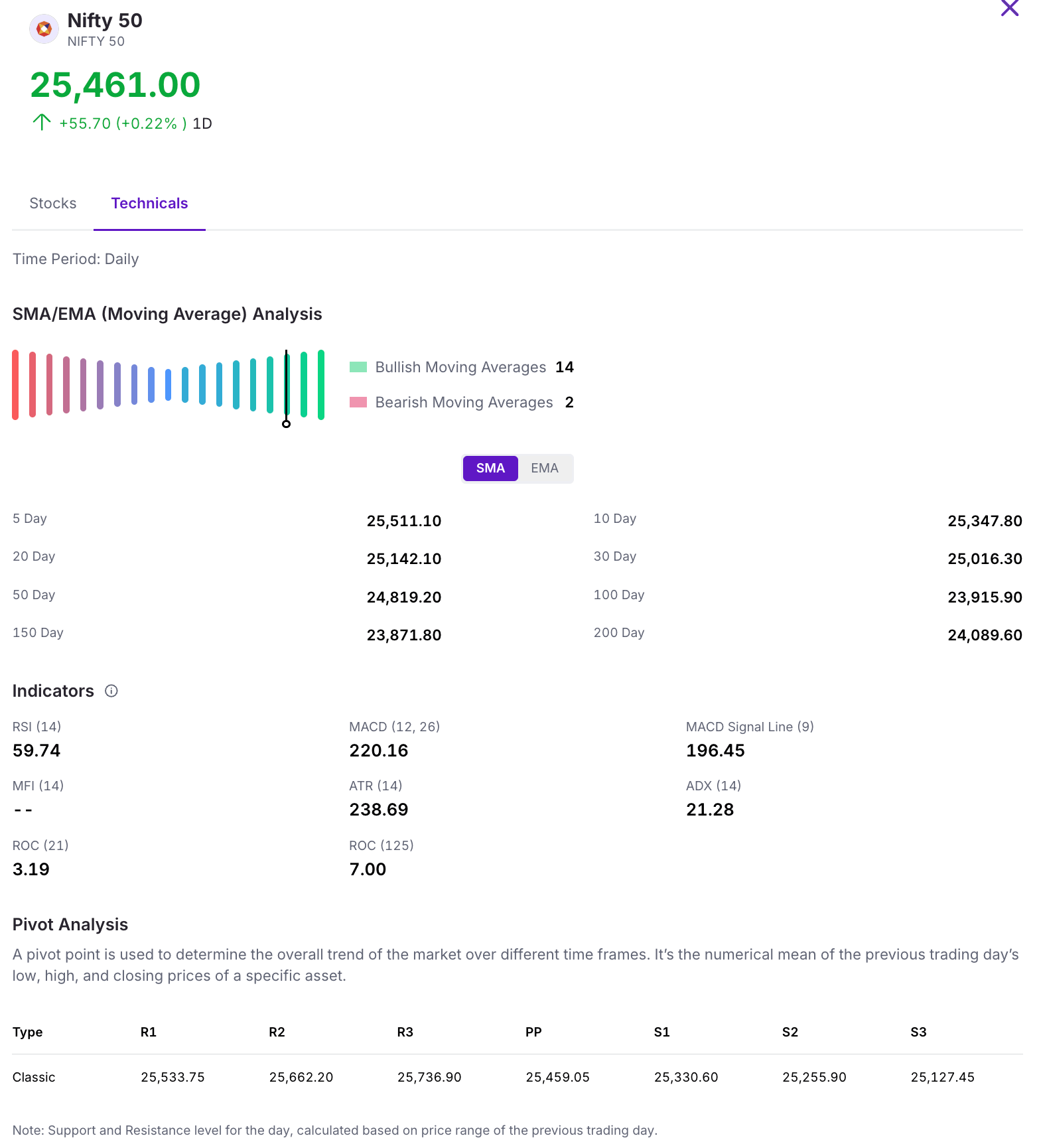

The Nifty 50 was flat this week, gaining only 216 points to close at 25,461. The index found support at both the 9-day moving average, indicating underlying strength in the market. Looking ahead, the Nifty 50 has key support at 25,300 and faces resistance near the 25,700 mark.

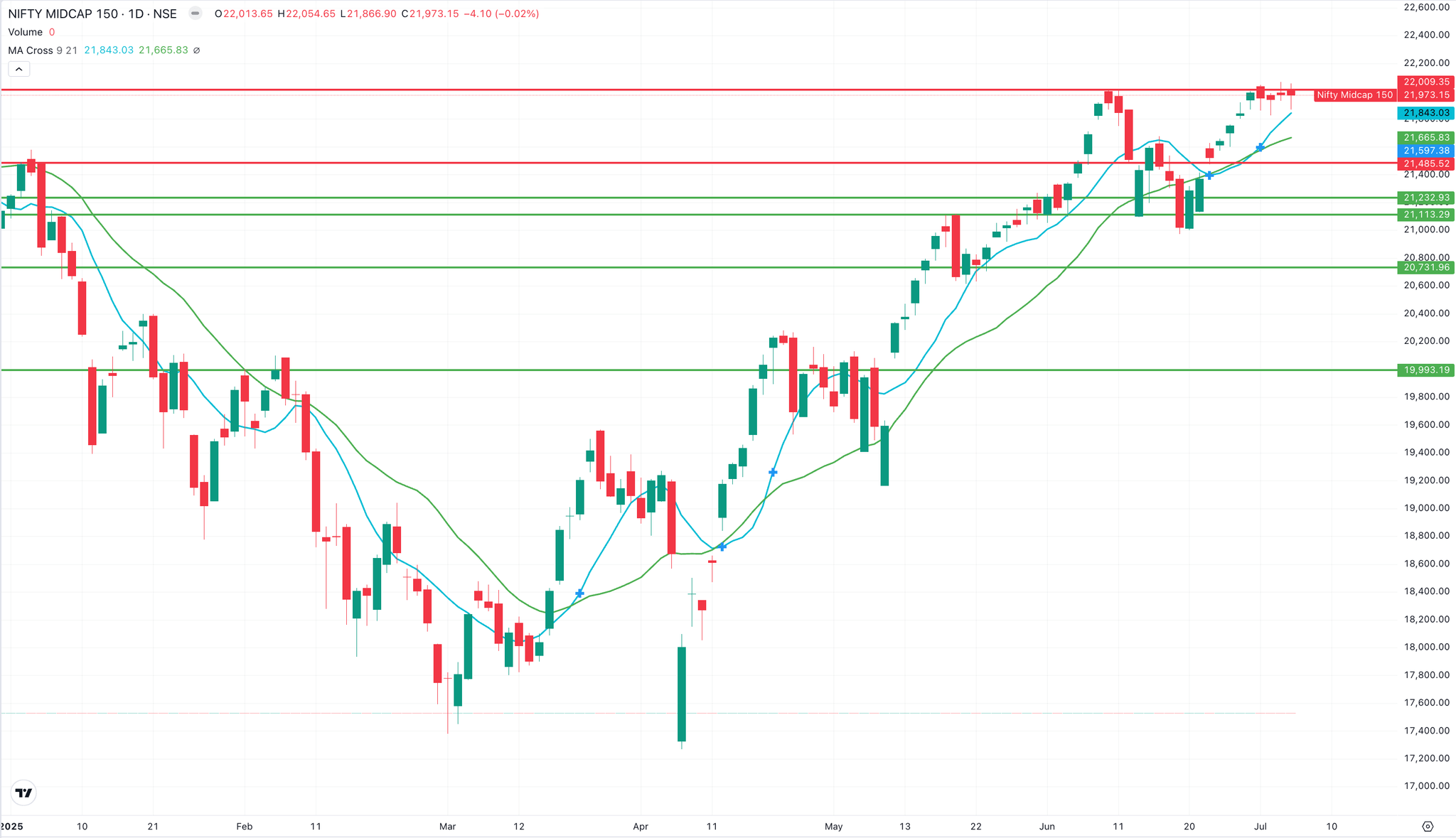

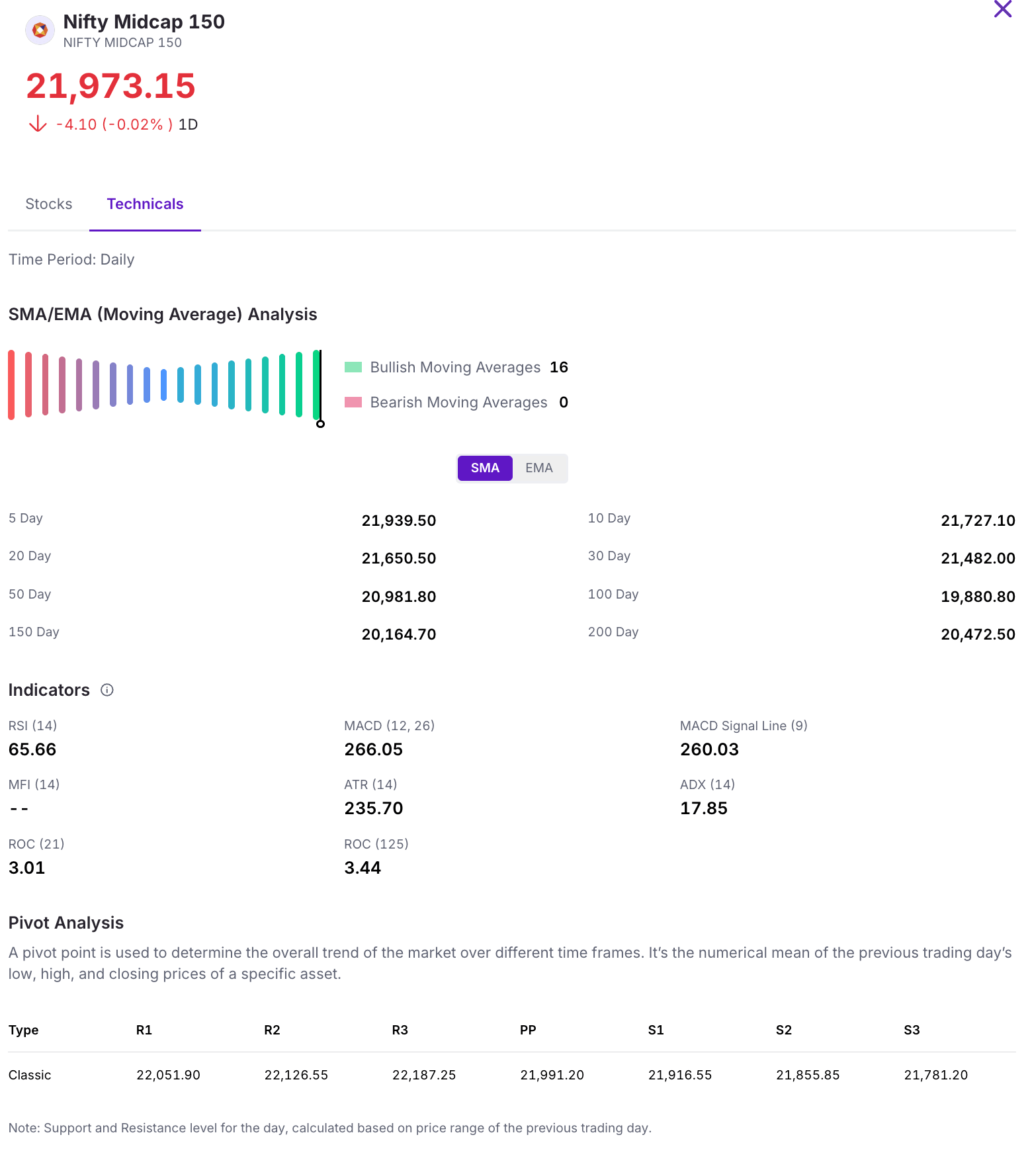

The Nifty Midcap 150 closed in the green this week, advancing by approximately 332.20 points to settle at 21,973 on Friday. Looking ahead, strong support is expected at 21,400, while resistance is at 22,000 levels, which is being tested again.

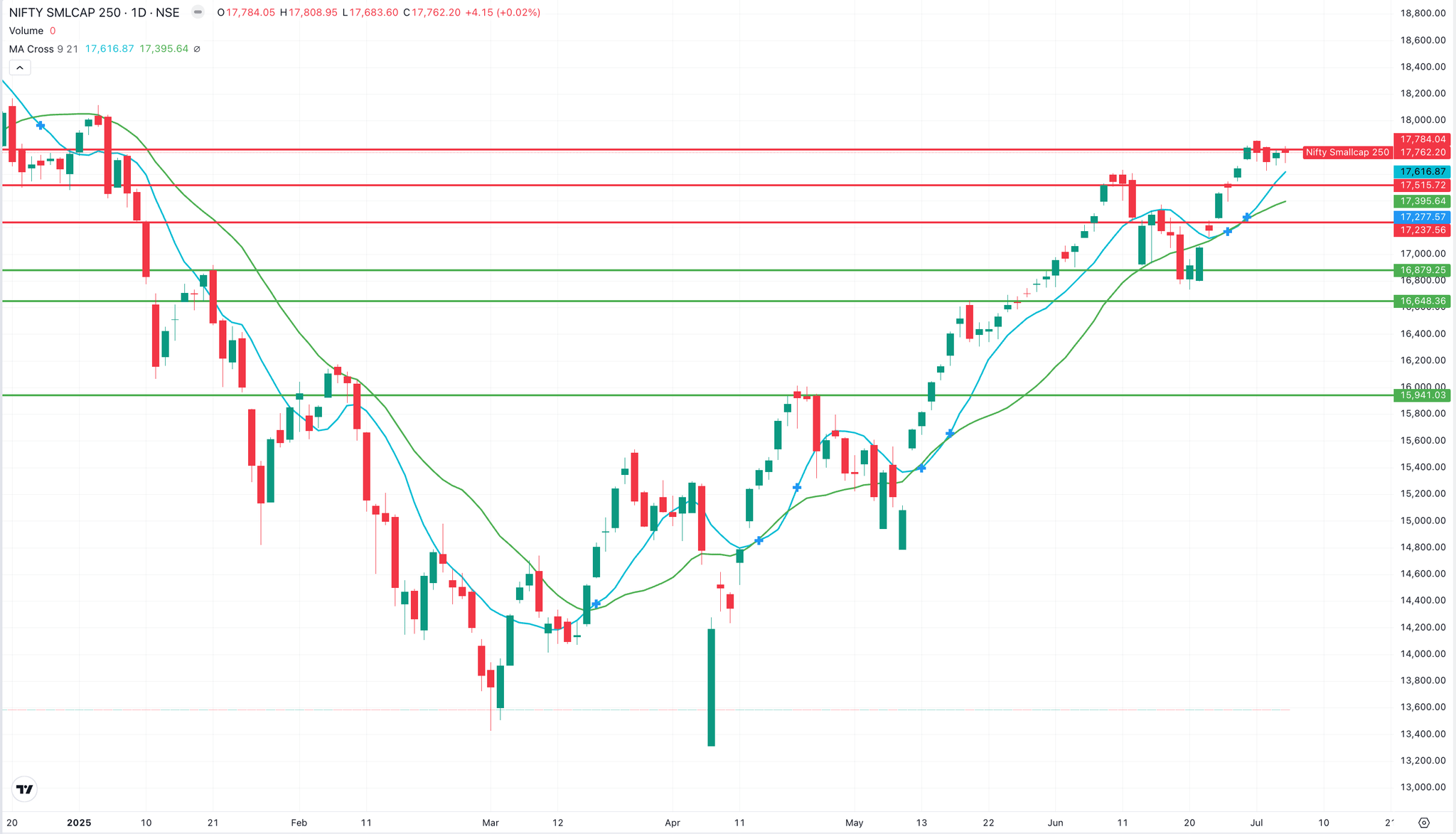

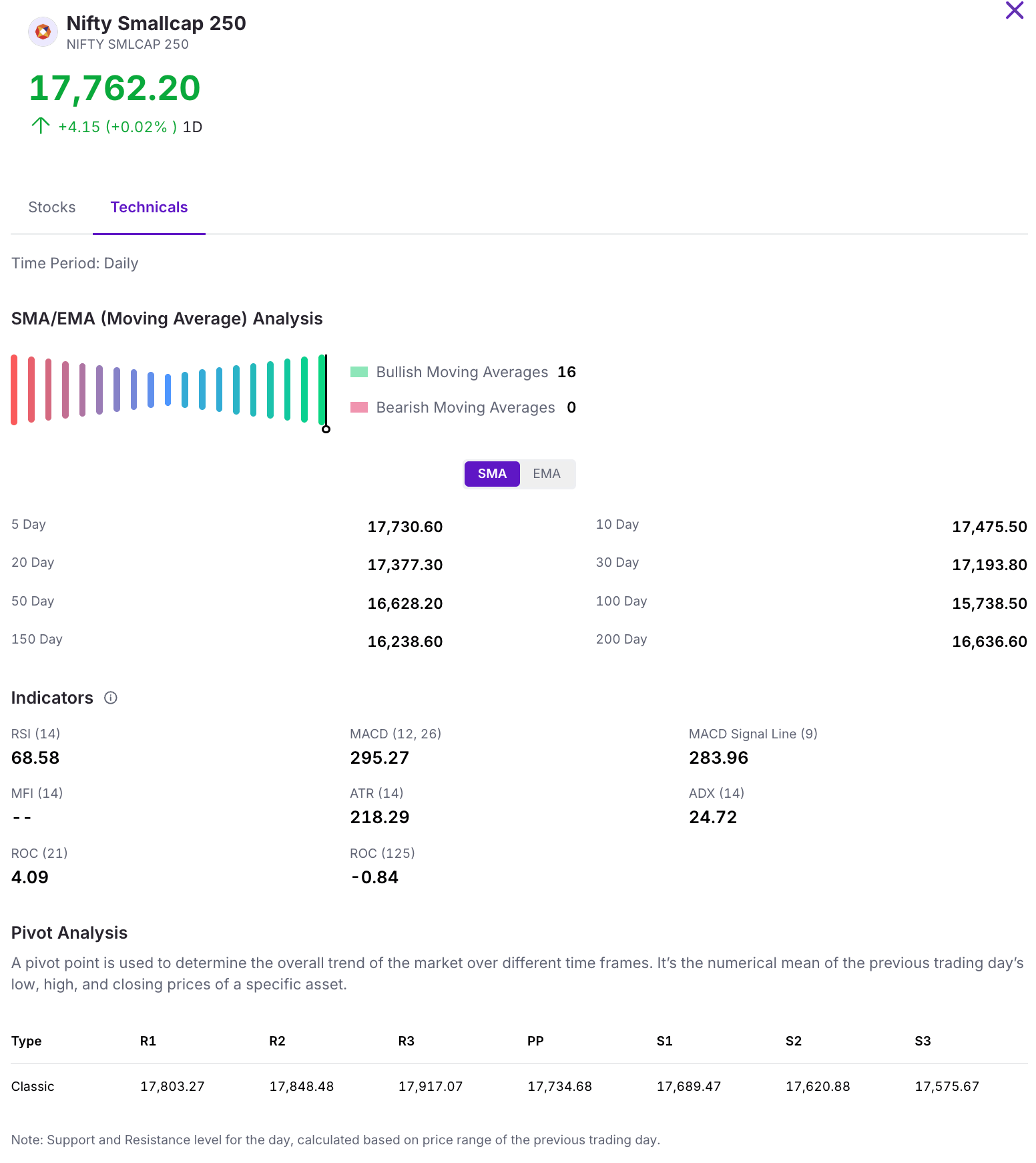

The Nifty Smallcap index posted a strong performance this week, rising 1.76% with a gain of nearly 306 points to close at 17,762. The index has solid support around the 17,500 mark, and immediate resistance is likely near the 17,800 – 18,000 level.

This Week’s Spotlight Story

A deep dive into the headline that defined market conversations

Sona Comstar Plans Local Magnet Production as Supply Risks Rise

Sona Comstar, India’s top importer of rare earth magnets, is preparing to manufacture them locally. This move aligns with the government’s upcoming incentive scheme and growing concerns over China’s export restrictions.

China supplies about 90% of the world’s rare earth magnets and recently tightened export rules.

For Sona Comstar, which imported 120 tonnes in FY24 to support EV clients like Tesla and Stellantis, the shift is both strategic and necessary.

With plans to import 200 tonnes this year, the company is directly exposed to any supply disruption.

The Indian government is now working on a scheme to promote local magnet manufacturing.

While policy details are awaited, Sona has signaled readiness to invest, leveraging its strong balance sheet and consistent cash flows.

The company has grown revenues 5x in five years and generates over 40% of its topline from the U.S.

Mining and refining rare earths is a long-cycle play, involving regulatory clearances, environmental hurdles, and complex infrastructure.

But magnet manufacturing, while still specialized, is a faster, more achievable step in the near term.

For India, which currently imports nearly all of its rare earth magnets, building domestic capacity offers a practical hedge.

Buzz

Middle East Tensions, Indian Markets at 9-Month High, RBI Cut the Repo Rate & More

Indian market indices delivered positive returns despite mid-month volatility due to Middle East tensions. India’s VIX declined from elevated levels of 15+ to more manageable ranges. The month concluded with strong momentum, driven by easing geopolitical tensions, robust domestic flows, and supportive monetary policy.

That’s a wrap for this week.

As the markets pause to catch their breath, we’ll be back next week with sharper insights and stories to help you invest intelligently.

Disclaimer and Disclosure

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887 and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst with Exchange and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC14695