Share Market Weekly

- Share.Market

- 5 min read

- 27 Jun 2025

Highlights

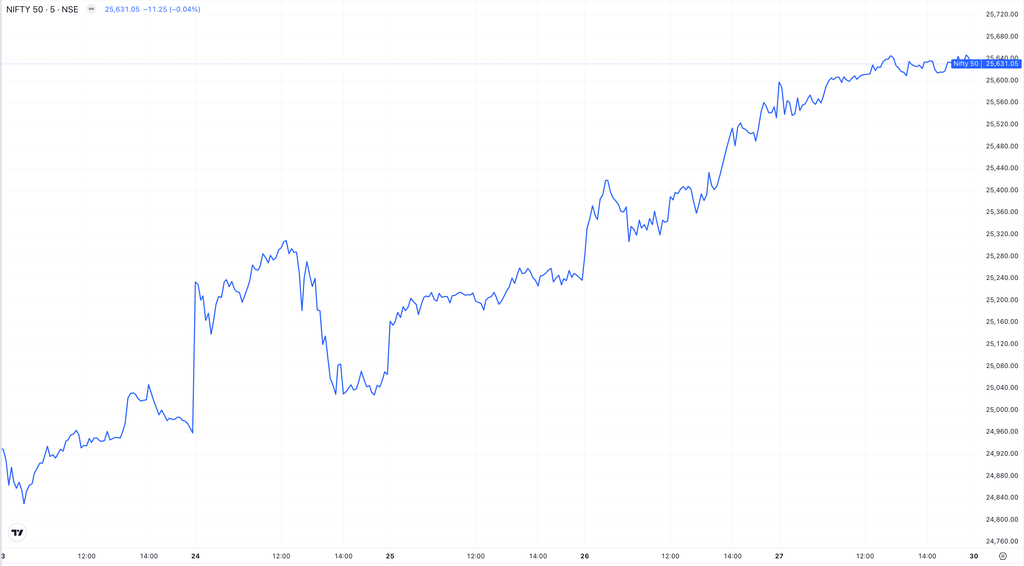

Nifty 50 25,637,80 +784.65 (+3.26%)

| Monday | – 0.56% |

| Tuesday | – 0.29% |

| Wednesday | + 0.80% |

| Thursday | + 1.21 % |

| Friday | + 0.35% |

What moved the market?

Top Gainers & Top Losers

| Nifty Realty | + 6.09% | Nifty Auto | + 2.10% |

| Nifty Infra | + 4.79% | Nifty Consumer Durables | + 1.41% |

| Nifty PSU Bank | + 4.67% | Nifty FMCG | – 2.47% |

Broader Markets this week

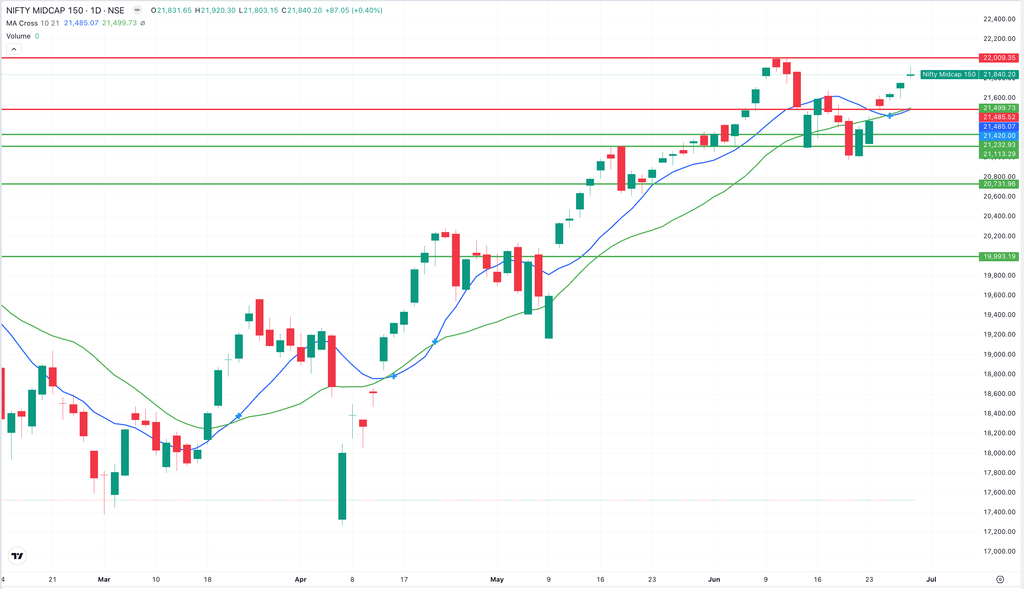

| Nifty Midcap 150 | 21,840.20 (+ 4.63%) |

| Nifty Smallcap 250 | 17,642.30 (+ 6.71%) |

| India VIX | 12.39 (- 28.30%) |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Multi Commodity Exchange of India Ltd. | 🔼 37.16% | 4/5 | 1/5 | 5/5 | 5/5 | 5/5 |

| Reliance Power Ltd. | 🔼 36.50% | 5/5 | NA | 1/5 | 2/5 | NA |

Top Losers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Ola Electric Mobility Ltd. | 🔻17.96% | 2/5 | 1/5 | 1/5 | NA | NA |

| Aditya Birla Fashion and Retail Ltd. | 🔻13.89% | 1/5 | 1/5 | 2/5 | 5/5 | 2/5 |

Technical Analysis

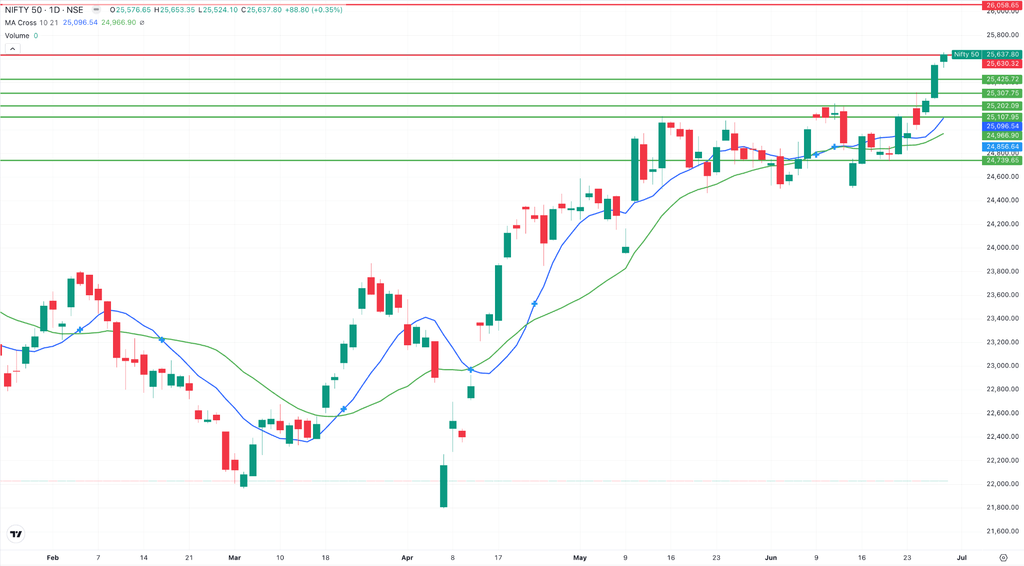

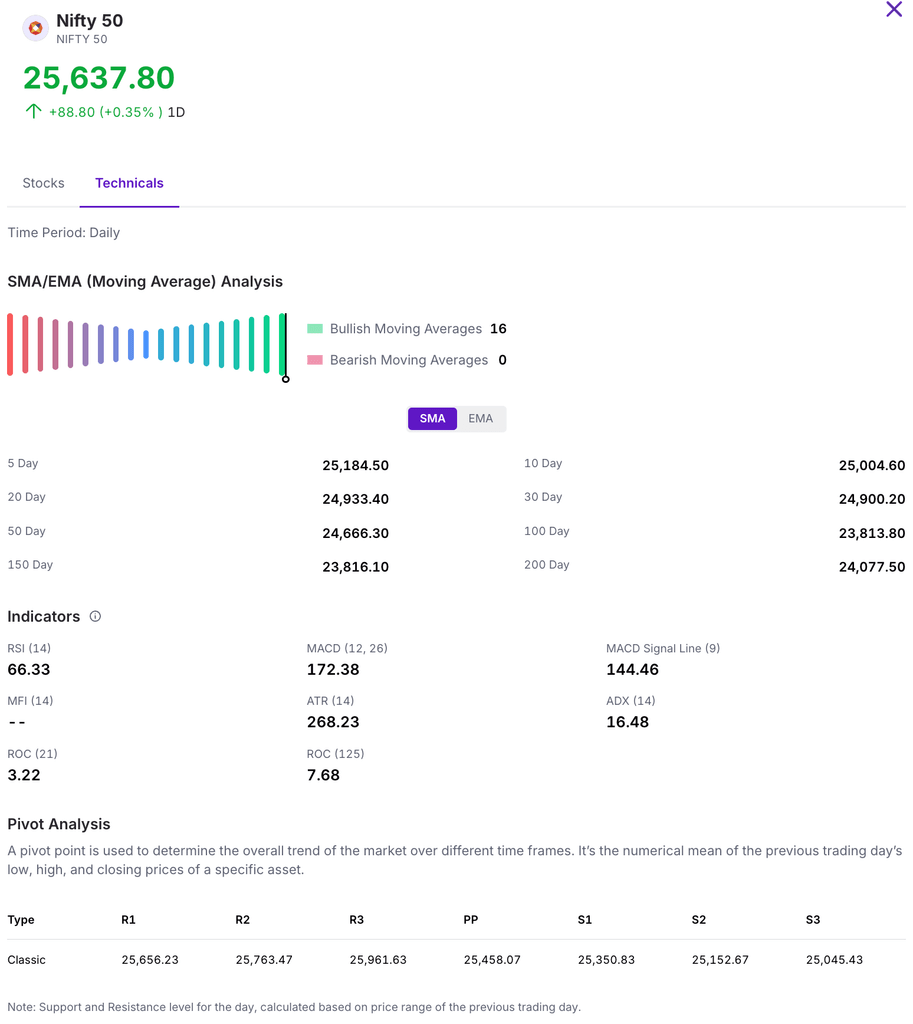

Nifty 50 closed in green this week, gaining 3.33%. The index faced a gap down on Monday but ended up moving 825 points up, closing at 25,637 on Friday.

Currently, the index seems a little overextended from its 10 and 21-day moving averages.

Looking ahead, immediate support for the Nifty 50 is seen at 25,400, while resistance is expected near the 26,000 level.

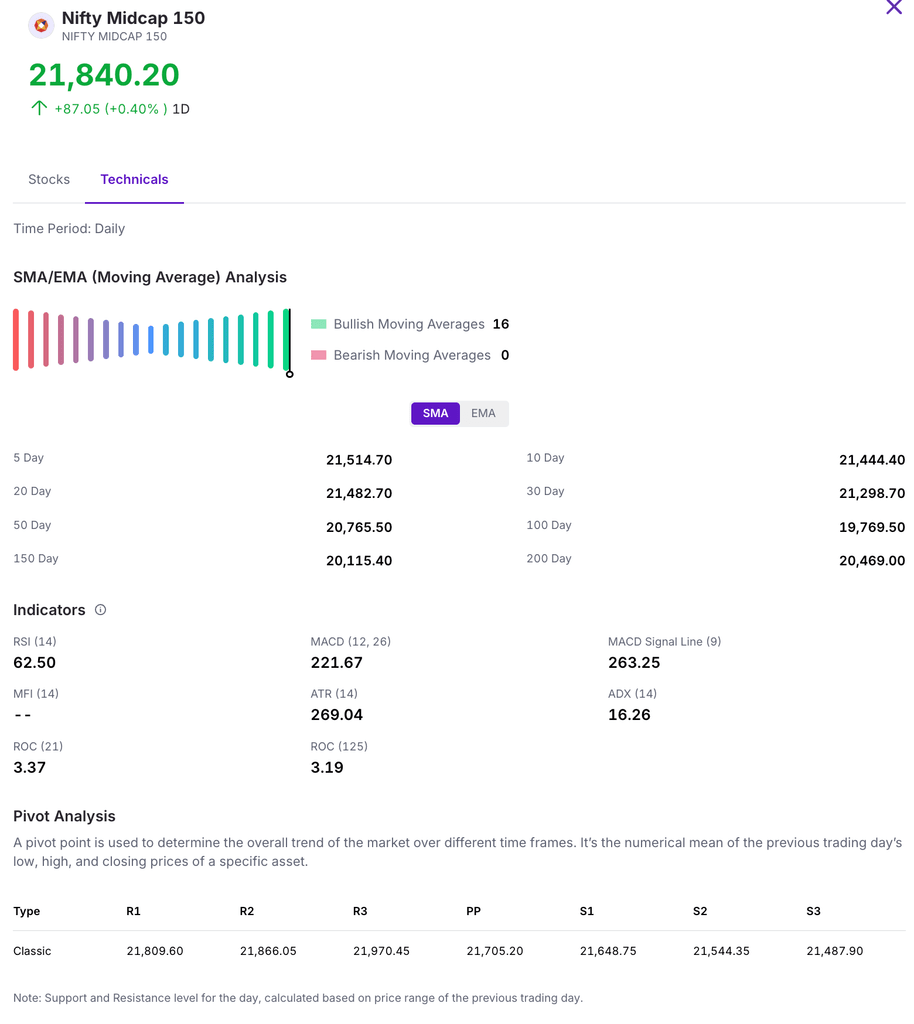

The Nifty Midcap 150 ended the week in the green, gaining approximately 480 points to close at 21,840 on Friday, which is a good 2.26% upmove compared to last week.

Looking ahead, immediate support is expected around the 21,500 mark, while resistance is likely near 22,000, a level that could be tested in the upcoming sessions.

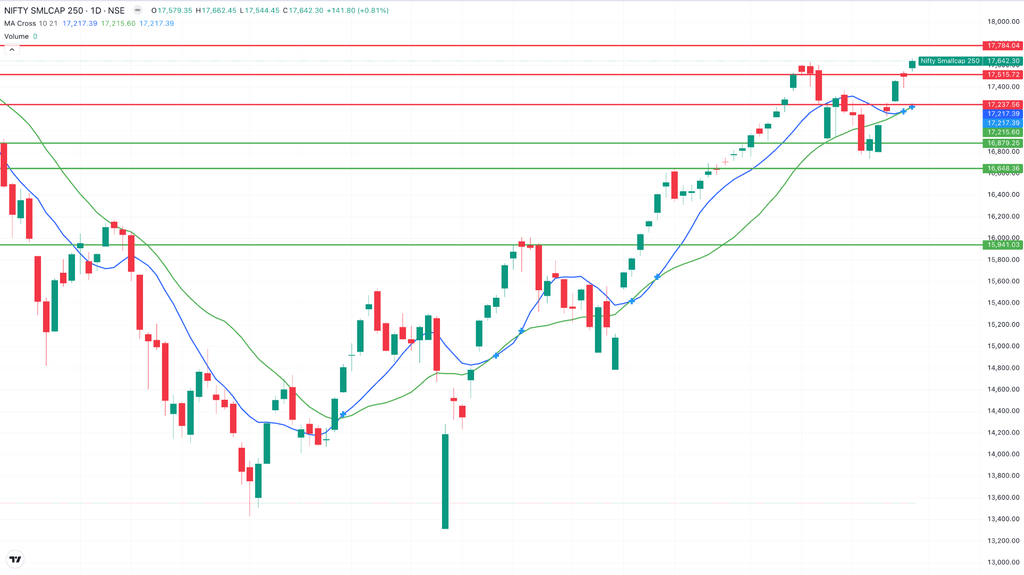

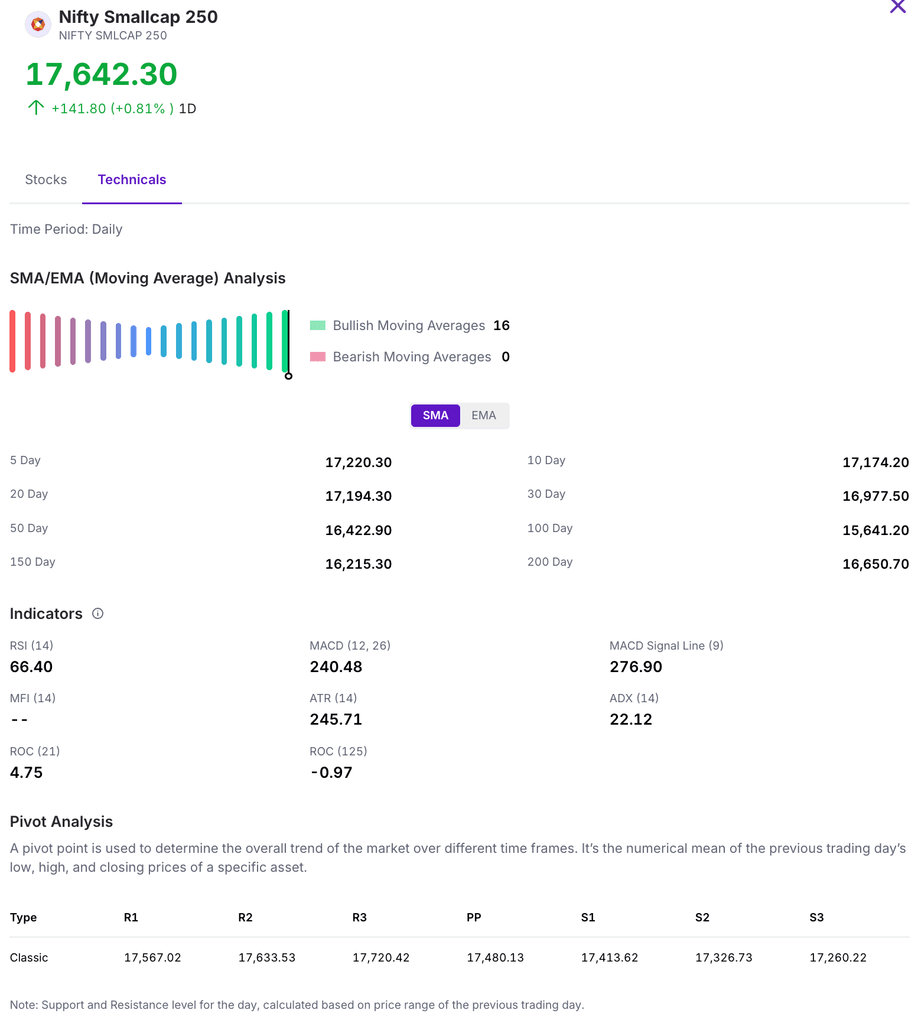

Nifty Smallcap saw a massive rally this week, gaining 2.26%. The index rose up by 481 points from the previous week’s close to settle at 17,642. The index has strong support around the 17,200 level, while immediate resistance is expected near 17,800.

This Week’s Spotlight Story

A deep dive into the headline that defined market conversations.

India Cuts Back on Indonesian Coal as Higher-Grade Imports Gain Ground

India is steadily reducing its reliance on Indonesian thermal coal, favouring higher-calorific value (CV) grades from countries like South Africa, Mozambique, Colombia, and Kazakhstan.

With global coal prices easing, energy-dense coal has become more cost-effective, delivering more output per ton and improving overall plant efficiency.

In the first five months of 2025, South Africa’s coal exports to India jumped over 26%, while Indonesian supplies dropped 14.3%, according to trade data.

Indian buyers are increasingly opting for coal that offers better heat content, even if it costs more upfront, as it reduces logistics costs and fuel consumption per unit of power generated.

China is seeing a similar trend, with more imports from Mongolia and Australia replacing Indonesian volumes.

The shift has hit Indonesia hard. Exports to both countries have dropped, and miners are now pivoting toward domestic demand. Local consumption, driven by nickel smelters, is expected to account for nearly 49% of Indonesia’s coal output this year, the highest in a decade. Smelters also offer better margins than the power sector, where coal prices are capped.

The change in trade patterns shows how both cost and energy output are shaping sourcing decisions and coal supply in Asia.

Buzz

What is a Cover Order: Meaning, Types, How it Works, & Advantages

Trade fast, stay safe! Discover how Cover Orders let you grab intraday opportunities and control losses automatically. Ready to trade smarter?

That’s a wrap for this week.

As the markets pause to catch their breath, we’ll be back next week with sharper insights and stories to help you invest intelligently.

Disclaimer and Disclosure

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887 and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst with Exchange and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954