Share Market Weekly

- Share.Market

- 5 min read

- 13 Jun 2025

Highlights

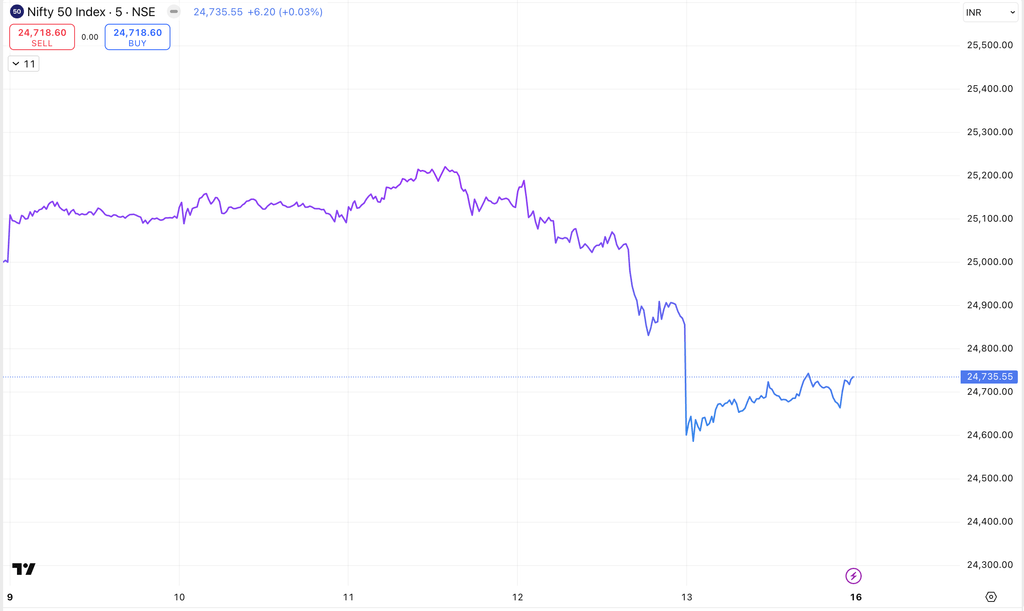

Nifty 50 24,718.60 98.40 (-0.40%)

| Monday | + 0.40% |

| Tuesday | + 0.00% |

| Wednesday | + 0.15% |

| Thursday | – 1.01% |

| Friday | – 0.68% |

What moved the market?

Top Gainers & Top Losers

| Nifty IT | + 4.15% | Nifty PSU Bank | –2.34% |

| Nifty Realty | +3.18% | Nifty FMCG | -1.81% |

| Nifty Healthcare Index | +3.14% | Nifty Consumer Durables | -0.74% |

Markets this week

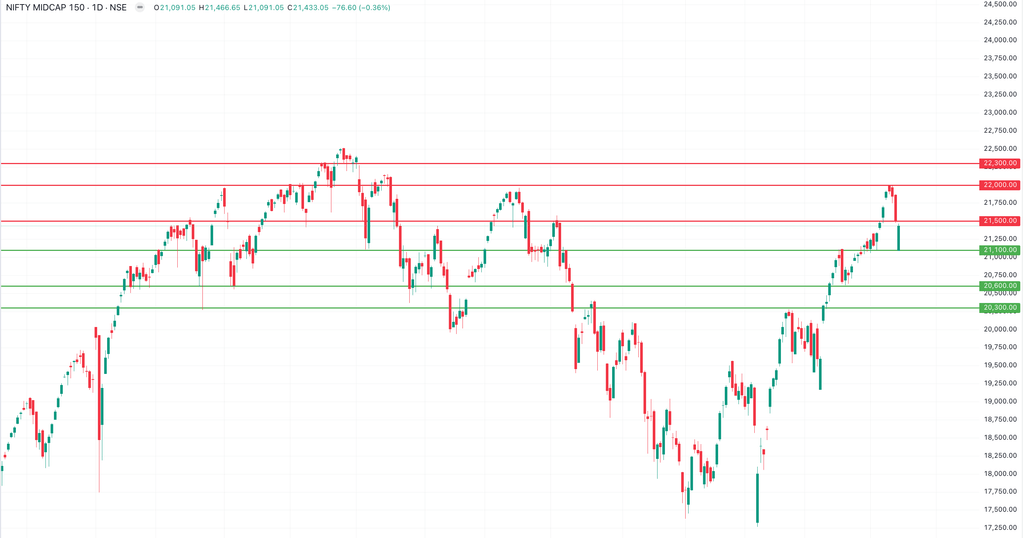

| Nifty Midcap 150 | 21,433.05 (+0.46%) |

| Nifty Smallcap 250 | 17,210.40 (+0.88%) |

| India VIX | 15.08 (-4.19%) |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| RattanIndia Enterprises Ltd. | 🔼 26.12% | 1/5 | NA | 4/5 | 3/5 | NA |

| Manappuram Finance Ltd. | 🔼 19.17% | 5/5 | 5/5 | 1/5 | 5/5 | 3/5 |

Top Losers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Jyoti CNC Automation Ltd. | 🔻 11.51% | 5/5 | 1/5 | 4/5 | 3/5 | NA |

| Netweb Technologies India Ltd. | 🔻 10.73% | 2/5 | 1/5 | 5/5 | 3/5 | NA |

Technical Analysis

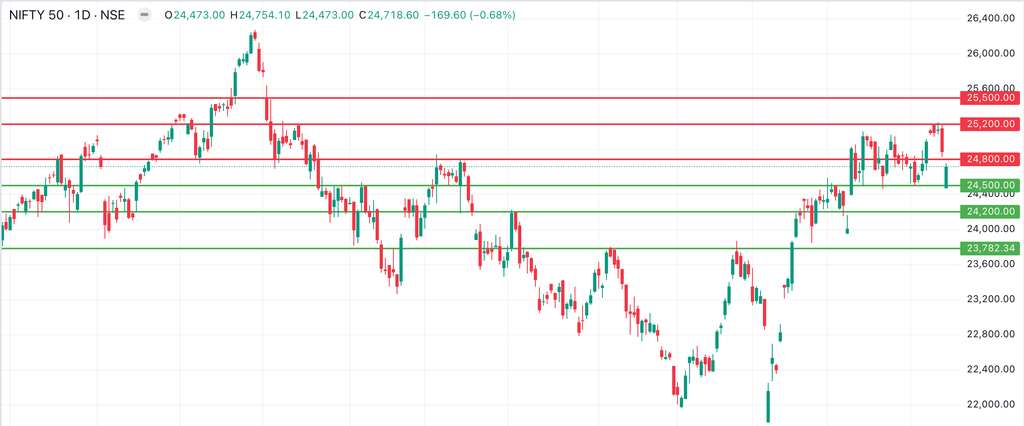

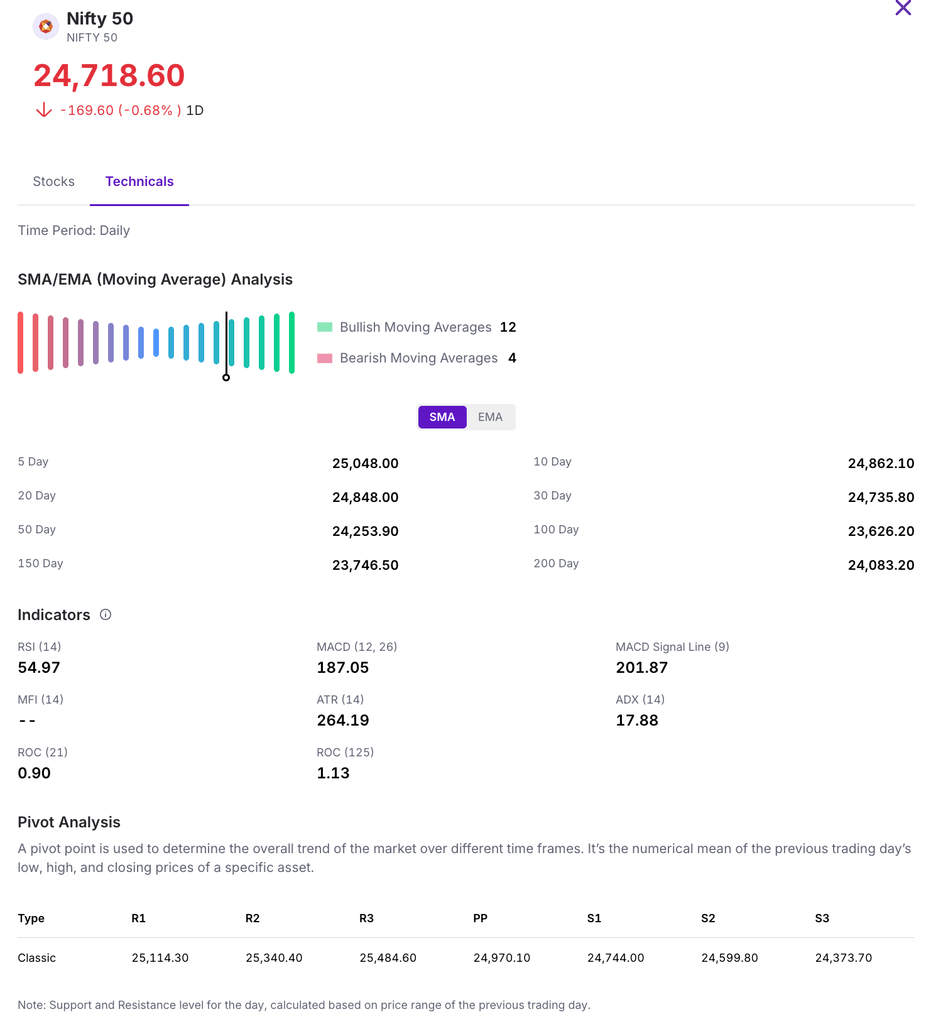

The Nifty 50 declined by 1.14% this week, losing 284.45 points to close at 24,718.60. The index found support around the 24,500 level and closed below its 20-day Simple Moving Average (SMA), signaling weakness in market momentum.

Looking ahead, the Nifty 50 has immediate support at 24,500, while resistance is expected near the 24,800 mark.

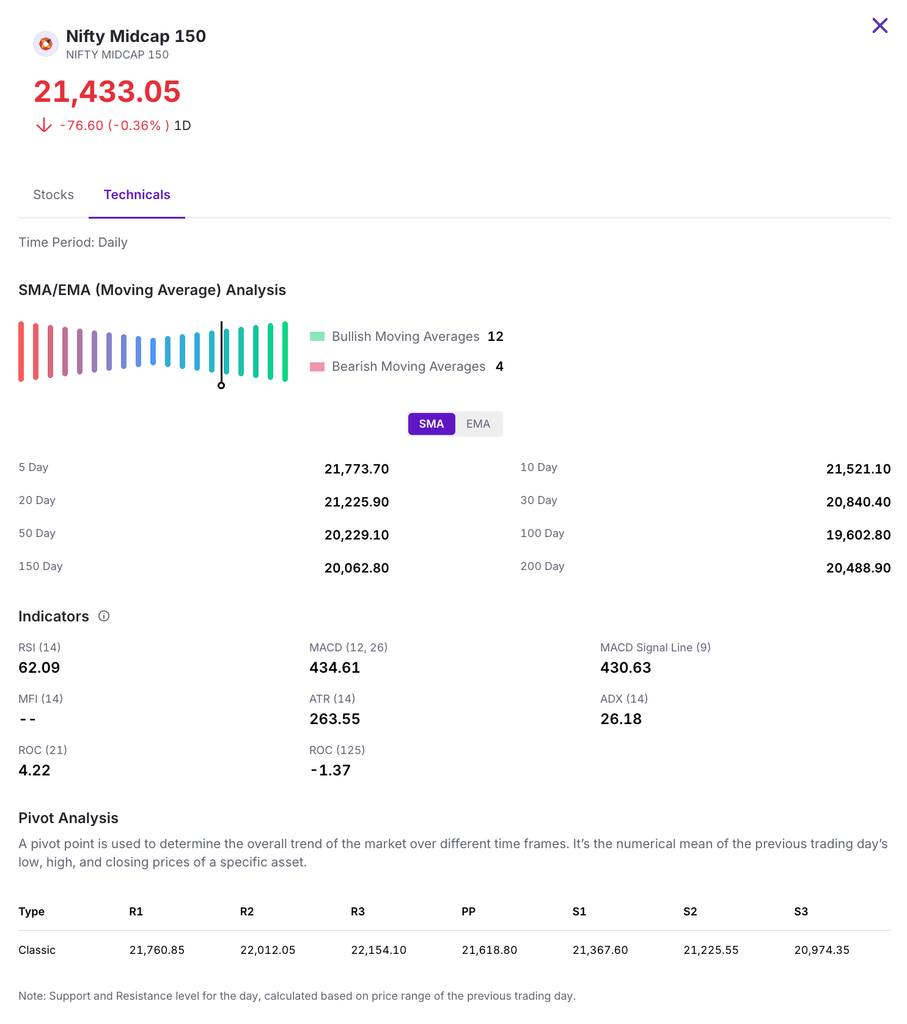

The Nifty Midcap 150 ended the week in the red, declining by approximately 255.55 points to close at 21,433.05 on Friday.

Looking ahead, immediate support is expected in the 21,000–21,100 range, while resistance is likely between 21,500 and 21,600, which could be tested in the upcoming sessions.

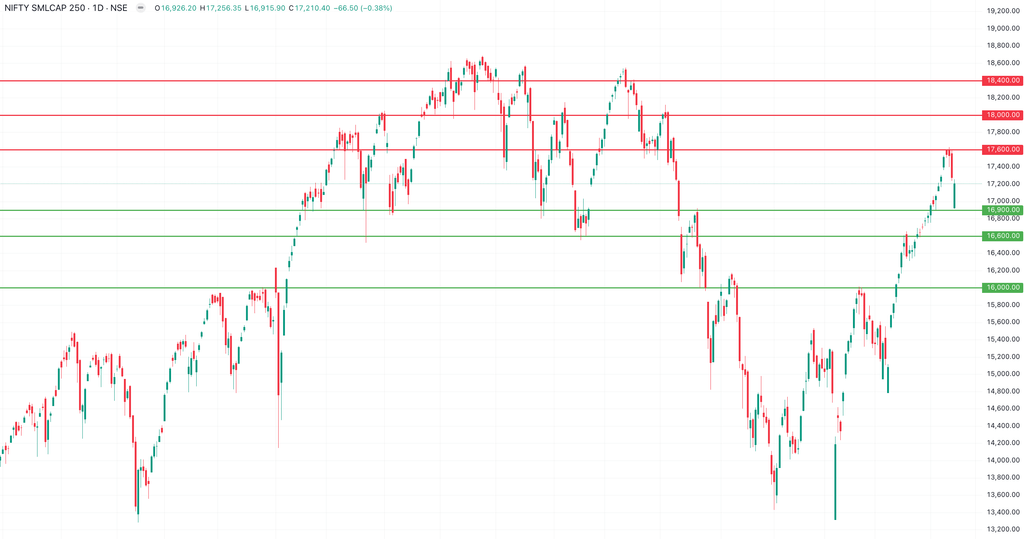

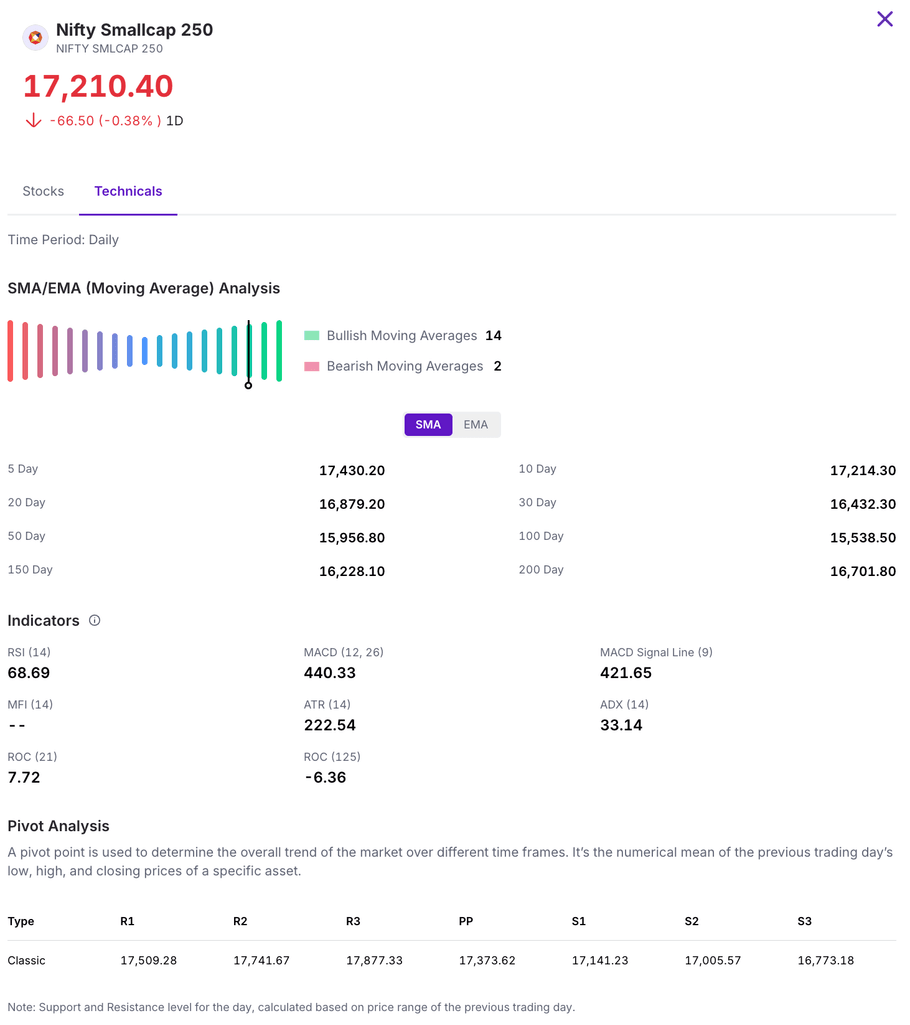

The Nifty Smallcap index remained in consolidation this week, slipping 0.44% with a decline of nearly 75 points from the previous week’s close, to settle at 17,210.40. The index has strong support around the 16,900 level, while immediate resistance is expected near 17,600.

This Week’s Spotlight Story

A deep dive into the headline that defined market conversations.

India’s Inflation Drops to Six-Year Low in May

India’s retail inflation fell to 2.82% in May 2025, its lowest level since February 2019.

This marks the fourth straight month inflation has stayed below the Reserve Bank of India’s 4% target.

Food inflation cooled sharply to just 0.99%, thanks to lower prices for vegetables, pulses, cereals, fruits, and household goods.

Both rural and urban areas saw similar declines. Experts credit the drop to a favorable base effect, subdued global commodity prices, and recent government measures.

With inflation easing, the RBI is expected to keep rates steady in the near term as it balances growth and price stability

Buzz

The Role of Doji Candlesticks in Identifying Trend Reversals

Doji candlestick patterns are a key component of technical analysis, often signaling market indecision and potential trend reversals. This article explores their formation, variations, and practical application in stock trading, evaluating their effectiveness in predicting market shifts.

That’s a wrap for this week.

As the markets pause to catch their breath, we’ll be back next week with sharper insights and stories to help you invest intelligently.

Disclaimer and Disclosure

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887 and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst with Exchange and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954