Share Market Weekly

- Share.Market

- 4 min read

- 30 May 2025

30th May 2025

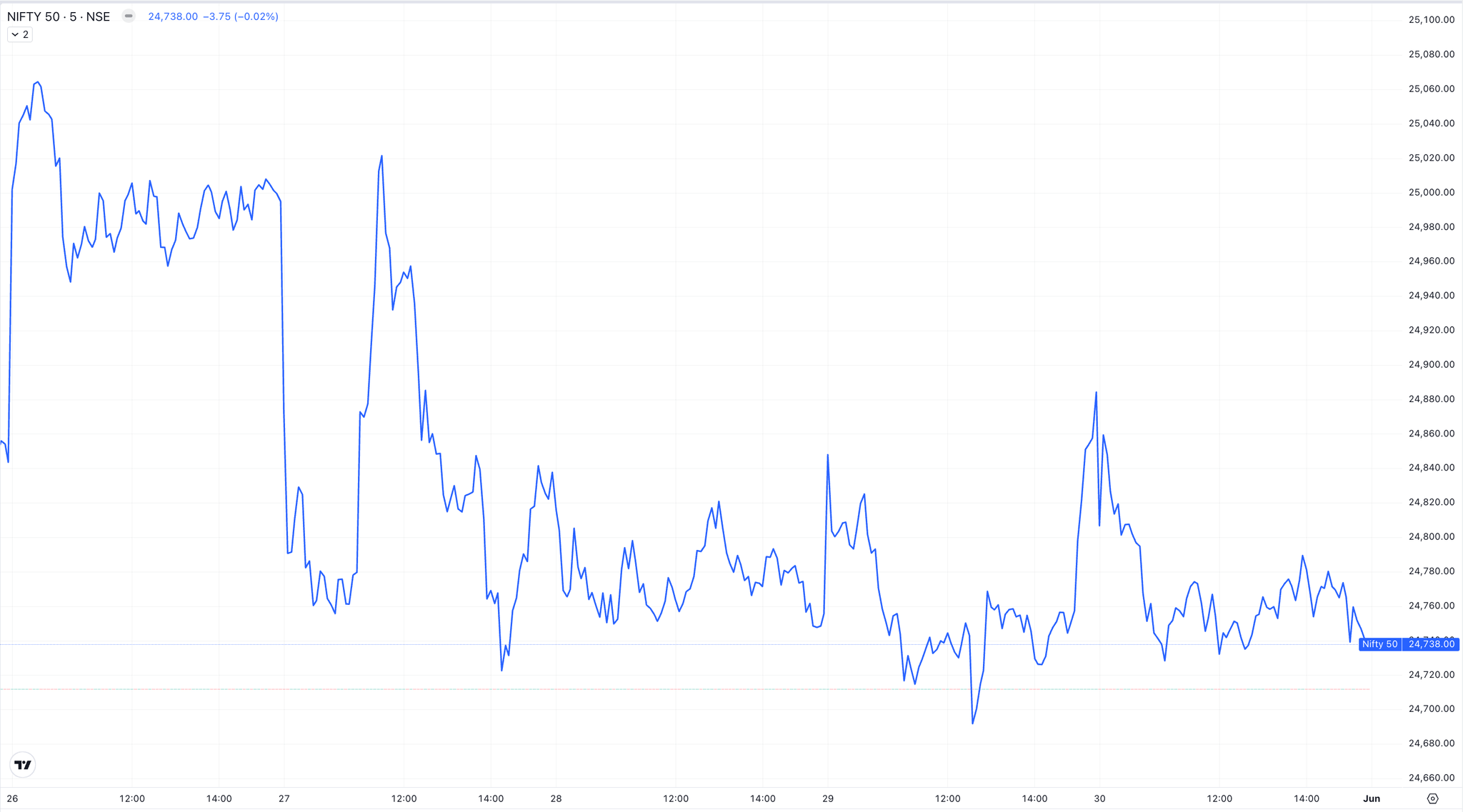

Nifty 50 24,750.70 62.75 (-0.25%)

| Monday | + 0.60% |

| Tuesday | – 0.70% |

| Wednesday | – 0.30% |

| Thursday | + 0.33 % |

| Friday | – 0.33% |

What moved the market?

6 sectors

| Nifty PSU Bank | +4.01% | Nifty FMCG | –2.00% |

| Nifty Media | +3.36% | Nifty Commodities | -1.81% |

| Bank Nifty | +1.22% | Nifty Consumer Durables | -1.59% |

Markets this week

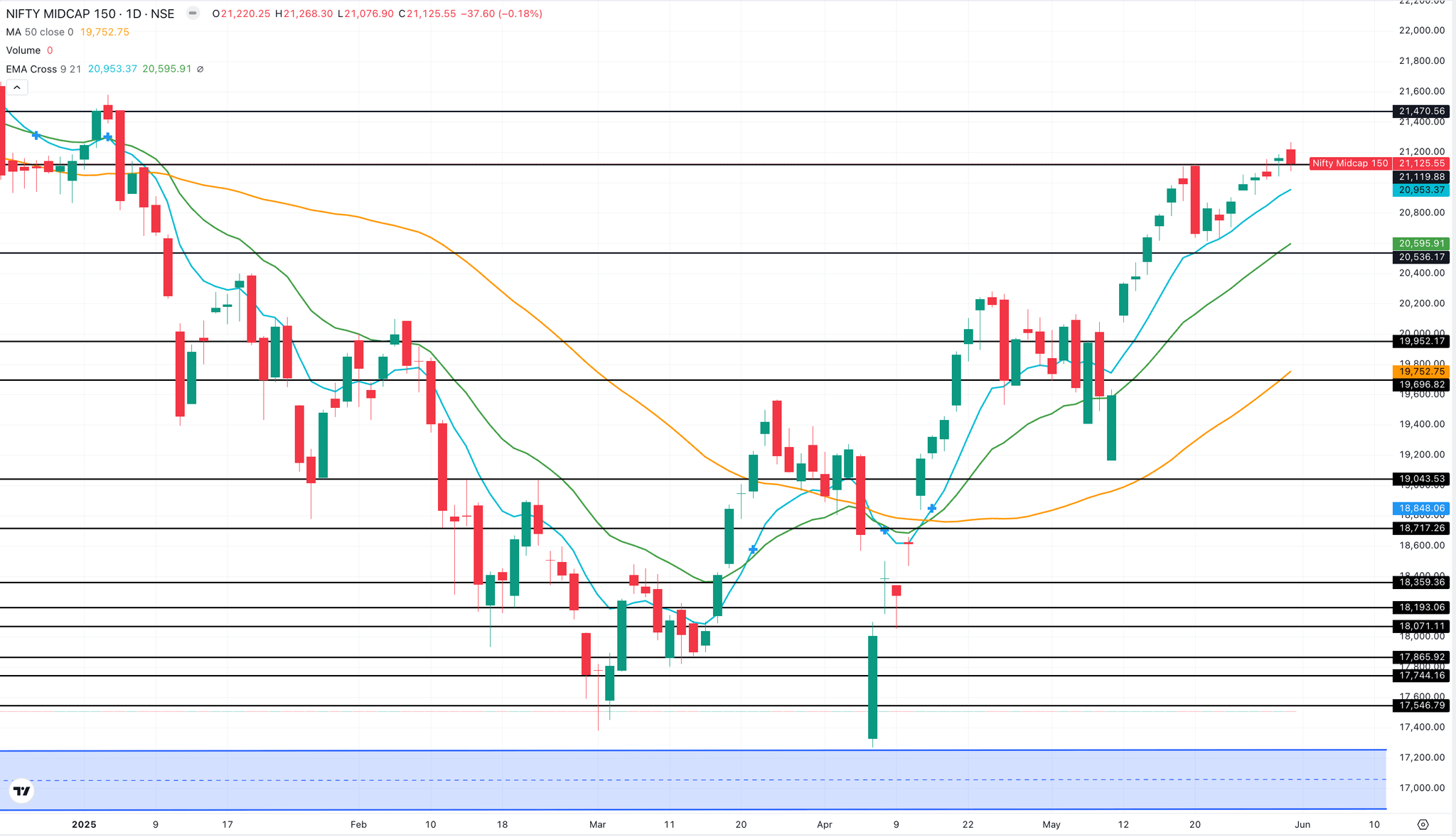

| Nifty Midcap 150 | 21,125 (+1.42%) |

| Nifty Smallcap 250 | 16,833 (+2.41%) |

| India VIX | 16.08 (-8.38%) |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| MMTC | 🔼 40.12% | 2/5 | NA | 5/5 | 2/5 | NA |

| IFCI | 🔼 35.06% | 3/5 | NA | 1/5 | 1/5 | NA |

Top Losers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Welpsum Living | 🔻12.31% | 3/5 | 4/5 | 4/5 | 4/5 | NA |

| Gujarat Fluorochemicals | 🔻11.89% | 4/5 | 1/5 | 3/5 | 5/5 | 3/5 |

Technical Analysis

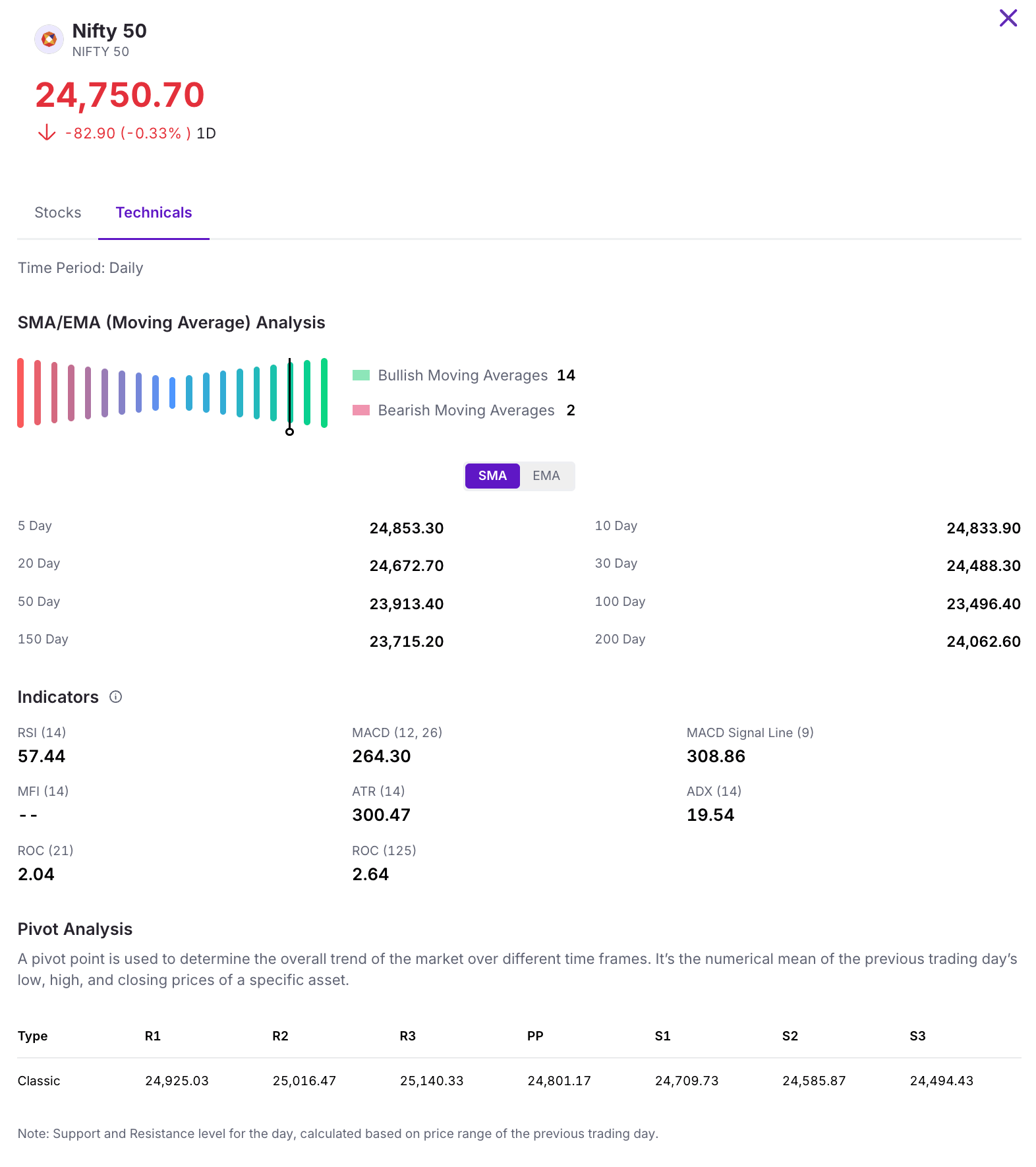

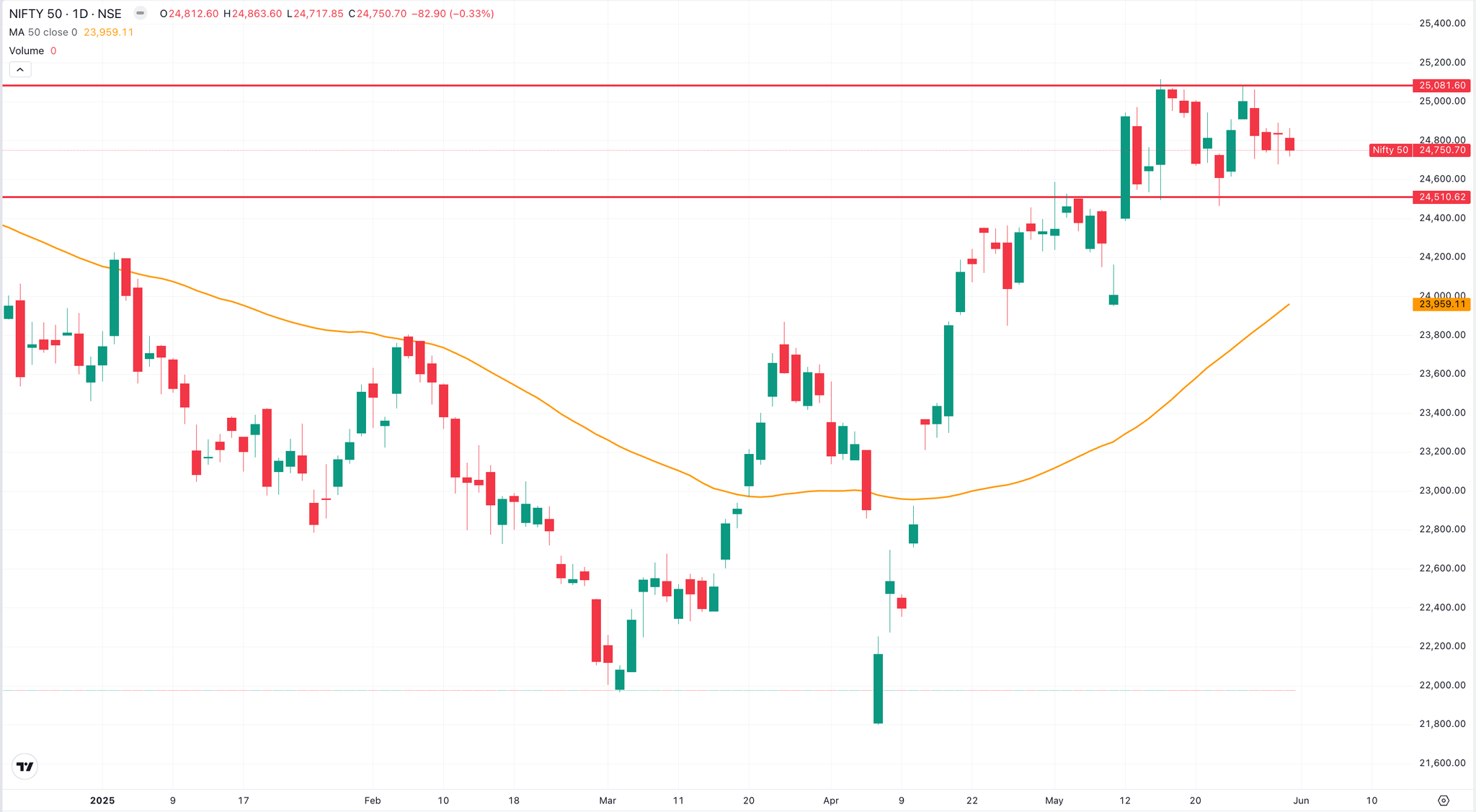

Nifty 50

The Nifty 50 dipped modestly by 0.25% this week, shedding 62.75 points to close at 24,750.70. It found support at the 9-day moving average, suggesting underlying strength. Looking ahead, the index has key support at 24,500 and faces resistance near the 25,000 mark.

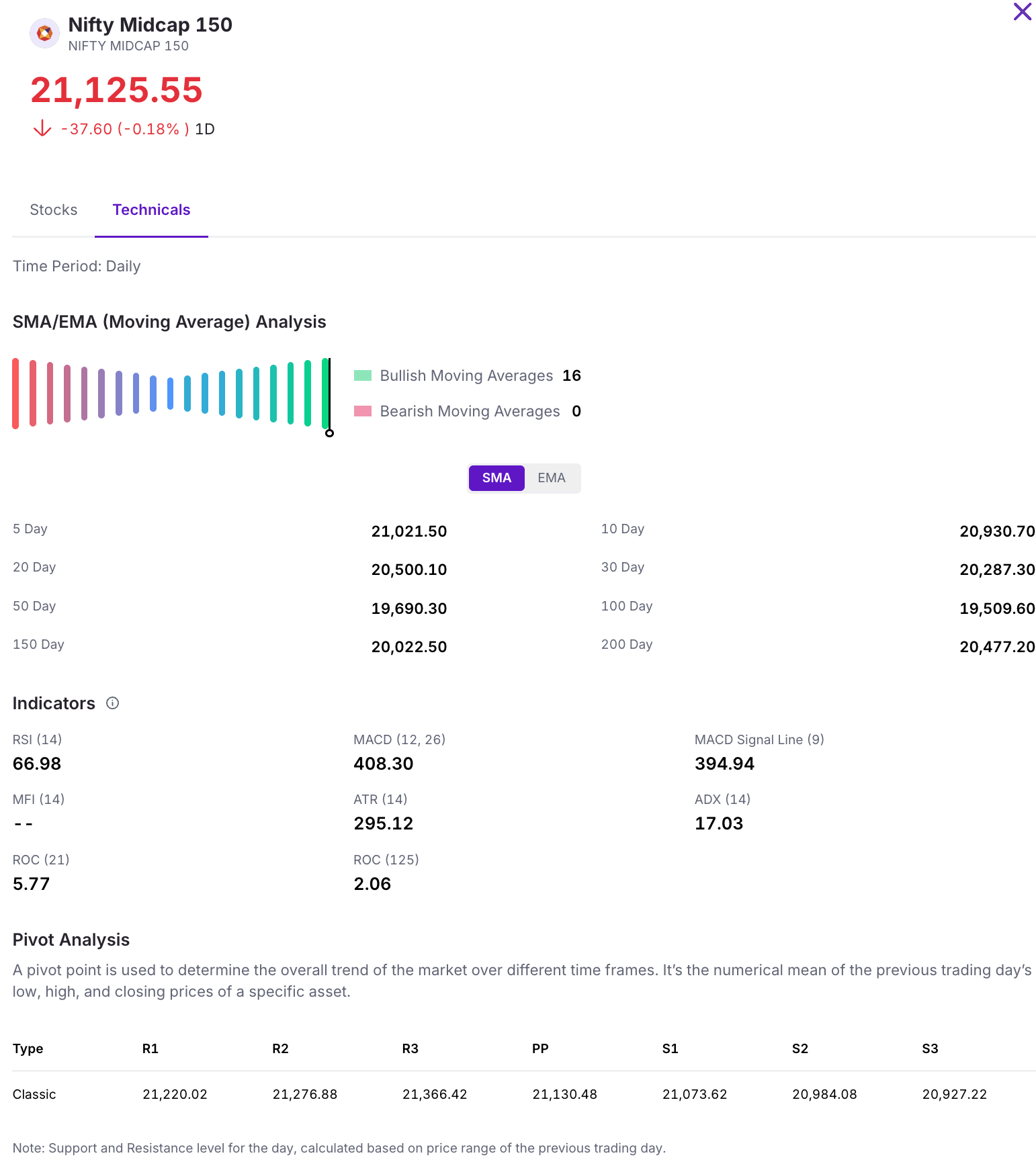

Nifty Midcap 150

The Nifty Midcap 150 closed in the green this week, advancing by approximately 296 points to settle at 21,125.55 on Friday. Going forward, strong support is expected in the 20,300–20,500 range, while resistance is seen between 21,400 and 21,600 levels that could be tested in the upcoming sessions.

Nifty Smallcap 250

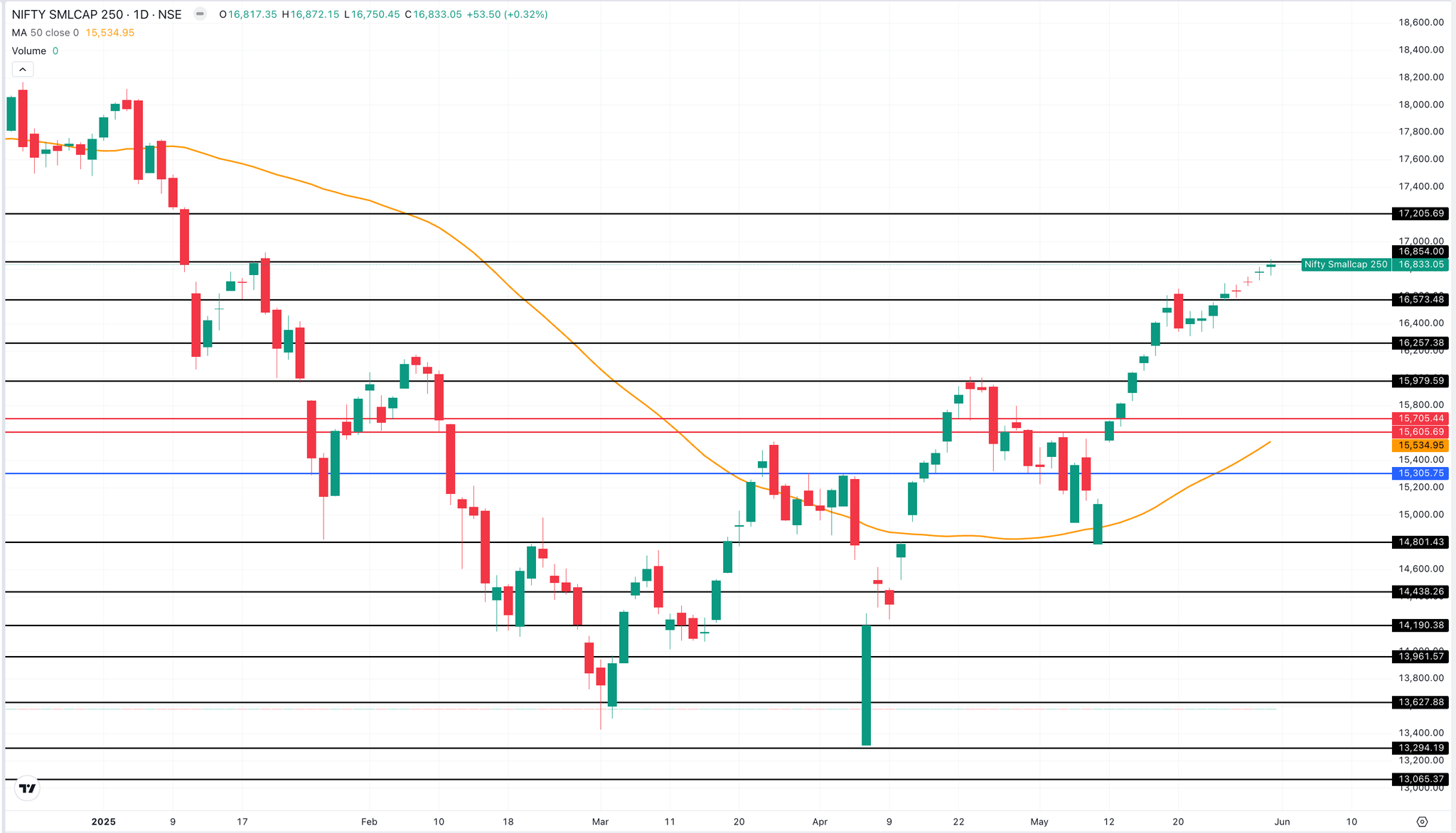

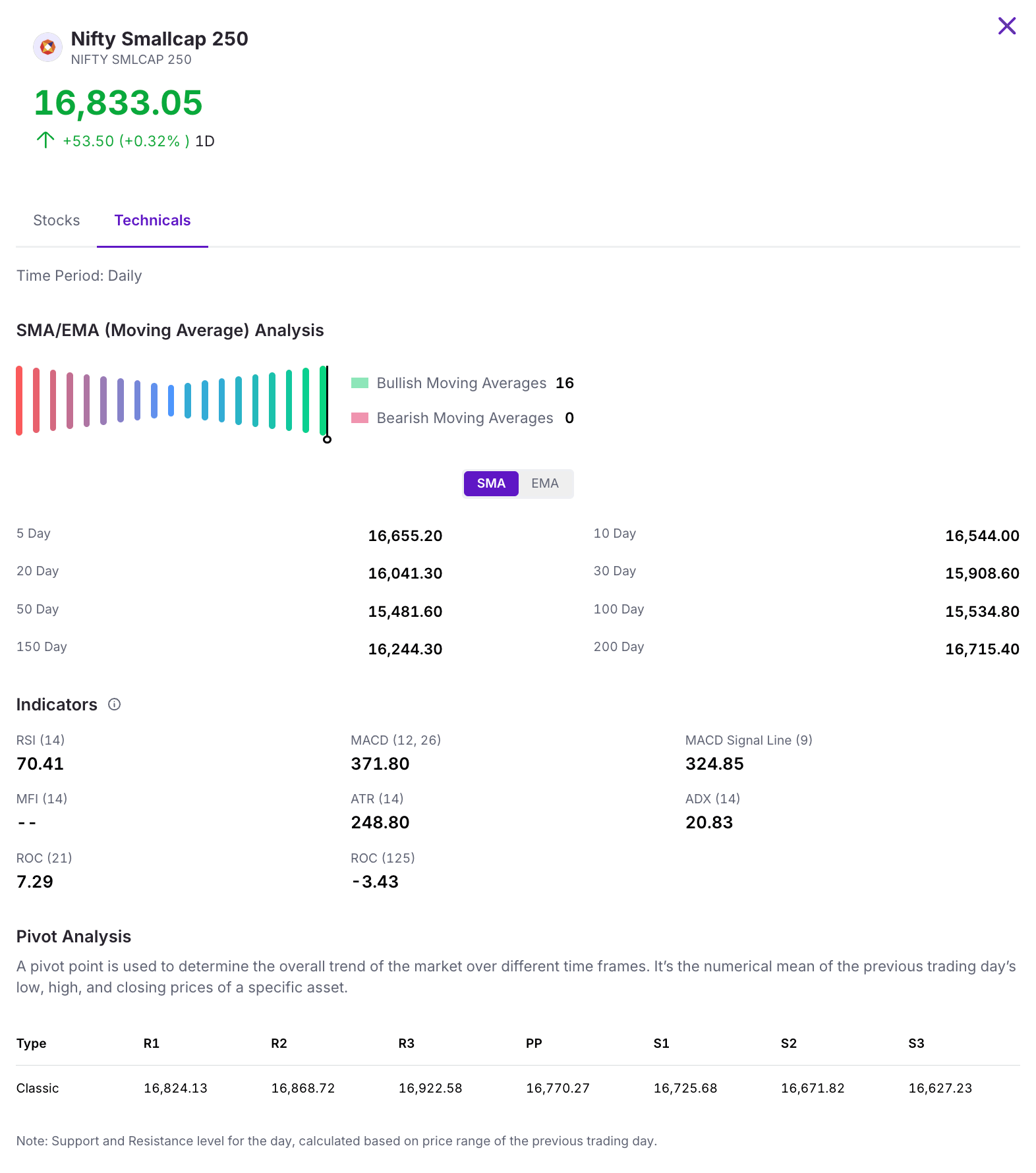

The Nifty Smallcap index posted a strong performance this week, rising 2.41% with a gain of nearly 395 points to close at 16,833. The index has solid support around the 16,500 level and is likely to encounter immediate resistance near 17,000.

This Week’s Spotlight Story

A deep dive into the headline that defined market conversations.

Rare Earth Metals Emerge as a Key Watchpoint for Automakers

Rare earth metals have emerged as one of the most strategic inputs in modern manufacturing, critical to technologies ranging from electric motors to advanced electronics. China controls over 90% of global processing capacity. Recent export restrictions by China have reignited concerns about the stability of global supply chains for companies betting on electric mobility.

Amid rising uncertainty, automakers have reached out to the Prime Minister’s Office and key ministries. They are urging the government to address the rare earth magnet issue at the policy level. This reflects how serious and critical the supply chain risk has become.

These global pressures are now showing up in company updates. In its latest quarterly results, Bajaj Auto said that delays in getting rare earth magnets from China could affect its electric vehicle production. If the supply doesn’t improve soon, the company warned that EV production could be hit as early as July.

Interestingly, this caution comes alongside a strong financial performance for the January–March 2025 quarter. Bajaj Auto reported a net profit of ₹1,801 crore, beating estimates. This growth was primarily driven by a 14% rise in motorcycle exports and favorable forex movements. The company’s overall revenue from operations rose 9% QoQ to ₹12,646 crore, with total vehicle sales across two- and three-wheelers, up around 4%.