Share Market Weekly

- Share.Market

- 5 min read

- 09 May 2025

09th May 2025

Nifty 50 24,008.00 -265.80 (-1.10% )

| Monday | +0.47% |

| Tuesday | -0.33% |

| Wednesday | +0.14% |

| Thursday | -0.58% |

| Friday | -1.10% |

What moved the market?

| Nifty Media | 1.80% | Nifty Realty | -7.01% |

| Nifty Auto | +1.43% | Nifty PSU Bank | -4.22% |

| Nifty IT | +0.24 | Nifty Pharma | -3.22% |

Markets this week

| Nifty Midcap 150 | 19,596.25 (- 1.39%) |

| Nifty Smallcap 250 | 15,080.45 (- 1.82%) |

| India VIX | 21.63 (+ 18.72%) |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| KPR Mill | 🔼 30.99% | 5/5 | 2/5 | 4/5 | 5/5 | 4/5 |

| CCL Products India | 🔼 22.29% | 3/5 | 3/5 | 4/5 | 5/5 | 5/5 |

Top Losers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Jindal Saw | 🔻18.68% | 2/5 | 5/5 | 3/5 | 4/5 | NA |

| Sonata Software | 🔻13.25% | 1/5 | 4/5 | 4/5 | 4/5 | 1/5 |

Technical Analysis

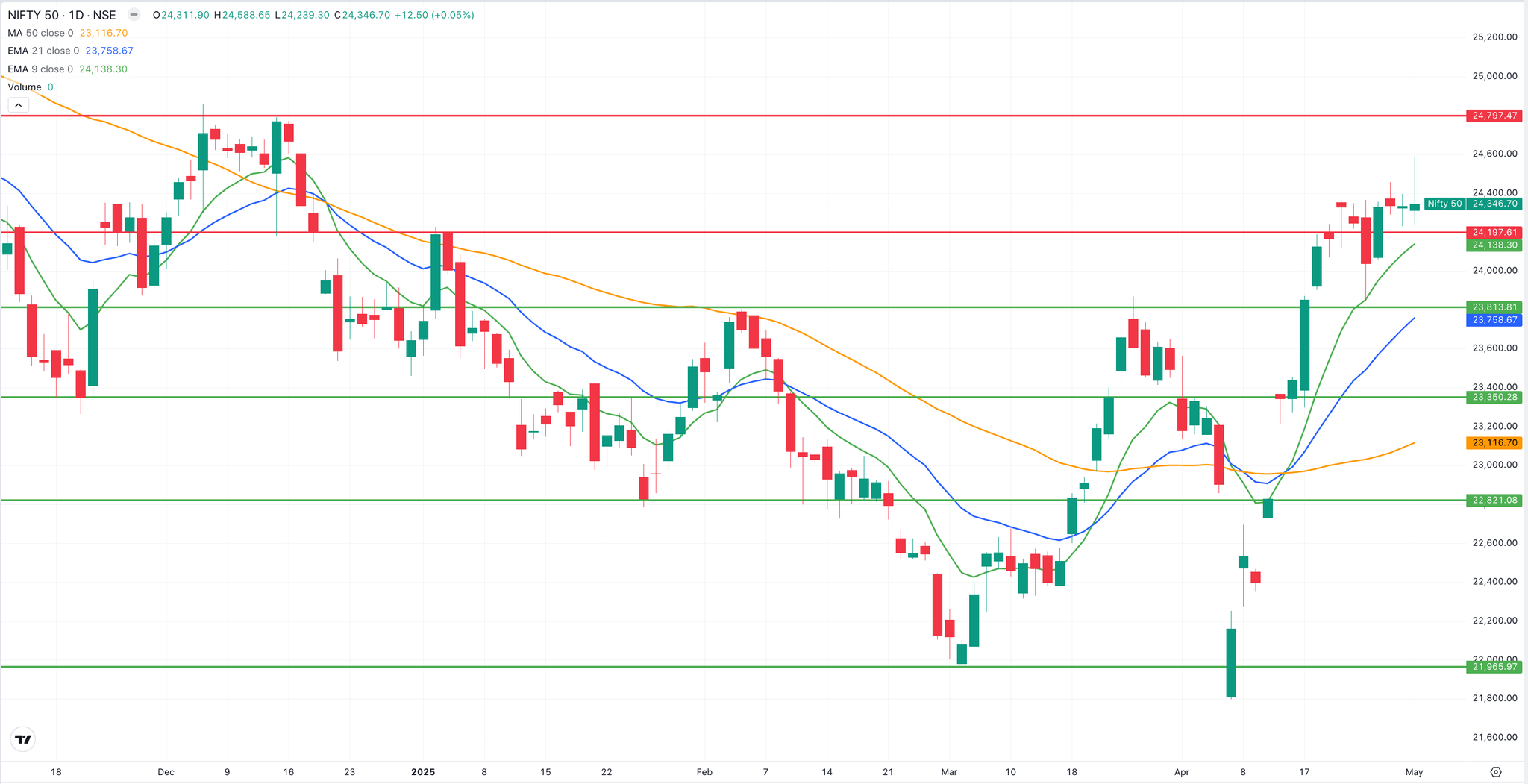

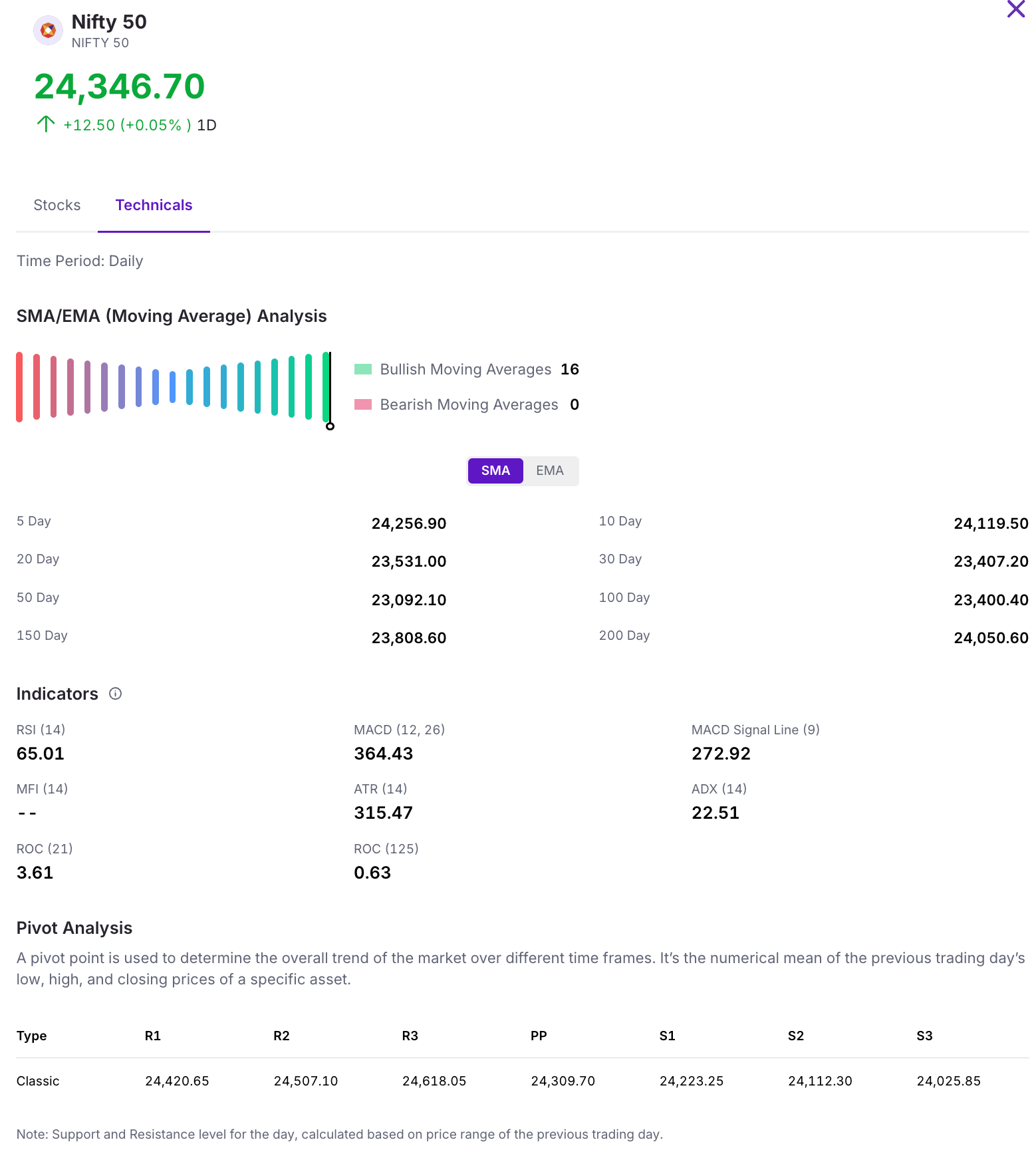

Nifty 50

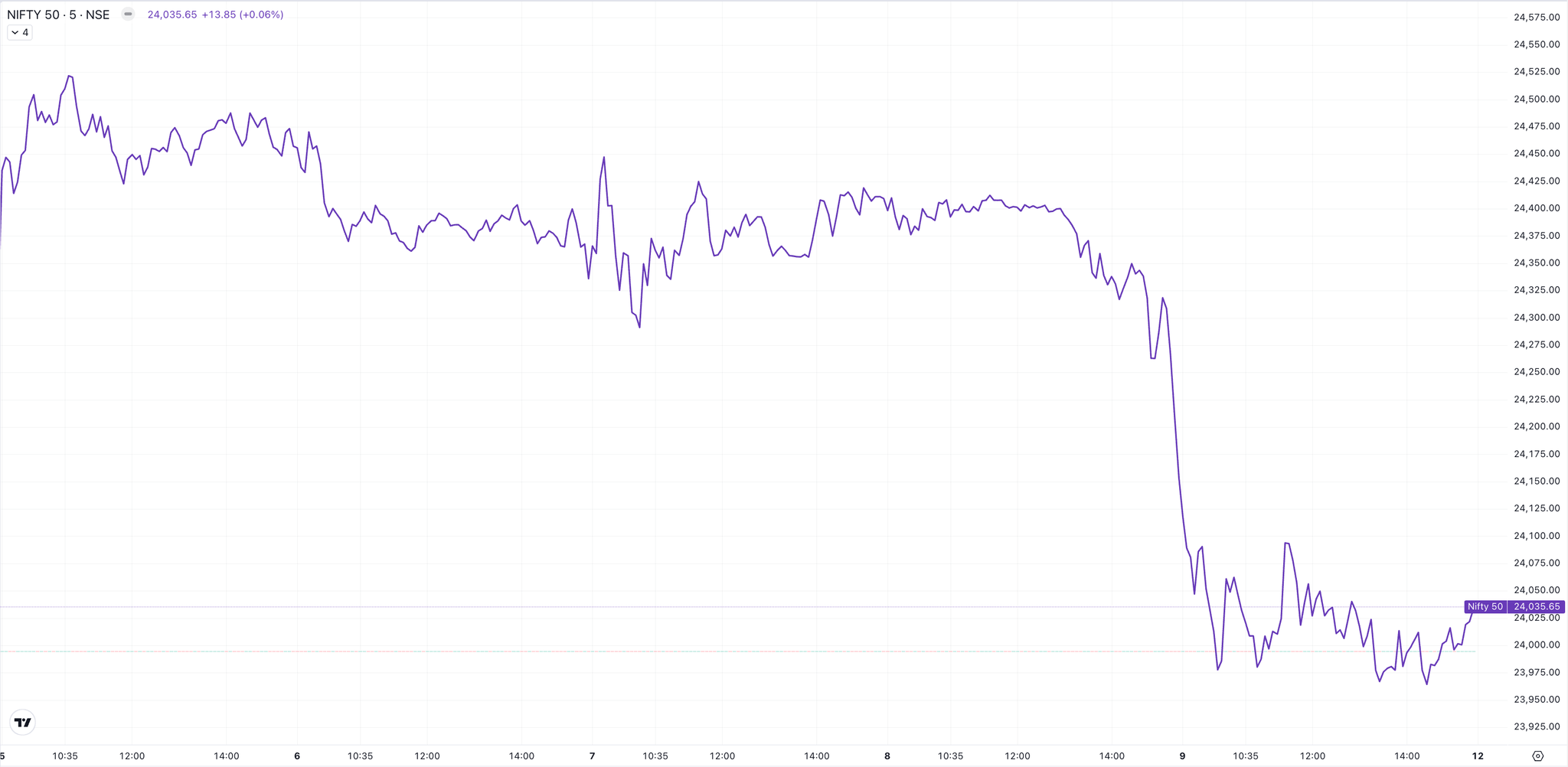

The Nifty 50 fell by 1.34% this week, shedding 326 points. The index found support at its 21-day moving average. This decline followed an eventful week marked by heightened geopolitical tensions, including the Indo-Pak conflict and the launch of Operation Sindoor. The market reacted sharply to these developments.

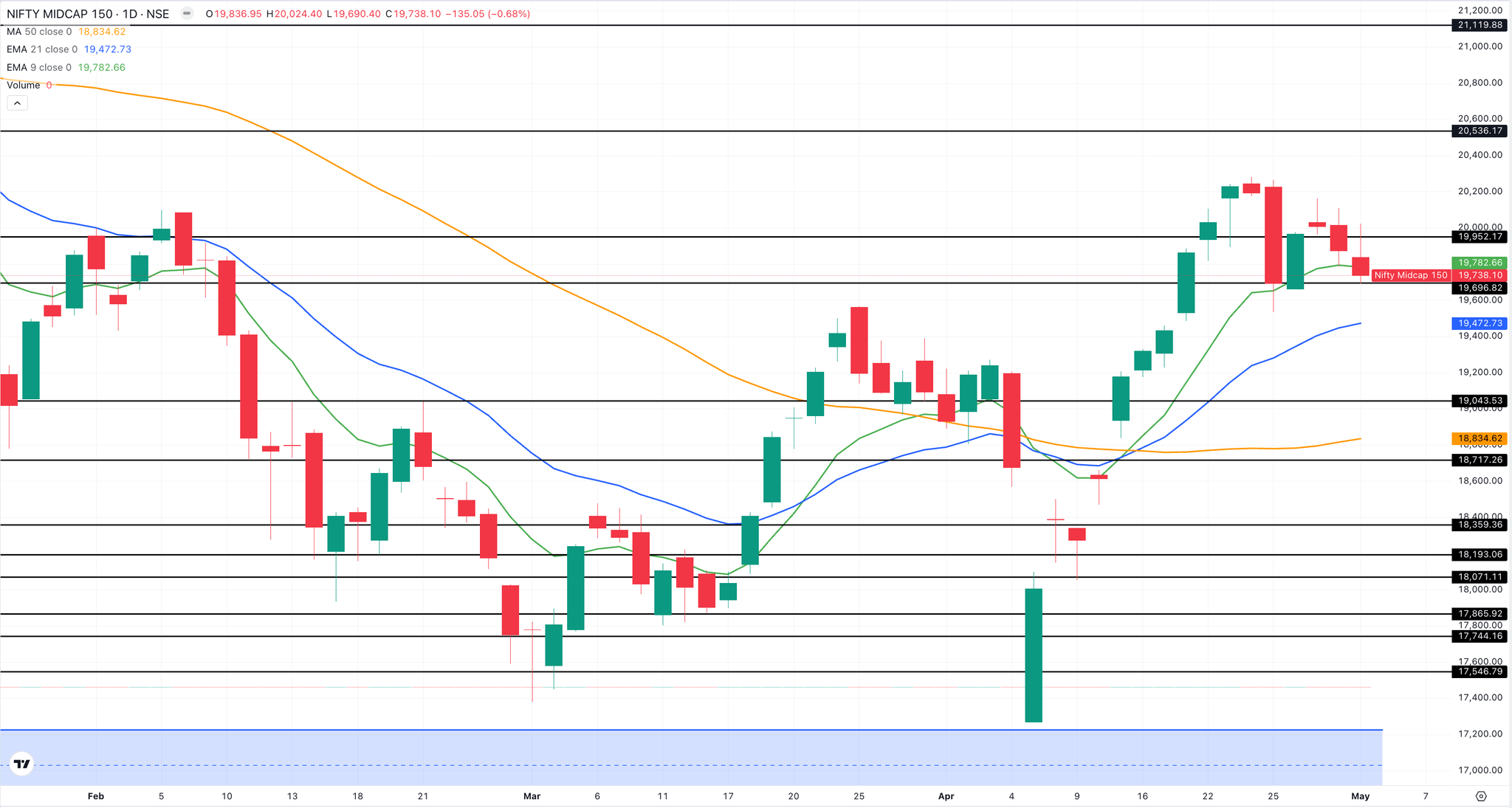

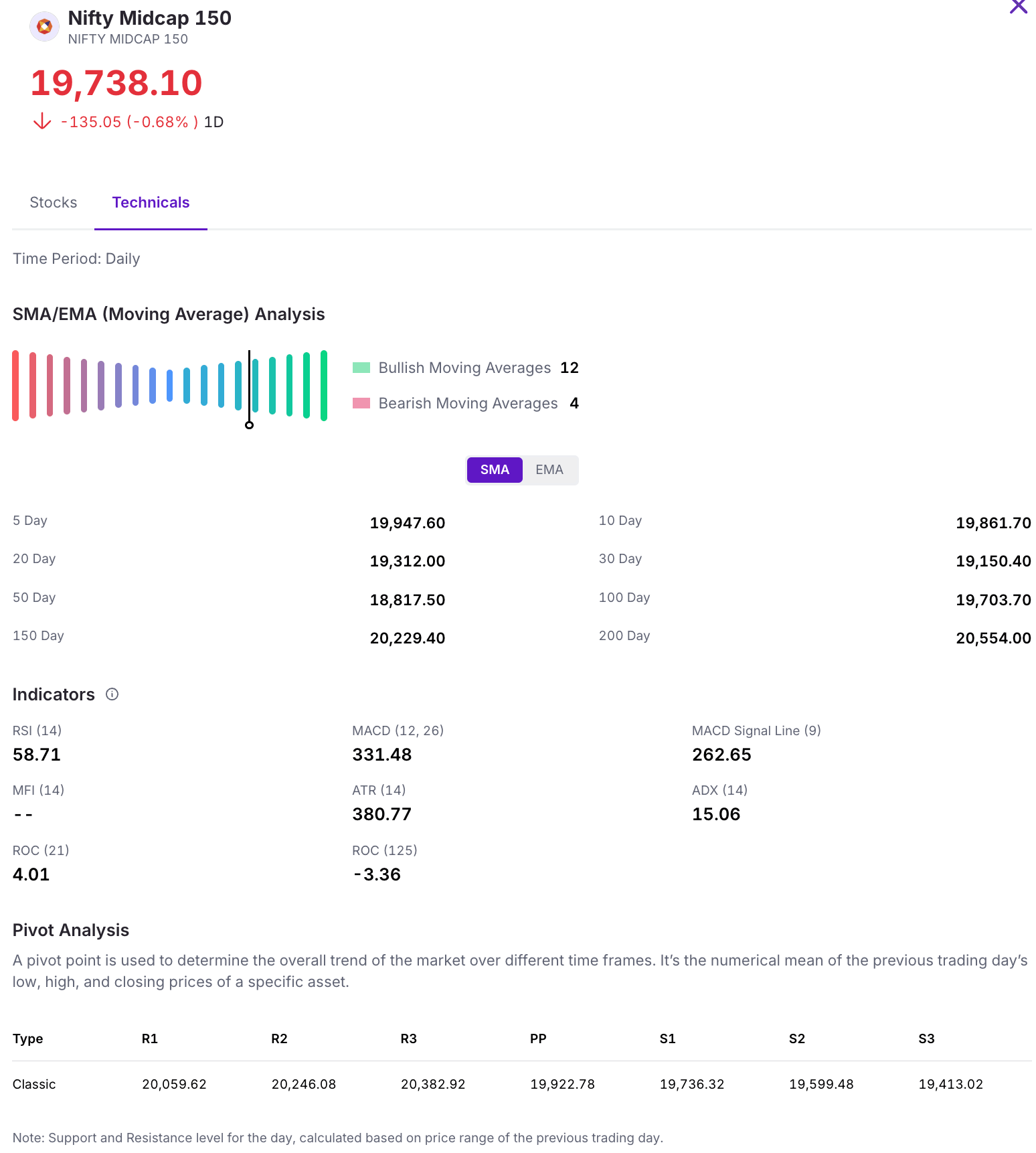

Nifty Midcap 150

The Nifty Midcap 150 declined 1.39% this week, losing 276 points and failing to hold the 19,596 level. The index is now testing immediate support at its 21 day moving average near 19,582, with resistance levels seen at 20,000 and 20,500. This week’s move can be viewed as a minor pullback, and it will be interesting to observe how the index performs in the coming week.

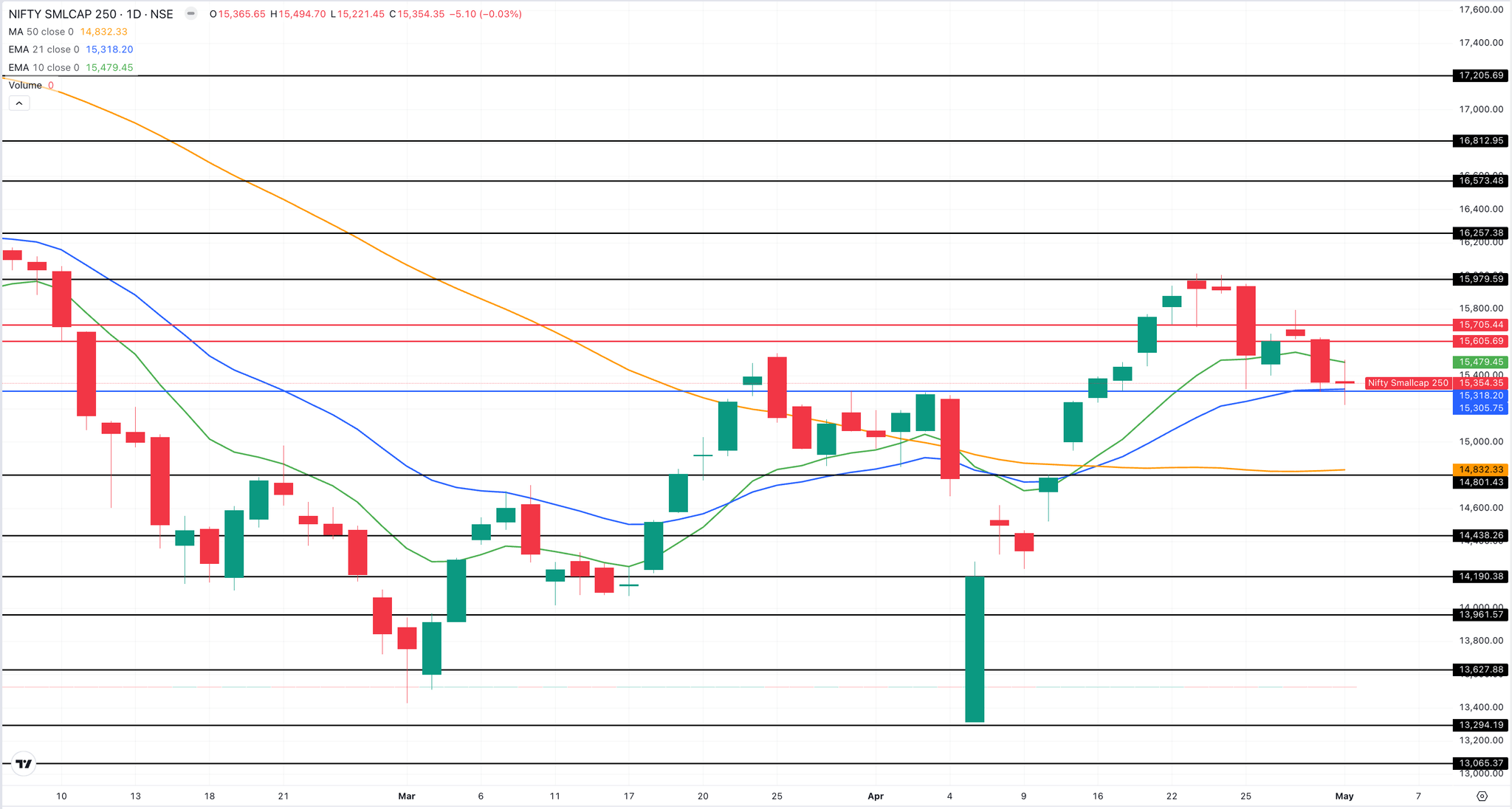

Nifty Smallcap 250

The Nifty Smallcap 250 declined 1.82% this week, losing 279 points as the index came under pressure. It is currently taking support at its 50 day moving average, which stands at 14,902. For a potential upside in the coming week, the index needs to decisively break through the 15,300–15,600 resistance zone.

This Week’s Spotlight Story

Key Sectoral Impacts of the India-UK Free Trade Agreement

The India-UK Free Trade Agreement (FTA) brings significant opportunities across multiple sectors. One of the key beneficiaries is the jewellery industry, with Indian exports to the UK expected to surge by 150%, reaching $2.5 billion within the next two years. This is due to reduced import duties and better access to the UK market.

Similarly, the FTA opens doors for British luxury car brands, like Jaguar and Rolls Royce. The FTA slashed import duties on UK-made vehicles from over 100% to 10% under a quota, which could increase their market share in India. The premium alcohol segment also stands to gain, with reduced duties from 150% to 75% on UK brands such as Scotch whisky, making them more accessible in India. However, domestic alcohol producers might feel the pressure from this increased competition.

Apparel exporters from India are especially optimistic. The FTA is expected to help them capture an additional $1 billion in market share in the UK, thanks to lower tariffs and easier access to the market. On the agriculture front, the exclusion of dairy products and rice from the agreement offers relief to Indian farmers, protecting them from the potential impact of foreign imports.

Moreover, the FTA helps both India and the UK reduce their reliance on China, allowing for more diverse and stable trade relationships. This agreement presents strong growth potential while also safeguarding sensitive sectors.

Buzz

Renewable Energy in India: A Journey of Explosive Growth and Promising Future

India’s clean energy capacity has jumped from just 13 GW in 2010 to over 140 GW today, with solar and wind leading the way. Backed by strong government support, falling storage costs, and tech upgrades, renewables now account for nearly half of India’s total power capacity. In this post, we break down what’s driving the shift, the top states and companies behind the momentum, and why the sector’s just getting started.