Share Market Weekly

- Share.Market

- 5 min read

- 02 May 2025

02nd May 2025

Nifty 50 24,346.70 12.50 (+0.05%)

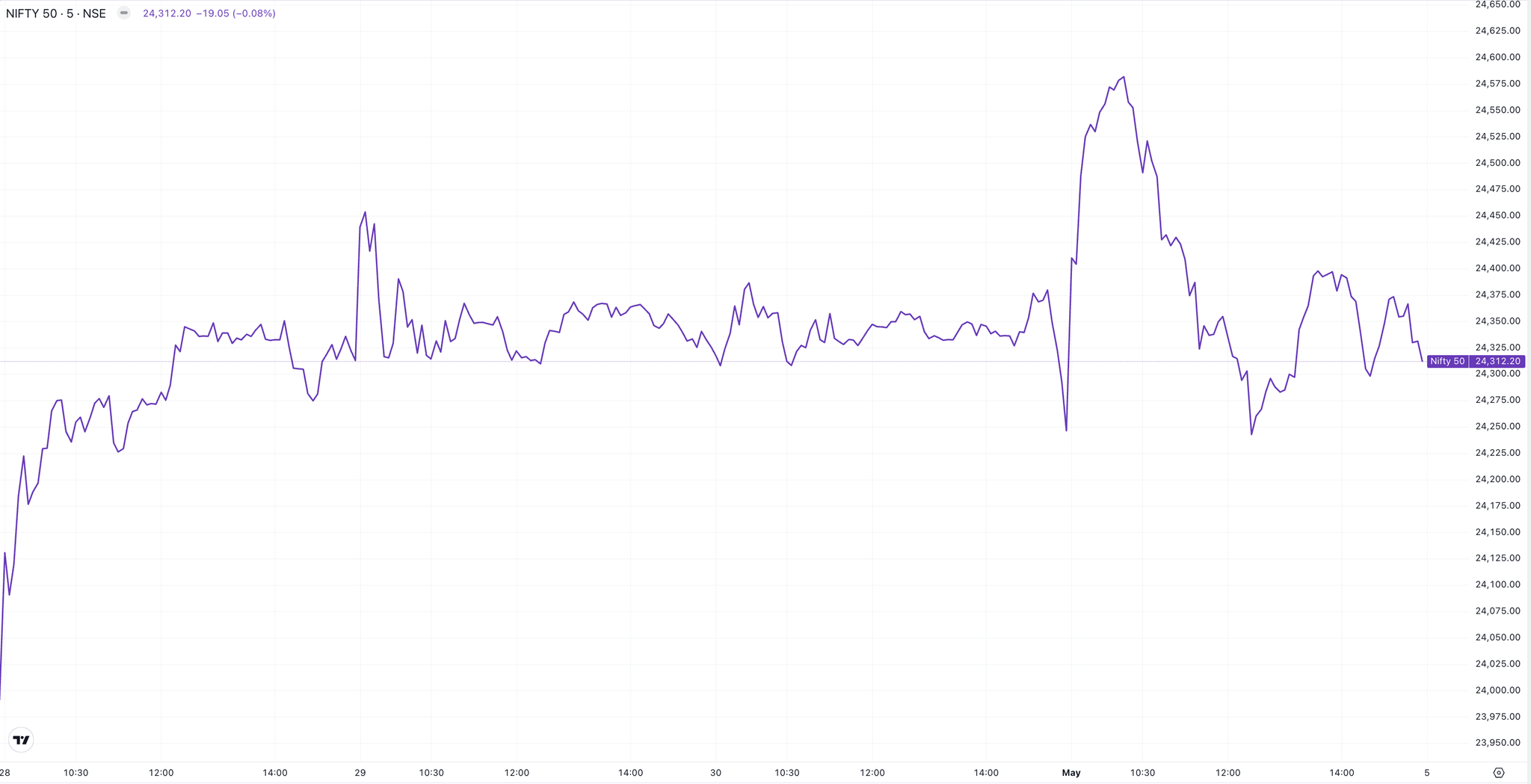

| Monday | +1.20% |

| Tuesday | +0.03% |

| Wednesday | – 0.01% |

| Friday | +0.05% |

What moved the market?

| Nifty Oil & Gas | +2.77% | Nifty Media | -4.75 |

| Nifty IT | +1.35% | Nifty Consumer Durables | -3.23% |

| Nifty Infra | +0.54 | Nifty Metal | -2.51% |

Markets this week

| Nifty Midcap 150 | 19,738 (- 2.43%) |

| Nifty Smallcap 250 | 15,354.35 (- 3.57%) |

| India VIX | 18.26 (+ 14.41%) |

Stocks in the Spotlight

Top Gainers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Sonata Software | 🔼 18.33% | 1/5 | 3/5 | 5/5 | 3/5 | 1/5 |

| Atul | 🔼 12.98% | 2/5 | 2/5 | 4/5 | 5/5 | 4/5 |

Top Losers

| Name of the company | Movement | Factors | ||||

| Momentum | Value | Quality | Low Vol | Sentiment | ||

| Sterling and Wilson Renewable Energy | 🔻20.84% | 1/5 | 1/5 | 3/5 | 3/5 | NA |

| Tejas Networks | 🔻20.42% | 2/5 | 2/5 | 2/5 | 3/5 | NA |

Technical Analysis

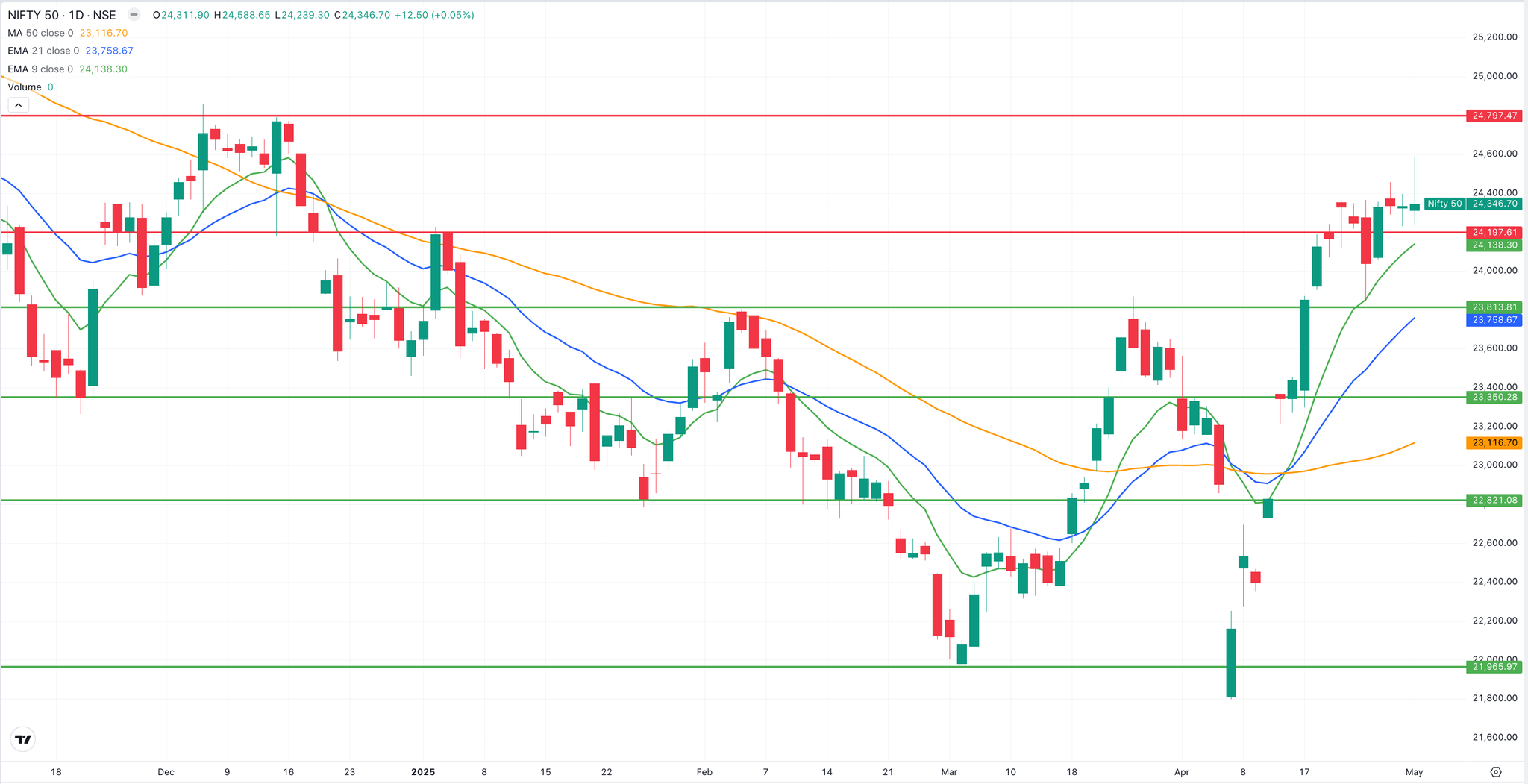

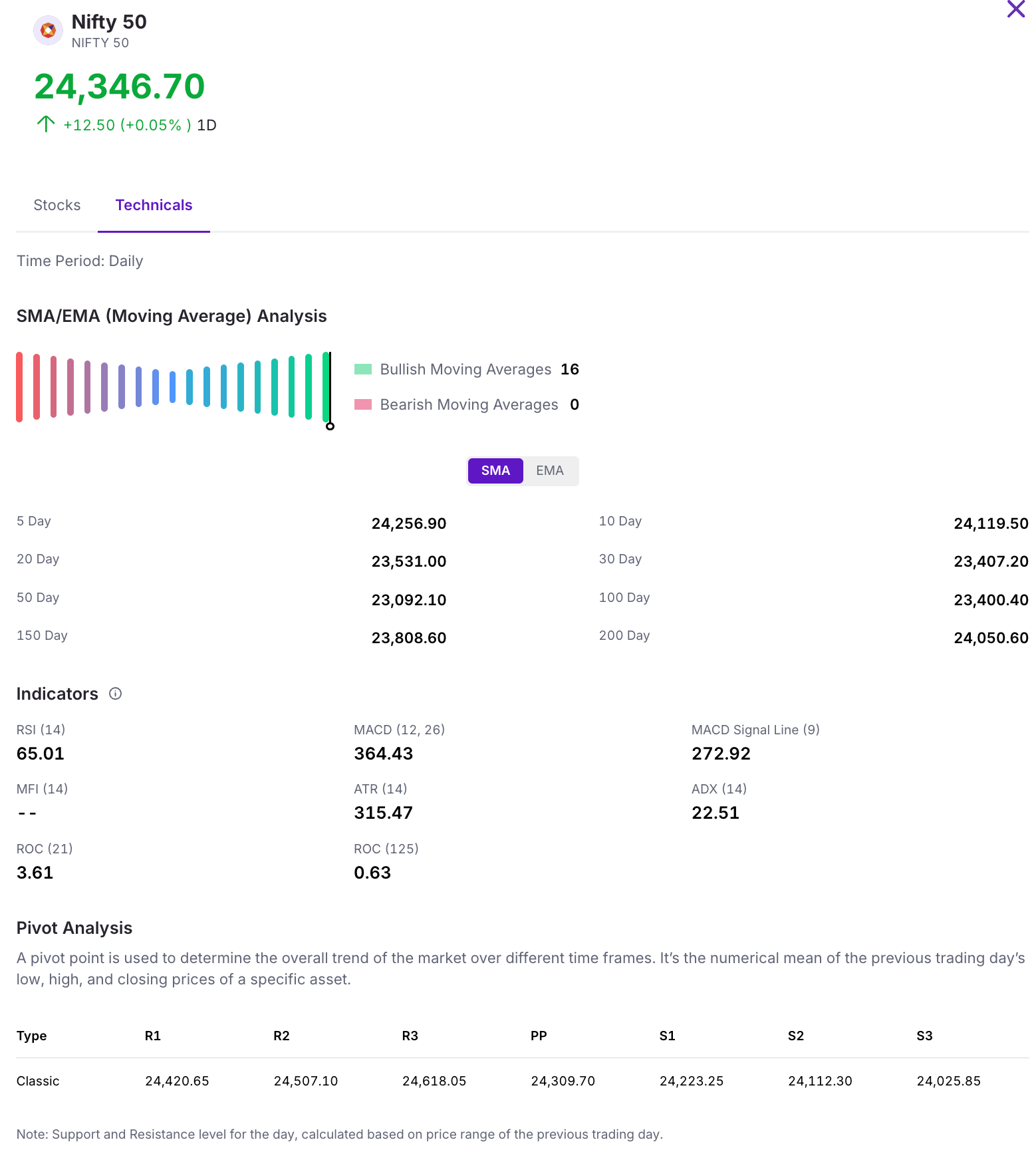

Nifty 50

The Nifty 50 ended the week nearly flat, posting a modest gain of just 0.07%. The index continues to trade above its 10, 21 and 50 day moving averages, indicating underlying strength. Currently, it is finding support around the 24,200 level, while immediate resistance is seen at 24,700.

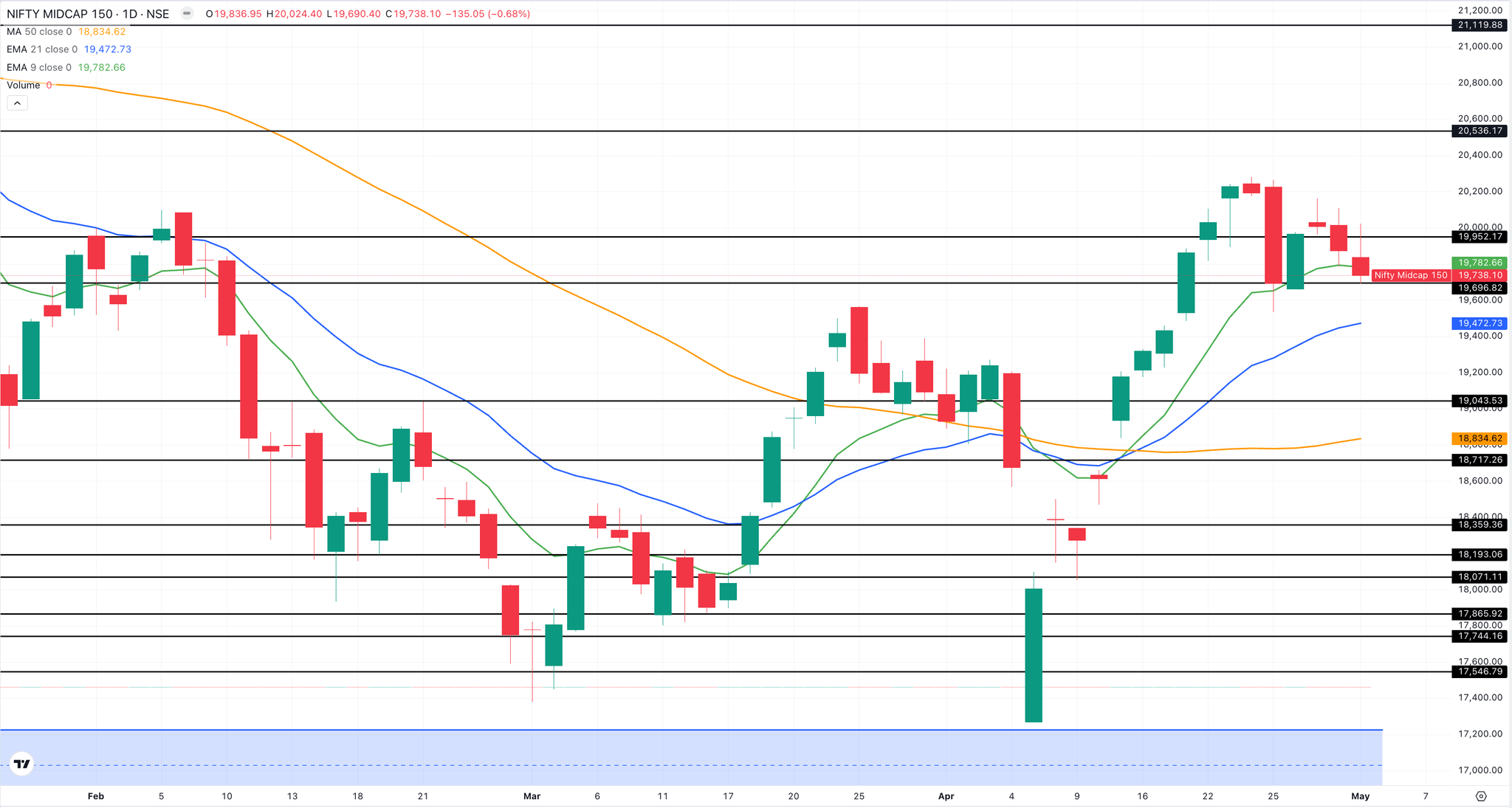

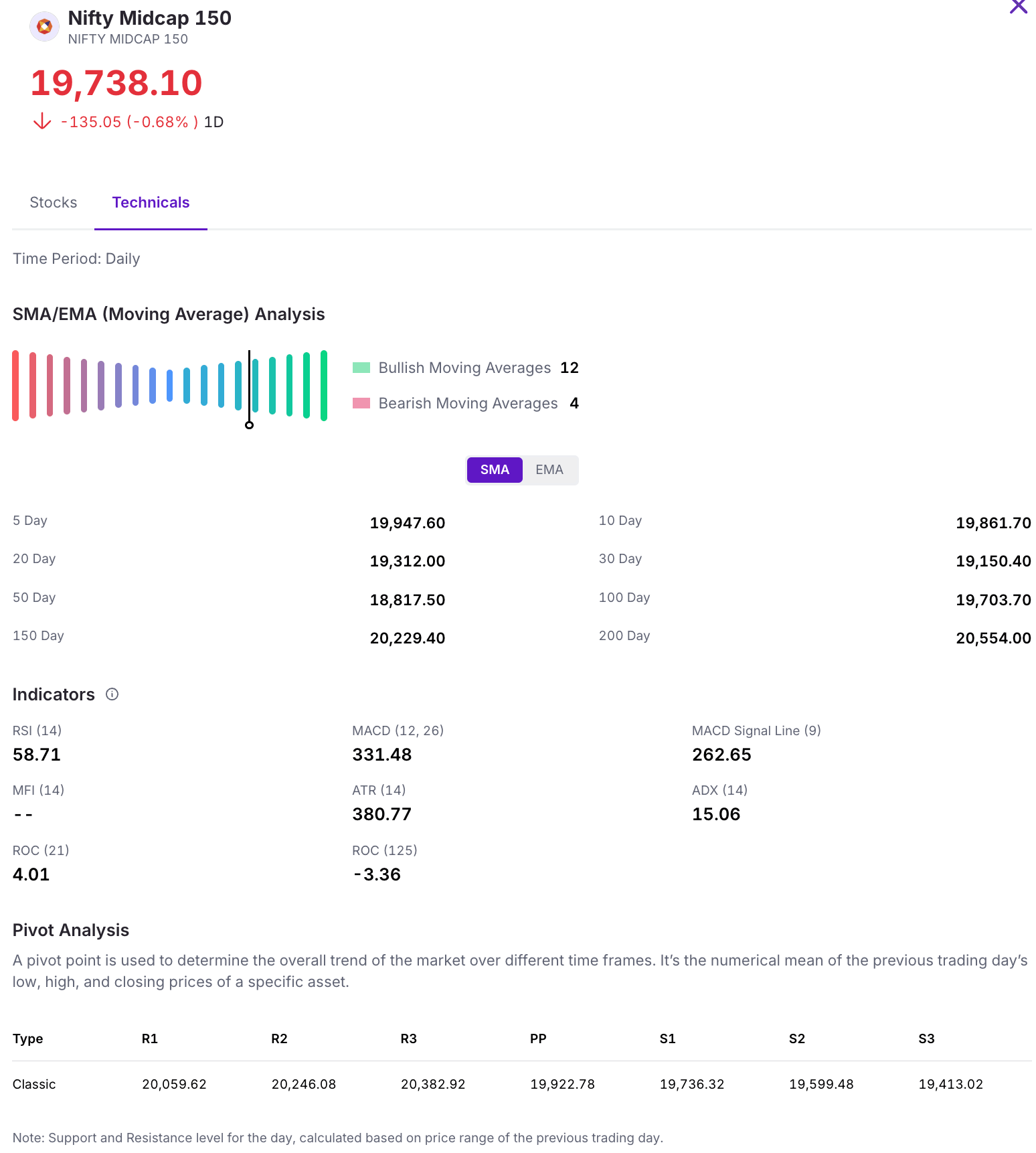

Nifty Midcap 150

The Nifty Midcap 150 declined 2.43% this week, losing 490.95 points and failing to hold the 20,000 level. The index is now testing immediate support at its 10 day moving average near 19,755, with resistance levels seen at 20,000 and 20,500. This week’s move can be viewed as a minor pullback, and it will be interesting to observe how the index performs in the coming week.

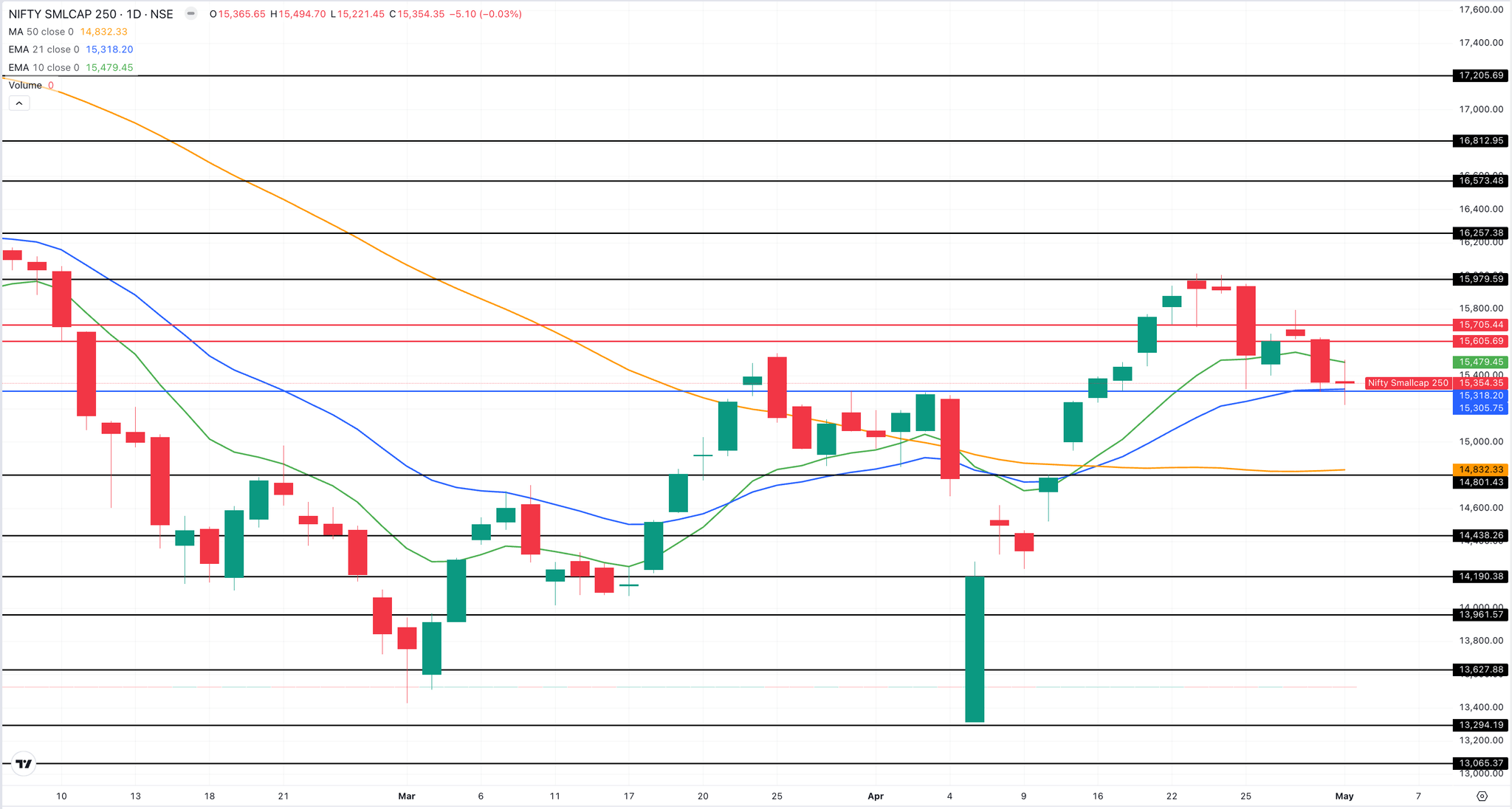

Nifty Smallcap 250

The Nifty Smallcap 250 declined 3.57% this week, losing 567 points as the index came under pressure. It is currently taking support at its 21 day moving average, which stands at 15,318. For a potential upside in the coming week, the index needs to decisively break through the 15,600–15,700 resistance zone. If it fails to do so, the 21 day moving average may continue to act as a key support level in the near term

This Week’s Spotlight Story

Zomato Faces Demand Challenges Across Verticals

Zomato’s Q4 FY25 results show that the company is changing its game plan. While its revenue went up by 64% YoY to ₹5,833 crore, profit dropped by 78% to just ₹39 crore.

This drop is mainly because Zomato is spending more to grow Blinkit, its quick commerce business.

The main food delivery segment, which once drove Zomato’s growth, is now showing signs of slowing down. Orders in big cities aren’t growing like before, and Gross Order Value actually fell 1.3% from the previous quarter. Even though the GOV still grew 16% over the year, it missed the 20% target. To stay on track, Zomato is now focusing more on smaller cities where more people are starting to order food online.

On the other hand, Blinkit’s losses expanded by 381% YoY to ₹178 Cr. Despite losses, Blinkit’s GOV rose 134% over last year to ₹9,421 crore, almost equal to Zomato’s food delivery numbers. The number of Blinkit users doubled to 13.7 million, and more dark stores were added to meet demand.

Zomato is also cutting back on experiments that didn’t work, like shutting down its ₹89 offline meal project.

Zomato’s future now depends on how well it can turn Blinkit’s rapid growth into a profitable business, while recharging food delivery in smaller cities.

Buzz

Long Straddle vs Long Strangle Strategy

Did you know traders use Long Straddles and Long Strangles to profit from big market moves, even when they’re unsure of the direction? These option strategies are popular before events like earnings or elections. While Straddles need smaller moves but cost more, Strangles are cheaper but need bigger swings. Our latest post breaks down when to use each, how they work, and what to watch out for—read now and trade smarter.

Click to read more