- Share.Market

- 3 min read

- Published at : 21 Apr 2025 01:23 PM

- Modified at : 16 Jul 2025 07:05 PM

India’s transition to renewable energy is gaining momentum, driven by the growing need for grid stability amid the increasing integration of solar and wind power. Battery Energy Storage Systems (BESS) have emerged as a key enabler in this shift, helping ensure a reliable energy supply by storing and balancing power flow.

Recent policy initiatives—including energy banking mechanisms, revised wind turbine certification guidelines, and enhanced digital transparency—are further reinforcing the country’s commitment to clean energy. These developments are also creating strong tailwinds for renewable energy stocks, with investors eyeing promising opportunities in the sector.

Suzlon Energy Ltd. is a global leader in renewable energy solutions, primarily focused on wind turbine generators (WTGs). The company operates as a vertically integrated manufacturer, producing core WTG components such as rotor blades, towers, generators, and control systems. It also offers end-to-end project services, including wind resource assessment, infrastructure development, power evacuation, and technical execution, along with operations and maintenance (O&M) services across both domestic and international markets.

Suzlon’s stock surged over 7% today, supported by a spike in trading volume as it tested resistance at ₹58. The stock is currently trading above its 10, 21, and 50-day moving averages. With multiple positive technical indicators, market participants are closely watching for signs of continued momentum in the coming days.

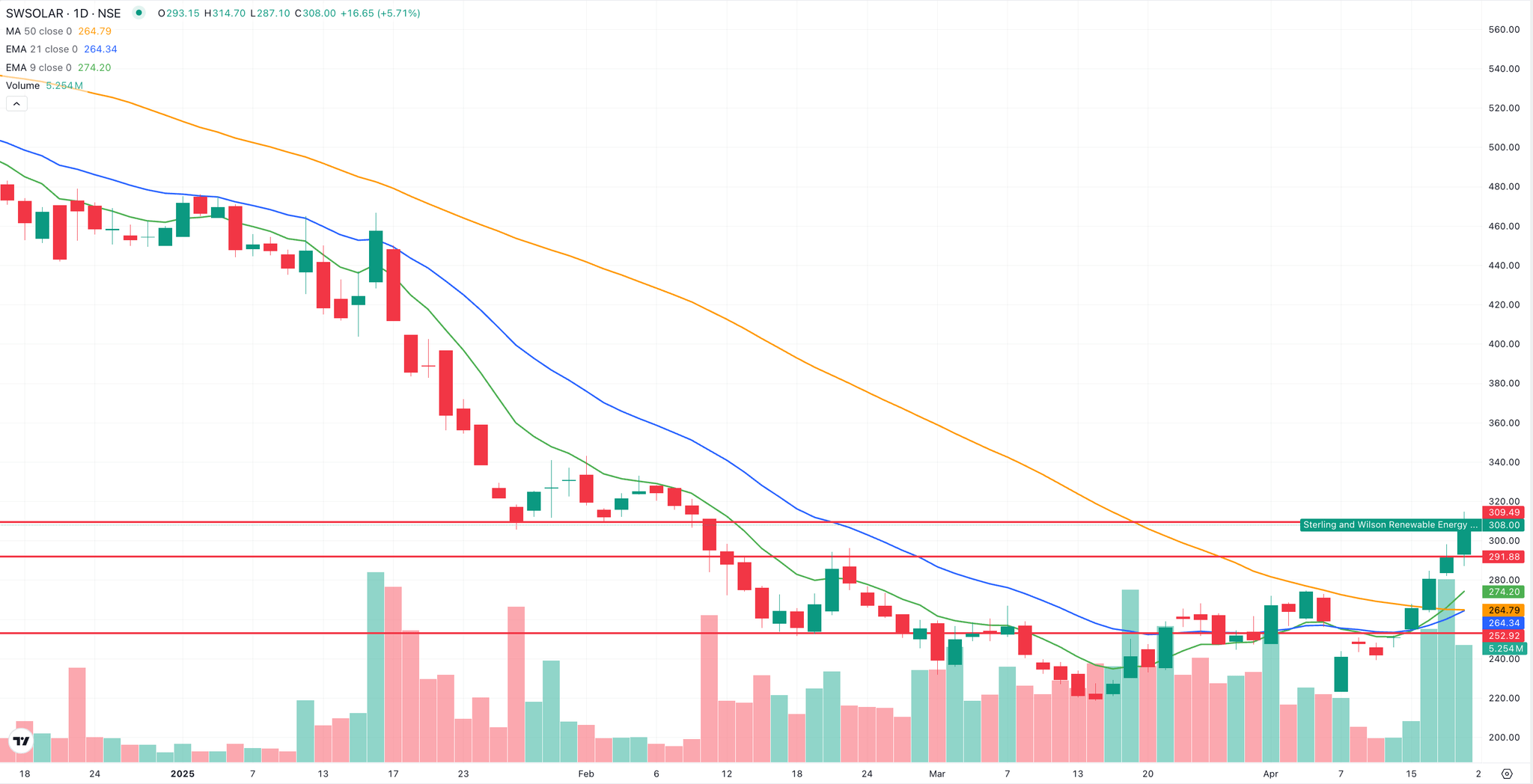

Sterling & Wilson Renewable Energy provides complete turnkey solutions for the engineering, procurement, construction (EPC), and O&M of renewable energy power projects. Known for its global leadership in solar EPC, the company also operates large-scale solar power plants and benefits from the strong backing of Reliance Industries.

Today, the stock rose 6%, attempting to break through its 50-day moving average resistance. A bullish ‘Three White Soldiers’ candlestick pattern appears to be forming, often seen as a strong indicator of upward price momentum. Investors are now watching to see if this trend continues and leads to a potential breakout in the near term.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887 and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.