- Share.Market

- 8 min read

- Published at : 05 Jun 2025 11:39 AM

- Modified at : 16 Jul 2025 08:04 PM

The shares of Tata Steel, Bank of Baroda, JSW Energy, ICICI Lombard General Insurance, Container Corporation of India, and HDFC Asset Management Company are set for their record date on Friday, June 06, 2025. To be eligible for the upcoming dividends, investors must have bought the shares before the ex-date and hold them at least till the record date.

Tata Steel Ltd. has announced a final dividend of ₹3.60 per equity share. Its current dividend yield is 2.29%. The company had previously announced a final dividend of ₹3.60 per equity share on 21 June 2024.

Tata Steel is one of the world’s most geographically diversified steel producers, with an annual crude steel capacity of 35 million tonnes and operations across five continents. Headquartered in India, it has a consolidated turnover of around $26 billion in FY25.

Tata Steel reported consolidated revenue of ₹2,18,543 crores in FY25, and a 10% YoY EBITDA growth despite a challenging operating environment. India operations delivered their best-ever crude steel production at ~21.7 MT.

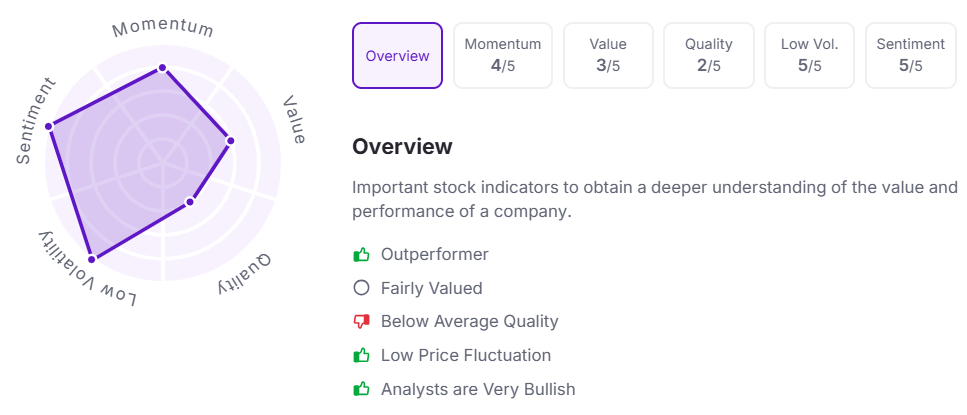

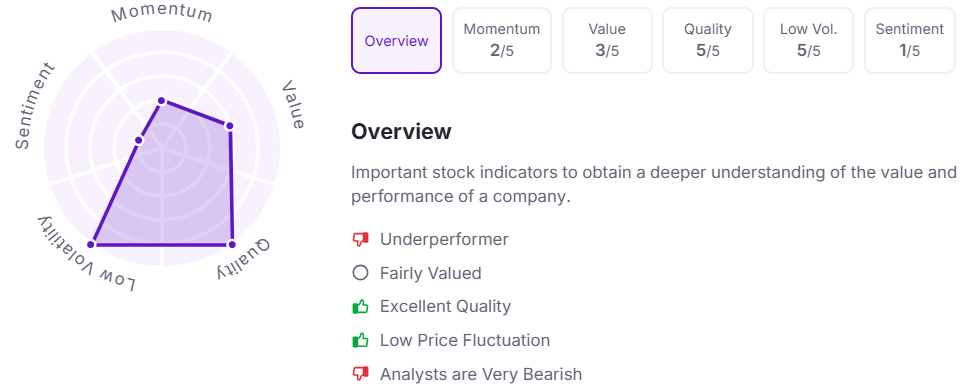

Let’s take a look at its Factor Analysis scores:

Bank of Baroda has announced a final dividend of ₹8.35 per equity share. Its current dividend yield is 3.00%. The company had previously announced a dividend of ₹7.60 per equity share on 28 June 2024.

Bank of Baroda is one of India’s leading public sector banks with a strong presence across domestic and international markets. Headquartered in Vadodara, it offers a full range of banking and financial services. Following the 2019 merger with Vijaya Bank and Dena Bank, BoB has grown to become a dominant player with over 8,400 branches and nearly 11,000 ATMs across India, alongside a global footprint spanning 17 countries.

Bank of Baroda posted its highest-ever standalone net profit of ₹19,581 crore in FY25, up 10.1% YoY, driven by strong non-interest income growth of 14.8% and a steady operating performance. Global business crossed ₹27 lakh crore, with global advances up 12.8% and domestic retail loans rising 19.4%. Asset quality improved sharply, with gross NPA falling to a 13-year low of 2.26%.

Over the last three years, this stock has given multibagger returns of more than 149%.

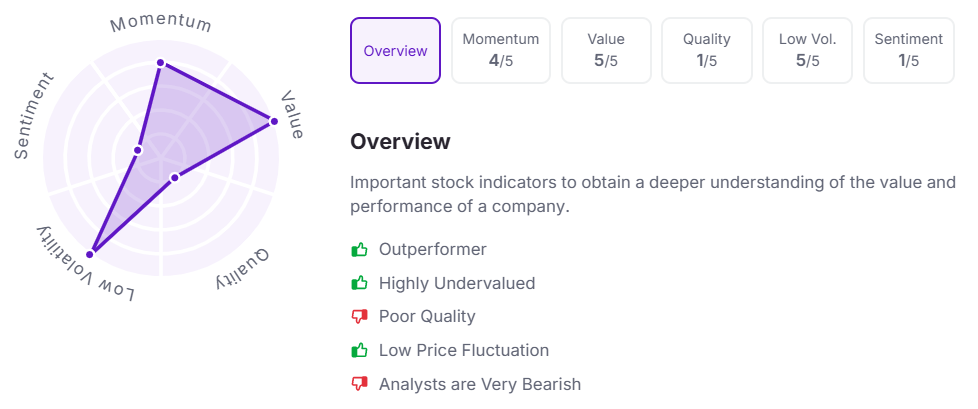

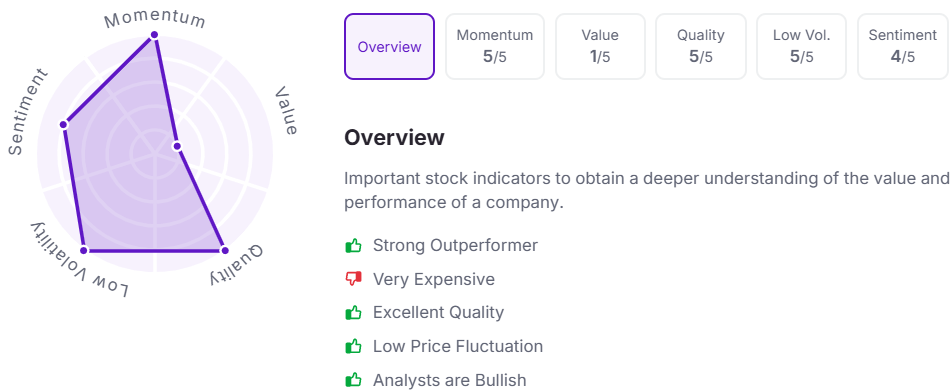

Let’s take a look at its Factor Analysis scores:

JSW Energy Ltd. has announced a final dividend of ₹2 per equity share.

The company had previously announced a dividend of ₹2 per equity share on 31 May 2024.

JSW Energy is one of India’s leading power producers and a key part of the JSW Group. It operates across thermal, hydro, solar, and wind power, with a clear focus on accelerating India’s clean energy transition. The company is targeting 20 GW of generation capacity and 40 GWh of energy storage by 2030.

JSW Energy delivered a strong FY25 performance, with revenue from operations growing 6% YoY to ₹12,639 crores and PAT rising 13% to ₹1,951 crores. Net generation rose 24% YoY to 7.9 billion units (BUs), supported by new wind assets and contributions from the 1,800 MW KSK Mahanadi thermal plant and Utkal plant. The company added 2.8 GW of installed capacity during the quarter, including commissioning of 2.2 GW, bringing its total to 7.2 GW.

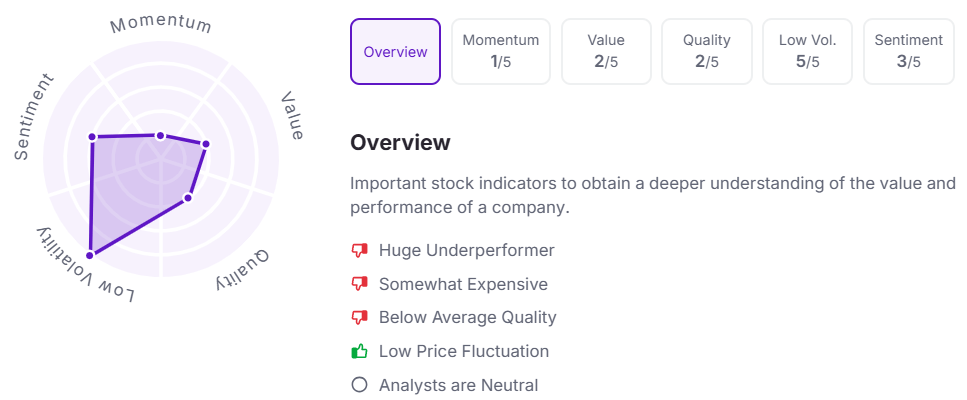

Let’s take a look at its Factor Analysis scores:

ICICI Lombard General Insurance Company Ltd. has announced a final dividend of ₹7 per equity share. Its current dividend yield is 0.60%.

The company had previously announced an interim dividend of ₹5.50 per equity share on 28 October 2024, and a final dividend of ₹6 per equity share on 07 June 2024.

ICICI Lombard is India’s largest private general insurance company, offering various products across motor, health, fire, marine, and liability insurance segments. With over two decades of operational history, the company has served millions of customers, leveraging a strong digital backbone, a nationwide branch network, and AI-driven tools.

ICICI Lombard delivered a resilient performance in FY25 despite regulatory changes in accounting norms. Gross Direct Premium Income (GDPI) rose 8.3% YoY, outperforming industry growth. Profit after tax surged 30.7% YoY to ₹25.08 billion, while return on average equity improved to 19.1%.

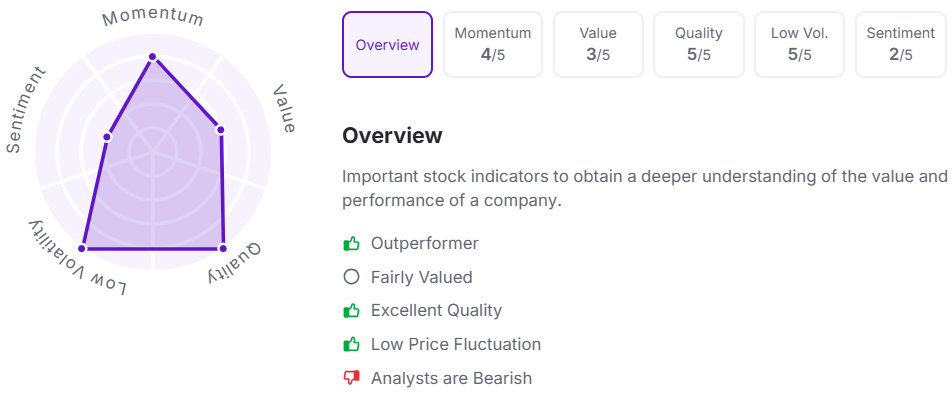

Let’s take a look at its Factor Analysis scores:

Container Corporation of India Ltd. has announced a final dividend of ₹2 per equity share. Its current dividend yield is 1.50%.

The company had previously announced interim dividends of ₹4.25, ₹3.25, and ₹2 per equity share on 06 February 2025,14 November 2024, and 16 August 2024, and a final dividend of ₹2.50 per equity share on 17 September 2024.

Container Corporation is India’s leading multimodal logistics company, originally formed by taking over seven ICDs from Indian Railways. Today, it operates the country’s largest network of 66 Inland Container Depots (ICDs) and Container Freight Stations (CFSs). While rail transport remains its core, CONCOR has diversified into port management, air cargo, cold chain logistics, and door-to-door multimodal solutions.

The company reported stable financials in FY25, with consolidated revenue rising 3% YoY to ₹8,887 crore and PAT growing 2% to ₹1,260 crore. Revenue from the EXIM segment stood at ₹5,734 crore, while domestic operations contributed ₹3,153 crore.

Let’s take a look at its Factor Analysis scores:

HDFC Asset Management Company Ltd. has announced a final dividend of ₹90 per equity share. Its current dividend yield is 1.50%. The company had previously announced an interim dividend of ₹70 per equity share on 18 June 2024.

HDFC Asset Management Company is the investment manager to HDFC Mutual Fund, one of India’s largest and most trusted mutual fund houses. As of March 31, 2025, it managed assets worth ₹7.55 trillion and served over 13.2 million unique investors. The company offers a wide range of investment products, including mutual funds, PMS, and AIFs, and operates through 280 offices and a network of over 95,000 distribution partners.

HDFC AMC reported a strong performance in FY25, with profit after tax rising 26% YoY to ₹24,609 crore. Revenue from operations grew 35% to ₹34,980 crore, while operating profit jumped 43% to ₹27,261 crore. Quarterly average AUM (QAAUM) stood at ₹7.74 trillion, giving the company an 11.5% market share and a leading 12.8% share in actively managed equity funds.

Over the last three years, this stock has given multibagger returns of more than 158%.

Let’s take a look at its Factor Analysis scores:

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.