- Share.Market

- 4 min read

- Published at : 06 May 2025 04:03 PM

- Modified at : 16 Jul 2025 07:19 PM

The shares of Crisil and Sundram Fasteners are set to trade ex-dividend and Info Edge is set to trade ex-split on Wednesday, May 07, 2025. Investors who wish to be eligible for the upcoming dividends and stock split, must have bought the shares before the ex-date and hold them at least till the record date.

Crisil has announced an interim dividend for the year ended December 31, 2025, of ₹8 per equity share. The dividend will be paid on May 19, 2025. The company had previously announced a final dividend of ₹26 per equity share on April 11, 2025, and interim dividends of ₹15, ₹8, and ₹7 on October 30, 2024, July 31, 2024, and May 03, 2024, respectively. It has a dividend yield of 1.10% on a TTM basis.

Crisil’s ratings segment delivered a strong Q1CY25 performance with income from operations rising 32.5% YoY, and segment profit up 31.1%. For the full year, ratings revenue grew 17.7%, and profit grew 18.9%. Despite curtailed discretionary spending from global clients, CRISIL continued to see traction in credit, risk, consulting, and benchmarking solutions.

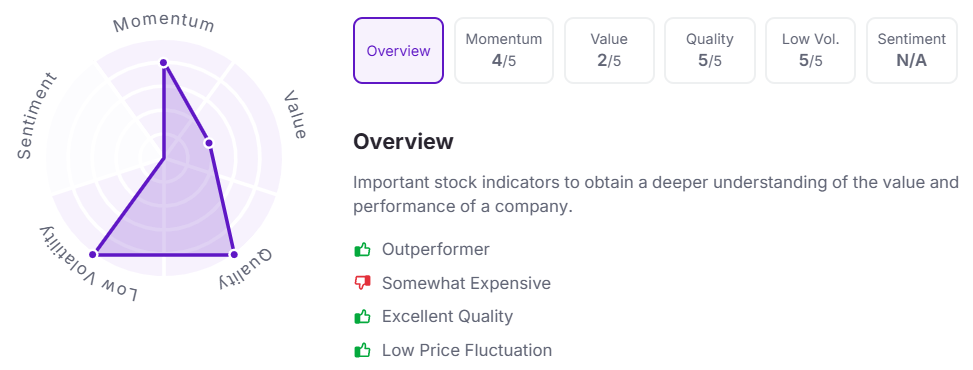

Let’s take a look at its Factor Analysis scores:

Info Edge has approved a stock split in the ratio of 1:5. This means that each existing equity share with a face value of ₹10 will be subdivided into 5 equity shares with a face value of ₹2 each. After the split, the value of total investment will remain the same, but the number of shares one owns will increase in proportion.

The stock split aims to make shares more affordable, increasing their attractiveness to a wider range of investors. This move is expected to boost investor participation and improve the liquidity of the company’s shares in the market.

Info Edge (India) is known for its strong presence across online classifieds in recruitment, real estate, matrimony, and education. Founded in 1995, the company operates leading platforms like Naukri.com, 99acres.com, Jeevansathi.com, and Shiksha.com.

With a diversified portfolio, a track record of early-stage tech investments (including Zomato and Policybazaar), and a wide operational footprint across India and the Gulf, Info Edge continues to shape India’s consumer internet ecosystem.

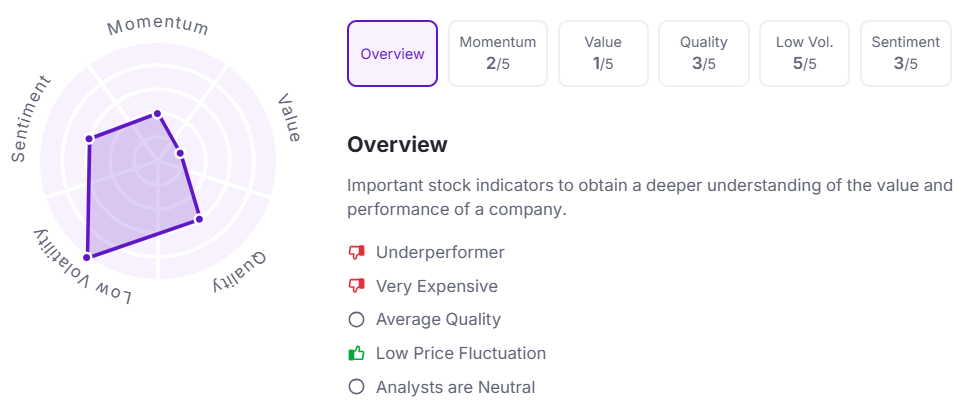

Let’s take a look at its Factor Analysis scores:

Sundram Fasteners has declared a second interim dividend of ₹4.20 per equity share. The company had previously announced interim dividends of ₹3 per equity share and ₹4.17 per equity share on November 18, 2024, and June 03, 2024. It has a dividend yield of 0.80% on a TTM basis.

Sundram Fasteners Ltd, founded in 1966, is a global manufacturer of high-precision components for the automotive, infrastructure, windmill, and aviation sectors. Its product portfolio includes fasteners, powertrain parts, sintered metals, radiator caps, and wind energy components. The company serves OEM and aftermarket clients across key global markets like India, China, the US, UK, Germany, and Brazil.

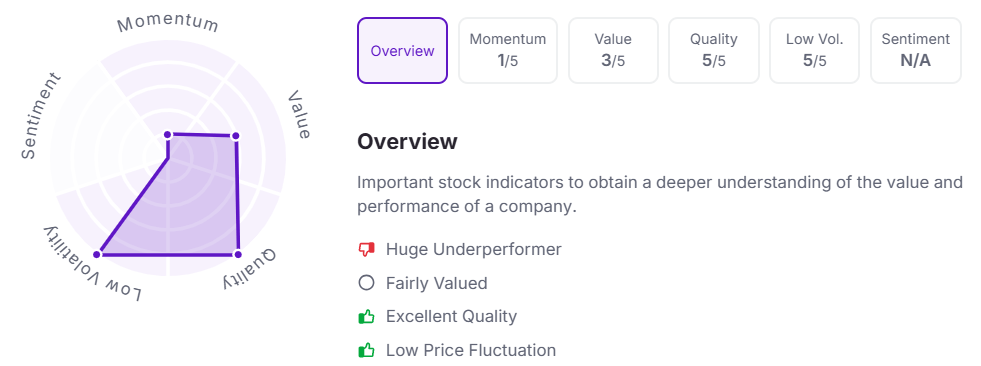

Let’s take a look at its Factor Analysis scores:

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887, and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst, and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.