- Share.Market

- 3 min read

- Published at : 06 Jun 2025 12:49 PM

- Modified at : 16 Jul 2025 07:58 PM

The Reserve Bank of India (RBI) just wrapped up its 55th Monetary Policy Committee (MPC) meeting, chaired by Governor Sanjay Malhotra, and it delivered a bold triple move aimed at boosting the economy.

Another Cut in Interest Rates

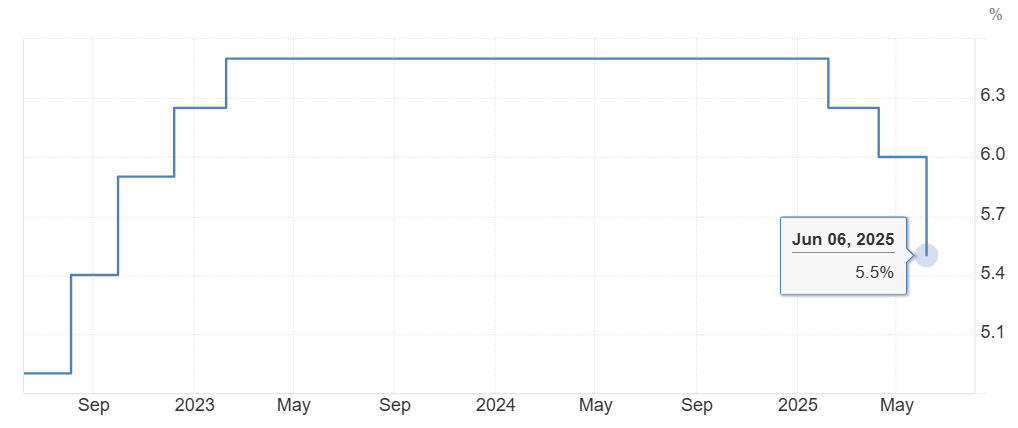

The central bank slashed the repo rate by 50 basis points (bps), bringing it down to 5.50%.

(Repo rate = the rate at which the RBI lends money to banks).

Alongside this, two more rates were adjusted:

- Standing deposit facility (SDF) – the rate at which banks can park their surplus funds with the RBI overnight, without providing collateral, is now 5.25%

- MSF/Bank Rate – used by banks to borrow in emergencies & acute liquidity situations, now 5.75%

A Shift in Policy Stance: From Accommodative to Neutral

Since February 2025, the RBI has cut the repo rate by 100 bps (1%). With limited room left to cut further, the MPC has now moved to a neutral stance, signalling a more cautious approach going forward.

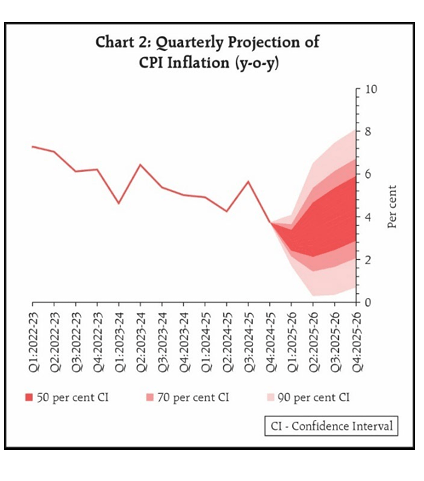

Inflation is Cooling Faster Than Expected

Headline inflation (based on CPI) fell to 3.2% in April – a six-year low, driven mainly by declining food prices.

As a result, the RBI lowered its CPI inflation for the financial year 2025-26 is now projected at 3.7%, with Q1 at 2.9%, Q2 at 3.4%, Q3 at 3.9%, and Q4 at 4.4%.

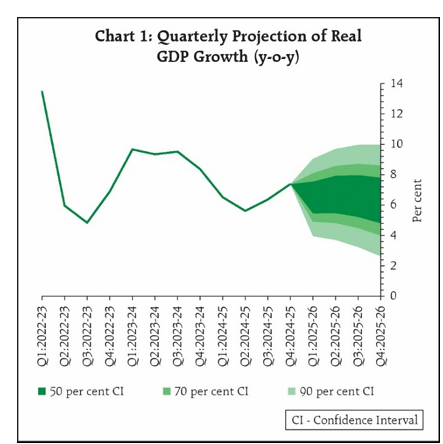

Growth Outlook: Optimistic but Realistic

India’s economy grew 7.4% in Q4 FY25, bringing the full-year growth to 6.5%. RBI expects the economy to maintain this pace in FY26, supported by strong consumption, rising investments, and a healthy services sector.

Taking all these factors into account, real GDP growth for 2025-26 is projected at 6.5%, with Q1 at 6.5%, Q2 at 6.7%, Q3 at 6.6%, and Q4 at 6.3%.

What This Means for Investors

A cut provided a near-term tailwind, especially in rate-sensitive sectors like banking, real estate, and auto, as lower borrowing costs improve profitability and spur demand. borrowing cheaper, which can lead to lower EMIs and easier access to loans.)

With inflation under control and global risks still looming, the RBI is trying to stimulate domestic demand while keeping price stability in check.

From here onwards, the MPC will be carefully assessing the incoming data and the evolving outlook to chart out the future course of monetary policy in order to strike the right growth-inflation balance.

RBI Monetary Policy Committee