- Share.Market

- 2 min read

- Published at : 05 Nov 2025 03:37 PM

- Modified at : 15 Nov 2025 10:03 AM

Motherson Sumi Wiring India Ltd. has announced its unaudited financial results for the second quarter and half year ended September 30, 2025.

The company reported a robust revenue of ₹2,762 crore for Q2 FY26, marking a 19% year-over-year (YoY) growth. This strong growth rate significantly outpaced the passenger vehicle industry’s volume growth of only 4% YoY for the same quarter. The strong outperformance was primarily driven by an increase in premiumization (higher content per vehicle), overall volume growth, and the company’s strategic presence on new model launches by OEMs.

The company reported a Profit After Tax (PAT) of ₹165 crore for Q2 FY26, representing a 9% growth compared to ₹152 crore in the corresponding quarter of the previous fiscal year. EBITDA for the quarter stood at ₹280 crore, an increase of 12% YoY.

The company continues to maintain a debt-free status. While net cash stood at ₹53 crore, the total Net Debt, including accounting for lease liabilities (as per Ind AS 116), was ₹190 crore as of September 30, 2025.

The company confirmed its investment in future capacity and technology:

- Greenfield Projects: One of the three planned Greenfield projects has successfully started production as per schedule, with the ramp-up expected to continue and drive future growth.

- The project in Kharkhauda (for ICE vehicles) had its SOP (Start of Production) delayed to Q4 FY26, a delay from the initial Q2 plan, due to a customer launch delay.

- EV Contribution: The company’s focus on future trends is evident in its revenue mix, as the Electric Vehicle (EV) segment contributed 6.7% to the total revenue for Q2 FY26.

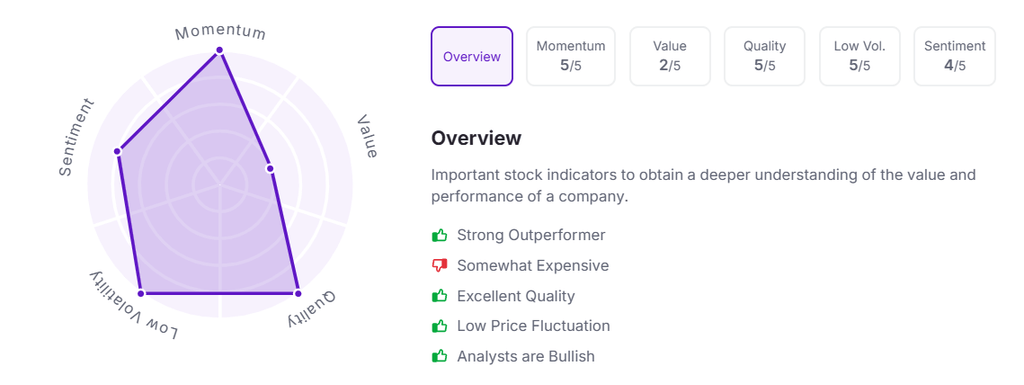

Let’s take a look at its Factor Analysis scores: