- Share.Market

- 4 min read

- Published at : 29 Apr 2025 01:18 PM

- Modified at : 29 Apr 2025 03:10 PM

As of 1:00 PM, markets turned bullish following positive developments around India’s revised Foreign Direct Investment (FDI) policy in the defense sector. Garden Reach Shipbuilders & Engineers Ltd (GRSE) and Mazagon Dock Shipbuilders Limited (MDL) posted significant gains on strong volumes, with technical indicators pointing to potential further upside.

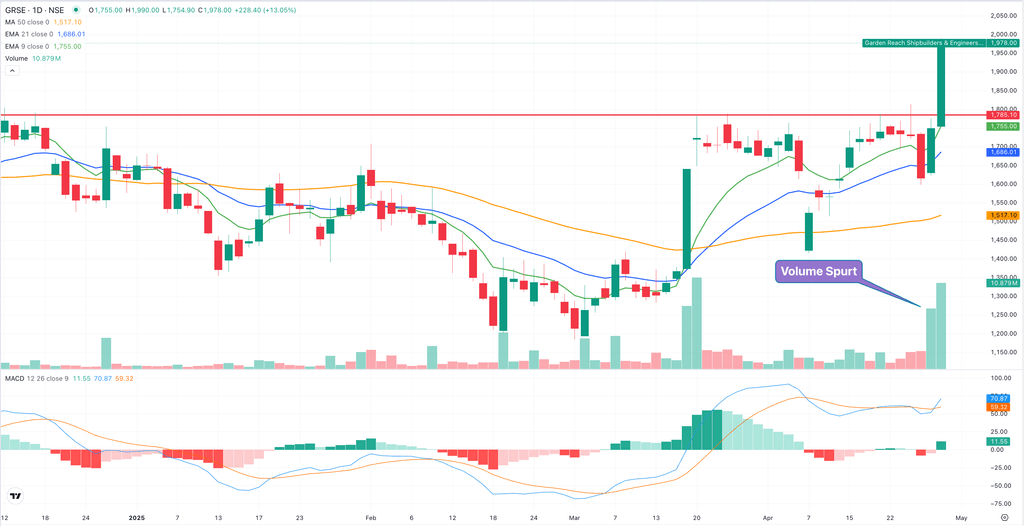

GRSE Breaks Key Resistance with 13% Surge

Garden Reach Shipbuilders & Engineers Ltd (NSE: GRSE), a premier state-run shipbuilding enterprise under the Ministry of Defence, jumped 13% in today’s trade, closing at ₹2,000. The stock broke past a major resistance level of ₹1,785 on heavy volume, aligning with a broader upswing in defense counters.

Known for its expertise in warship construction, GRSE has delivered over 100 warships to the Indian Navy and Coast Guard. It also holds the distinction of being the first Indian shipyard to export warships, reinforcing its strategic importance in bolstering India’s maritime defense capabilities.

From a technical standpoint, GRSE is trading comfortably above its 20-day and 50-day moving averages, and a bullish MACD crossover suggests sustained momentum. However, analysts caution that the 200-day moving average at ₹1,820 remains a critical resistance level. A close above this mark could pave the way for further gains. Traders are advised to consider a stop loss at ₹1,840.

Mazagon Dock Rallies 7% Amid Sectoral Tailwinds

Mazagon Dock Shipbuilders Limited (NSE: MAZDOCK) also saw its shares climb 7% to ₹3,000, buoyed by a similar wave of optimism in the defense space. The Mumbai-based shipbuilder, one of India’s oldest and most reputable naval constructors, has delivered over 800 vessels since its inception in 1774, including submarines, offshore platforms, and warships.

The stock broke through a crucial resistance zone today, supported by rising trading volumes and favorable technical signals. Moving average crossovers and a bullish MACD pattern suggest the rally could extend further. Investors are watching closely to see if the stock can maintain its upward trajectory, with a suggested stop loss at ₹2,760.

Defense Sector Finds Tailwinds in Policy Reforms

Both stocks are seen as direct beneficiaries of the government’s push to liberalize FDI norms in defense manufacturing, aiming to enhance self-reliance and attract global capital. The revised policy is expected to unlock greater investment flows and accelerate technology transfer in India’s strategic defense sector.

Market participants anticipate continued interest in defense-related equities as geopolitical tensions and strategic maritime imperatives keep national security at the forefront of policy and investor agendas.

Disclaimer

Investments in securities market are subject to market risks, read all the related documents carefully before investing. This is for informational purposes and should not be considered as recommendations.

Kindly refer to https://share.market/ for more details.

PhonePe Wealth Broking Private Limited is a member of NSE & BSE with SEBI Regn. No.: INZ000302639, Depository Participant of CDSL Depository with SEBI Regn. No.: IN-DP-696-2022, Research Analyst with SEBI Regn No: INH000013387, BSE RA Enlistment Number: 5887 and Mutual Fund distributor with AMFI Registration No: ARN- 187821. Member ID: BSE- 6756, NSE- 90226.

Registration granted by SEBI, enlistment as Research Analyst and Certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors

Registered office – 2, Floor 3, Wing A, Block A, Salarpuria Softzone, Service Road, Green Glen Layout, Bellandur, Bengaluru South, Bengaluru, Karnataka – 560103, INDIA.

CIN: U65990KA2021PTC146954.